April 2025

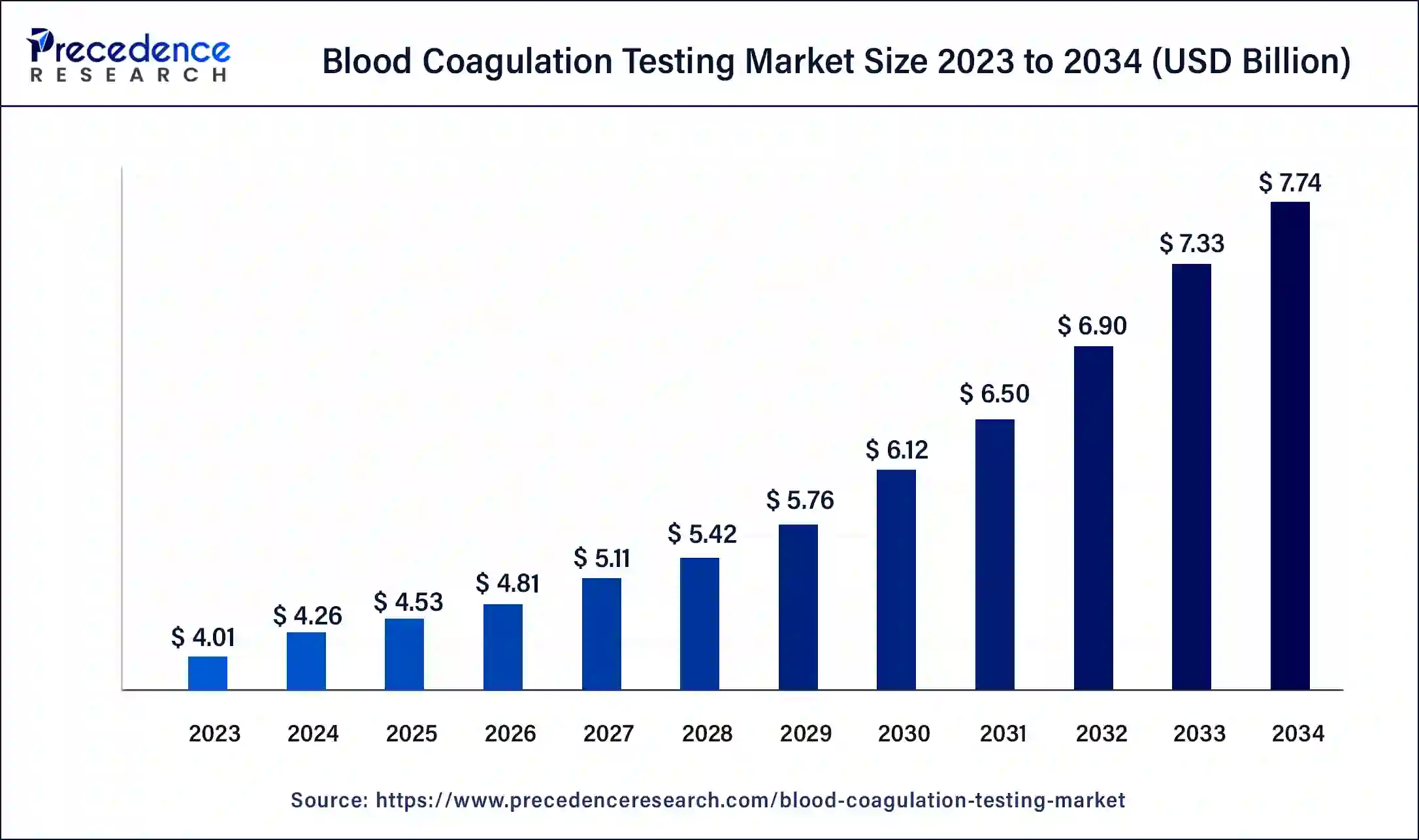

The global blood coagulation testing market size was USD 4.01 billion in 2023, calculated at USD 4.26 billion in 2024 and is projected to surpass around USD 7.74 billion by 2034, expanding at a CAGR of 6.2% from 2024 to 2034.

The global blood coagulation testing market size accounted for USD 4.26 billion in 2024 and is expected to be worth around USD 7.74 billion by 2034, at a CAGR of 6.2% from 2024 to 2034. The North America blood coagulation testing market size reached USD 1.52 billion in 2023.

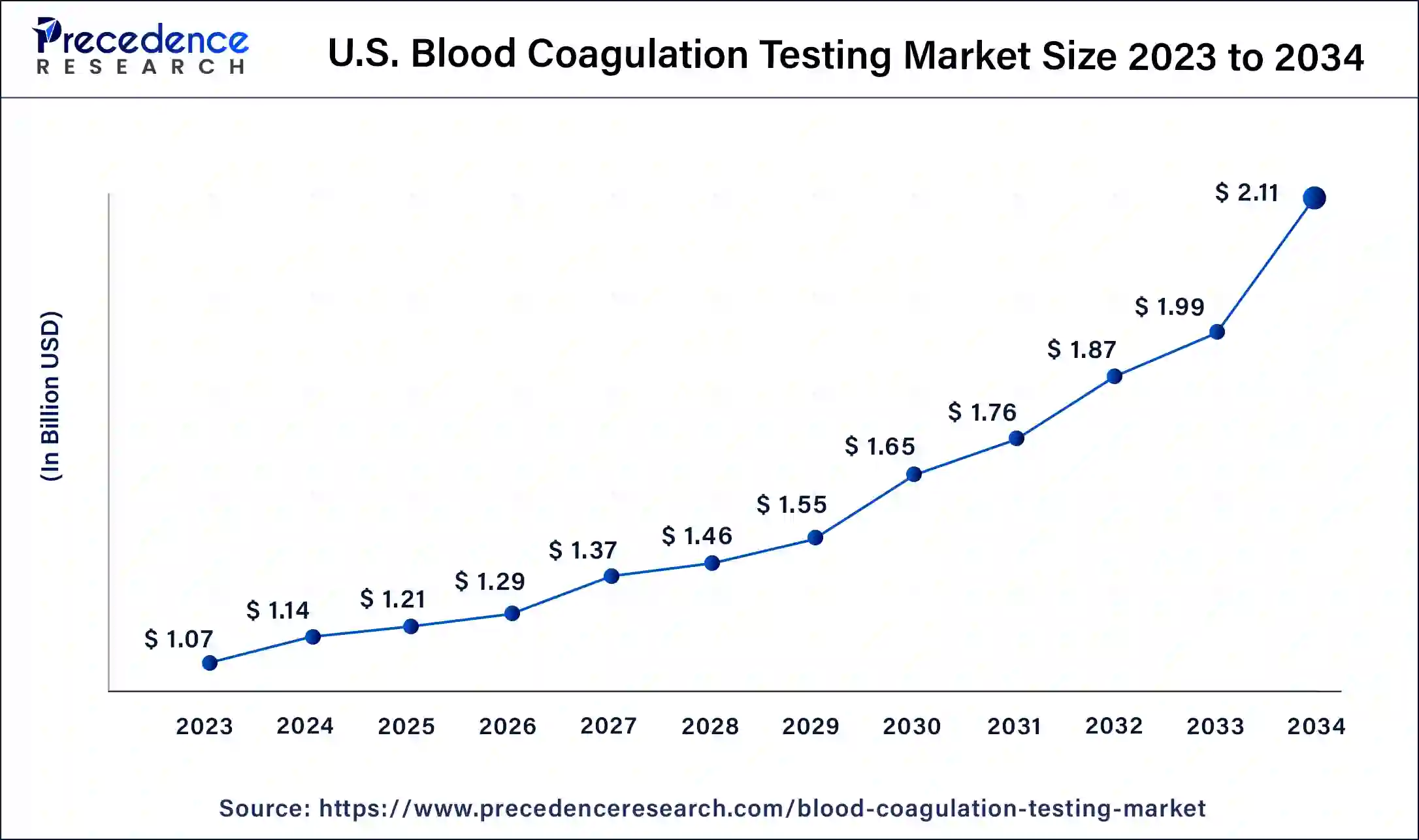

The U.S. blood coagulation testing market size was estimated at USD 1.07 billion in 2023 and is predicted to be worth around USD 2.11 billion by 2034, at a CAGR of 6.4% from 2024 to 2034.

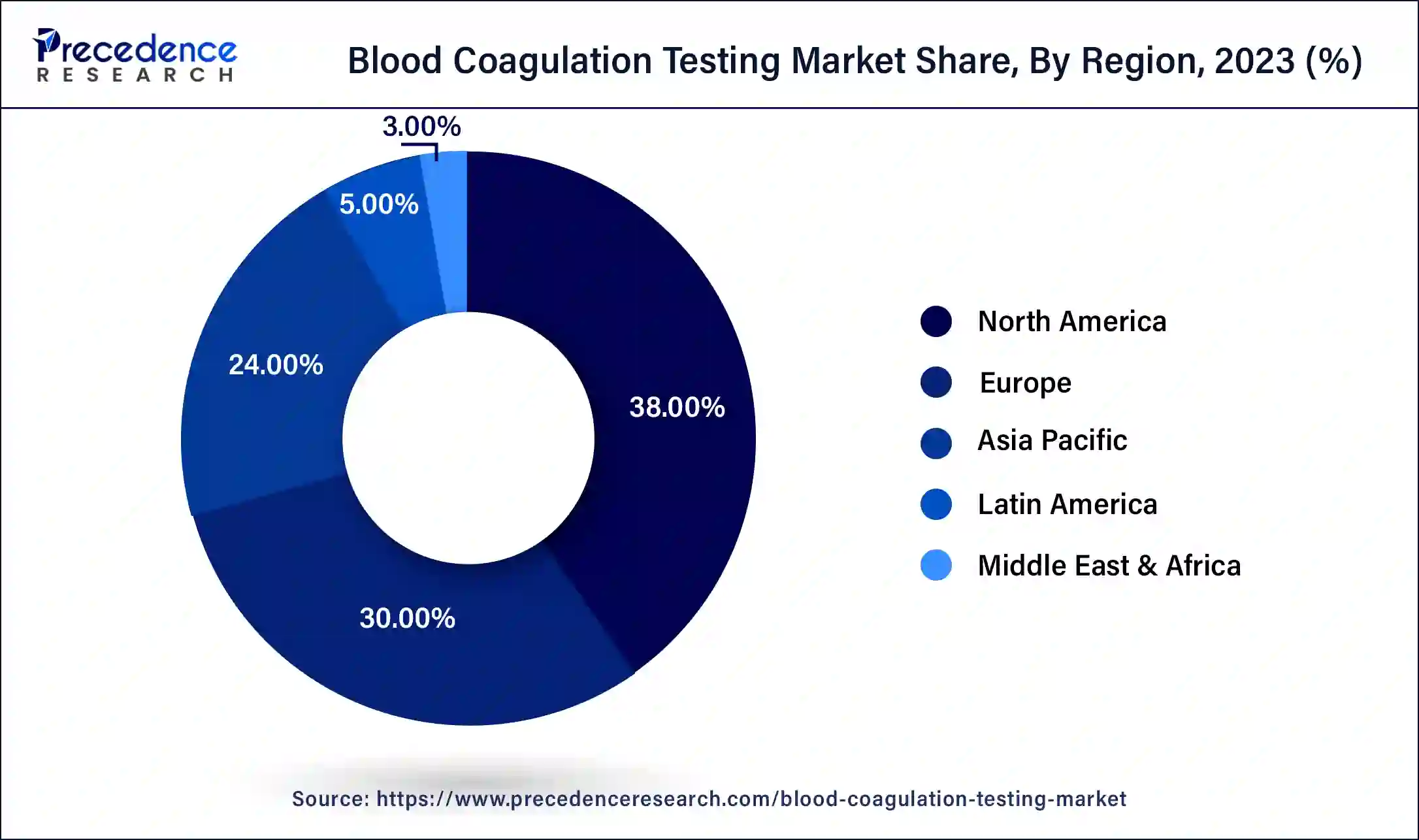

North America region has generated more than 38% of revenue share in 2023. Europe region recorded for the second-highest market share and will likely be the most lucrative market during the forecast period. The rising prevalence of cardiovascular disorders such as strokes and heart attacks and the rise in hospitals and healthcare centers will likely drive growth in the European coagulation testing market during the forecast period.

The Asia-Pacific market for coagulation testing will likely grow at a rapid pace during the forecast period. The Asia-Pacific market is being propelled by an aging population, a growth in the cases of chronic diseases such as immunological disorders and cardiovascular disease, the Development of point-of-care (POC) coagulation testing, and an increase in laboratory automation. Because of the rise in conditions linked to modern lives, like bleeding, many people are adopting blood clotting testing. Sekisui, headquartered in Japan and Abbott have joined forces to provide solutions for coagulation diagnostics to laboratories worldwide. Blood clotting tests assess a person's ability to clot bleeding, which can help clinicians predict the risks of excessive clot formation or bleeding.

Coagulation tests determine blood's clotting ability and time to clot. This test helps the physician discover the chances of severe bleeding or blood vessel thrombosis. Testing helps medical personnel ascertain the probability of thrombosis or forming of blood vessel clots and excess bleeding. Some popular coagulation test types are fibrinogen level, complete blood count (CBC), prothrombin time, Factor V assay, thrombin time, platelet count, and bleeding time.

With the Development in the fields of machine learning and artificial intelligence (AI), tracking several parameters simultaneously via algorithms during a diagnosis/treatment and finding out patient-specific patterns which can help in pinpointing underlying causes or the proper treatment, will be one of the significant developments in technologies of coagulation development in the years to come. Given the challenges posed by novel anticoagulant technologies for current measurement techniques and the applicability and validity of diagnostic parameters like INR, simultaneous observation of complicated patterns or multiple parameters within these individuals may be required for proper observation of patients with special needs.

The major factors driving the coagulation testing market growth are the increasing prevalence of blood disorders and cardiovascular diseases, the high demand for point-of-care coagulation testing, the growing geriatric population, and technological advancements like faster, simpler devices with more sophisticated sensor technology.

Furthermore, coagulation testing advancing technology is adding fuel to the market growth. The rising prevalence of thrombophilia, liver disease, and hemophilia also drives the market's growth.

Also, the rapid transition of medical infrastructure in emerging and developed economies is among the significant factors driving the market's growth. Another essential driving element is the availability of sophisticated coagulation testing kits that can perform tests with high precision. The usage of such kits is encouraged by favorable government policies that support the best healthcare services in various regions.

| Report Coverage | Details |

| Market Size in 2023 | USD 4.01 Billion |

| Market Size in 2024 | USD 4.26 Billion |

| Market Size by 2034 | USD 7.74 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.2% |

| Largest Market | North America |

| Second Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Application, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising cases of chronic blood diseases

The cases of chronic blood diseases are growing exponentially and will likely drive the worldwide coagulation testing market. The coagulation testing market will likely increase because of the need for coagulation laboratories and specialized hematology. Innovation technologies like fluorescence microfluidics, microscopy, photoacoustic detection, and electrochemical sensing make point-of-care devices, and POC tools measure blood clotting's mechanical, optical, and electrochemical components.

According to projections, the coagulation testing market will grow more rapidly in the years to come. Additionally, it is anticipated that rising cardiovascular issues and chronic blood illnesses will spur expansion in the worldwide coagulation testing market. For instance, the World Health Organization (WHO) reports cardiovascular diseases are responsible for about 31% of all patient mortality annually.

The rising price of coagulation devices and lack of expertise

The worldwide coagulation testing market has been adversely affected by strict government regulations and the high cost and risk of treatments and tests, which restrict their use to just the economically capable population. The growth of the global market could be affected by a lack of skilled labor and increased device costs. Numerous studies have concluded that the findings of tests performed in central laboratories are more accurate than those obtained using point-of-care coagulation testing (POCCT) devices, thus further questioning the marketability of these devices.

Smart-phone enabled coagulation tests

Smartphone-based blood coagulation test will likely offer opportunities for the market’s growth during the forecast period. A device is used in this self-testing technique to monitor blood flow in those taking anticoagulant medication. Patients can carry out this test themselves because of the gadget. Activated partial thromboplastin time (APTT) and Prothrombin time (PT), two crucial coagulation markers can be evaluated on this platform. These devices are very effective and dependable. These developments in the coagulation testing market could provide the sector with numerous expansion opportunities.

The market is split into consumables and instruments based on type. The sub-segment for consumables held the largest market share, while the sub-segment for instruments will likely increase at the quickest rate throughout the forecast period.

The market's largest share belongs to the sub-segment for consumables. In the coming years, the consumables market will rise primarily due to the growing appeal of kits and reagents. For instance, over the analysis period, a rise in the use of coagulation analyzers in blood-related conditions such as cardiovascular diseases will spur the expansion of this sub-segment.

In the market, the sub-segment for instruments is growing at the fastest rate. As analyzers in hospitals and labs must operate around the clock to produce rapid and reliable findings, significant advancements have also been made in the flexibility and capability of coagulation apparatus. Today's technologies provide a complete walkaway environment where the operator can perform other tasks after loading the specimens and chemicals and starting the testing procedure. The most recent POC coagulation analyzers provide quick results without forgoing the central lab's diagnostic quality controls. These elements will likely fuel the coagulation testing market's instrument demand.

The market has been segmented based on Application into activated partial thromboplastin time, prothrombin time, activated clotting time, and thrombin time. The sub-segment prothrombin time has the largest revenue share of all of them.

The market's most significant revenue-generating section was the prothrombin time sub-segment. Prothrombin time tests and other clotting time examinations are frequently performed in a hospital or outpatient setting to evaluate the hemostatic system. Sensor technologies that are faster and easier to use are paired with newly created prothrombin time testing equipment. Prothrombin time (PT) tests are expected to become more widely used in clinical laboratories, hospitals, and other healthcare facilities, likely increasing demand for them.

The sub-segment for activated clotting time will likely develop at the quickest rate during the forecast period. The partial thromboplastin time (PTT) test, often called activated partial thromboplastin time (APTT), is frequently used to determine how long it takes for a blood clot to develop. The activated partial thromboplastin time, or PTT test, is used to identify any bleeding diseases like hemophilia by determining how well-defined coagulation factors function. Additionally, this test can be beneficial in identifying autoimmune illnesses that have severe bleeding or clotting issues. The plasma activated by kaolin or ellagic acid is subjected to an APTT test, which can detect intrinsic coagulation.

The sub-segment point-of-care testing is rapidly gaining ground throughout the forecast period. The point-of-care testing subsegment will likely grow most rapidly during the forecast period. POCCT (point-of-care coagulation testing) lets clinicians immediately check a patient's coagulation state in real-time. POCCT provides several advantages over traditional coagulation assays. Increased demand for hospitals, as well as increased rivalry among suppliers and therapists, will likely drive global market growth. Furthermore, professionals evaluate newly developed technology and guarantee that patients take advantage of new coagulation testing breakthroughs. POCT for perioperative coagulation allows for advanced interactions inside the clotting system, shorter turnaround times, and less incorrect transfusion.

The hospital sub-segment will likely maintain its lead in the forecasted period. The hospital, an essential part of a medical and social institution, provides people with complete healthcare facilities in preventive and curative ways. As consumers become increasingly aware of the hazards of obesity, cardiovascular disease, and hypertension, they are turning to health facilities and hospitals for routine blood tests.

Segments Covered in the Report

By Product Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

August 2024

March 2024