April 2025

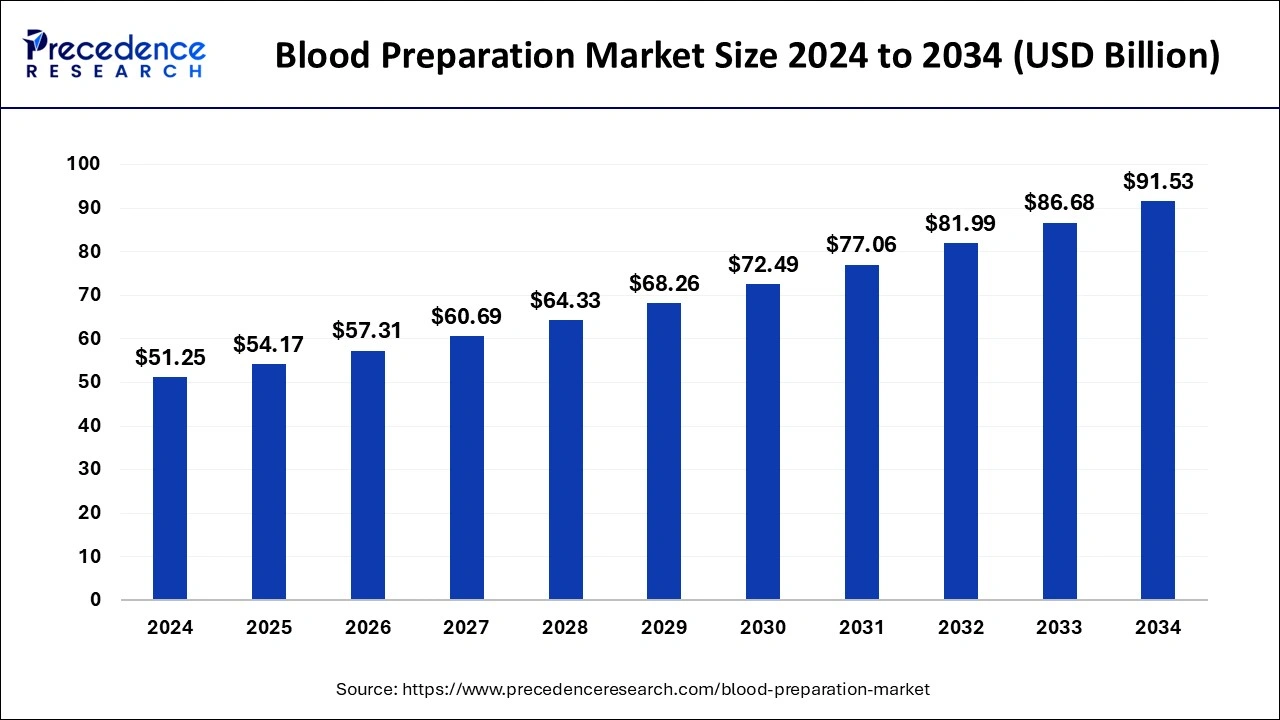

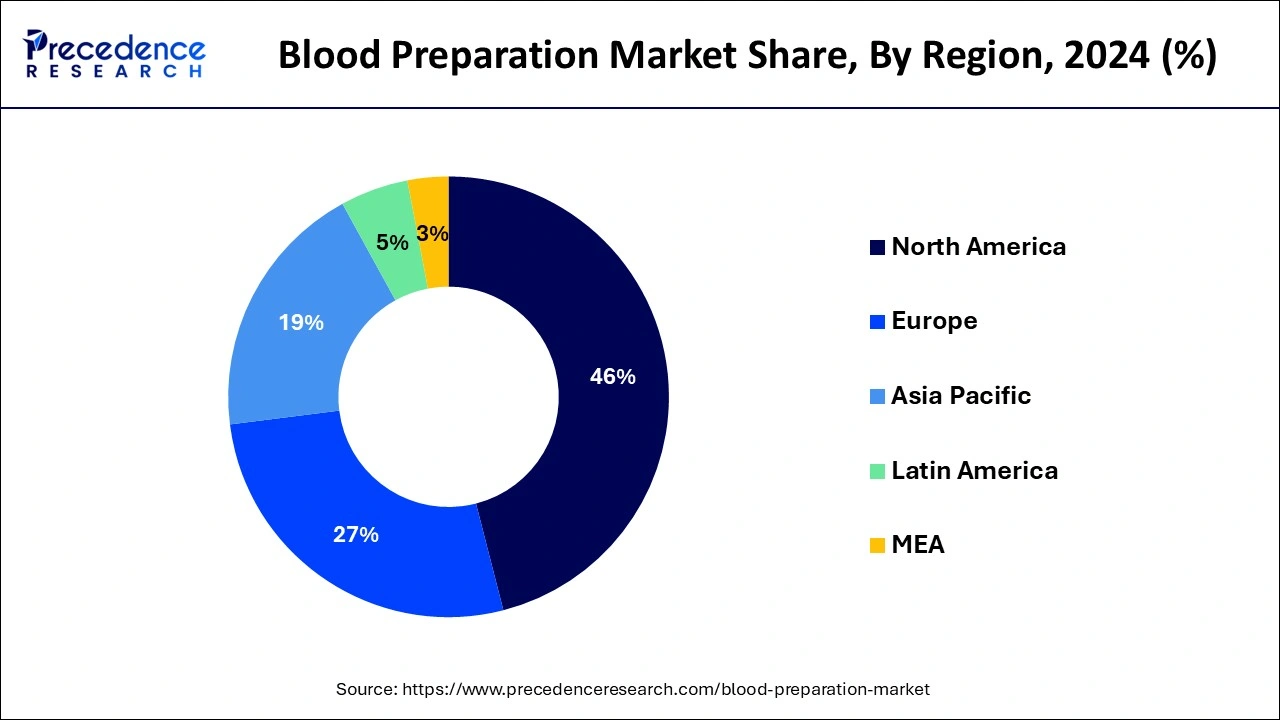

The global blood preparation market size is accounted at USD 54.17 billion in 2025 and is forecasted to hit around USD 91.53 billion by 2034, representing a CAGR of 5.97% from 2025 to 2034. The North America market size was estimated at USD 23.58 billion in 2024 and is expanding at a CAGR of 5.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global blood preparation market size accounted for USD 51.25 billion in 2024 and is predicted to increase from USD 54.17 billion in 2025 to approximately USD 91.53 billion by 2034, expanding at a CAGR of 5.97% from 2025 to 2034.

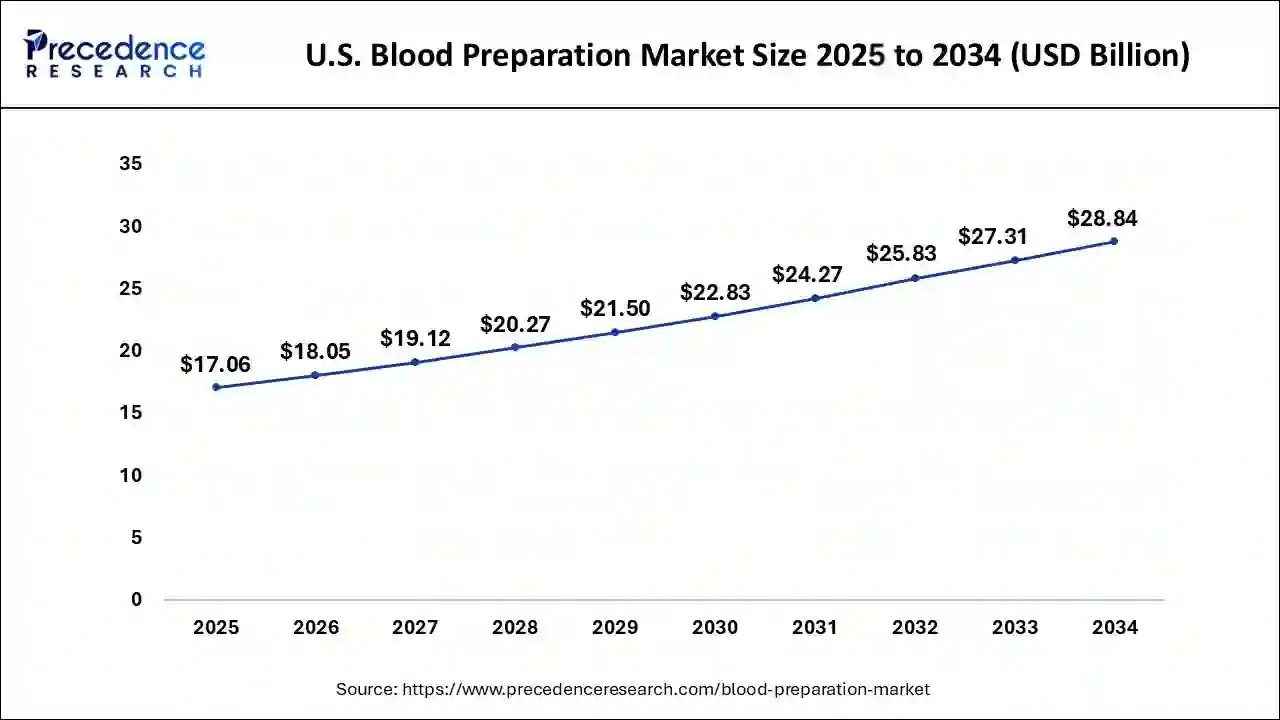

The U.S. blood preparation market size was evaluated at USD 16.14 billion in 2024 and is projected to be worth around USD 28.84 billion by 2034, growing at a CAGR of 6.00% from 2025 to 2034.

As per the American National Red Cross, someone in the United States requires blood and/or platelets every 2 seconds. Around 29,000 units of red blood cells are needed each day in the United States. About 6,500 units of plasma and 5,000 units of platelets are required every day in the U.S. Approximately 16 million blood components are transfused every year in the United States. Thus, the high demand for blood components is driving the blood preparation market growth in the North American region.

In April 2024, fifty community groups and organizations across Wales and England received £685,000 ($856,983) in funding. This financial support was provided as part of the Government’s commitment to tackle health inequalities by promoting blood donation among Asian and Black communities. German Red Cross has 6 blood transfusion services including 28 donation centres and institutes. Some of these institutes and donation centers also offer an opportunity for plasmapheresis. The presence of a significant number of blood transfusion and donation centers is strengthening the European blood preparation market from the supply side.

In June 2024, the Indian Health Ministry reported that India needs an average of 14.6 million blood units every year. As per the Press Information Bureau (PIB), someone in India requires blood every 2 seconds, and 1 out of every 3 Indians will need blood in their lifetime. Thus, the high demand for blood is expected to drive the blood preparation market in the Asia Pacific (APAC) region in the coming years.

The growing number of transfusion procedures, rising incidence of blood-related disorders, and increasing blood donations are majorly driving the blood preparation market growth across the world. Additionally, the growing incidence of road accidents is also expected to fuel the market growth over the study period. In June 2023, the WHO stated that in total, 79 nations collect more than 90% of their blood supply from voluntary unpaid blood donors and 54 nations collect over 50% of their blood supply from family/replacement or paid donors. As per The American National Red Cross, nearly 6.8 million people donate blood in the U.S. every year. The American National Red Cross also mentioned that around 13.6 million units of whole blood and red blood cells are collected every year in the United States. The high donation of blood and its components supports the blood preparation market growth remarkably.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.97% |

| Market Size in 2025 | USD 54.17 Billion |

| Market Size by 2034 | USD 91.53 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Antithrombotic and Anticoagulants Type, Application, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The growing blood donations in various countries are driving the blood preparation market growth remarkably. As per an analysis of Increasing blood donation

mentioned by the National Library of Medicine, the blood donation rate in Japan in FY 2020 increased and accounted for 6.0% (5.04 million). While addressing ‘National Voluntary Blood Donation Day’ in October 2022, the Indian Union Health Minister stated that over 250,000 people donated blood under ‘Raktdaan Amrit Mahotsav’ in India.

Complications associated with blood transfusion

Inappropriate handling of blood products during processes such as blood transfusion can probably lead to various blood-borne infections. Transfusion-transmitted infections (TTIs) refer to infections that originate from the introduction of a pathogen into a person’s body through blood transfusion. A broad range of organisms, including viruses, bacteria, parasites, and prions can be transmitted through blood transfusions. Transfusion–transmitted sepsis can cause severe illness. More common reactions with blood transfusion include allergic reactions. These allergic reactions may cause fever, hives, and itching. The risk of respective infections associated with blood transfusion tends to restrain the blood preparation market growth to a certain extent.

New research initiatives

Several new initiatives supporting the research and awareness of blood transfusions have been observed in the past few decades. The policies support business to develop a better understanding regarding blood and its components. In January 2023, it was announced that a scientist from the University of Maryland School of Medicine (UMSOM) will lead a new research program for developing and testing a whole blood product.

This whole blood product will be storable at room temperature and useful to transfuse wounded soldiers within 30 minutes of injury. With $46.4 million in Federal funding, UMSOM will manage this whole blood product project. The growing research and development activities for blood products are anticipated to create promising opportunities for the blood preparation market growth.

The whole blood segment held the largest market share in 2024. Whole blood is used in the treatments of cases that require large amounts of all blood components. Majorly individuals who have sustained significant blood loss due to major surgeries or massive trauma need substantial quantities of whole blood. As per the German Heart Surgery Report 2022, the total number of heart surgical procedures increased from 92,838 in 2021 to 93,913 in 2022. The growing number of heart surgeries is contributing to the enormous growth of the whole blood segment.

The blood derivatives segment is predicted to grow at a notable compounded annual growth rate (CAGR) during the study period. The increasing requirement for the development of plasma-derived proteins, such as coagulation factor products, immunoglobulins, dried human plasma, human fibrin foam, and human thrombin, is expected to cater to the growth of the blood derivatives segment during the forecast period.

The thrombocytosis segment had a higher revenue share in 2024. The National Library of Medicine mentions that in a retrospective study involving 801 adult patients, primary thrombocytosis was observed in 5.2% of cases. Thus, the high prevalence of thrombocytosis, increasing awareness, and advancements in diagnostic techniques contribute to the growth of the thrombocytosis segment.

The angina blood vessel complications segment is anticipated to grow with a significant compounded annual growth (CAGR) during the forecast period. Angina is generally caused by a reduction in blood flow to the heart muscle, which is commonly observed in coronary artery disease (CAD). As per the Centers for Disease Control (CDC), about 1 in 20 adults (nearly 5%) aged 20 years and older have coronary artery disease (CAD) in the U.S. The high prevalence of coronary artery disease is estimated to contribute to the angina blood vessel complications segment growth.

By Product

By Antithrombotic and Anticoagulants Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

August 2024

March 2024