April 2025

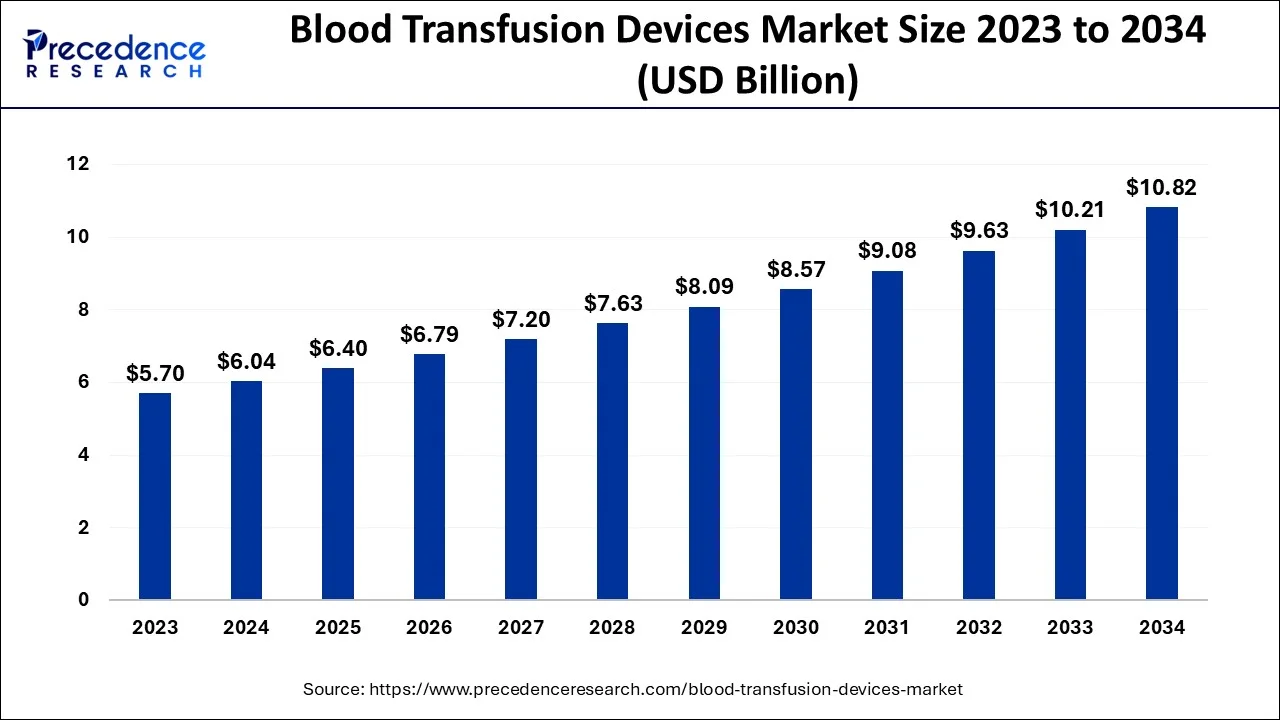

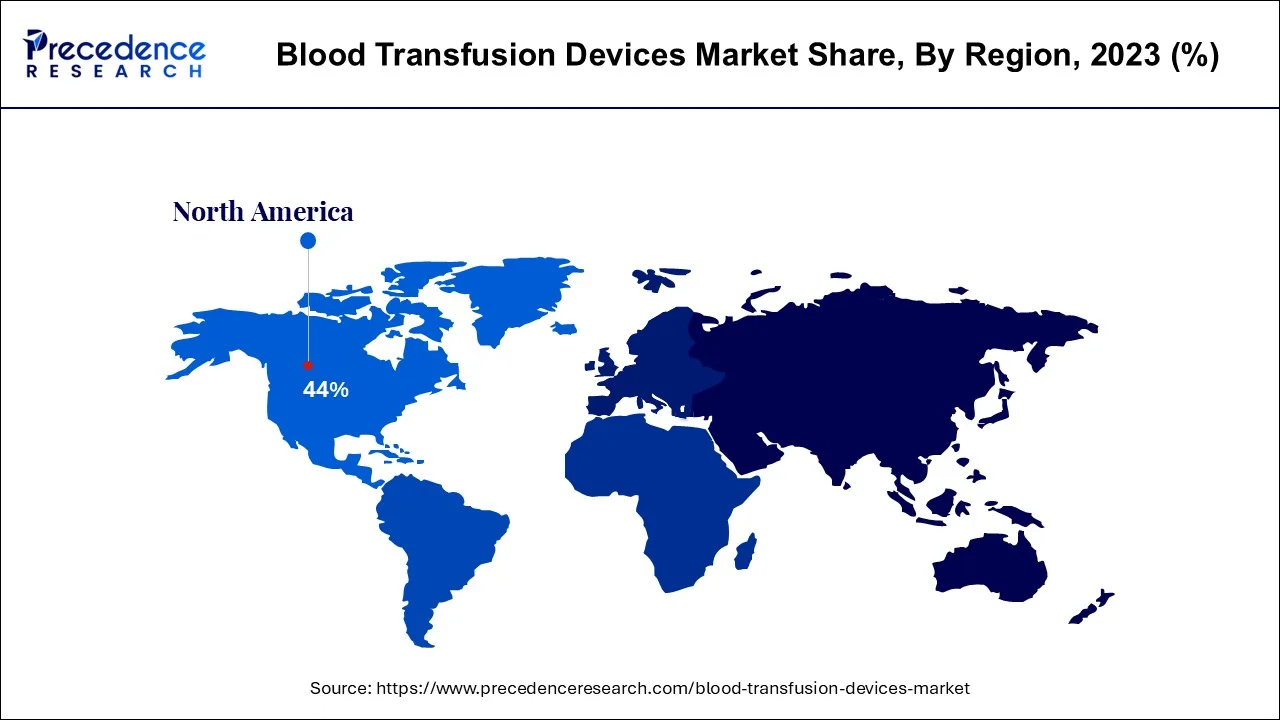

The global blood transfusion devices market size accounted for USD 6.04 billion in 2024, grew to USD 6.40 billion in 2025 and is predicted to surpass around USD 10.82 billion by 2034, representing a healthy CAGR of 6% between 2024 and 2034. The North America blood transfusion devices market size is calculated at USD 2.66 billion in 2024 and is expected to grow at a fastest CAGR of 6.09% during the forecast year.

The global blood transfusion devices market size is estimated at USD 6.04 billion in 2024 and is anticipated to reach around USD 10.82 billion by 2034, expanding at a CAGR of 6% from 2024 to 2034.

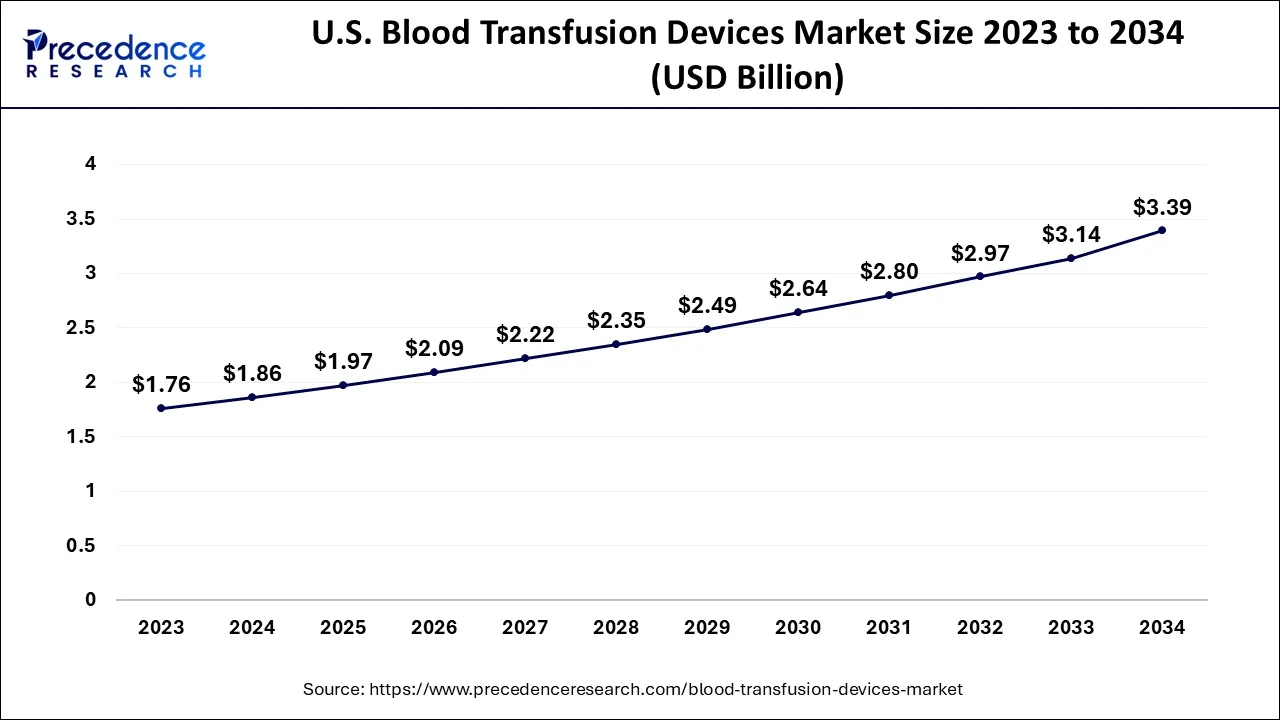

The U.S. blood transfusion devices market size is evaluated at USD 1.86 billion in 2024 and is predicted to be worth around USD 3.39 billion by 2034, rising at a CAGR of 6.14% from 2024 to 2034.

Globally, the COVID-19 epidemic has put an enormous strain on everyone on the planet. Not only is the public healthcare system overburdened with patients, but the general populace is terrified and confined in their movement, and their everyday lives have been drastically altered. According to Jennifer N. S. Leung ET a research report, published in the International Society of Blood Transfusion in April 2020, the first three months of the year 2020 in China were difficult and stressful in managing both blood safety and supply.

Furthermore, the blood transfusion service has considerable challenges in maintaining a safe blood supply. The public and donors' trust in blood donation has been restored thanks to precautionary measures. However, when mobility limitations are tightened, it will be difficult to collect enough blood to satisfy patients' transfusion needs. According to a research article published in the ISBT in December 2020 by Andre Loua et al., the African area, like the rest of the globe, experienced socioeconomic upheaval as a result of the COVID-19 epidemic. It has a substantial influence on the delivery of healthcare services. Overall, the study found that the region's safe blood supply and demand were under threat due to a decline in these activities in the majority of respondent nations, particularly during the start of the COVID-19 pandemic. As a result, the COVID-19 epidemic has reduced blood-related activity in Africa, including supply and demand.

Some of the reasons driving market expansion include an increase in the number of surgical operations, an increase in the number of accidents and trauma cases, an increase in the number of blood diseases, and technological advancement.

To collect and re-infuse the patient's blood, transfusion devices are frequently employed. These mechanisms are crucial for cell recovery. Procedures that make it possible to transfuse autologous blood to lessen the danger of infections brought on by transfusions of allogeneic blood. These Devices are used in invasive procedures such as cardiovascular, orthopedic, neurological, obstetrical, and gynecological. based on the systems can be divided into intraoperative systems, post-operative systems, and dual-mode systems based on their usefulness. Cardiovascular operations, C-section procedures, and trauma and accident injuries are the most common surgeries that require blood transfusion. According to World Health Organization updates in 2021, worldwide caesarean section rates have increased from roughly 7% in 1990 to 21% now, and are expected to climb further over the next decade. If current trends continue, Eastern Asia (63%), Latin America and the Caribbean (54%), Northern Africa (48%) Western Asia (50%), Southern Europe (47%), and New Zealand, Australia (45%) would have the highest rates by 2030. As a result, the increasing number of surgical procedures is expected to raise the demand for blood transfusion equipment.

| Report Coverage | Details |

| Market Size in 2024 |

USD 6.04 Billion |

| Market Size by 2034 |

USD 10.82 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, End Use, and Geography |

| Companies Mentioned | Immucor, Inc. (U.S.), BD (U.S.), B. Braun Melsungen AG (Germany), Terumo Corporation (Japan), Grifols, S.A. (Spain), Fresenius SE & Co. KGaA (Germany), Haemonetics Corporation (U.S.), Teleflex Incorporated (U.S.), Redax (U.S.), Medtronic (Ireland), LivaNova PLC (U.K.), Brightwake Ltd. (U.K.), Advancis Surgical (U.K.), Atrium Medical Technologies (U.S.) |

Rise in the number of blood disorders

Growth in the number of various types of surgeries in all worldwide locations

Increased demand for minimally invasive surgery and the use of hemostatic devices to restrain the growth

The autotransfusion systems segment will dominate due to increased use in both developed and developing countries. The market is divided into two categories: autotransfusion systems and consumables and accessories. Autotransfusion systems are further divided as intraoperative autotransfusion systems, perioperative autotransfusion systems and post-operative autotransfusion systems. Autotransfusion systems with two modes The growing use of autotransfusion devices in both developed and developing countries as a result of Their effectiveness in blood transfusion is likely to drive growth in this category throughout the forecast period.

Additionally, increased flexibility, transfusion report generating, technological developments for better clinical results, and by 2034, connectivity is expected to promote the growth of the dual-mode autotransfusion systems market. Furthermore, increased acceptance and use of autotransfusion systems are expected to provide significant potential for the global market for consumables and accessories is expanding. This, together with the rising emphasis on intraoperative cell therapy, Salvage during big invasive procedures is likely to drive this segment's growth throughout the forecast period.

Cardiovascular Surgeries will take the lead, supported by an increasing number of surgical procedures. The market is classified into cardiovascular surgeries, orthopedic surgeries, neurological operations, and obstetrics. Gynecological procedures, among other things

The cardiovascular surgeries category is expected to lead the worldwide market in terms of revenue, owing to increased adoption of these devices used during cardiovascular surgery operations. Furthermore, the growing number of cardiovascular treatments, such as coronary angioplasty, CABG (coronary artery bypass grafting), ICD & pacemaker implantations, heart transplants, valve replacements Replacement operations, among other things, will help this market flourish.

The use of post-operative cell salvage in orthopedic operations is predicted to fuel the orthopedic surgeries segment's growth. Furthermore, the rising number of invasive operations, such as caesarian section and others is expected to fuel the obstetrics & gynecology market. The market category with the greatest CAGR in 2024 is gynecological surgery.

The increasing number of surgical procedures performed in hospital settings will drive segment growth. The market is divided into hospitals, specialized clinics, and others based on end-user. Over the projected period, the hospitals sector is expected to dominate the worldwide market. The growing prevalence of cardiovascular and Obstetrics and gynecological procedures performed in hospitals are expected to boost market growth throughout the forecast period. Furthermore, several aspects such as emerging nations' improving healthcare infrastructure and an increasing number of sophisticated healthcare institutions are projected to increase the usage of autotransfusion equipment in user hospitals, which may eventually accelerate the expansion of the hospital sector in the worldwide market.

However, the increasing use of intraoperative and post-operative cell salvage in specialty clinics, particularly in industrialized countries, is concerning. By 2034, the specialist clinics and other category are expected to drive significantly.

By Product

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

August 2024

March 2024