August 2024

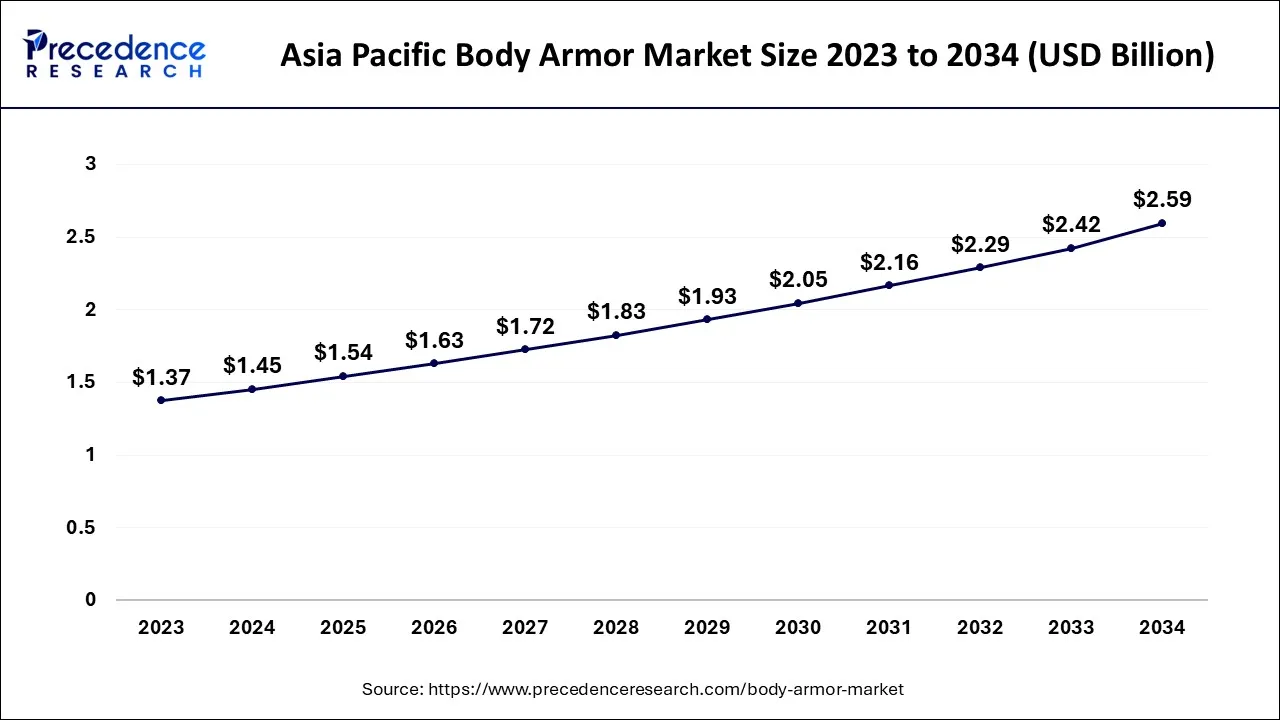

The global body armor market size accounted for USD 3.30 billion in 2024, grew to USD 3.50 billion in 2025, and is expected to be worth around USD 5.83 billion by 2034, poised to grow at a CAGR of 5.86% between 2024 and 2034. The Asia Pacific body armor market size is predicted to increase from USD 1.45 billion in 2024 and is estimated to grow at the fastest CAGR of 5.98% during the forecast year.

The global body armor market size is expected to be valued at USD 3.30 billion in 2024 and is anticipated to reach around USD 5.83 billion by 2034, expanding at a CAGR of 5.86% over the forecast period from 2024 to 2034.

The Asia Pacific body armor market size is exhibited at USD 1.45 billion in 2024 and is projected to be worth around USD 2.59 billion by 2034, growing at a CAGR of 5.98% from 2024 to 2034.

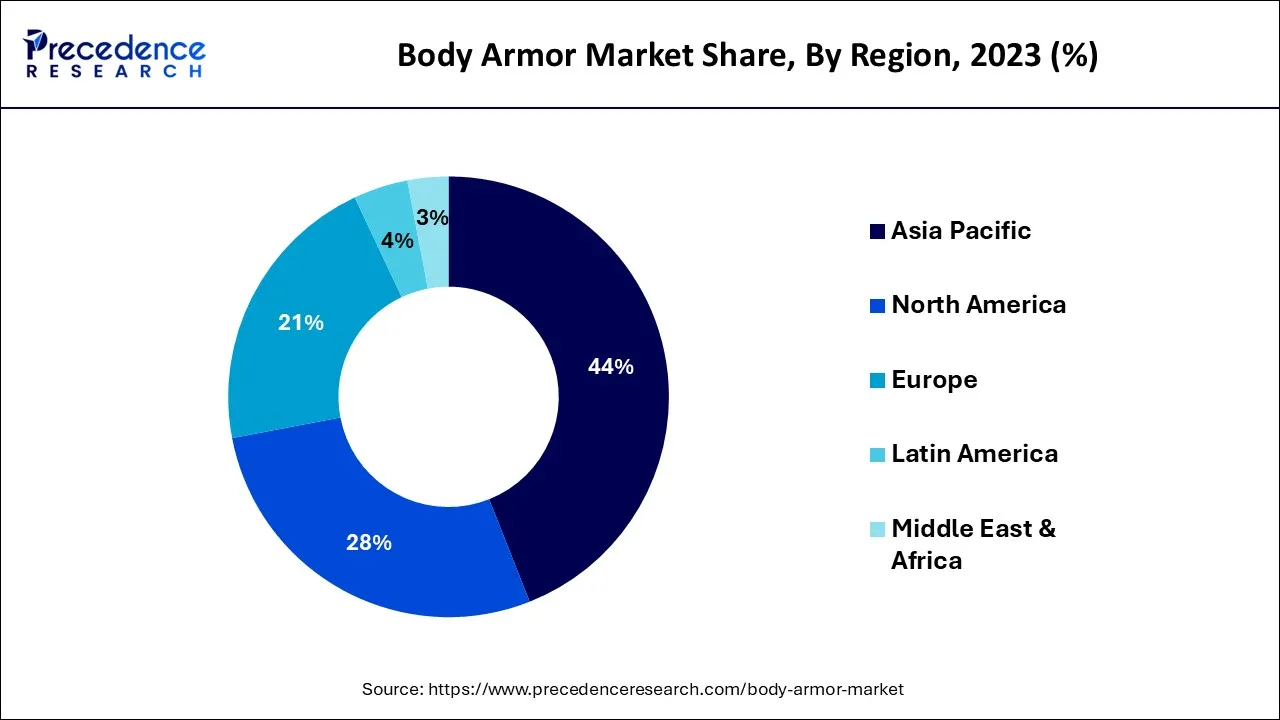

Asia-Pacific generated for more than 44% revenue share in 2023 by growing military expenditure. Countries like India, Japan and China with large military troops are recognized for substantial charges on military gear. Raising border disputes and warfare illustrates are foreseen to propel the need for body armor.

The United States registered a significant revenue share. The United States has broadened its military spending to offset the aggressiveness of its strategic rivals as China and Russia. Additionally, the U.S. has aggressively provided Ukraine with military support to combat Russia due to raised demand for armor in the upcoming months.

Europe is predicted to observe a growing CAGR of 6.94% from 2024 to 2034. The increased spending is awaited military upgradation with personal safety and weapons. European nations like Germany, France, and Italy contribute a part of their defence spending to NATO, boosting the need for this product over the estimated period.

High-performance body armor is incorporated with specialized equipment like video cameras, communication systems, oxygen systems, face protection, and other advanced technologies allowing the person to undertake a fight without any obstacles.

The heavy weight of body armor compelled dealers to finance research and development to optimize the manufacturing process and tone down its importance. They also formulate armor with health monitors and communication apparatus, growing the cost of the working and leading to challenges in taking full advantage of the price and weight of the product. This could significantly challenge the market's growth throughout the estimated period. Increasing emphasis on the security of military personnel throughout modern warfare practices is anticipated to build up the market in the upcoming years.

The development of lightweight raw matter is remarkably leading market growth. Dealers are focused on lightweight materials in the making process. For example, Fibrotex's partnership with Israel Defense Forces formulated FIGHTEX, a type of next-generation two-sided combat uniform that is light in weight, innovative fabric. These uniforms use advanced materials that bolster soldiers' survivability over critical missions.

These light uniforms are fire-resistant and can be incorporated with other items, that includes winter uniforms, jackets, and load carriers. With the increasing adoption of lightweight materials, the demand for lighter armor rises due to their benefits. This is predicted to foster the market's growth over the estimated period.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.30 Billion |

| Market Size by 2034 | USD 5.83 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.86% |

| Largest Market | Asia-Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Protection Level, By End-User, By Type and By Style |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Counter-terrorism, insurgency, and warfare operations illustrate contemporary warfare tactics that could induce fatal injuries to soldiers. This also arises in law enforcement, where felons, criminals, and other lawbreakers have the potential to fatally hurt correspondent officers, necessitating the acquisition of protective suits and related gear that eventually results in the growing demand for ballistic protection gear and claims to protect military forces worldwide. Likewise, modernization services have opened various doors for sector players, ensuing in contractual unions with armed forces organizations.

Optimizing the weight of body armor is the major challenge hindering market growth. The importance of body armor rises even more when blended with equipment such as optics, radio, and ammunition. These devices add extra weight to the heavy armor, affecting the wearer's mobility, efficiency, and flexibility. The body armor market is fragile and subject to several laws and regulations. The guidelines for screening the level of keenness the body armor can endure against any danger must be met by dealers producing and marketing armor.

The United States Department of Defense (DoD), Underwriters Laboratories (UL India), as well as the National Institute of Justice (NIJ) are the three regulative bodies that check the standard of body armor. Further, the bar can determine the point of danger an armor plate can withstand. Regimes are being altered to secure more excellent security, making it challenging for market sellers to compete.

Modernizations in materials employed for bulletproof jackets are the primary tendency in the market. There has been significant progress in body armor, like bulletproof jackets. Conventional bulletproof jackets are made up of protective stuff called Kevlar. Kevlar is a commonly used matter as armor for bullet protection. Hence, the material bends up to 3.5 centimeters on impact inwards, and the material's safety is questionable. To enhance the drawbacks of traditional vests, a fresh fluid, considered a non-Newtonian liquid, has been developed.

Similarly, a new material called graphene is also being used to manufacture defense equipment. Thus, introducing these raw materials will improve the quality and security of bulletproof jackets, which is estimated to push the market's growth over the forecast period.

Protection level III accounted for the maximum global revenue share of over 26% in 2023. It is the most extensively used protection armor. These protection outfits are more flexible, lighter in weight, and concealable under clothing, capable of defeating a more comprehensive range of ammunition. It provides more excellent blunt protection than IIA. Suitable for council employees, civilians, and officers.

The level II section is expected to expand at a 7.4% CAGR from 2024 to 2034. It protects a typical handgun round and is even light in weight, comfortable and concealable. It provides excellent protection against blunt force trauma as compared to level II.

Different IIIA levels are used with other protective panels, assigning maximum protection. It is a soft armor, and the materials used to manufacture the level IIIA and group III choices differ. This type of body armor can be worn both covertly and overtly. Few makers also offer IIIA+ goods to protect against shotgun shells, for instance, 9mm civil defense rounds.

Lastly, the level IV goods offer protection from AP bullets of 30 calibers. It is used in military contexts and provides the maximum level of security. This gear is pricey and bulky compared to grade III and III+ products.

The defense sections dominate the market with a maximum global revenue share of around 59% in 2023. This is due to the progression of battlefield threats, for instance, bone-breaking shrapnel or batons in improvised explosive devices, which has pushed for the approval of new tactical ballistic vest protection and pioneering body armor.

The law enforcement section is estimated to record a significant CAGR of 7.9% from 2024 to 2034. This is mainly boosted by security personnel and first respondents as they carry out their duties to ensure safety and security and to defeat, prevent and prosecute offenses. An increase in government expenditure for internal protection and control in the country worldwide will likely propel the growth of this section.

Governments and companies worldwide are investing in manufacturing new lightweight vests with increased mobility over the integration of advanced technologies such as 3D printing and the utilization of composite materials. DRDO has announced the development of bulletproof with the implementation of new technology. This advancement focused on avoiding the enormous weight of the body armor that makes it difficult for military men to wear and move freely on the battlefield. As per the rules and regulations of the National Institute of Justice (NIJ), the enforced officers face numerous difficulties. Firearms are a significant need for lightweight shields with strict quality control and fast turnaround for law enforcement agencies.

The vest section generated for more than 56% of revenue shares in 2023, comprising stab-resistant and bulletproof vests that protect against the assault on the body's essential organs. Further, it provides the highest security in close combat situations and frontline defense battles. Depending upon the end-user and concern, covert and overt vests offer different levels of flexibility.

The helmet section is estimated to have a higher CAGR of 6.9% between 2024 and 2034. It can be found in different shapes and sizes, such as a ballistic helmet. Based on the design, the helmet can be high-cut, mid-cut, and full-cut. As level II ballistic helmets are light and comfortable, it is extensively used by police and law enforcement officers to protect from handguns, shrapnel, and blunt force.

The soft product offers highly comfortable and flexible pistols, mainly used by first respondents and for covert operations. Complex products feature durability property materials like steel, ceramics, polyethylene, ceramic composites, and materials such as kevlar. Other sections contain safety gear, for instance, eye protection, gloves, joint guards, groin protection, and neck guard. Transition and military combat eye protection are safety gear for the eyes.

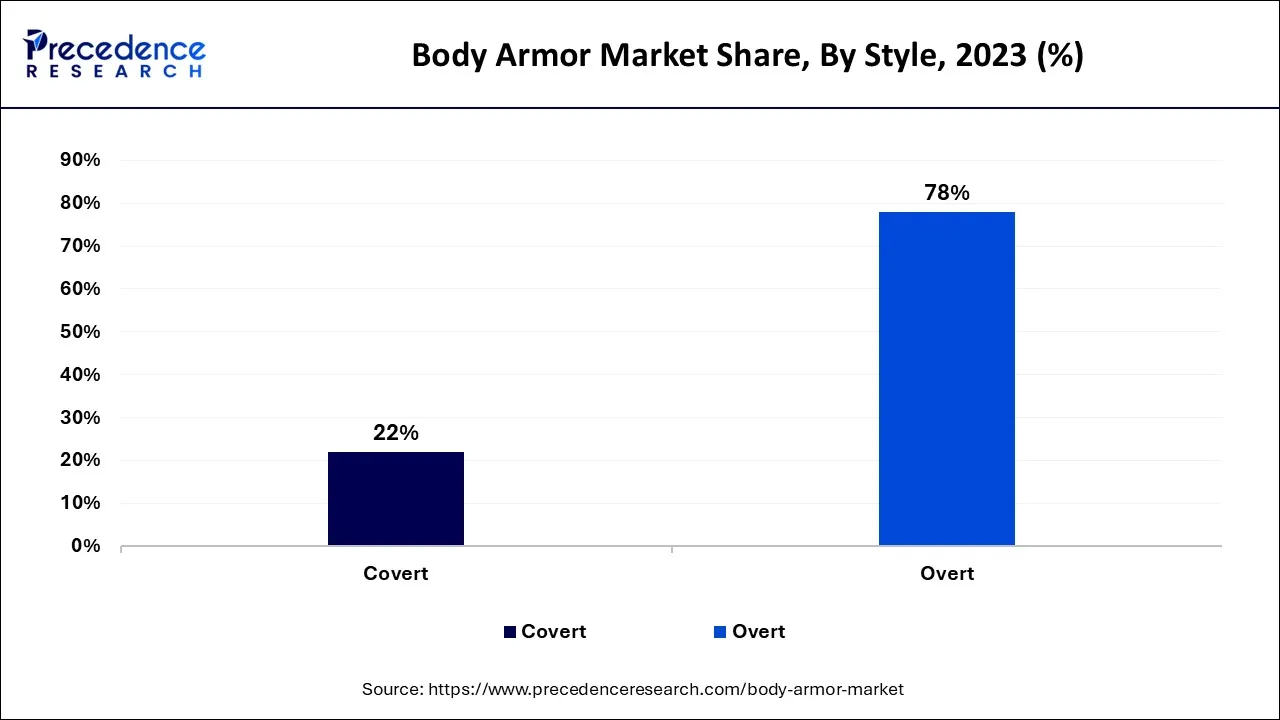

The overt section is estimated for the highest revenue share of around 78% in 2023. It is due to a higher level of protection from larger spikes or blades and heavy gunfire. Basically, this type of armor is worn on top of the clothing even bulkier. These armors are heavier as it is prepared using different kevlar layers. It is used to protect against many different weapons comprises of knives, bullets, etc., and is available in all levels of protection.

This can be customized which acts as an advantage with multiple pockets and even protecting cover for arm and neck regions. It is made up of sturdier bulletproof panels and are preferred by personnel in high-risk sectors as in controlling riots, war zones and military operations.

Segments Covered in the Report

By Protection Level

By End-User

By Type

By Style

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024