March 2025

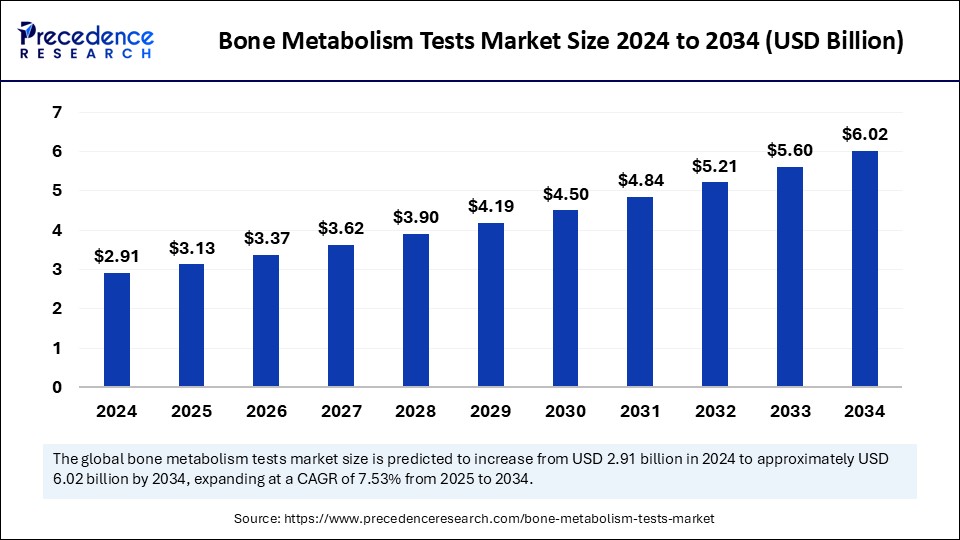

The global bone metabolism tests market size is calculated at USD 3.13 billion in 2025 and is forecasted to reach around USD 6.02 billion by 2034, accelerating at a CAGR of 7.53% from 2025 to 2034. The North America market size surpassed USD 1.13 billion in 2024 and is expanding at a CAGR of 7.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bone metabolism tests market size was estimated at USD 2.91 billion in 2024 and is predicted to increase from USD 3.13 billion in 2025 to approximately USD 6.02 billion by 2034, expanding at a CAGR of 7.53% from 2025 to 2034. The global market growth is attributed to the introduction of innovative bone metabolism testing products.

Artificial Intelligence is used for classifying, predicting, and evaluating OP risk factors in clinical data for women and men separately. In addition, artificial intelligence was used to suggest the most effective sports programs for bone-related disease treatments. Integrating AI technologies in a clinical setting can improve treatment and help primary care providers classify patients with osteoporosis.

AI is effective in quick access and classification of bone metabolism tests. In addition, AI technologies are used to classify and predict subjects into OP, osteopenia, and healthy. AI model improves diagnostic accuracy and saves time for malignant bone diseases. Artificial intelligence offers unprecedented insights and diagnostic innovations, by artificial intelligence offers unprecedented insights and diagnostic innovations.

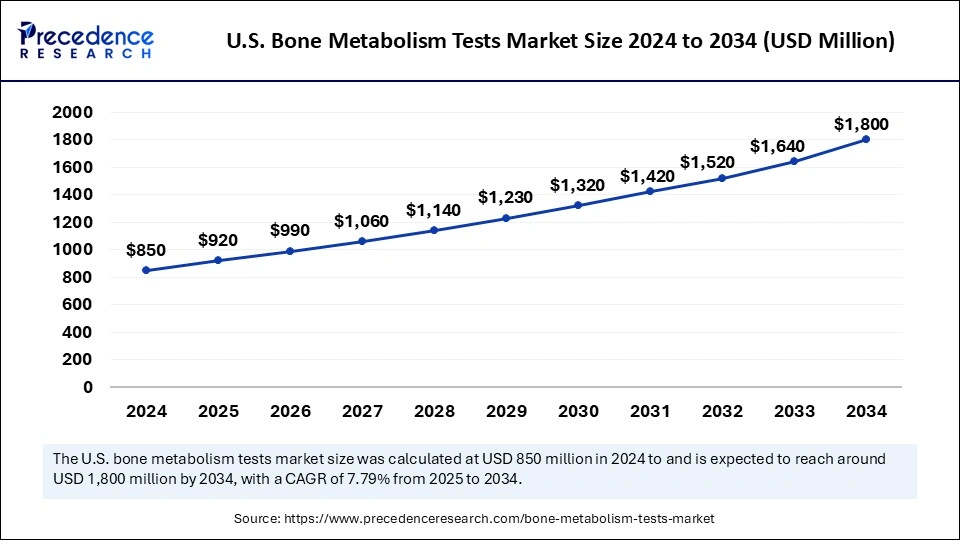

The U.S. bone metabolism tests market size was exhibited at USD 850 million in 2024 and is projected to be worth around USD 1.80 billion by 2034, growing at a CAGR of 7.79% from 2025 to 2034.

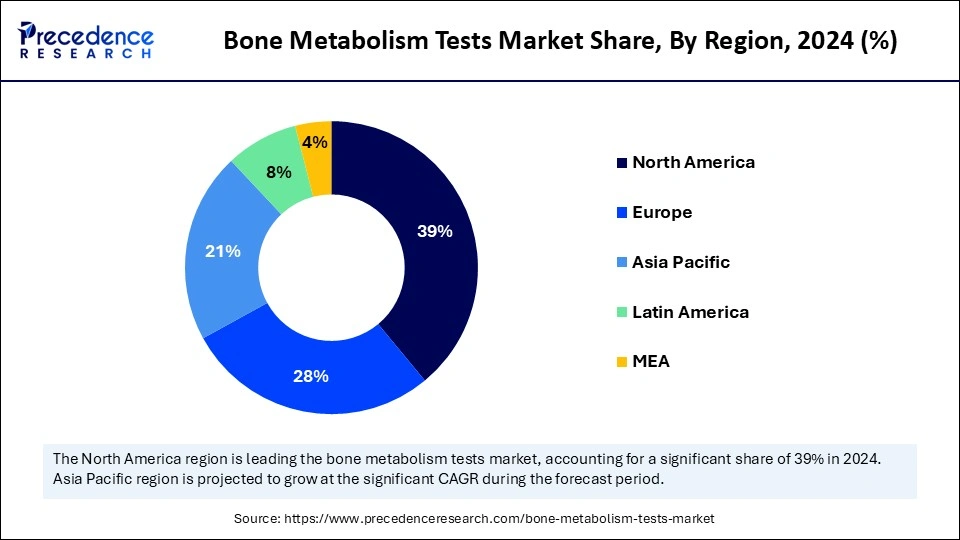

North America dominated the bone metabolism tests market in 2024. The market growth in the region is attributed to the early adoption of innovative solutions, increasing robust infrastructure, and rising technological advancements. The prevalence of strong investments and major market leaders in research and development are further expected to enhance market growth in the region. The U.S. and Canada are the major dominant countries in the region. The increasing consumer preferences for advanced solutions and increased industrial applications are further anticipated to drive the growth of the market in the U.S.

The Asia Pacific is expected to grow fastest during the forecast period. The market growth in the region is attributed to the growing demand from developing countries, rapid urbanization, and industrialization. In addition, the increasing consumer demand for innovative solutions, the increasing middle-class population, and the increasing adoption of advanced technologies, equipped with increasing investments in manufacturing and infrastructure, are further expected to accelerate the growth of the bone metabolism tests market in the region. China, India, Japan, and South Korea are the major countries driving the market growth.

The bone metabolism tests market deals with the functioning and health of the skeletal system. These tests help in the monitoring and evaluation of bone diseases such as bone cancer, Paget’s disease, and osteoporosis. The growing senior population across the globe, the increasing frequency of bone-related and osteoporosis diseases, and rising technological advancements in diagnostic technologies are anticipated to enhance the market growth.

In addition, the introduction of innovative bone metabolism testing products is also a major driver in enhancing the growth of the bone metabolism tests market. Various manufacturers are concentrating on developing more efficient and accurate tests to allow precise and early detection of bone-related diseases. In addition, integrating bone metabolism tests with other diagnostic modalities, including dual-energy X-ray absorptiometry (DEXA), enhances patient care and diagnostic accuracy.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.02 Billion |

| Market Size in 2025 | USD 3.13 Billion |

| Market Size in 2024 | USD 2.91 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for point-of-care testing

The growing demand for rapid and convenient diagnostic solutions creates lucrative opportunities for point-of-care bone metabolism tests. POC tests reduce laboratory processing time and eliminate the need for sample transportation. The quick and convenient turnaround time of point-of-care tests makes them desirable in remote settings, clinics, and emergency departments. In addition, by developing user-friendly and portable point-of-care devices for bone metabolism testing, various market leaders can capitalize on this opportunity.

Limited reimbursement coverage

The lack of reimbursement coverage for bone metabolism tests creates major challenges to market growth. Reimbursement policies vary across healthcare systems and various countries, and some bone metabolism tests may not be reimbursed or covered fully. This can limit patient access and discourage healthcare providers from prescribing these tests. In addition, by increasing reimbursement coverage for bone metabolism tests, healthcare organizations and governments need to address this issue and ensure equitable access for patients.

The rising focus on personalized medicine

The increasing trend toward personalized medicine provides lucrative opportunities for the market of bone metabolism tests. Based on individual patient characteristics, personalized medicine aims to tailor medical treatments and decisions. Personalized medicine can involve genetic testing to predict the response to specific treatments or to identify individuals at high risk of bone disorders in order to test bone metabolism tests. To integrate genetic testing with bone metabolism tests, various major companies can invest in research and development and further offer personalized treatment solutions and diagnostics.

The assays or consumables segment dominated the bone metabolism tests market in 2024. The market is segmented into instruments and assays or consumables. Assays or consumables include kits, reagents, and other consumable products needed for bone metabolism testing. These products are consumed with each test and necessary components of the testing procedure. In addition, consumables represent the most frequently used category of products and increased significant demand for these items from diagnostic laboratories, clinics, and medical facilities.

The instruments segment is expected to grow fastest during the forecast period. These tools include analyzers for biochemical analysis, devices for quantitative ultrasound measurement, machines that utilize dual-energy X-ray absorptiometry (DEXA), and various other equipment used for laboratory purposes or imaging.

The enzyme-linked immunosorbent assay (ELISA) segment accounted for the largest market share in 2024. The market is segmented into clinical laboratory improvement amendments (CLIA), enzyme-linked immunosorbent assay (ELISA), and other tests. Due to the exceptional ability to quantify and identify various biomarkers related to the condition with a high degree of specificity and accuracy, ELISA is identified as a highly accepted method in the evaluation of bone health. In addition, these tests encompass a type of techniques such as molecular diagnostics, immunoassays, and other laboratory-based approaches that are used to assess bone metabolism. Furthermore, a range of assessment tools are available for the development of bone health, such as imaging techniques such as molecular diagnostics, genetic testing, quantitative ultrasound (QUS), and dual-energy X-ray absorptiometry.

The vitamin D testing segment dominated the bone metabolism tests market in 2024. The market is segmented into bone metabolism and vitamin D testing. Vitamin D testing plays an important role in bone health and includes measuring vitamin D levels in the body. In addition, the segment growth is attributed to the increasing prevalence of vitamin D insufficiency.

The bone metabolism segment is expected to grow fastest during the forecast period. In order to maintain the integrity of bone structure and bone tissue quantity, bone metabolism is characterized by an intimate cooperation of bone cells such as osteocytes, osteoclasts, and osteoblasts. Bone metabolism is regulated by osteoblastic bone formation and osteoclastic bone destruction, which investigates the interplay between the bone system and the immune system.

The hospital segment dominated the bone metabolism tests market in 2024. The market is segmented into diagnostic laboratories, clinics, and hospitals. The segment growth is attributed to the increasingly high demand for bone metabolism tests in hospitals for the treatment and diagnosis of bone diseases.

The clinics segment is expected to grow fastest during the forecast period. Various clinics associated with bone metabolism tests within the metabolism division and endocrinology focus on the care of patients and diagnosis of complicated, rare, or inherited bone conditions, such as skeletal dysplasias and congenital diseases, endocrine and metabolic bone diseases.

By Product

By Technology

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

August 2024

August 2024

February 2025