January 2025

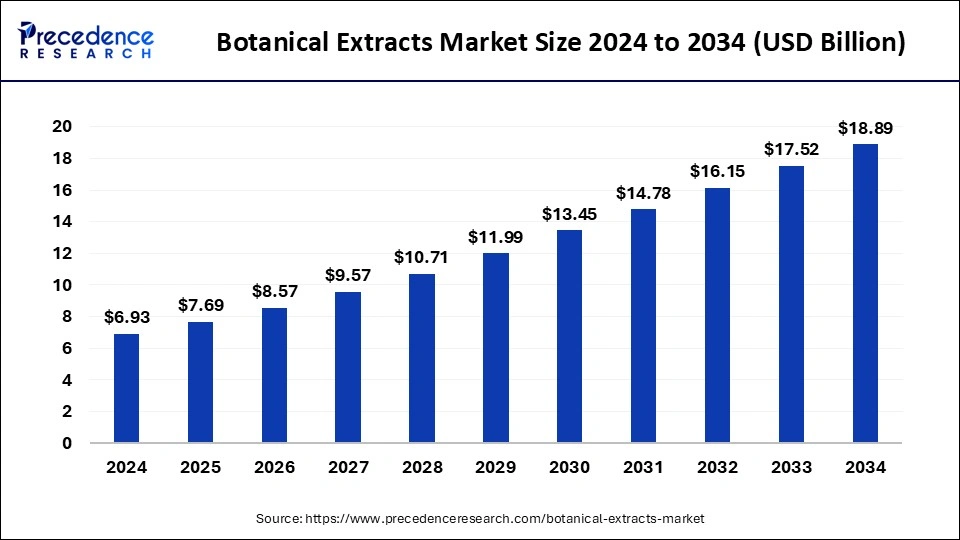

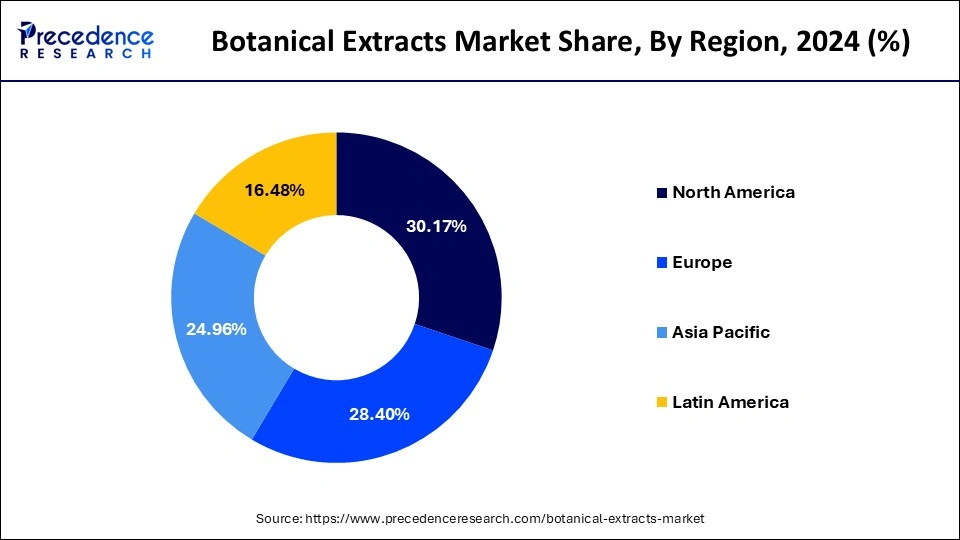

The global botanical extracts market size accounted for USD 7.69 billion in 2025 and is forecasted to hit around USD 18.89 billion by 2034, representing a CAGR of 11.79% from 2025 to 2034. The North America market size was estimated at USD 2.09 billion in 2024 and is expanding at a CAGR of 11.52% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global botanical extracts market size was calculated at USD 6.93 billion in 2024 and is predicted to increase from USD 7.69 billion in 2025 to approximately USD 18.89 billion by 2034, expanding at a CAGR of 11.79% from 2025 to 2034.

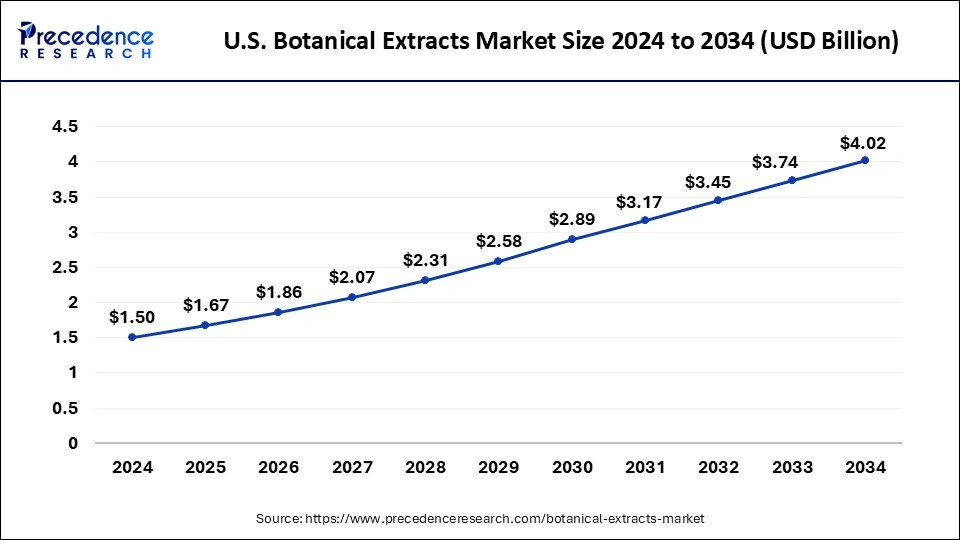

The U.S. botanical extracts market size was exhibited at USD 1.50 billion in 2024 and is projected to be worth around USD 4.02 billion by 2034, growing at a CAGR of 11.54% from 2025 to 2034.

North America held the largest share of the botanical extracts market in 2024. The market for botanical extracts includes a range of product kinds, including fruit, vegetable, herb, and spice extracts. These extracts are used in food and beverage, pharmaceutical, cosmetic, and nutraceutical industries. The market for botanical extracts in North America has been significantly influenced by customer demand for natural and clean-label products; consumers are looking for products with few artificial components and additives. Due to this trend, producers create pure and effective botanical extracts to satisfy consumer demands. The market has grown due to rising interest in plant-based diets and more excellent knowledge of the advantages of botanical extracts for health. Consumers are adopting them into their everyday routines because they believe that botanical extracts have anti-inflammatory, immune-stimulating, and health-promoting qualities.

Asia Pacific is the fastest-growing region in the botanical extracts market. Due to health and wellness concerns, consumer preferences have clearly shifted in favor of natural and plant-based products. In the nutraceutical business, there has been a sharp increase in demand for botanical extracts due to growing knowledge of the health advantages of herbal supplements. The Asia Pacific cosmetics sector is expanding rapidly due to several causes, including changing customer preferences, rising disposable incomes, and evolving lifestyles. Because of their purported benefits for skin and natural attractiveness, botanical extracts are frequently employed in cosmetics and personal care products. Businesses in the botanical extracts industry are concentrating more on R&D endeavors to create novel goods and expand their product lines.

Demand for goods that have health benefits has increased as consumer attitudes have shifted toward healthier living. Due to their numerous health-promoting qualities, including anti-inflammatory, antibacterial, and antioxidant activities, botanical extracts are becoming increasingly popular as components of functional meals, drinks, and dietary supplements. Customers are looking for items with natural and clean labels as they become more concerned about synthetic substances and the possible health dangers they pose. Growing knowledge of preventative healthcare and the effectiveness of traditional herbal medicines has increased the demand for herbal supplements. Botanical extracts are prized for their anti-aging, anti-acne, and hydrating qualities in skincare products.

Ongoing research and development efforts are being made to investigate the medicinal potential of plant extracts and create novel products, promoting the botanical extracts market’s growth. This covers the identification of new bioactive substances, the production of standardized formulations for reliable quality, and applying extraction techniques to increase the potency and bioavailability of extracts. Different regions have different regulatory frameworks controlling the use of botanical extracts, and market participants must adhere to safety and quality criteria. There are many competitors in the fiercely competitive market for botanical extracts, ranging from small-scale growers to major international corporations. Sustainable sourcing methods and traceability along the entire supply chain are becoming more and more critical to guarantee the moral and ecologically sound extraction of botanical raw materials.

The usage for plant extracts is expected to rise significantly during the projected period due to its various health advantages and capacity to function as a substitute to contemporary treatment. Growing appetite for ready meals, expanding knowledge about the benefits of organic goods versus synthetic products, and growing preference from food and other uses are all expected to drive growth of the market. For the previous few years, world consumption for fast food products such as bakery & confectionary, sauces & dressing, ready - to - eat, ready-to-drink (RTD) drinks and sports & energy drink has been quickly expanding. This growth is mainly attributed largely to shifting customer lifestyles, an increment in the population of working women, the introduction of food products in innovative packaging by producers and retailers, rapid expansion of brick and online retail channels, and a rise in spending power, particularly in emerging economies such as India, China, and Brazil.

Botanical components are often used in convenience foods to offer scent, taste, and nutritive quality. Botanical extracts provide enhanced flavour and a longer lifespan, thus convenience food and beverage makers choose botanical extracts or concentrated over fresh botanicals. Furthermore, botanical components have a more realistic flavour since they are taken directly from vegetation, generally from the fruits, leaves and flowers as well opposed to non-botanical extracts. As a result, rising intake of convenience foods is expected to drive growth for these extracts in future years.

With the increasing frequency of chronic and lifestyle diseases, rising medical issues necessitate a much more creative strategy that treats the illness while minimising detrimental effects. Botanical pharmaceuticals can be used in place of allopathic medications. These medications are derived from natural ingredients that have health-promoting or therapeutic properties. As a result, increased knowledge about the harmful effects of allopathic drugs is yet another contributing force in the industry. Unlike many other chemical-based substances used within personal care and cosmetics, medications, and food and beverage items, botanical extracts have no adverse side effects.

Furthermore, the issue of environmental and natural component sourcing has risen to the top of the priority list for producers, particularly in North America and Europe. Natural extracts' extensive overall health advantages are expected to stimulate product sales in pharmaceutical and nutraceutical industries. These variables are anticipated to have a substantial influence on product consumption in the coming years.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.79% |

| Market Size in 2025 | USD 7.69 Billion |

| Market Size by 2034 | USD 18.89 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Technology, Form, Product, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

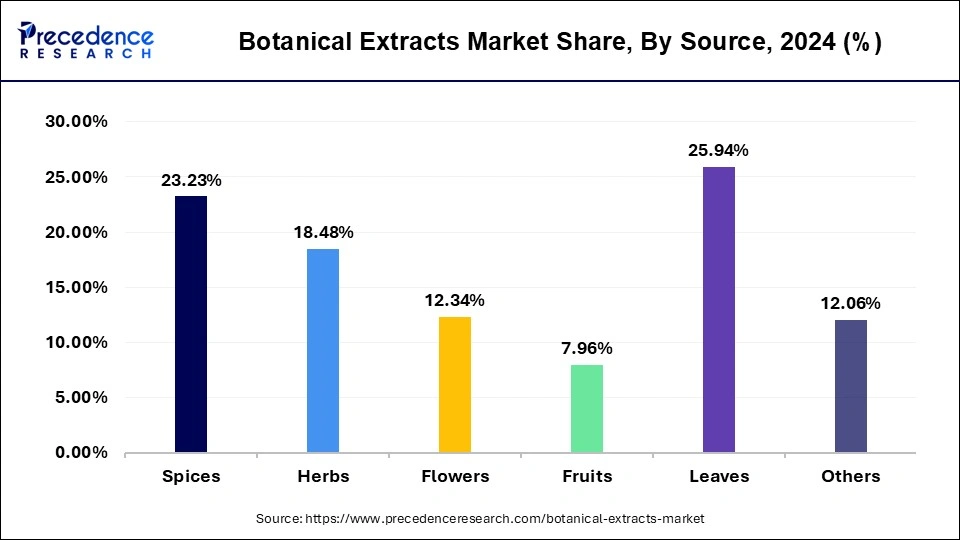

Leaves segment dominated the market and garnered largest revenue share in 2024. Any flattening green sprout within the stems of vascular plants is referred to as a leaf. A leaf's principal job is to produce food for plants through photosynthesis. Chlorophyll, it is the chemical that imparts plants their green colour and helping them absorbs light. Botanically, leaves are an important component of the stems system. A continuous vascular system connects them to the entire plant, enabling unrestricted flow of water, nourishment, and photosynthetic end products like as carbohydrates and oxygen.

Herbs are leafy parts of plants that are utilised in a number of purposes including nutritional supplements cosmetics, food and beverage and medications. Because of their widespread use in traditional remedies, herbs are projected to fuel the expansion of this industry. Herb-based pharmaceutical solutions are gaining popularity across the world since it is their health advantages such as hormone stabilisation, metabolism, and immune system improvement, as well as the fact that they are less expensive than traditional drugs.

Carbon Dioxide extracts, also known as cryogenic CO extracts, are very pure plant extracts derived from a novel and greater extraction method. Superior herbal extracts produced by the CO extraction technique are extensively used in botanical medicinal to flavour a variety of items as soft drinks, confectionery and dairy products. CO extract is utilised in medicinal, nutritional supplements, and oral care products, in addition to food and ayurvedic supplements. CO extracts are derived from a variety of plant components, including veggies, fruit, herbs and spices and numerous other plant parts as roots and leaves. CO extract consist of natural flavour extract that is gaining popularity among customers.

The pharmaceuticals and nutraceuticals segment held the largest share of the botanical extracts market in 2024. Botanical extracts are active ingredients in medicines and supplements for various medical ailments. They might go through in-depth studies and clinical trials to confirm these extracts' safety and effectiveness for medicinal usage. Herb extracts, such as those found in supplements for immune system support, echinacea, and St. John's wort, are among the examples. These medicines are used to treat a variety of illnesses and mood disorders. Contrarily, nutraceuticals are goods that combine the benefits of both food and medicine to provide health advantages that go beyond simple nourishment. Nutraceutical formulations frequently include botanical extracts to achieve targeted health-promoting outcomes.

As consumers' awareness of their health grows, they seek natural substitutes for prescription drugs. Demand for pharmaceutical and nutraceutical products is driven by the perception that botanical extracts are safe and effective alternatives. Regulatory agencies are creating rules for the use of botanical extracts in pharmaceutical and nutraceutical goods as they become aware of the potential advantages of these products. Clear regulations provide customers' and manufacturers' trust, which promotes market growth. More powerful and bioavailable plant extracts are being developed thanks to formulation and extraction technology developments. This makes it possible to create cutting-edge nutraceutical and pharmaceutical products with improved consumer appeal and efficacy.

Global Botanical Extracts Market Revenue, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Food | 1,584.89 | 1,755.72 | 1,962.40 |

| Beverages | 1,190.64 | 1,309.14 | 1,452.32 |

| Pharmaceutical & Nutraceutical | 1,769.37 | 1,950.38 | 2,169.21 |

| Cosmetic and Personal Care | 1,079.28 | 1,199.14 | 1,344.24 |

In 2024, the powders segment held the largest share in the botanical extracts market. The desire for clean-label components and increased consumer awareness of the health advantages of natural products have been the main drivers of the market’s steady growth for powdered botanical extracts. Pharmaceuticals, nutraceuticals, food and beverage, cosmetic, and personal care industries are just a few of the industries that use powdered botanical extracts. In addition to their health advantages, they are used for their functional qualities. Concerns over wellness and health are growing, and customers are looking for natural substitutes for artificial substances. Powdered plant extracts are becoming increasingly popular among customers since they are thought to be natural. Market participants must adhere to safety, quality, and labeling laws to establish consumer confidence and gain market acceptance.

In the botanical extracts sector, sustainable sourcing and production methods are becoming more and more critical. Customers are looking for products that are made in an environmentally conscious manner in addition to being natural. There are many competitors in the fiercely competitive market for powdered botanical extracts, ranging from major multinational firms to small and medium-sized businesses. Although North America and Europe have historically been the largest markets for powdered botanical extracts, rising disposable incomes and shifting consumer habits drive demand from emerging economies in Asia Pacific and Latin America.

The organic segment held the dominating share in the botanical extracts market in 2024. Organic products are essential in the botanical extracts market since consumers are increasingly interested in natural and sustainable ingredients. Plants without synthetic pesticides, herbicides, or genetically modified organisms (GMOs) yield organic botanical extracts. Customers looking for safer, greener solutions for their food, drink, cosmetics, and pharmaceutical items may find these products appealing. Because of its anti-inflammatory and anti-aging qualities, green tea extract, which is high in antioxidants, is frequently utilized in skincare products. Organic green tea extract is made from tea leaves cultivated organically and commonly used in functional beverages, dietary supplements, and cosmetics.

Consumers worried about the environmental effects of conventional agriculture practices and the possible health concerns linked with synthetic chemicals in food and personal care items are growing in interest in organic botanical extracts. Growing consumer demand for natural and clean-label components in various industries, such as food and beverage, personal care and cosmetics, medicines, and dietary supplements, drives organic botanical extracts. Organic plant extracts are in high demand across various industries since they are considered safer and healthier than synthetic additions. Regulation support motivates producers to spend money obtaining organic certification and contributes to consumers' growing confidence in organic botanical extracts.

Global Botanical Extracts Market Revenue, By Product, 2022-2024 (USD Million)

| By Product | 2022 | 2023 | 2024 |

| Organic | 3648.97 | 4042.22 | 4518.03 |

| Conventional | 1975.21 | 2172.16 | 2410.13 |

By Source

By Technology

By Form

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

July 2023