February 2025

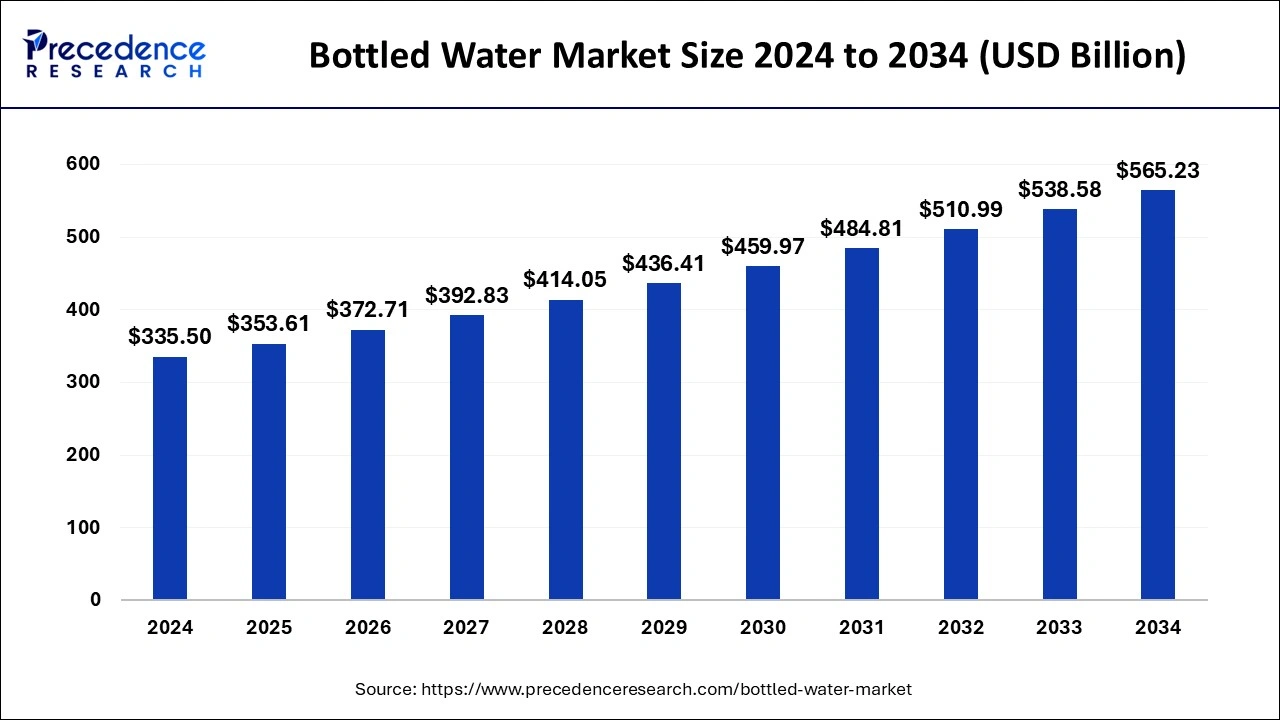

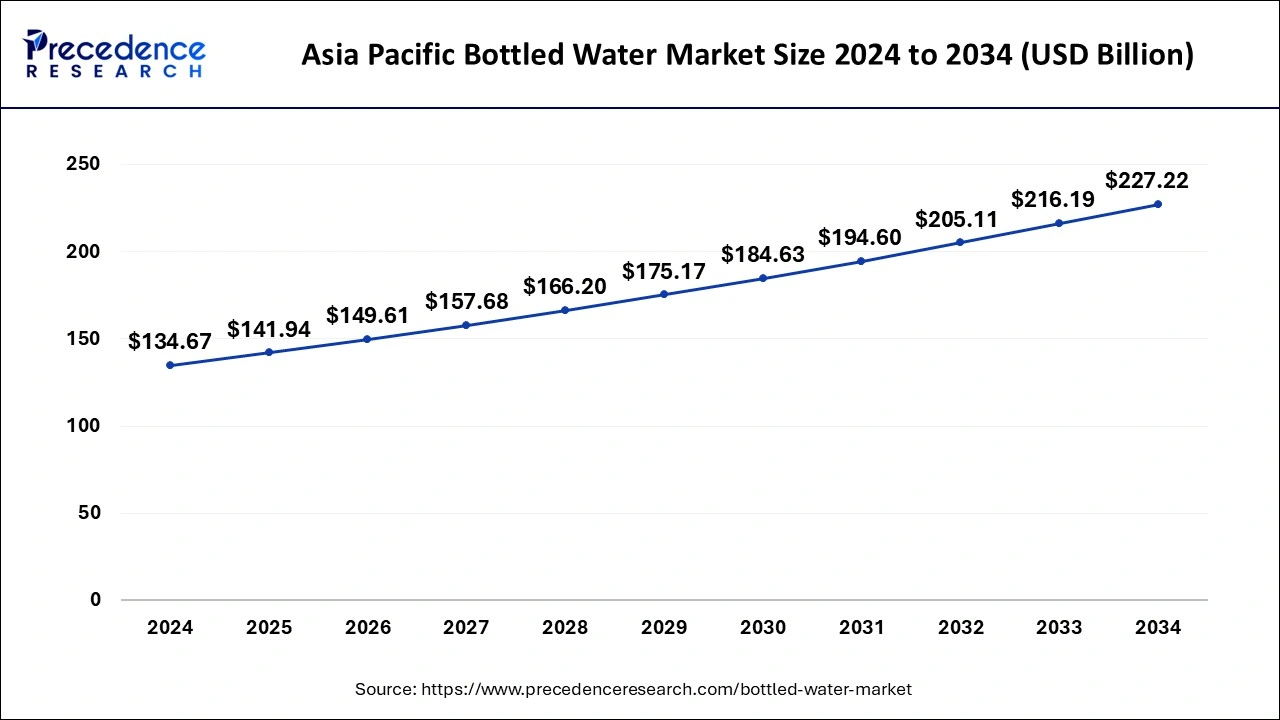

The global bottled water market size is calculated at USD 353.61 billion in 2025 and is forecasted to reach around USD 565.23 billion by 2034, accelerating at a CAGR of 5.35% from 2025 to 2034. The Asia Pacific bottled water market size surpassed USD 141.94 billion in 2025 and is expanding at a CAGR of 5.37% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bottled water market size accounted for USD 335.5 billion in 2024, and it is expected to hit around USD 565.23 billion by 2034, poised to grow at a CAGR of 5.35% from 2025 to 2034. The increasing awareness of health and wellness among consumers and concerns about the safety and quality of tap water boost the growth of the bottled water market.

Applications of AI and machine learning are typically used to find flaws in the manufacturing of bottled water. These technologies help facilities run more effectively without sacrificing quality by evaluating production data. AI is also used by bottlers to estimate demand, reduce waste, and provide a greater variety of specialty drinks. Globally, bottling processes are changing due to the Internet of Things (IoT). Every step of the production process is tracked by IoT sensors and linked devices, allowing for "smart bottling," in which fillers, cappers, and labelers exchange information in real-time to speed up the procedure.

The Asia Pacific bottled water market size was estimated at USD 134.67 billion in 2024 and is predicted to be worth around USD 227.22 billion by 2035, at a CAGR of 5.37% from 2025 to 2034.

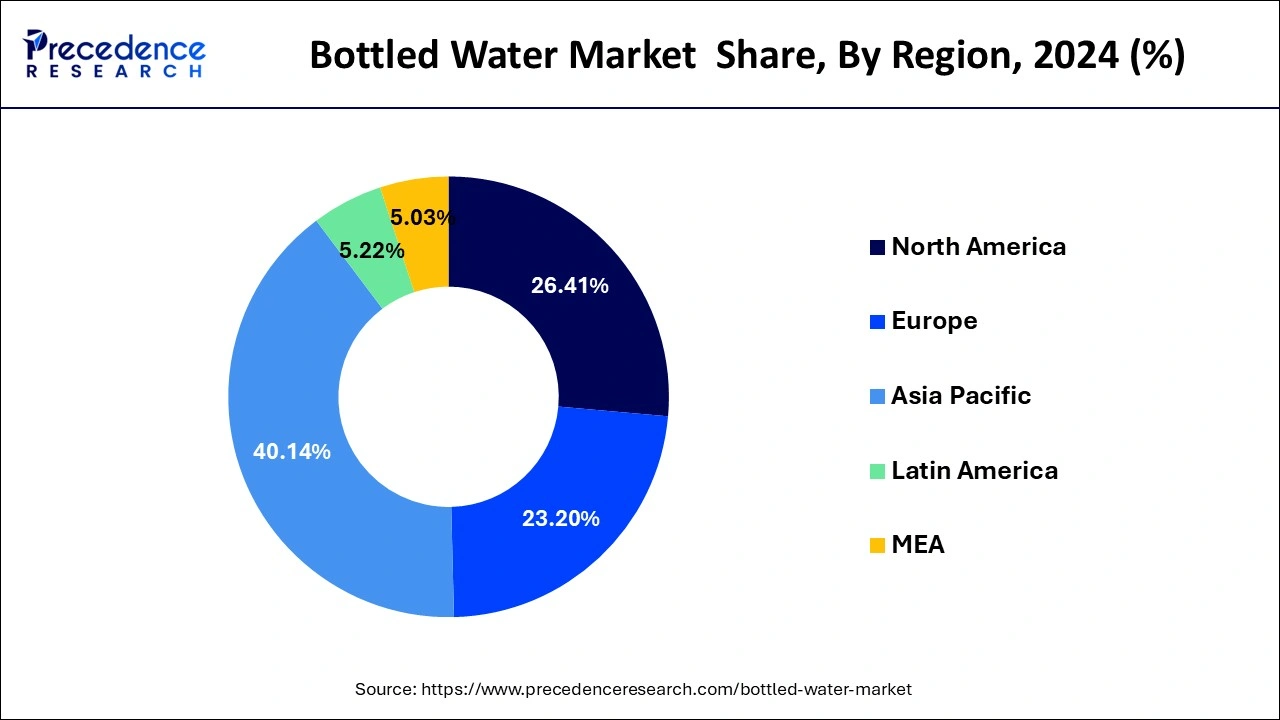

Based on the region, in terms of revenue, the Asia Pacific dominated the global bottled water market in 2024 and is estimated to sustain its dominance during the forecast period. It accounted for more than 40.14% of the market share in 2024. This is mainly due to the increasing demand for the bottled water owing to the lack of drinkable water, rising health consciousness, growing awareness regarding waterborne health diseases, rising disposable income, rapid urbanization, growing penetration of food service industry, and improvement in living standards. Moreover, the rapidly developing organized retail sector and growing demand for functional water is significantly contributing towards the development of the bottled water market in the region. Asia Pacific is also estimated to be the fastest-growing region during the forecast period. This is owing to the presence of huge youth population that demands quality food and beverage items owing to increased health consciousness.

North America is expected to witness the fastest growth in the market during the forecast period. People in North America increasingly prefer bottled water over tap water due to its perceived purity. There is a heightened awareness among people about the benefits of bottled water. Bottled water offers a convenient, on-the-go solution in today's fast-paced world, contributing to market growth. Moreover, the growing emphasis on health and wellness among health-conscious consumers and high disposable incomes contribute to regional market growth.

The bottled water market revolves around the production and distribution of water packaged in bottles. This drinking water is packaged in glass or plastic bottles. This water helps prevent and treat kidney stones and aids in digestion. Bottled water is convenient for on-the-go consumption. The growing awareness about the health benefits associated with bottled water drives the growth of the market. Moreover, the increasing disposable incomes of consumers and government initiatives to promote bottled water contribute to market expansion.

| Report Highlights | Details |

| Market Size in 2025 | USD 353.61 Billion |

| Market Size by 2034 | USD 565.23 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.35% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Health and safety concerns

Growing worries about convenience and health are driving consumers to choose bottled water over tap water. Customers now consider bottled water to be a more convenient and purer alternative to tap water due to rising concerns about its safety and purity. This trend is being driven by the increased awareness of aquatic pollutants and the desire for healthier hydration options. Customers with hectic schedules find bottled water appealing due to its excellent quality and portability. Another factor in bottled water's enormous appeal is its widely accessible packaging and single-serve bottles' simplicity of use. As consumers continue to place a higher priority on convenience and health, the demand for bottled water is steadily rising.

Waste Generation & environmental concerns

The issue of plastic pollution worldwide is mostly caused by the manufacture and disposal of plastic water bottles. Oceans get millions of metric tons of plastic debris every year, endangering ecosystems and marine life. Plastic bottle production, shipping, and disposal all increase greenhouse gas emissions. Every phase of the lifetime of a plastic bottle, from the extraction of raw materials to the manufacturing process, increases the carbon footprint. To lessen our overall influence on climate change, we must switch to sustainable alternatives.

Sustainability

Growing concerns regarding plastic waste from the bottled water industry have encouraged manufacturers to increasingly adopt PET and plant-based water bottles to achieve sustainability. These eco-friendly bottles are expected to drive the demand for bottled water in developed economies like Europe and North America. Innovative packaging is expected to play a crucial role in the growth of the market in the foreseeable future. The adoption of sustainable materials in making bottles is very helpful in creating a positive brand image among consumers.

By product, the purified segment led the market with considerable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the presence of desalination facilities across the globe that serves the need for the purified water. According to the United Nations, there are around 16,000 desalination facilities in across 177 nations of the world that provides purified water. The rapid growth in the population, increasing disposable income, increasing per capita water consumption, and improvement in the standard of living are the various important factors that boosted the growth of the purified water segment across the globe.

On the other hand, the sparkling water segment is estimated to be the fastest-growing segment during the forecast period. This is attributed to the rising popularity of sparkling water among consumers owing to its fizzy and bubbly taste. Further sparkling water is known to stave off dehydration and it has become a popular substitute for sodas. The growing awareness of the health benefits of sparkling water has increased the demand for sparkling water. Thus, manufacturers are making efforts to meet the growing demand for sparkling waters, contributing to segmental growth.

By distribution channel, the supermarkets & hypermarkets segment led the market with notable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. The supermarkets & hypermarkets provide a very wide range of consumer goods and food and beverages products along with convenience and huge discounts. It operates in convenient timings and is available in easy accessible areas. It attracts huge customer base and offers consistent revenue to the market players.

On the other hand, the others segment is estimated to be the fastest growing segment owing to the growing popularity of e-commerce and online food delivery apps across the globe. The rising penetration of internet and rapidly growing users of internet is expected to boost the growth of the e-commerce channels during the forecast period, thereby boosting the growth of this segment.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

September 2024

October 2024