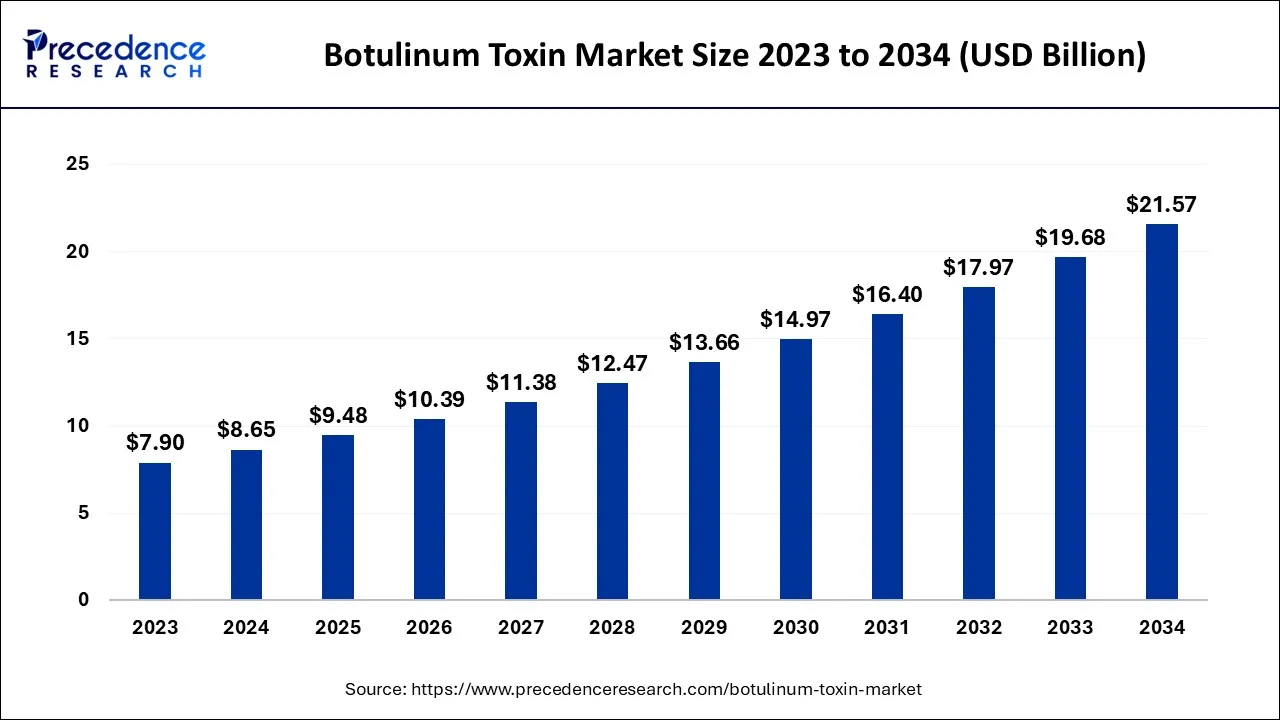

The global botulinum toxin market size accounted for USD 8.65 billion in 2024, grew to USD 9.48 billion in 2025, and is expected to be worth around USD 21.57 billion by 2034, poised to grow at a CAGR of 9.57% between 2024 and 2034. The North America botulinum toxin market size is predicted to increase from USD 3.11 billion in 2024 and is estimated to grow at the fastest CAGR of 9.72% during the forecast year.

The global botulinum toxin market size is expected to be valued at USD 8.65 billion in 2024 and is anticipated to reach around USD 21.57 billion by 2034, expanding at a CAGR of 9.57% over the forecast period from 2024 to 2034.

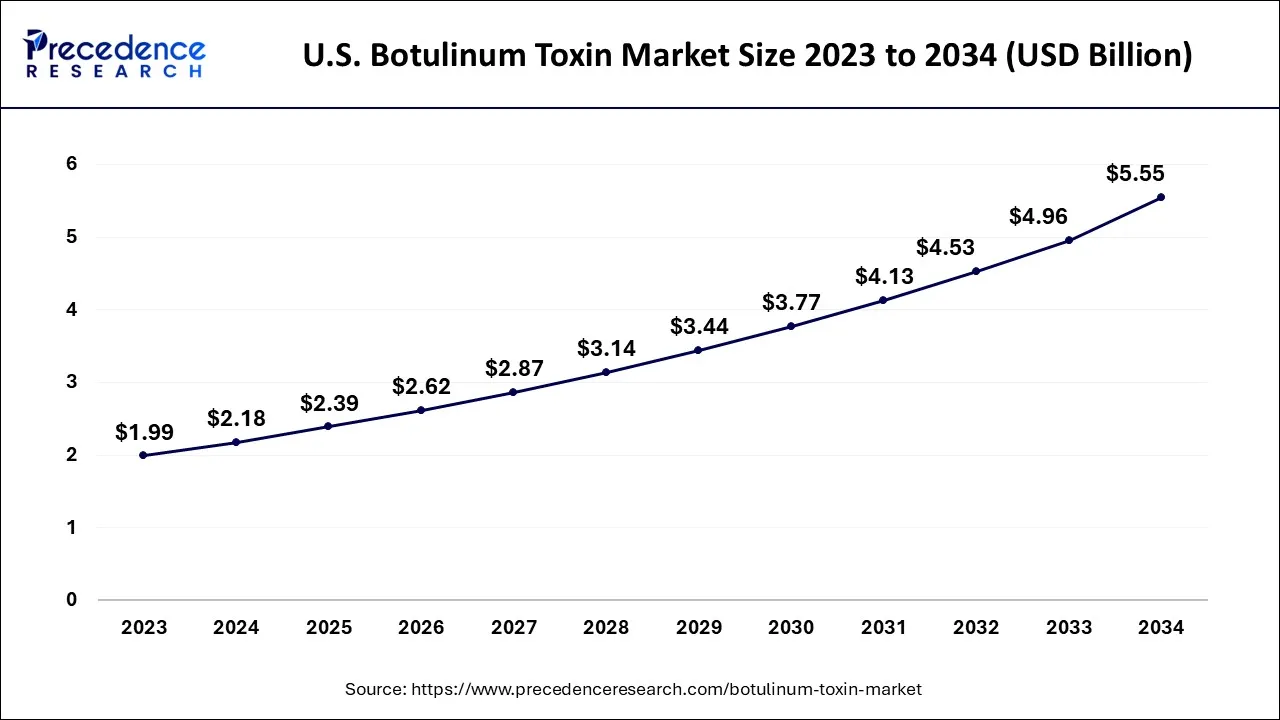

The U.S. botulinum toxin market size is exhibited at USD 2.18 billion in 2024 and is projected to be worth around USD 5.55 billion by 2034, growing at a CAGR of 9.8% from 2024 to 2034.

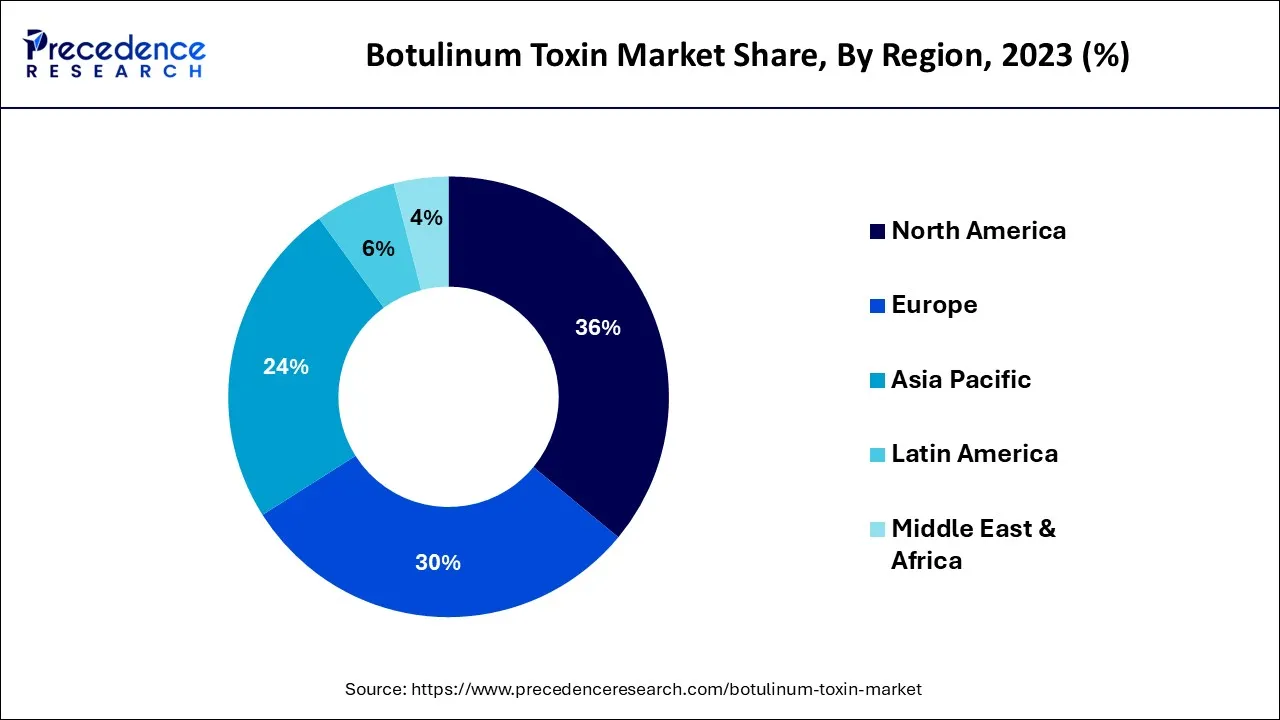

Due to rising expendable cash and an increase in cosmetic operations, the North American botulinum toxin market generated more than 36% of revenue share in 2023. For instance, 1.3 million operations with botulinum toxin-based products were carried out in 2019, as reported by the American region of Plastic Surgeons, making up 45% of all cosmetic procedures carried out in the United States.

As a result, the growth of the botulinum toxin industry in the United States will be fueled by the increasing use of botulinum injections in different aesthetic procedures carried out locally. In addition, medical and cosmetic procedures have advanced quickly in recent years. Patients seeking treatment now have access to a vast selection of products & services thanks to improved technology.

Among the most extraordinary chemicals discovered in medical and scientific research is botulinum toxin. The number of beauty treatments has increased as a result of rising concerns about aesthetic qualities in both developed and emerging nations. Although there are increasing chances for the extension of botulinum toxin's medicinal specific application in the nearish term, major producers are increasing their expenditure on R&D operations to investigate the medicinal usage of the toxin. About 6 million surgeries or treatments including cosmetic botox are carried out annually, a 700% increase in just the last 20 years. Because the COVID-19 epidemic started, the desire for aesthetic procedures like botox & filler has dramatically soared.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.65 Billion |

| Market Size by 2034 | USD 21.57 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.56% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Application, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased efficiency and changes to the financing procedures

Botulinum toxin medicinal uses in cosmetic procedures that open the door for further advancement in the application area

Highly efficient when used therapeutically

Minimally invasive medical surgery is in high demand, which will help the market grow

The effects of botulinum toxin on the body are quite harmful

The rise in drugs approved and products launched

The botulinum toxin-A sector is predicted to increase at a substantial rate throughout the forecast timeframe, holding the greatest market share from over 96% in 2023. Due to strong consumer preference and advantages including little blood loss, little discomfort, and no scarring during the surgery, botulinum A is predicted to advance at a robust rate. Additionally, there are several commercially accessible botulinum toxin A medications on the market, such as Botox and Dysport, which have been clinically shown to be efficient, secure over the long term, and have few side effects. Due to features such as no blood loss, low pain, and absence of scaring during the treatment.

The treatment of persistent tension-type headaches, migraine, and other primary neurological illnesses using botulinum toxin type-A is becoming more common. The market is divided into botulinum toxin types A and B based on the kind of product. Products containing botulinum toxin type-A are used for both medicinal and cosmetic purposes, and given the growing interest in aesthetic beauty, the market is expected to expand even more in the coming years. Additionally, there are several commercially available type-A botulinum toxin medications, including Botox and Dysport, that have undergone clinical testing and are been shown to be both safe and efficient over a long period with fewer side effects.

During the anticipated timeframe, the aesthetic application category is anticipated to experience a profitable CAGR. The need for cosmetic surgery has increased as aesthetic appearance has become a bigger concern in both developed and developing nations. Additionally, the accessibility of numerous products, including Dysport, botox, and Xeomin among many others, will hasten the industry's expansion. Additionally, the growing use of botulinum toxin injections in a variety of cosmetic treatments, such as the therapy of chemical browlift, glabellar, perioral, and preauricular lines among others, is anticipated to hasten the growth of the botulinum toxin share of the market over the ensuing years.

Botulinum toxin, a neurotoxin made by bacteria, is a staple of the cosmetology toolbox. There have been more cosmetic procedures performed as a result of increased aesthetic awareness and technology breakthroughs in both developed and developing nations.

The market was led by dermatological clinics in 2023. Increased demand for aesthetic operations is predicted to lead to an increase in dermatological clinics in both developing and developed nations, which will increase the market income for botulinum toxin. A significant factor in the segmental expansion is the strong patient desire for dermatological clinics for cosmetic procedures and state-of-the-art facilities to improve their aesthetic appeal. Additionally, several treatments, including those for cervical dystonia, overactive bladder, hyperhidrosis, and wonky eye among many others, are anticipated to raise demand for dermatological clinics that undertake minimally invasive procedures.

In 2023, the healthcare company's overall revenue was the highest. The market is divided into hospitals, clinics, dermatological spas, and cosmetic surgery centers based on the end-user. Customers are increasing, which is good news for medical spa operators and plastic doctors. Additionally, the expansion of medicinal spas and aesthetic clinics in areas such as the Asian Region is boosting the industry.

Product Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client