July 2024

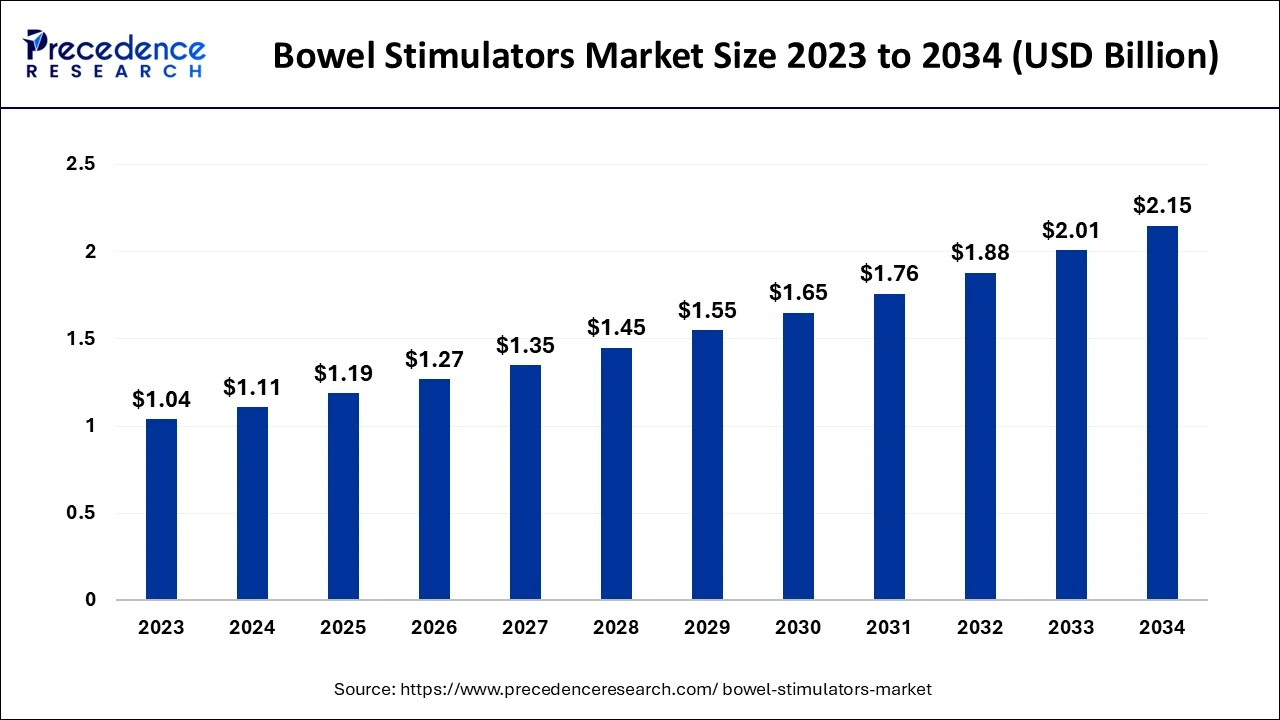

The global bowel stimulators market size accounted for USD 1.11 billion in 2024, grew to USD 1.19 billion in 2025 and is expected to be worth around USD 2.15 billion by 2034, registering a CAGR of 6.83% between 2024 and 2034.

The global bowel stimulators market size is calculated at USD 1.11 billion in 2024 and is projected to surpass around USD 2.15 billion by 2034, expanding at a CAGR of 6.83% from 2024 to 2034. The bowel stimulators market is driven by the growing aging population.

Effective treatment options are becoming increasingly important due to the rising prevalence of gastrointestinal (GI) problems, including irritable bowel syndrome (IBS), fecal incontinence, and persistent constipation. Patients who do not react to conventional therapy may find relief using bowel stimulators. By dramatically enhancing gastrointestinal function, bowel stimulators can improve patient outcomes, quality of life, and reliance on potentially harmful drugs. Increased patient satisfaction and treatment compliance may follow from this.

How is AI helping the Bowel Stimulators Market Growth?

Artificial Intelligence (AI) algorithms can examine patient data, such as medical history and prior treatment reactions, to develop customized bowel stimulation protocols. Patient happiness and treatment effectiveness are improved by this customization. AI can optimize the design of intestinal stimulators during the development stage by testing different configurations and settings through simulations. This improves device performance while cutting expenses and development time. Artificial intelligence can improve the planning and implementation of clinical trials for novel bowel stimulators by identifying appropriate patient populations, trial protocol optimization, and more effective result analysis.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.15 Billion |

| Market Size in 2024 | USD 1.11 Billion |

| Market Size in 2025 | USD 1.19 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.83% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing Prevalence of Bowel Incontinence

Patients are more likely to seek therapy now that non-surgical and less invasive surgical treatments are available. When compared to conventional surgical techniques, bowel stimulators can frequently be installed with less recovery time. Better diagnostic and treatment recommendations result from improved education for healthcare professionals on bowel management and the available devices, increasing the market for bowel stimulators.

Taboos Associated with Fecal Disorders

There is frequently shame and embarrassment associated with fecal problems, which include ailments including constipation, fecal incontinence, and other bowel irregularities. The public is less aware of treatment choices like bowel stimulators since many people shy away from talking about these problems out of fear of being judged. Some people may be deterred from considering these choices because they are worried about the possible adverse effects of bowel stimulators or because they are afraid of becoming reliant on them for regular bowel movements.

Advancements in Technology

Smaller, more effective bowel stimulators have been created due to materials science and microelectronics developments. These little devices increase patient comfort and compliance and can be worn externally or implanted. Improvements in technology frequently result in quicker and more effective regulatory approval procedures. Innovative technology-using devices might be given preference, enabling businesses to launch their goods faster. The likelihood of negative responses and complications related to implanted devices is decreased by using biocompatible materials. Hydrogels and bioresorbable polymers are examples of materials science innovations that help create safer gadgets.

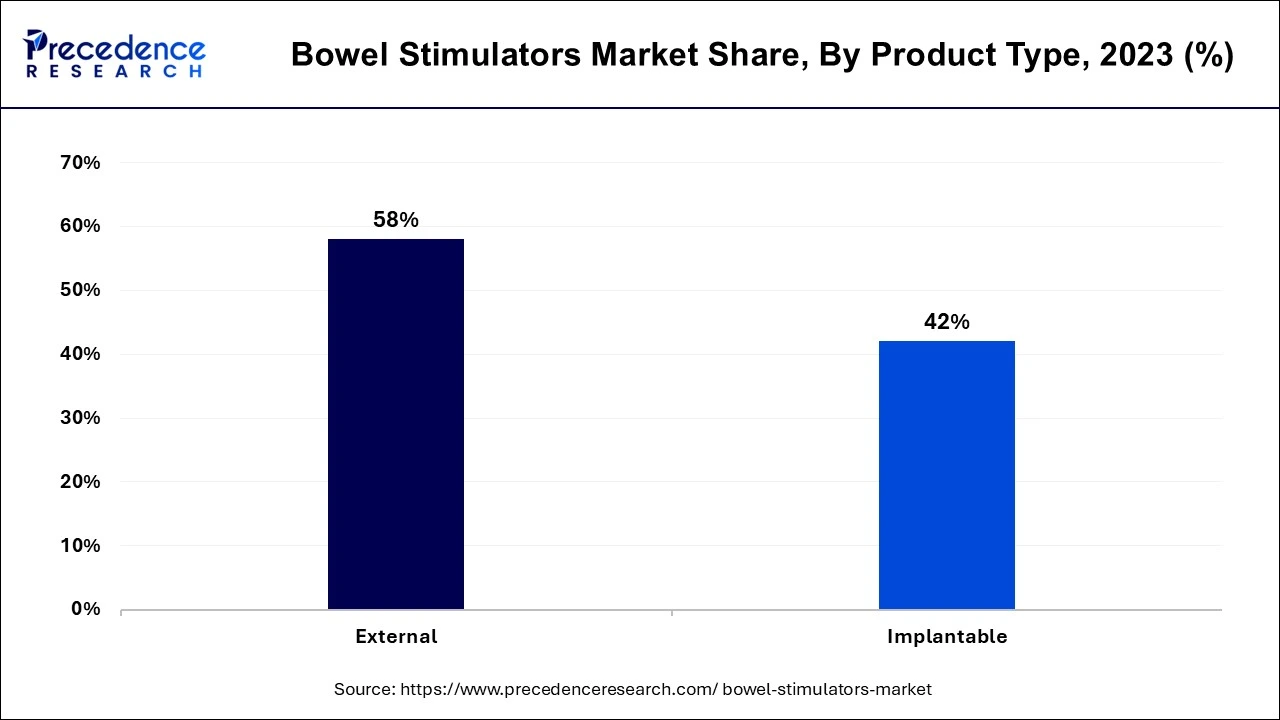

The external segment dominated the bowel stimulators market in 2023. The creation of sophisticated external intestinal stimulators has improved patient comfort, usability, and efficacy. Innovations like noninvasive stimulation treatments have increased patient compliance. In individuals with neurological illnesses, external bowel stimulators can help with a variety of bowel-related problems, such as constipation or bowel control. Their adaptability raises their market reach.

The implantable segment shows significant growth in the bowel stimulators market during the forecast period. Patient outcomes have improved due to the introduction of sophisticated implantable bowel stimulators that employ neuromodulation techniques. These devices can efficiently regulate bowel motions by stimulating nerves, providing a non-pharmaceutical option for treating diseases, including persistent constipation and fecal incontinence. Manufacturers enter into strategic alliances with medical facilities and academic institutions to enhance clinical research and product development. This partnership may result in creative answers to unmet gastrointestinal stimulation requirements.

The urinary & fecal incontinence segment dominated the bowel stimulators market in 2023. The market for bowel stimulators has seen technological developments that increase therapeutic effectiveness. Patients have more individualized and efficient management options due to devices with biofeedback mechanisms and stimulation technology. Bowel stimulators are being suggested by medical professionals more frequently as a component of all-encompassing therapy programs for people suffering from fecal and urine incontinence. A greater understanding of their efficacy in symptom management and enhancing patients' quality of life is reflected in this integration.

The hospitals and clinics segment dominated the bowel stimulators market in 2023. As the population ages and lifestyles change, gastrointestinal diseases like bowel blockage, constipation, and irritable bowel syndrome (IBS) are becoming more prevalent. Patients seek diagnosis and treatment for these illnesses, primarily in hospitals and clinics. Clinics and hospitals often participate in research studies and clinical trials that confirm the effectiveness of bowel stimulators. These studies raise awareness and motivate medical professionals to use these treatments as part of routine treatment plans.

North America dominated the bowel stimulators market in 2023. Gastrointestinal conditions, including constipation, irritable bowel syndrome (IBS), and other motility problems, affect a sizable section of the population. Effective bowel stimulators are in high demand due to this high frequency. Innovative bowel stimulation devices can now be approved more quickly because of rules set by regulatory bodies like the U.S. Food and Drug Administration (FDA). This incentivizes businesses to launch new goods.

Asia- Pacific is observed to be the fastest growing in the bowel stimulators market during the forecast period. The availability and efficacy of bowel stimulators are becoming more widely known to patients and healthcare professionals. Innovative medical gadgets are being accepted at higher rates due to patients' increased awareness of their treatment options. Healthcare organizations' campaigns and educational programs have also influenced this trend to raise awareness about intestinal health. The market for bowel stimulators is expanding due in large part to the demographic trend toward an elderly population in nations like South Korea, China, and Japan. The need for efficient gut health management is growing along with the number of seniors.

Segments Covered in the Report

By Product Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

August 2024

July 2024

July 2024