July 2024

Brachytherapy Market (By Dosage: High-dose Rate (HDR) Brachytherapy, Low-dose Rate (LDR) Brachytherapy; By Product: Seeds Applicators & Afterloaders, Electronic Brachytherapy; By Application: Prostate Cancer, Gynecological Cancer, Breast Cancer, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

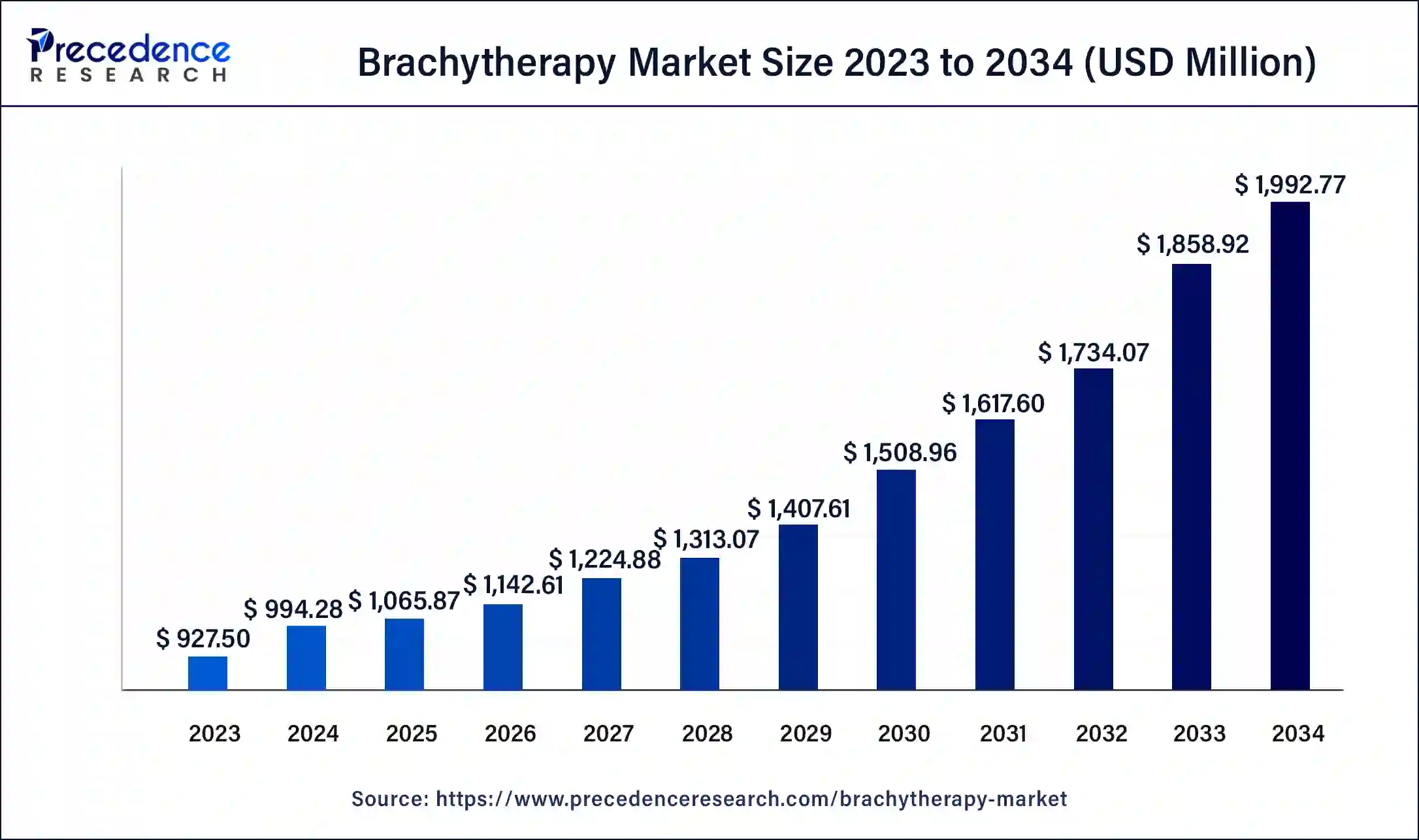

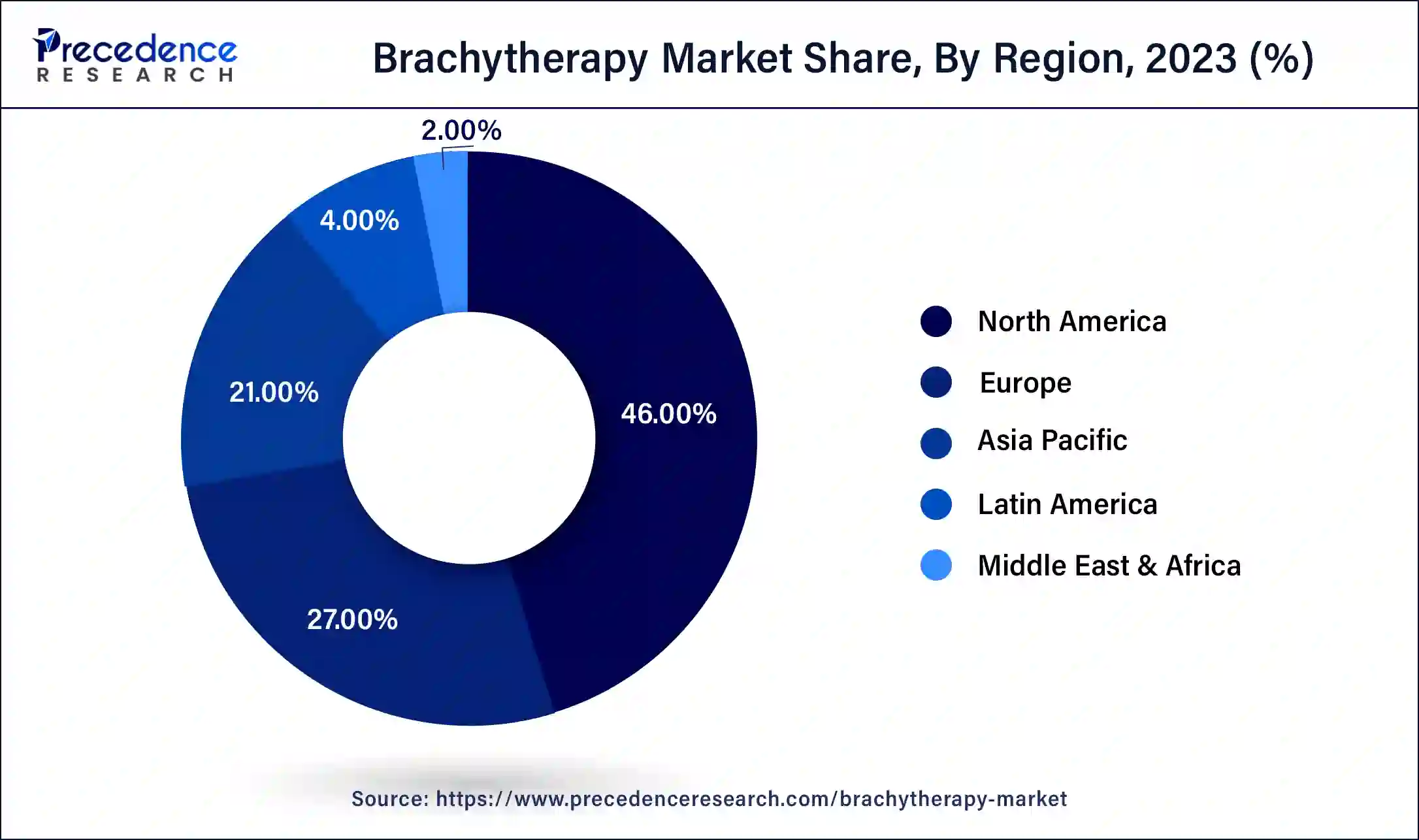

The global brachytherapy market size was USD 927.50 million in 2023, accounted for USD 994.28 million in 2024, and is expected to reach around USD 1,992.77 million by 2034, expanding at a CAGR of 7.2% from 2024 to 2034. The North America brachytherapy market size reached USD 426.65 million in 2023. The increasing prevalence of cancer, technological advancements, and a significant rise in the adoption of brachytherapy are expected to drive the growth of the market during the forecast period.

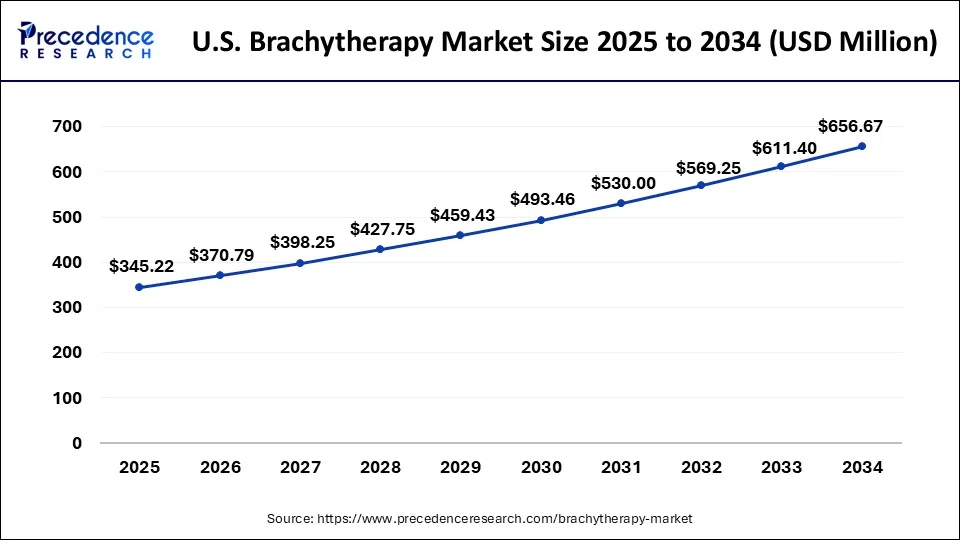

The U.S. brachytherapy market size was estimated at USD 299.24 million in 2023 and is predicted to be worth around USD 656.67 million by 2034, at a CAGR of 7.4% from 2024 to 2034.

North America took the lead in the brachytherapy market in 2023. This was driven by continuous advancements in healthcare technology in the region. North America's commitment to innovation, along with significant investments in research and development, has resulted in innovative brachytherapy solutions catering to various medical needs.

The high prevalence of cancer in North America has increased the demand for targeted treatments like brachytherapy. The region's dominance in the market is further fueled by growing awareness among patients and healthcare professionals about the benefits of this therapy.

Asia Pacific, in the brachytherapy market, is expected to see the fastest growth rate during the forecast period. This is primarily due to the region's high disease burden and increasing awareness among the population. Limited access to advanced cancer treatments also presents opportunities for market players. Moreover, the introduction of various brachytherapy systems in developing countries like India is anticipated to have a positive impact on the market.

Brachytherapy is a specialized cancer treatment that utilizes radiation therapy. It involves placing a radioactive source near or directly into the tumor, delivering powerful radiation precisely while safeguarding nearby healthy tissues. This treatment is widely used for cancers like cervical, prostate, breast, and skin cancers due to its focused approach and shorter treatment duration. The market size majorly depends on technological advancements, cancer rates, and awareness of the benefits of brachytherapy.

The brachytherapy market is centered around the business aspect of this cancer treatment, with companies manufacturing and selling devices for brachytherapy, including equipment and related products. Key players include medical research institutions and healthcare providers. Success in the market often stems from enhancing brachytherapy techniques and devices to offer more effective and precise cancer treatments.

The brachytherapy market size depends on advancements in technology, cancer rates, and awareness about the benefits of brachytherapy. Key players include medical research institutions, medical device manufacturers, and healthcare providers. Market dynamics can vary depending on location, regulatory rules, and cancer prevalence.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.2% |

| Global Market Size in 2023 | USD 972.50 Million |

| Global Market Size in 2024 | USD 994.28 Million |

| Global Market Size by 2034 | USD 1,992.77 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Dosage, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of cancer

The market for brachytherapy is experiencing growth due to the increasing prevalence of cancers such as prostate, breast, and cervical cancers. Subsidies, grants, and awareness programs are encouraging healthcare providers to invest in brachytherapy equipment and services, which further contributes to the growth of cancer care infrastructure. The treatment approach is becoming more popular as it provides accurate and efficient cancer therapy, either as a primary treatment or in combination with other methods. As cancer cases continue to rise, there is a growing demand for advanced treatment options such as brachytherapy.

High cost of equipment and alternative treatment modalities

Brachytherapy requires specialized equipment and infrastructure for treatment planning, radiation delivery, and patient safety, which can be costly to set up initially. This high upfront investment can be a challenge for healthcare facilities, especially in regions with limited resources, leading to slower adoption of brachytherapy. Additionally, the availability of alternative treatments like external beam radiation therapy, surgery, and chemotherapy presents competition for brachytherapy, which can directly affect its widespread use in the brachytherapy market.

Integration of AI in brachytherapy

The use of artificial intelligence (AI) in the planning and delivery of brachytherapy shows promising growth opportunities. AI can improve treatment accuracy, reduce planning time, optimize dose distribution, attract investments, and drive technological advancements. The emerging economies present untapped markets with significant growth potential for brachytherapy. These economies are supported by the growth of healthcare infrastructure and awareness of advanced cancer treatment options. Collaborations between industry players, healthcare institutions, and research organizations offer opportunities for market expansion by fostering the development of innovative brachytherapy solutions, streamlining regulatory processes, and broadening market reach.

The prostate cancer segment dominated the brachytherapy market share in 2023. This is because brachytherapy for prostate cancer offers several advantages over other treatments. These benefits include the ability to safely deliver a higher dose of radiation to the tumor while minimizing radiation exposure to nearby organs like the rectum, bladder, and urethra. Additionally, brachytherapy treatment is shorter, leading to faster recovery times. Its precise delivery of radiation minimizes the risk of side effects. It's an effective option for patients who experience prostate cancer recurrence.

The breast cancer segment is projected to grow at the fastest rate during the forecast period. This growth is driven by Accelerated Partial Breast Irradiation (APBI), an innovative radiation therapy method used after a lumpectomy. The segment's expansion indicates the effectiveness of brachytherapy in treating breast cancer cases, which offers hope for advancements in breast cancer treatment.

The applicators and loaders segment led the global brachytherapy market in 2023 and is expected to maintain its dominance throughout the forecast period. Applicators are preferred by patients because they are more effective and less invasive compared to other options. An after-loader device transports radioactive sources to the treatment site. In High Dose Rate (HDR) brachytherapy, a single radioactive source is briefly inserted into the tumor and then removed.

The electronic brachytherapy segment is projected to experience notable growth during the forecast period. With advancements in technology, electronic brachytherapy presents a modern approach that can transform treatment methods in the field. This technique is particularly effective for treating skin lesions and offers radiation shielding, which helps overcome challenges associated with handling radioisotopes.

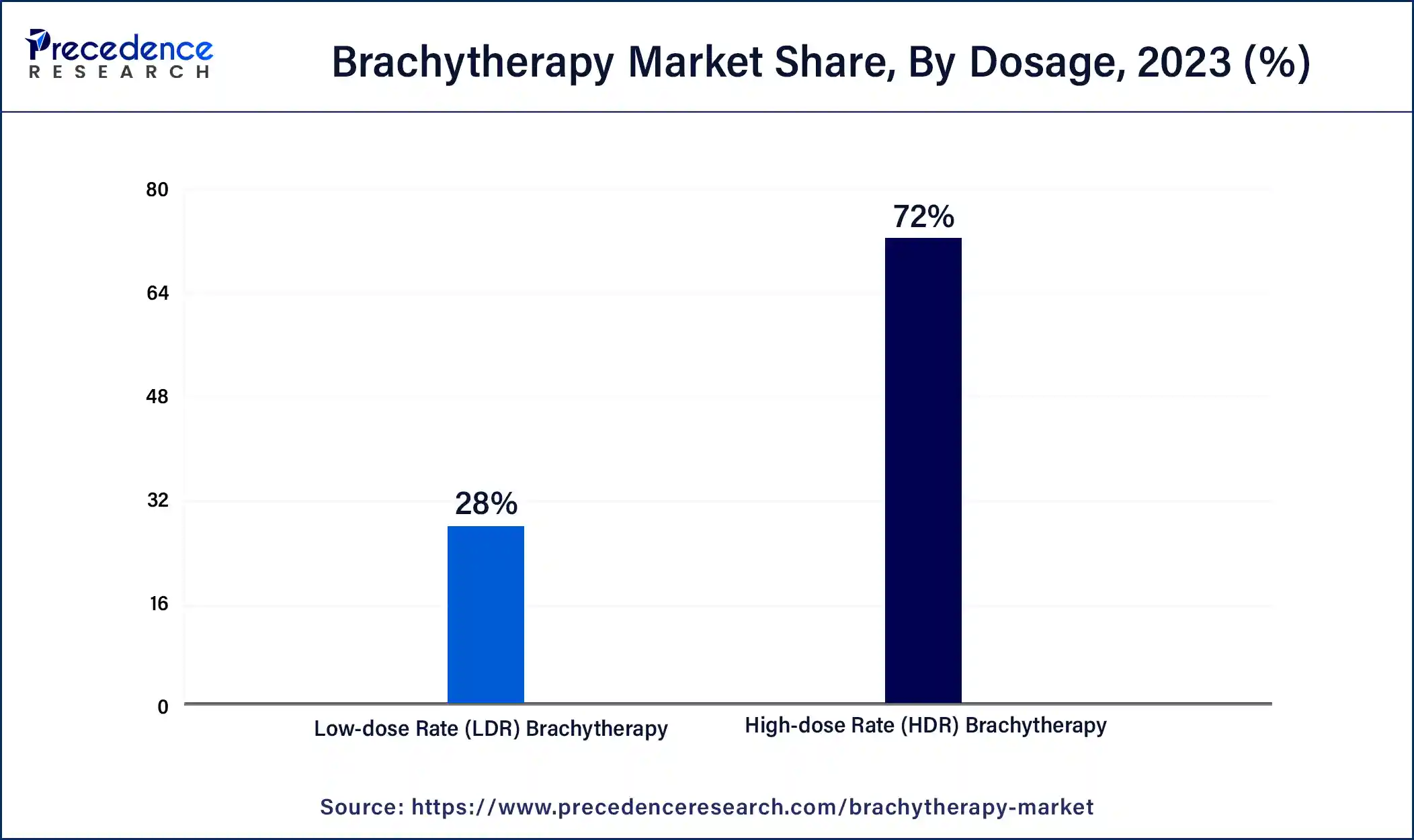

The high-dose-rate (HDR) brachytherapy segment held the largest market share in 2023. It's an outpatient procedure that can be utilized as a standalone treatment. The free treatment generally requires more than one session, depending on the kind of cancer being treated. Varian Medical Systems, ELEKTA AB, etc., are some key players in the market.

The low-dose-rate (LDR) brachytherapy is projected to witness significant growth over the forecast period. This can be attributed to the new products, such as gamma tile for the diagnosis of brain tumors, which is anticipated to boost the market growth further.

Segments Covered in the Report

By Dosage

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024