January 2025

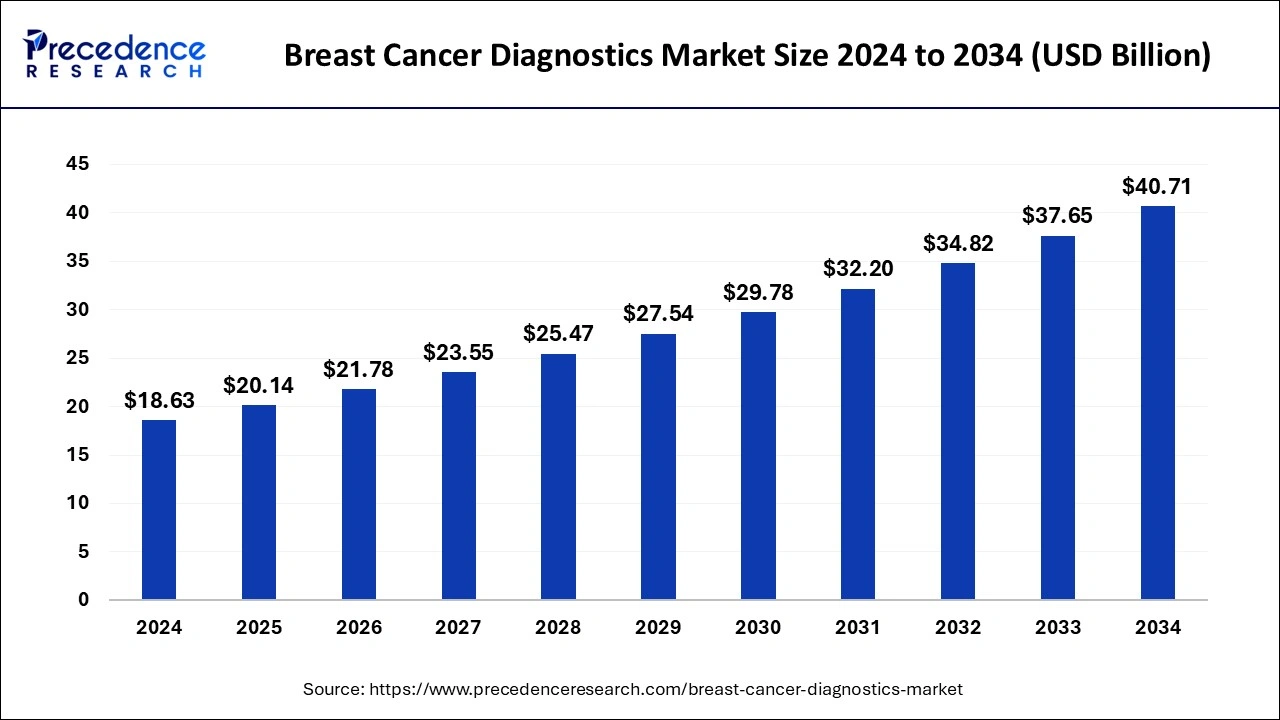

The global breast cancer diagnostics market size is calculated at USD 20.14 billion in 2025 and is forecasted to reach around USD 40.71 billion by 2034, accelerating at a CAGR of 8.13% from 2025 to 2034. The North America breast cancer diagnostics market size surpassed USD 8.53 billion in 2024 and is expanding at a CAGR of 8.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global breast cancer diagnostics market size was estimated at USD 18.63 billion in 2024 and is anticipated to reach around USD 40.71 billion by 2034, expanding at a CAGR of 8.13% from 2025 to 2034. The market growth is attributed to the increasing demand for early and accurate breast cancer diagnosis and technological advancements in diagnostic tools.

AI is an invigorating tool to boost the accuracy and efficiency of breast cancer diagnostics. Integrating AI algorithms in radiograms and other diagnostic tools helps spot patterns that might reflect malignancies. They can assess huge amounts of data like genetic and medical histories, which help doctors design personalized treatment plans for patients. Moreover, AI automates workflows, allowing radiologists to focus on more complex cases and improve overall productivity in diagnostic centers.

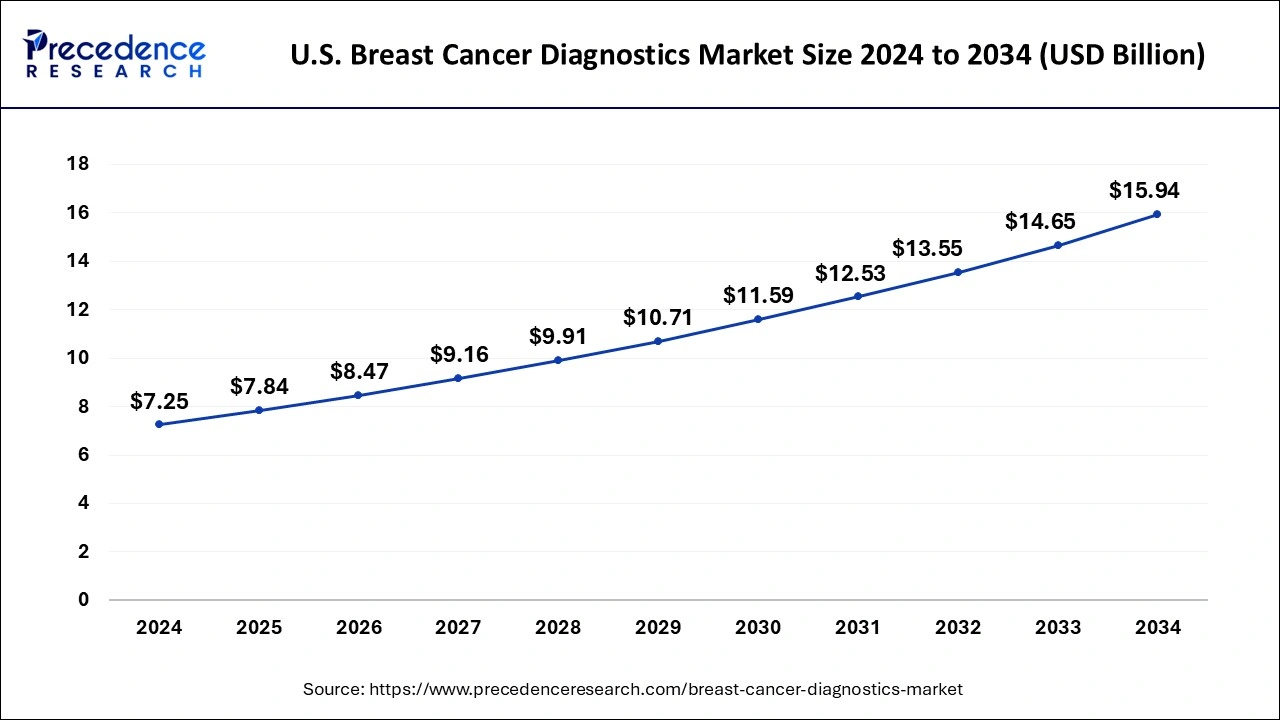

The U.S. breast cancer diagnostics market size was evaluated at USD 7.25 billion in 2024 and is predicted to be worth around USD 15.94 billion by 2034, rising at a CAGR of 8.20% from 2025 to 2034.

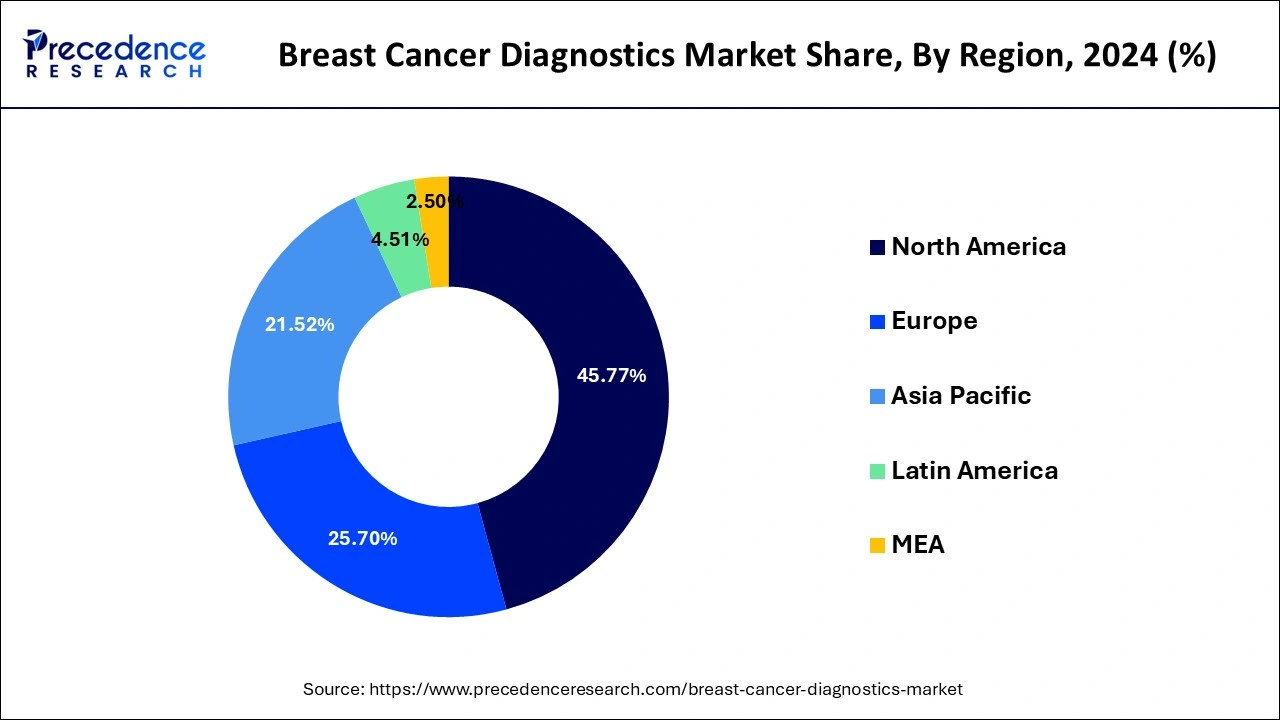

North America dominated the breast cancer diagnostics market with the largest market share of 45.77% in 2024. The presence of large players, well-established diagnostic and screening infrastructure, technological breakthroughs, strong patient awareness, and attractive reimbursement policies are all elements that contribute to the region’s dominance.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period, as a result of the rising incidence of breast cancer and the use of better diagnostic procedures. Furthermore, the breast cancer diagnostics market expansion is likely to be supported by increasing reimbursement guidelines and expanding healthcare infrastructure.

In the breast's glandular tissue, breast cancer develops in the living cells of the ducts or lobules. The malignant development is initially restricted to the duct or lobule, which usually causes no symptoms and has a low risk of spreading. The treatment for breast cancer can be quite effective, especially if the disease is detected early. Microscopic cancer that has spread from the breast tumor through the blood is generally treated with a combination of surgical removal, medication, and radiation therapy. This type of treatment, which can stop cancer from spreading and growing, saves lives.

Breast cancer is the most difficult to diagnose and cure because it is usually discovered after it has progressed to an advanced stage. People are looking for more efficient diagnostic options to deal with the condition effectively; hence, demand for early diagnosis of breast cancer is on the rise. Imaging and screening, in addition to other tests for detecting breast cancer, have gained immense popularity.

| Report Coverage | Details |

| Market Size in 2024 | USD 18.63 Billion |

| Market Size in 2025 | USD 20.14 Billion |

| Market Size by 2034 | USD 40.71 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.13% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End Use, Application, Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America , MEA |

Increasing Prevalence of Breast Cancer

The increasing prevalence of breast cancer is a major factor boosting the growth of the market. With the increasing incidences, majorly due to factors such as aging populations, hormonal changes, and lifestyle changes, the need for improved screening and detection methods is rising worldwide. According to the Breast Cancer Research Foundation, breast cancer is the most common cancer in women worldwide. In 2022, about 2.3 million women were diagnosed with breast cancer worldwide, and 670,000 died. Every 14 seconds, somewhere in the world, a woman is diagnosed with breast cancer, highlighting the need for improved diagnostics technologies to reduce this burden.

High costs of Advanced Diagnostic Technologies

Although there is a high need for advanced diagnostic technologies, their high costs are expected to hamper market growth. Various technologies, including 3D mammography, molecular imaging, and AI-driven diagnostic tools, are costly, and hence, they are not widely utilized, especially in low- and middle-income countries. Moreover, advanced diagnostic tools require substantial maintenance and operation costs, which further discourages small healthcare organizations from adopting them. Furthermore, the lack of insurance covering the screening and diagnoses hinders the market growth.

Rising Investments in Cancer Research

Increasing investments in cancer research by governments and healthcare organizations create lucrative growth opportunities in the market. In regions such as Asia Pacific, Latin America, and the Middle East, governments are heavily investing in cancer research to develop tailored therapeutics. Moreover, governments are implementing screening programs to reduce the overall burden of breast cancer, contributing to the growth of the market.

The instrument-based products had the highest revenue share in 2024. For widespread population-based screening of breast cancer patients, imaging is the first approach. All women with breast cancer undergoes a biopsy to confirm their diagnosis of the treatment.

The platform-based products segment is fastest growing segment of the breast cancer diagnostics market in 2024. Due to the increased demand of such products for targeted therapy, the platform-based products segment is expected to develop at the quickest rate throughout the projection period. The next generation sequencing, polymerase chain reaction, and other technologies are used to diagnose breast cancer.

The Imaging segment contributed the highest market share of 53% in 2024. The segment is expected to be driven by factors such as ease of access, high number of operations, and increased effectiveness. The ultrasounds, mammograms, and magnetic resonance imaging are the most common imaging methods used for screening and diagnosis.

The blood tests segment is fastest growing segment of the breast cancer diagnostics market in 2024, as a result of a number of research projects being conducted globally by research groups and key players. The liquid biopsy tests’ excellent efficacy is predicted to propel the blood testing segment growth.

The diagnostics and predictive segment captured the biggest market share of 49% in 2024. The rising popularity of genetic testing may contribute to the expansion of the segment.

The prognostic segment, on the other hand, is predicted to develop at a rapid rate over the projection period. As these tests are used to match patients with medicines, they are booming increasingly significant. As a result, the patient’s chances of survival improve dramatically.

The hospitals and clinics segment has held the largest market share of 51% in 2024. The segment’s expansion is likely to be fueled by rising patient hospitalizations and the growing burden of disease. The patients undergo biopsies for confirmation testing in hospitals after the screening test.

The diagnostic centers and medical laboratories segment, on the other hand, is predicted to develop at the quickest rate in the future years, as a result of an increase in the number of government programs to provide various services, such as diagnostic test reimbursement.

To strengthen their product portfolio, the major market players use organic and inorganic expansion tactics. To stay competitive in the global breast cancer diagnostics market, these companies have used methods such as geographic growth, collaborations, acquisitions, investment in research and development, and manufacturing of novel breast cancer diagnostic tools in the market.

By Type

By Product

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

August 2022