January 2025

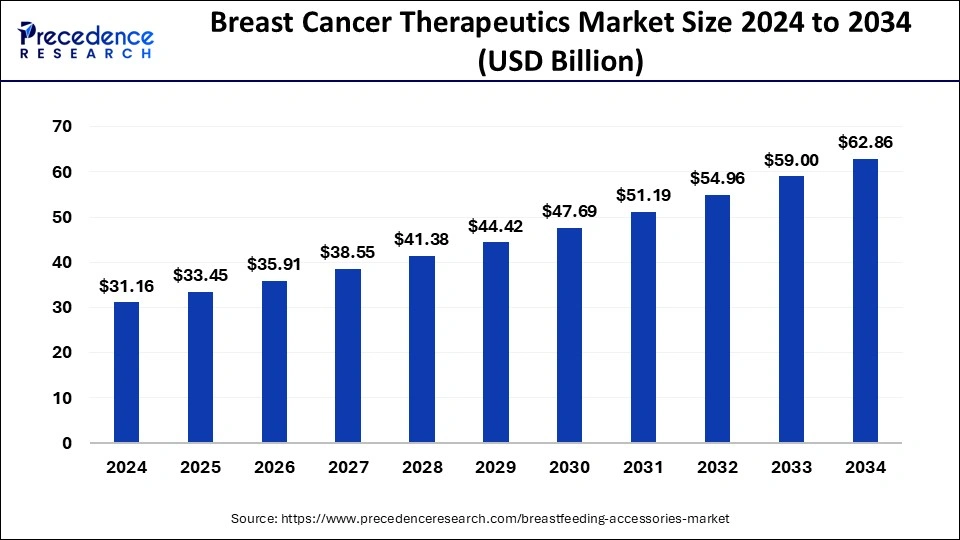

The global breast cancer therapeutics market size accounted for USD 33.45 billion in 2025 and is forecasted to hit around USD 62.86 billion by 2034, representing a CAGR of 7.27% from 2025 to 2034. The North America market size was estimated at USD 11.22 billion in 2024 and is expanding at a CAGR of 7.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global breast cancer therapeutics market size accounted for USD 31.16 billion in 2024 and is predicted to increase from USD 33.45 billion in 2025 to approximately USD 62.86 billion by 2034, expanding at a CAGR of 7.27%. The increasing number of patient support initiatives globally has the potential to fuel market growth.

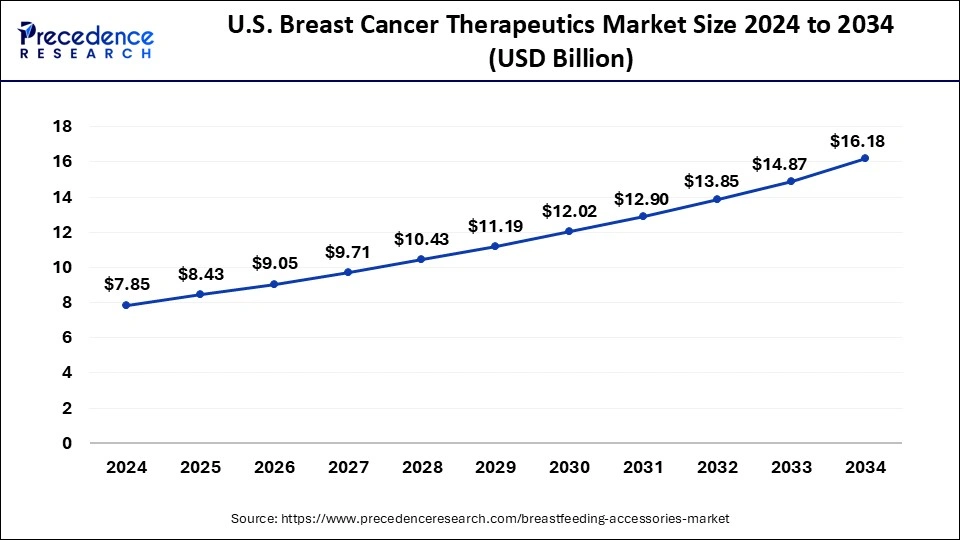

The U.S. breast cancer therapeutics market size was exhibited at USD 7.85 billion in 2024 and is projected to be worth around USD 16.18 billion by 2034, growing at a CAGR of 7.50%.

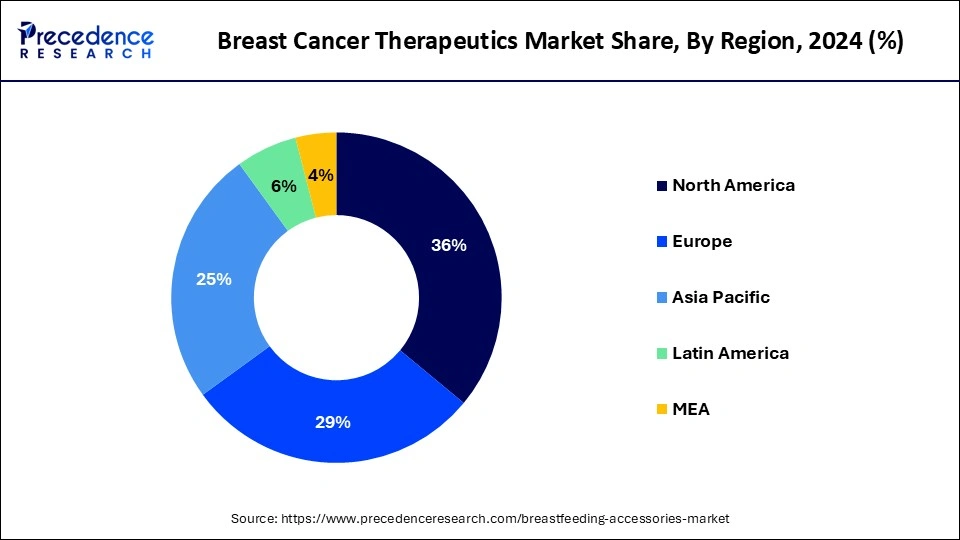

North America led the market with the biggest market share of 36% in 2024. Ongoing research initiatives supported by organizations like Susan G. Komen enhance our understanding of breast cancer biology and improve treatment outcomes. Furthermore, regulatory approvals, such as the FDA's authorization of Trodelvy for treating triple-negative breast cancer, indicate ongoing progress in therapeutic innovation and patient care in North America.

Europe is expected to hold a significant share of the breast cancer therapeutics market over the forecast period, mainly due to the rising incidence of breast cancer and increased adoption of advanced therapies. Among European countries, breast cancer is a prevalent form, accounting for about 523,000 new cases, which is 13% of all cancer cases in the region. Other common types of cancer include colorectal, lung, and prostate cancers. Despite improvements in healthcare infrastructure and cancer management, Europe faces challenges like demographic shifts, healthcare access issues, and disparities in cancer outcomes among different population groups.

Breast cancer, the most prevalent ailment affecting the population, predominantly targets women with proliferative disorders. Originating in breast tissues, this disease manifests through various signs such as changes in breast size and shape, nipple discharge, lumps in the breast, and irritated, scaly red spots on the skin. The expression of the human epidermal growth factor receptor 2 (HER2) gene is intricately linked to the genesis of breast cancer.

Treatment for breast cancer, known as breast cancer therapeutics, encompasses diverse approaches aimed at reducing or eliminating cancer cells within the breast. These interventions comprise chemotherapy, deploying specific drugs to eradicate cancer cells; radiation therapy, utilizing high-energy rays to obliterate cancer cells; and hormone therapy, inhibiting cancer cell growth by blocking crucial hormones.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.27% |

| Market Size in 2025 | USD 33.45 Billion |

| Market Size by 2034 | USD 62.86 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy, Cancer Type, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Disparities in cancer care and treatment

Disparities in cancer care and treatment access highlight the urgent need for improved global healthcare infrastructure and services. Disparities in cancer outcomes are linked to human development levels, with countries having lower Human Development Index (HDI) facing higher breast cancer mortality rates due to late diagnosis and inadequate access to quality treatment. These findings underscore the importance of addressing cancer inequities and investing in comprehensive cancer care infrastructure to enhance outcomes for breast cancer patients worldwide, potentially contributing to the growth of the breast cancer therapeutics market.

High treatment costs

The significant expenses linked to breast cancer therapeutics pose challenges to accessibility in the breast cancer therapeutics market, especially in areas with constrained healthcare resources. For example, advanced targeted treatments like trastuzumab (Herceptin) may impose a financial burden on numerous patients, limiting their ability to afford crucial treatments. Inequities in access persist, with underserved populations encountering difficulties in obtaining timely diagnoses and suitable therapies due to restricted healthcare infrastructure and geographical obstacles.

Advancements in targeted therapies and immunotherapies improve breast cancer patient outcomes

Advancements in the diagnosis and treatment of breast cancer are propelling the growth of the breast cancer therapeutics market. Targeted therapies and immunotherapies have transformed breast cancer treatment, providing more effective and less toxic options for patients. Additionally, the global cancer burden, including breast cancer, is increasing, with a surge in new cases and deaths fueling market expansion.

Advancement in diagnosis

The breast cancer therapeutics market is moving towards more focused and accurate treatments like HER2-targeted and hormone therapies. These advances have enhanced patient outcomes and survival rates. Additionally, there's a rise in the development of immunotherapies and combination therapies, providing new treatment choices with improved effectiveness. Furthermore, government support, research and development investments, and collaborations between pharmaceutical companies and research institutions drive market growth.

The targeted therapy segment held the dominant share of the breast cancer therapeutics market in 2024. Targeted therapy has become increasingly prominent due to its efficacy and fewer side effects than traditional chemotherapy. In breast cancer, targeted drug therapy involves medications directed at specific proteins in cancer cells, hindering their growth, spread, and longevity. These drugs aim to destroy cancer cells or impede their growth, exhibiting different side effects than chemotherapy. Trastuzumab demonstrated improved overall survival in late-stage breast cancer, extending from 20.3 to 25.1 months. In early-stage breast cancer, it reduced the risk of cancer recurrence after surgery by 9.5% and the risk of death by 3%.

The hormonal therapy segment is anticipated to show decent growth during the forecast period. Hormone therapy has become a crucial component in breast cancer treatment, particularly for estrogen receptor-positive tumors, leading to a significant reduction in recurrence rates. This therapy, also known as hormonal therapy or endocrine therapy, hinders the growth of hormone-sensitive tumors by either blocking the body's hormone production or interfering with hormones' effects on breast cancer cells. Typically administered after surgery to lower the risk of cancer recurrence (adjuvant therapy), it may also be initiated before surgery (neoadjuvant treatment).

The standard duration is at least five years. In some cases, therapy beyond five years might be recommended based on the likelihood of cancer recurrence, determined by tests like the breast cancer Index. Hormone therapy is also employed to treat cancer that has returned after initial treatment or has spread to other parts of the body.

The hormone receptor segment held the largest share of the breast cancer therapeutics market in 2024. Hormone receptors, which are large protein molecules located on target cells, play a crucial role in cell communication. Each cell typically has thousands of these receptors, and an essential feature is their specificity—each receptor can recognize only one hormone. Therefore, a hormone's corresponding receptor must be present to exert its effects on a target cell, in the context of breast cells, hormone receptors, specifically estrogen or progesterone, act as signal receivers, promoting cell growth. This includes the growth of cancer cells if they possess the receptors for these hormones.

The HER2+ segment is anticipated to show a higher CAGR in the breast cancer therapeutics market over the forecast period. This is attributed to recent product launches and market acquisitions. In breast cells, an excess of human epidermal growth factor receptor 2 (HER2) is a common feature tested for. HER2 proteins are receptors that govern the growth and division of cells. If there is an overexpression of HER2 receptors in breast tissue, it can lead to an accelerated multiplication of breast cells.

An article from Cancer Therapy Advisor in December 2023 suggests that a potential new standard of care for individuals with PIK3CA-mutant, hormone receptor (HR)-positive, HER2-negative advanced breast cancer could involve combining Inavolisib with palbociclib and fulvestrant. In the phase 3 INAVO120 trial, researchers observed that adding Inavolisib to this treatment combination doubled the median progression-free survival (PFS).

The hospital pharmacies segment held the dominating share of the market in 2024, the segment is observed to sustain the position in the breast cancer therapeutics market during the forecast period. This is attributed to the growing dependence of patients on chemotherapy-related drugs. The demand for breast cancer treatments will increase during this period, fueled by rising patient needs for diverse pharmaceuticals. Furthermore, improved accessibility to these products in hospital pharmacies contributes to the anticipated market expansion.

The retail pharmacies segment is anticipated to hold a significant share in the forecast period. Pharmacists have a significant role in managing postmenopausal breast cancer and vasomotor symptoms. They contribute by educating patients and suggesting medications in line with treatment guidelines. This involves considering potential side effects and drug interactions.

By Therapy

By Cancer Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

November 2024