January 2025

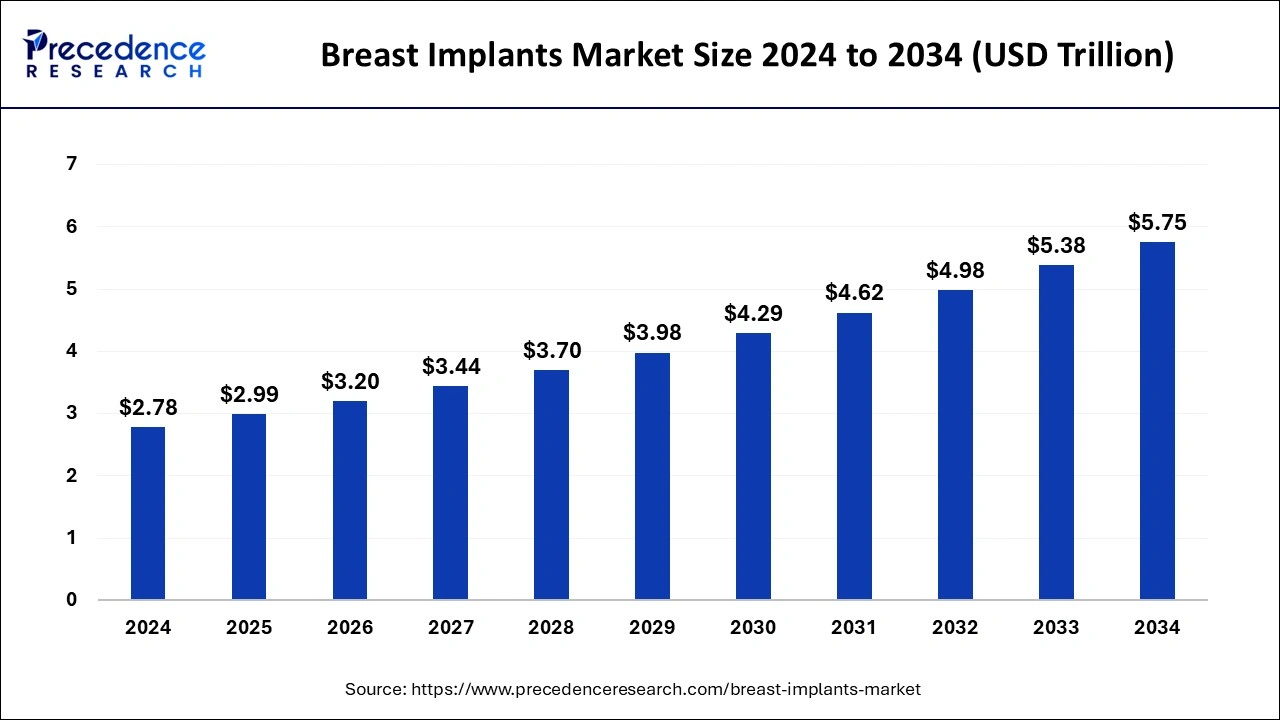

The global breast implants market size is calculated at USD 2.99 billion in 2025 and is forecasted to reach around USD 5.75 billion by 2034, accelerating at a CAGR of 7.54% from 2025 to 2034. The North America breast implants market size surpassed USD 890 million in 2024 and is expanding at a CAGR of 7.57% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global breast implants market size surpassed USD 2.78 billion in 2024 and is projected to hit around USD 5.75 billion by 2034, growing at a CAGR of 7.54% from 2025 to 2034. Rising demand for cosmetic surgery is the major factor expanding the breast implants market. The growing prevalence of breast cancers has increased breast implants. Advancing technologies and healthcare infrastructure fueling the breast implants market expansion.

AI integration has become crucial for improving breast implant techniques and medical devices. AI integration in the medical field has witnessed significant positive changes. The need for advanced medical devices and procedures due to increased hospitalizations and patient demands is transforming AI adoption in the medical field. The adoption of advanced technologies, including 3D imaging, modeling, and real-time guidance, is playing a favorable role in improving guidance and plans for surgeons with critical surgery information and potential errors. With the ability of AI to provide predictive analytics, it has become an essential procedure to understand ways to improve patient outcomes and reduce complexities. The growing need for advanced breast implants and AI integration is further highlighted.

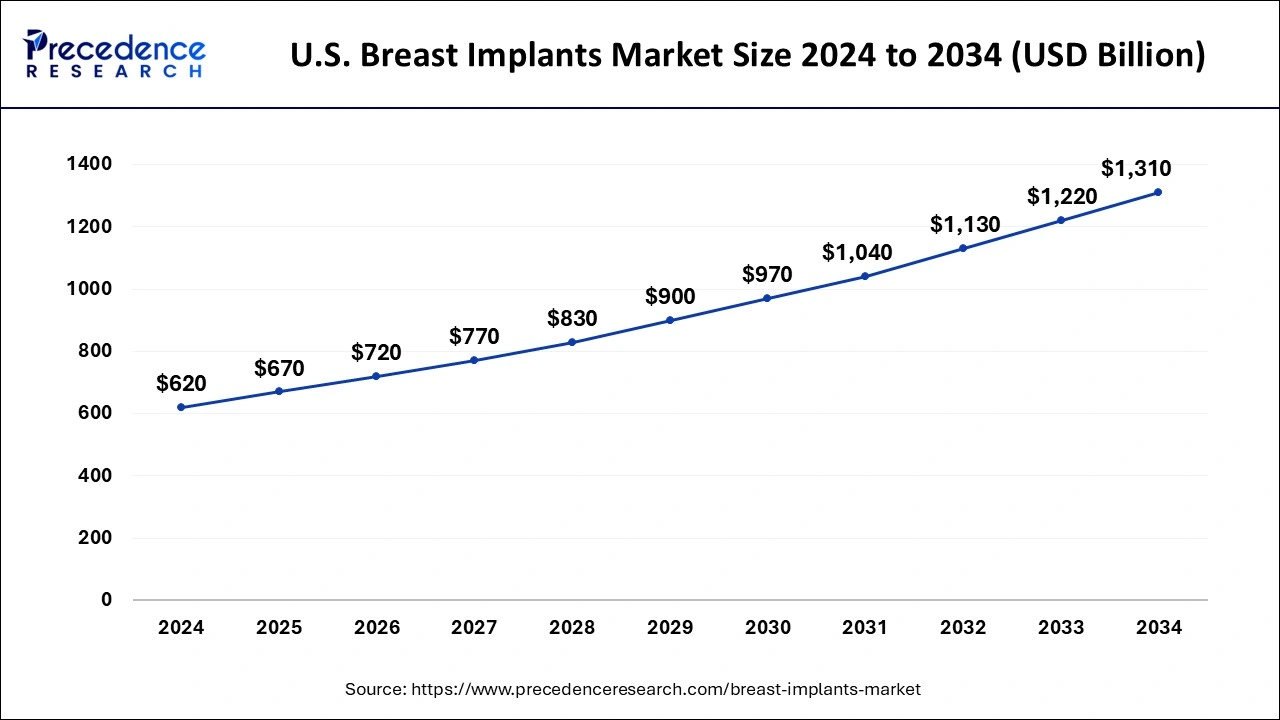

The U.S. breast implants market size was estimated at USD 620 million in 2024 and is anticipated to reach around USD 1,310 million by 2034, growing at a CAGR of 7.77% from 2025 to 2034.

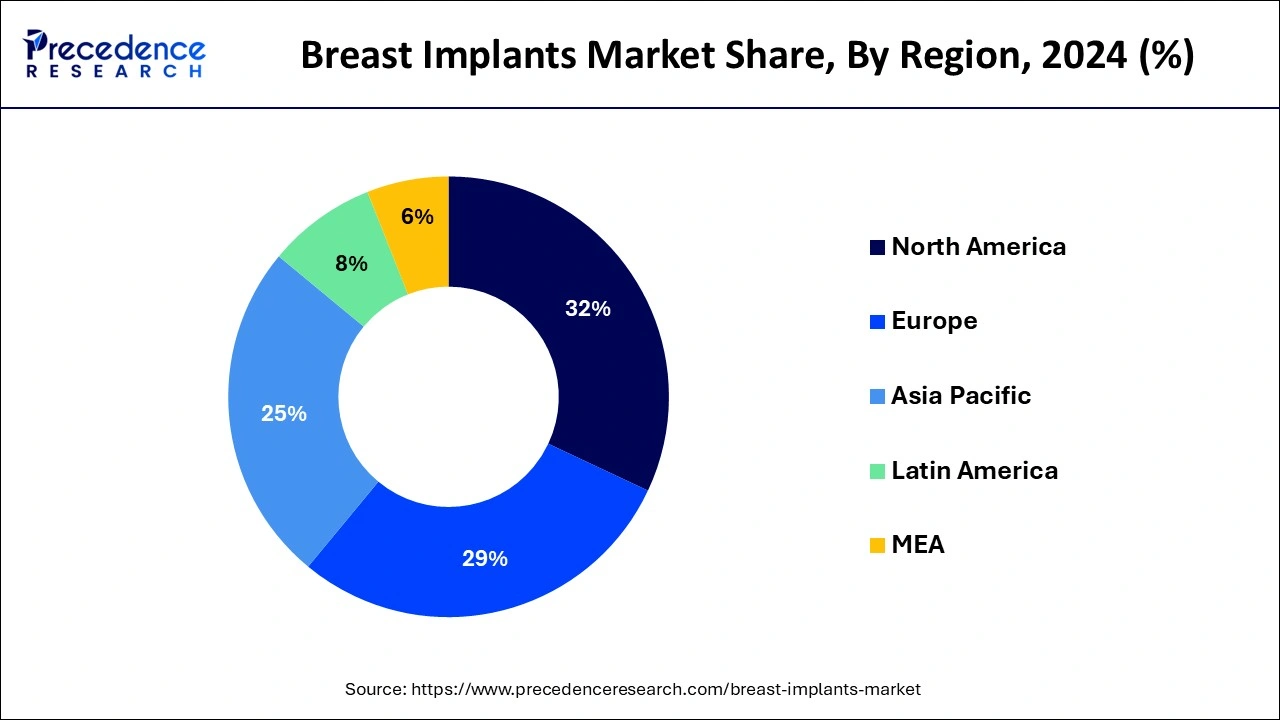

North America held the largest share of 32% in the breast implants market in 2024. The growth of the region is attributed to the presence of the sophisticated healthcare infrastructure, increasing use of medical devices, increasing investment in the healthcare sector, rising research and development activities, technological advancement in medical devices, rising awareness campaigns regarding breast implants, and rising burden of breast cancer which results in increasing demand for breast implants surgeries in the region.

The United States is one of the major contributors to the breast implants market. The growth of the market is driven by several factors, such as the increasing number of cosmetic surgeries, increasing product approvals by various regulatory organizations, rising disposable income, rising medical tourism, rising women's inclination toward breast augmentation and reconstruction procedures for beauty enhancement, and increasing prevalence of breast cancer.

Asia-Pacific breast implants market is expected to grow at a significant CAGR in the coming years. The growth of the market is due to several factors, such as rising demand for cosmetic procedures, increasing prevalence of breast cancer, rising awareness campaigns, the rising potential of the healthcare sector in developing markets, and rising strategic initiatives and product innovations. The wide use of artificial devices (prostheses) coupled with rising investment in advanced technologies in the healthcare sector is increasing the demand for breast implants.

People who get breast implants want to enhance the size and shape of their natural breasts. Breast implants are medical devices that are surgically inserted into the breasts. In recent years, breast implants have gained attention rapidly and have made incredible progress in yielding natural-feeling results. Breast implants are the most popular type of plastic surgery prostheses. Generally, there are two types of breast implants: saline and silicone gel. Breast implants come in different shapes and sizes according to the individual's needs. The breast implants market encompasses the activities of manufacturing, selling, and distributing breast implants.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.54% |

| Market Size in 2025 | USD 2.99 Billion |

| Market Size by 2034 | USD 5.75 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of breast cancer

Breast cancer is the most common disorder. This increasing prevalence of breast cancer across the globe has increased the need for breast reconstruction procedures, which can involve the use of breast implant surgeries. Therefore, with increasing cases of breast cancer, the demand for breast implants as a treatment option is anticipated to fuel the growth of the global breast implants market in the coming years.

High cost

The high cost associated with breast implant surgeries is observed to hamper the market's growth. An individual needs to invest high capital to undergo breast implant surgeries. In addition, risks associated with breast implants and post-surgery complications may restrain the market's growth during the forecast period. The side effects of breast implants include infection in the nipples, breast pain, and breast sensation, which may limit the adoption and restrict the expansion of the global breast implants market.

Rising demand for cosmetic procedures

The rising demand for cosmetic procedures for aesthetic appeal is projected to offer lucrative opportunities to the market during the forecast period. An individual undergoes breast implant surgeries to achieve an aesthetic appearance, which is mostly influenced by the growing hype of aesthetic appearance standards in society and social media.

Breast implants are one of the most popular cosmetic procedures for individuals seeking body transformation to be attractive. Breast implants assist in enhancing the breasts' shape, size, and symmetry according to the individual's desired aesthetic appearance, which also results in boosting their self-confidence. Therefore, increasing demand for cosmetic procedures globally is expected to spur the demand for breast implants in the coming years.

According to the report published by the International Society of Aesthetic Plastic Surgery in 2022, breast augmentation remains the most common surgical procedure for women, with 2.2 million procedures and a significant increase of 29 percent compared to 2021. All breast procedures witnessed significant growth from the previous year, with more than 4.4 million procedures on breasts and a 25 percent increase.

The silicone breast implants segment dominated the market with the largest share in 2024. The segment is observed to grow in the coming years. Silicone breast implants offer a more natural feel than saline breast implants. Soft textured breast implants from silicone are filled with a silicone gel, and this gel is similar to natural breast tissue, which also has less risk of forming hard scar tissue around the implantation. In case of leakage, the gel may remain within the implant shell. Silicone breast implants are FDA-approved for augmentation in women aged 22 or above.

The saline breast implants segment is expected to grow at a rapid CAGR rate during the forecast period. Saline breast implants are filled with sterile salt water. These implants offer a consistent shape and firmness. Saline breast implants are FDA-approved for augmentation in women aged 18 or above. In case of leakage, saline implants get absorbed naturally into the body without causing any harm.

Based on application, the cosmetic surgery segment dominated the global breast implant market. The segment growth is attributed to increased awareness of physical appearance. Cosmetic breast implant surgeries are becoming popular among appearance-conscious people. Additionally, the rising availability of disposable income allows for affording such surgeries. The demand for natural-looking breast results has increased among women. Furthermore, demand for fat transfer procedures is contributing to the segment expansion. Moreover, growing FDA approval for advanced and innovative breast surgeries is projected to fuel the segment growth further.

The reconstructive surgery segment is expected to witness growth in the forecast period. The segment is observed to sustain the position throughout the forecast period. Reconstructive surgery deals with the defects and deformities of the chest wall and post-mastectomy procedure. Reconstruction surgery is conducted to restore the natural look and improve physical appearance to become more aesthetic.

Advances in surgical techniques, implant designs, and materials have improved the safety, durability, and aesthetic outcomes of breast reconstruction with implants. Surgeons have access to a variety of implant options, including saline, silicone gel, and structured implants, to meet the diverse needs of patients. Overall, reconstructive surgeries with breast implants offer a viable and effective option for individuals seeking to restore breast appearance, symmetry, and confidence following mastectomy, breast deformities, or other related conditions. The popularity of these procedures underscores their significant impact on physical and emotional well-being, empowering patients to reclaim their bodies and lives.

The hospitals segment dominated the breast implants market in 2024. Hospitals provide access to advanced machines for patients. Individuals seeking body transformation mostly choose hospitals to undergo breast augmentation procedures as they offer more efficient solutions. Such supportive factors are fueling the segment’s dominance in the market.

Moreover, the hospital has a high volume of breast reconstruction surgeries due to the availability of advanced medical devices and healthcare professionals. The expanding advanced healthcare infrastructures are attracting the people. Moreover, the availability of government funds and medical insurance is making breast implants more affordable, leading to more demand for the surgeries. Growing government investments in hospitals are contributing to the segment expansion.

By Product

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

November 2024