January 2025

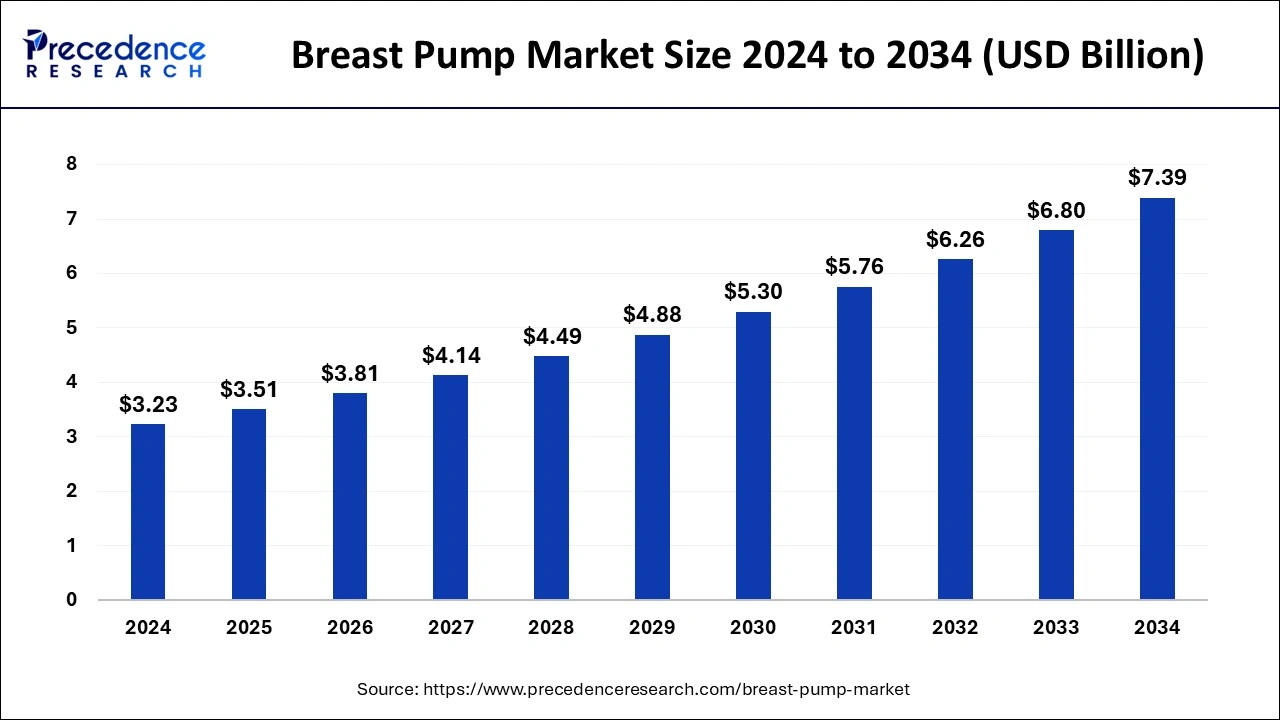

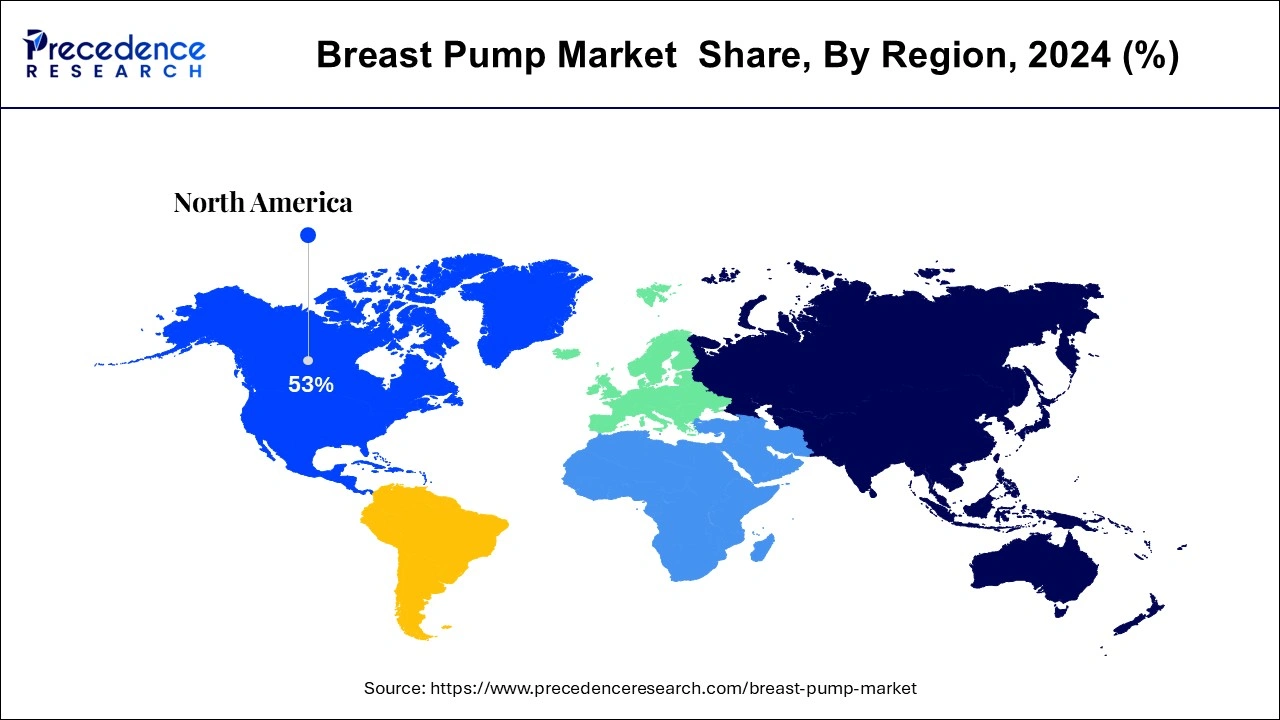

The global breast pump market size is calculated at USD 3.51 billion in 2025 and is forecasted to reach around USD 7.39 billion by 2034, accelerating at a CAGR of 8.64% from 2025 to 2034. The North America breast pump market size surpassed USD 1.71 billion in 2024 and is expanding at a CAGR of 8.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global breast pump market size was worth around USD 3.23 billion in 2024 and is anticipated to reach around USD 7.39 billion by 2034, growing at a CAGR of 8.64% from 2025 to 2034. The growth of the breast pump market is driven by the increasing women's employment rate and the growing awareness about the importance and benefits of breastfeeding among mothers.

The emergence of artificial intelligence (AI) technologies has paved the way for the development of smart medical devices. Manufacturers are developing advanced breast pumps using AI algorithms. AI-driven breast pumps analyze real-time data like milk flow and suction levels and provide personalized recommendations. This further helps mothers in their breastfeeding journey.

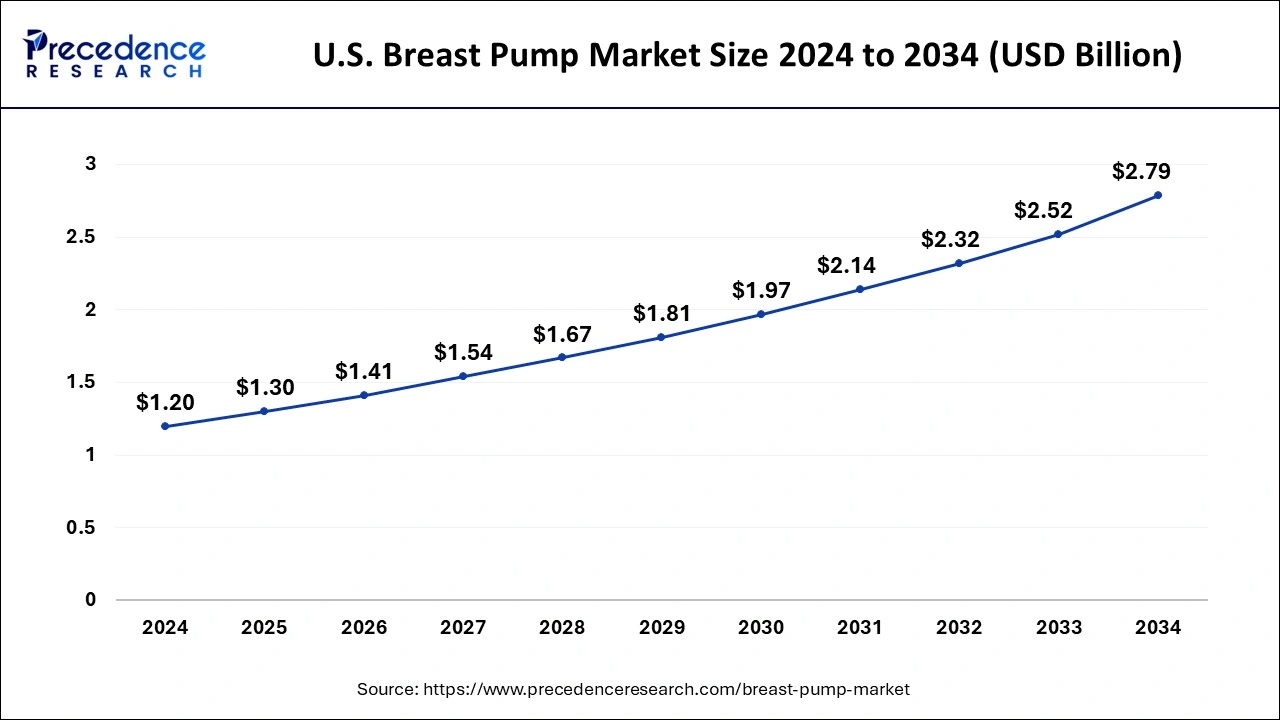

The U.S. breast pump market size was exhibited at USD 1.20 billion in 2024 and is projected to be worth around USD 2.79 billion by 2034, growing at a CAGR of 8.80% from 2025 to 2034.

The North American market witnessed decent development throughout the forecast period due to high employment rate of women, embrace health care expenditure, more improved reimbursement policies. European countries contribute with considerable market share for breasts pumps industry, with Russia being the most lucrative market in Eastern European countries. The European breasts pumps market has witnessed considerable development in the recent years due to features of breast penis pumps such as permit women to keep dairy production and supply healthy feed to infants in their lack. Asia Pacific market is currently in growth stage and is expected to grow with highest market share during the analysis period.

Healthcare devices used for extracting milk from the breast of lactating mothers are defined as breasts pumps. Employed women are forefront users of this device they use it to continue breastfeeding their babies while they are at work. In some instances, physicians also recommend women to use breasts pumps to activate milk supply when the child is not able to suck dairy. Breast pumps have become as an appropriate choice for the working women. The particular breast pump market is expected to witness a significant growth, mainly because of to growing technical advancements such as double breast penis pumps that assist to eliminate fat content from milk and replacement it with higher caloric value.

Throughout 2020, Covid-19 greatly impacted the overall medical devices market, with different segments of industry experiencing wide-ranging effects. The speedy initial spread of the pandemic come in healthcare systems being severely stressed, with resources and staffing being re-directed to address the surge in patients, particularly in intense care units.

Health-related device markets that are imperative to supplying hospital equipment for the management of Covid-19, such as personal defensive equipment, ventilators and general hospital items, experienced a spike in sales to fulfill the frustrating demand. However, the pandemic also come in postponements and cancellations of non-essential and elective treatments. Manufacturers centering on devices used in such elective procedures were extensively impacted fiscally during the worst-hit months of the pandemic, from Drive to April 2020. Several of these device market segments had already restored by Q2 of 2020, yet , with some even recording a surge in sales, while a few others had yet to experience such surges in 2021. Other device market segments were less influenced overall by the pandemic, particularly those found in essential treatments, such as in the heart disease place.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.51 Billion |

| Market Size by 2034 | USD 7.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.64% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

On Technology basis the market is bifurcated into two subtypes; manual and electric. The electric pumps section held the greatest market share of over 49% in 2022 and is expected to develop further at the speediest CAGR on the forecast period. These items are powered with a motor and provide much more suction, making pumping significantly faster. The double moving model decreases the time taken when compared to the normal pump. Frequently, electric pumps can be quite heavy and noisy but manufacturers continue to use advanced technology to produce lightweight products that generate lower noise. Some key brands in this segment include Solely Yours Ultra Breasts Pump by Ameda AG and Isis iQ Duo Breasts Pump by Philips AVENT. Technological developments with the intro of lightweight devices, such as Platinum eagle electric breast pump motor by Ameda and Electric swing chest pumps by Medela, are expected to drive segment expansion over the approaching years.

On the basis of product type the market is segmented into open and closed system. The closed system sub segment accounted for the highest revenue in 2022 and is also likely to witness the most effective growth rate in the forecast period. This growth can be attributed to the higher consumption rates of these systems as they are more contamination-free. Closed system products include a lid which acts as a barrier between a pumping unit and variety kit, or motor that avoids the contamination of collected milk. This kind of protective layer also prevents the dairy products particles from stepping into the pump lines or motor. These products provide better safe practices, ensure maximum associated with impurities, and are super easy to clean. The introduction of convenient new products, such as AmedaHygieniKit, is expected to drive the segment expansion in the coming years.

On the basis of application the breast pump market is sub divided into personal use and hospital-grade pumps. The hospital-grade segment held the highest market with more than 60% revenue in 2022. This same segment is anticipated to expand with the highest CAGR over the forecast period. The increase in the use of hospital-grade chest pumps is the major factor driving the segment expansion. Several factors, such as favorable federal initiatives and a rise in can certainly employment rate, are also promoting portion growth. According to Eurostat, there has already been an increase in the employment of women from 1993 to 2016 in nearly all of the Europe; for instance, in Ireland in Europe, it has increased from ~40% in 1993 to ~65% in 2016. Such factors will increase the demand for breast pumps from working women.

Important market players concentrate on strategies, such as mergers & acquisitions, relationships, and new product launches, to improve their foothold in the global market.

For instance, in May 2017, Medela announced that it might conduct in-house tests to boost the precision of the comments received by the organization regarding its device. This is expected to increase patient compliance with the device.

Many companies are also trading heavily in R&D to improve their product portfolio. For example, in October 2017, Philips launched uGrow, a baby application, which helps parents monitor the baby’s development.

Segments Covered in the Report

By Product

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

August 2022