January 2025

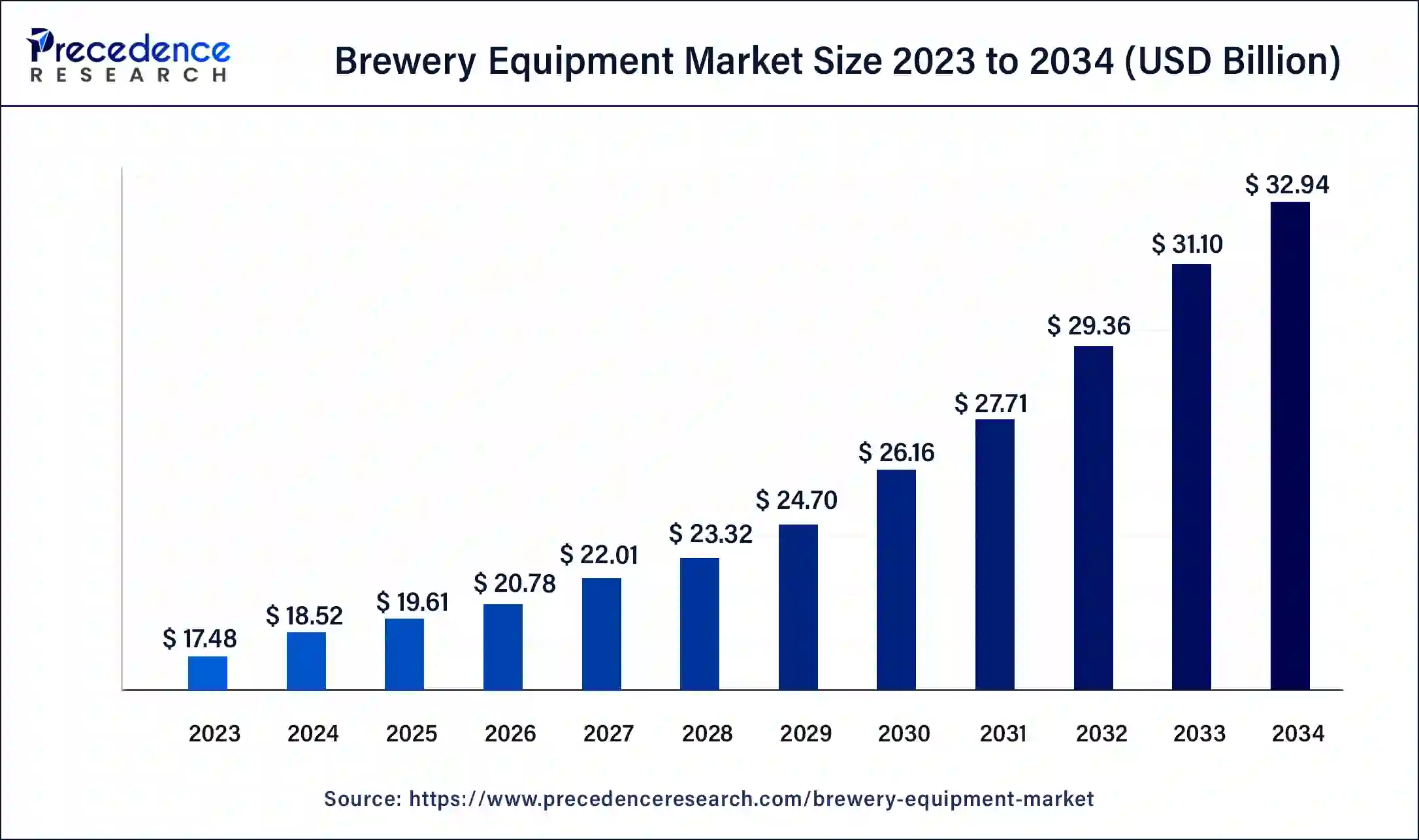

The global brewery equipment market size was USD 17.48 billion in 2023, calculated at USD 18.52 billion in 2024 and is expected to be worth around USD 32.94 billion by 2034. The market is slated to expand at 5.93% CAGR from 2024 to 2034.

The global brewery equipment market size is projected to be worth around USD 32.94 billion by 2034 from USD 18.52 billion in 2024, at a CAGR of 5.93% from 2024 to 2034. The rising demand for beer consumption is aiding in the growth of the brewery equipment market globally. The global brewery equipment market includes equipment used for brewing, fermenting, and packaging beer, as well as temperature and cleanliness maintenance. Breweries have sprouted recently, especially in developing nations, to fulfill the growing demand from the urban middle class, whose lives heavily depend on such alcoholic beverages. The brewing equipment market is one of the most beneficial markets from the point of view of profit and investment due to the availability of different kinds of beverages and beverage manufacturers.

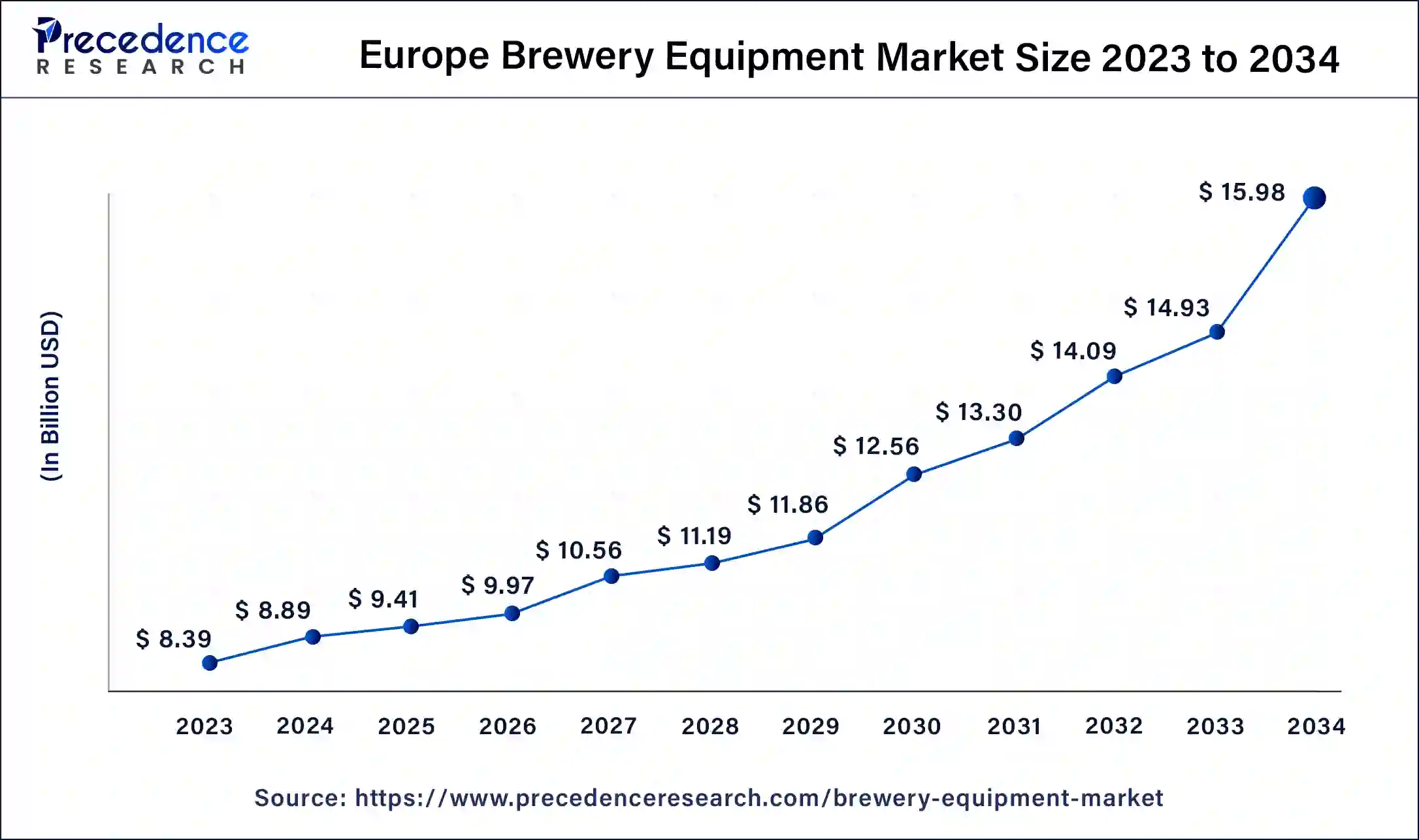

The Europe brewery equipment market size was exhibited at USD 8.39 billion in 2023 and is projected to be worth around USD 15.98 billion by 2034, poised to grow at a CAGR of 6.03% from 2024 to 2034.

Europe accounted for the highest market share of 48% in 2023. This is due to rising global beer consumption and the presence of major market players in the region. Germany and the United Kingdom are the dominating regions in the market. Europe produces beer on a massive scale due to which utilization of brewery equipment is high in the region along with the rise in consumption. These factors will further boost the market growth in the region in the future.

Top 5 European beer consuming countries

| Country | Beer Consumption Per Capita | Total Beer Consumption |

| Czech Republic | 140 L | 1,498,000,000 L |

| Austria | 107.8 L | 949,000,000 L |

| Romania | 100.3 L | 1,956,000,000 L |

| Germany | 99 L | 99 L |

| Poland | 97.7 L | 3,713,000,000 L |

North America is expected to witness the fastest CAGR of 6.74% over the forecast period. This can be linked to the growing demand for beer among most consumers and improving their recipes and production methods to fill customers with premium blends with innovative flavors. Furthermore, the presence of key companies in countries such as the U.S. and Canada emphasizes the rising number of craft breweries and pubs. The U.S. beer brewery equipment market might experience sluggish growth because of the rising popularity of branded beers and energy drinks.

How is AI changing the Brewery Equipment Market?

The introduction of artificial intelligence (AI) has created opportunities for brewers to experiment with unique fusion beers. For example, Indian-inspired fusion beers combine traditional Indian flavors with modern brewing techniques. Automation and improvement of multiple aspects of the brewery equipment market are essential. AI's applications include controlling fermentation temperatures and predicting equipment maintenance. This highlights the innovative potential of AI-powered brewing.

In January 2024, Artificial Intelligence Meets Artisanal Brewing will take place at Columbus’s Species X., a unique combination of a taproom and a brewing innovation hub. This isn’t just another brewery; it’s a groundbreaking endeavor that fuses ancient brewing methods with cutting-edge artificial intelligence, all under the guidance of Beau Warren, a visionary brewer with over a decade of industry experience.

| Report Coverage | Details |

| Market Size by 2034 | USD 32.94 Billion |

| Market Size in 2023 | USD 17.48 Billion |

| Market Size in 2024 | USD 18.52 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.93% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Mode Of Operation, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for premium and craft beer

Growing demand for craft beer is the crucial factor driving the market growth. Craft beer has a deeper and more distinct flavor. Craft breweries frequently experiment with different ingredients to give their beers a unique flavor that is rarely found in other types of breweries. These factors can further propel the brewery equipment market growth. Most craft brewers focus on their beer's taste and flavor. Premium and craft beers have risen to promotion due to their unique flavors and standardized ingredients. Additionally, there are various benefits linked to craft beers, such as reduced risk of cardiovascular disease (CVD), hypertension, etc.

Strict regulations

The industry is subject to strict regulations regarding the manufacturing and sale of alcohol, which can create some hurdles for companies working in this space. Moreover, the brewery equipment market is competitive because of many companies operating in this sector. This can further make it difficult to stand out and gain a significant market share in this domain.

Compressor technology

In craft breweries, compressors play an important role throughout the brewing process. They are essential during fermentation, where they generate compressed air for aeration, a key step in brewing. The air from these compressors also powers beer-clearing equipment and helps remove solid particles. There are two main types of industrial air compressors used in brewing: reciprocating and rotary screws; each contributes to the brewing and distilling processes. Furthermore, the strong sales of compressors in the brewery equipment market can be attributed to their versatile uses. Beyond fermentation, compressed air is vital for beer bottling and carbonation, as well as for creating oxygen, pushing out yeast and beer from containers, and cleaning and sanitation.

The microbrewery equipment segment dominated the market with the biggest market share of 84% in 2023. This segment is expected to continue to lead the market shortly due to the increasing demand for standard beer, which is readily available from numerous brands at various price levels. The advantages of using this machinery include its efficiency in large-scale beer production. Moreover, the fermentation equipment sector is projected to retain its dominant role in the macro brewery equipment market throughout the forecast period.

The craft brewery equipment segment is growing at a notable CAGR of 6.84% over the forecast period. The growing global popularity of craft beer is driven by its unique flavors and all-natural ingredients. Additionally, craft beer provides several health benefits, including a lower risk of diabetes, arthritis, and cardiovascular issues. As the consumption of craft beer increases, demand for craft brewery equipment also rises.

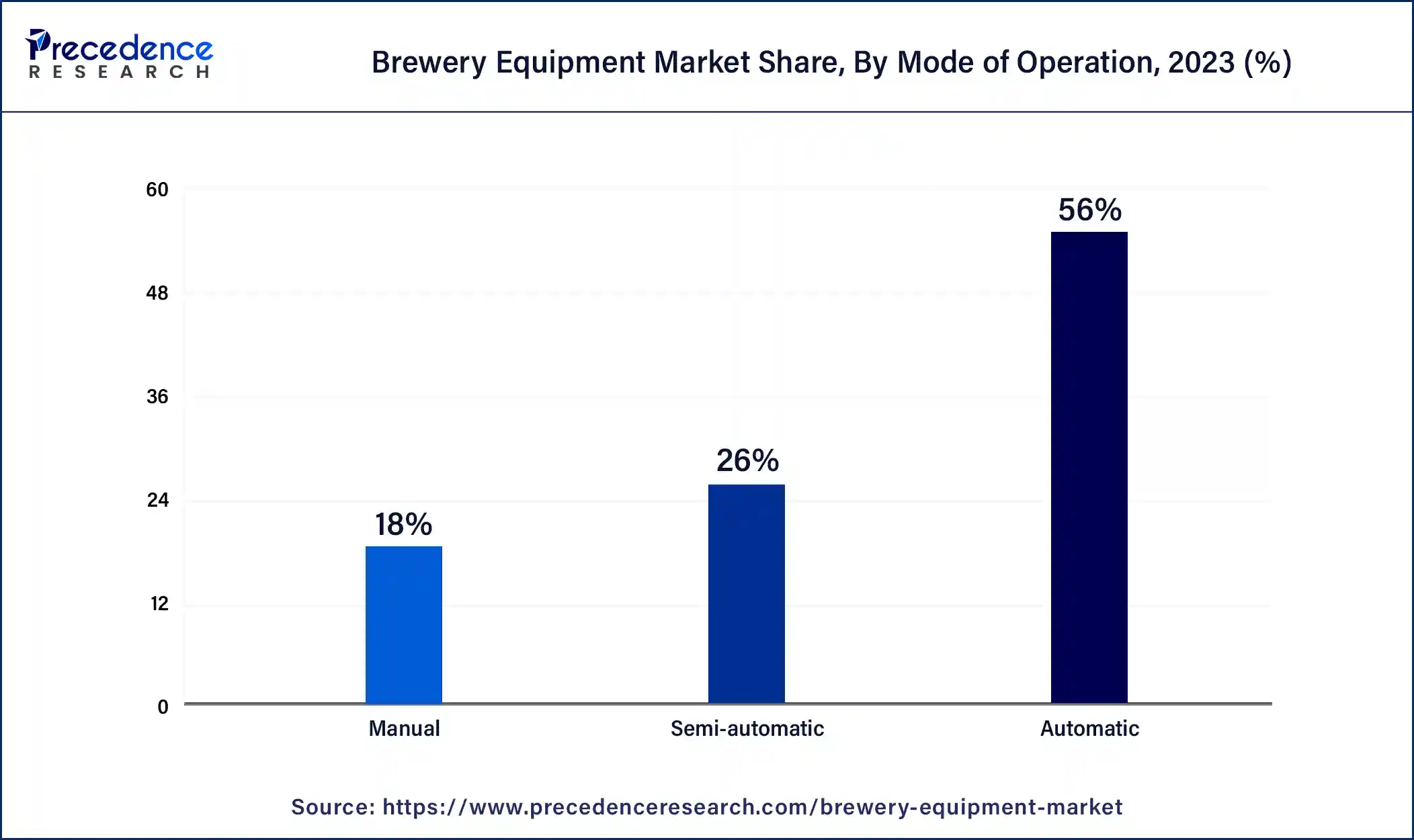

The automatic brewery equipment segment led the market with the largest market share of 56% in 2023. The craft brewing process is rapidly incorporating automation to streamline production. Leading companies are heavily investing in the creation of automated systems designed to produce high-quality beers. Large-scale brewers rely on automation as a vital part of their operations to boost their core business of beer production. Hence, these major breweries are channeling significant investments into autonomous fermentation technology by expanding packaging capabilities and improving brewing efficiency. These developments are expected to drive growth in the brewery equipment market.

The semi-automatic segment is anticipated to grow at a remarkable CAGR of 5.72% during the forecast period. This can be attributed to the increasing consumer preference for artisanal and handcrafted beer over other liquors. Also, the increasing need for high-quality and inexpensive brewing equipment is estimated to fuel the growth of the semi-automatic equipment segment throughout the forecast period.

Segments Covered in the Report

By Type

By Mode Of Operation

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

September 2024