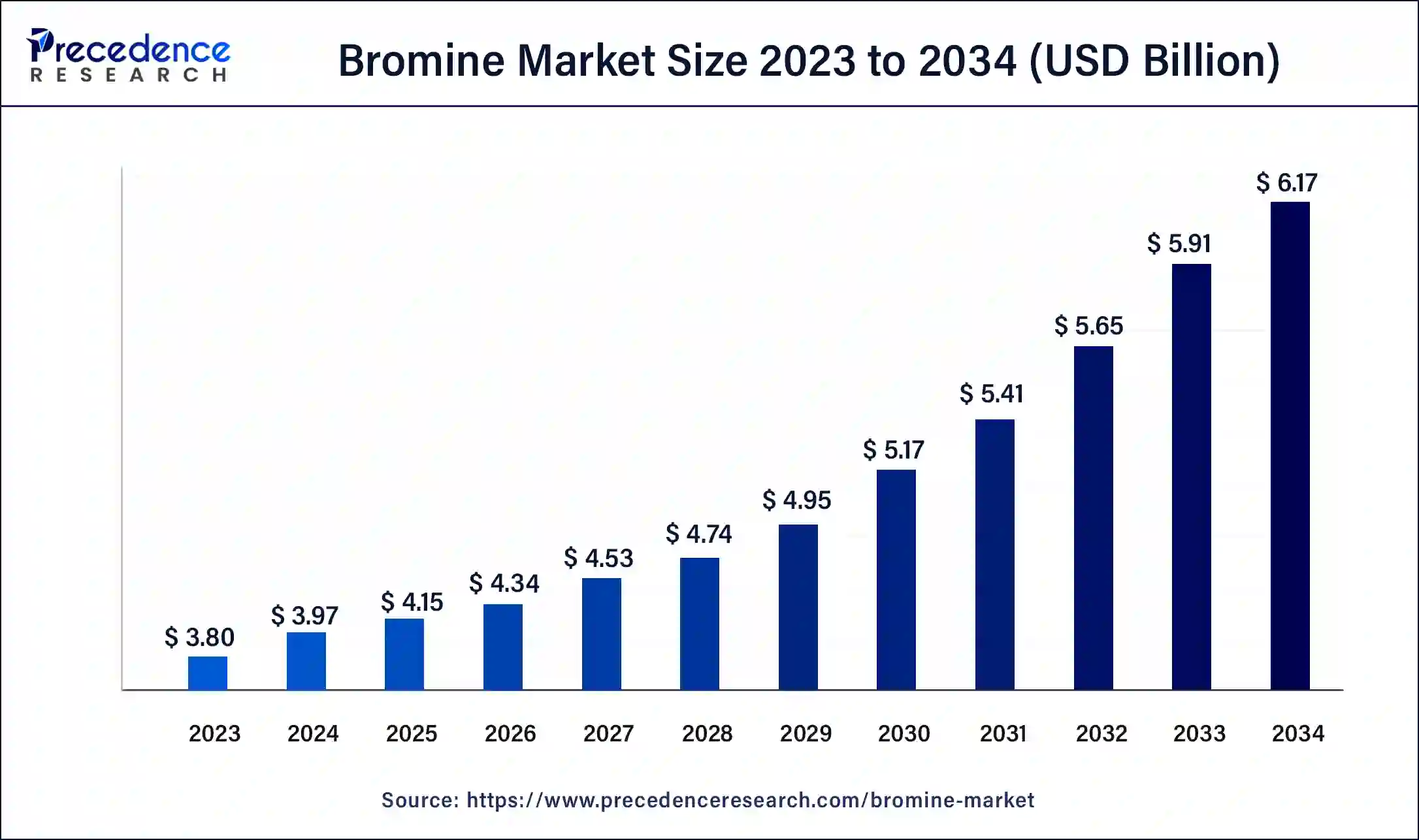

The global bromine market size was USD 3.80 billion in 2023, calculated at USD 3.97 billion in 2024 and is expected to be worth around USD 6.17 billion by 2034. The market is slated to expand at 4.51% CAGR from 2024 to 2034.

The global bromine market size is worth around USD 3.97 billion in 2024 and is anticipated to reach around USD 6.17 billion by 2034, growing at a CAGR of 4.51% over the forecast period 2024 to 2034. The benefits of bromine include specialty rubber uses, used as catalysts in plastic, pharmaceutical production, energy storage and generation, crop protection, oil drilling, mercury emissions reduction, water treatment, etc. contributing to the growth of the market.

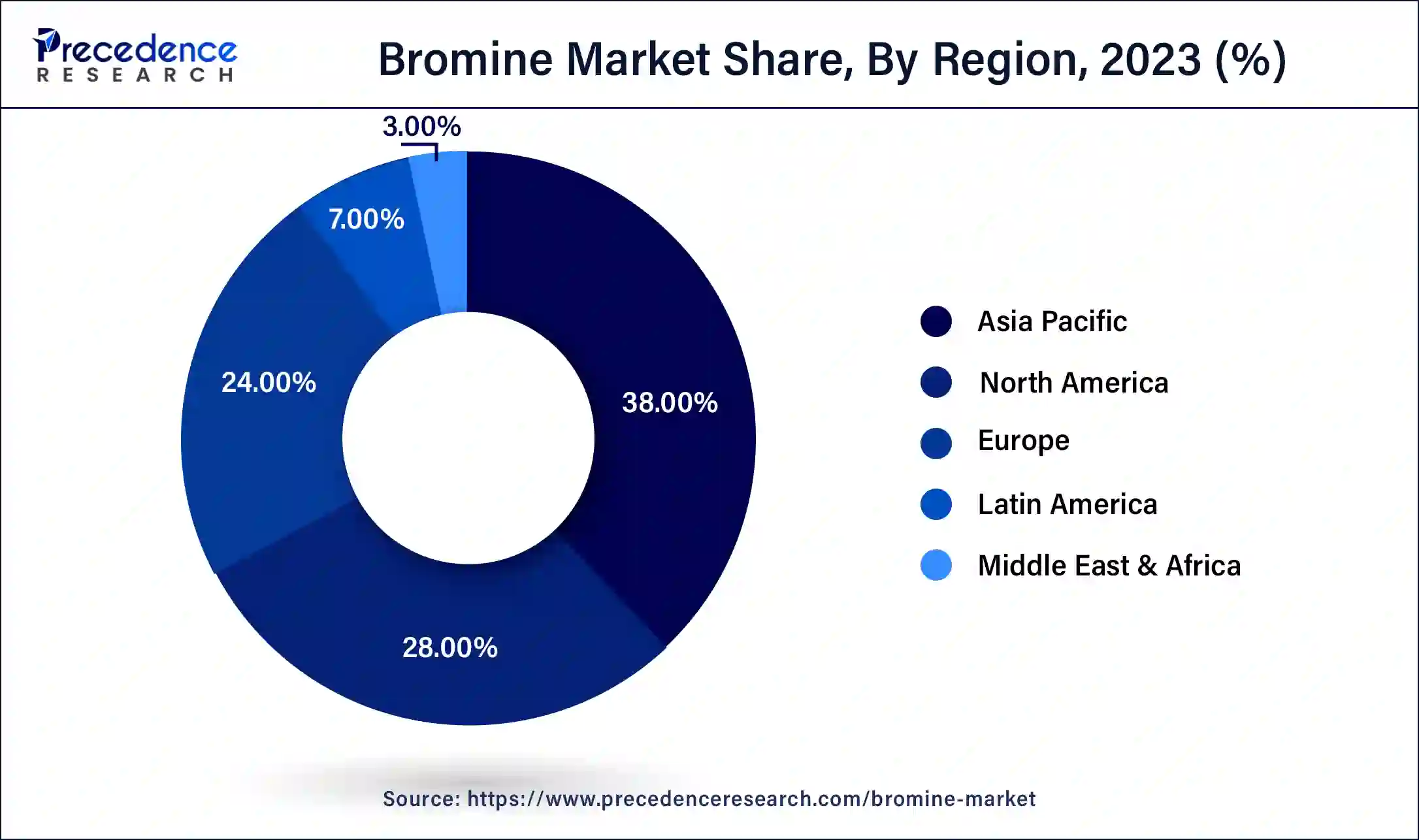

The global asia pacific bromine market size was exhibited at USD 1.44 billion in 2023 and is predicted to reach around USD 2.38 billion by 2034, growing at a CAGR of 4.67% over the forecast period 2024 to 2034.

Asia Pacific region has generated the highest market share of 38% in 2023. Bromine has many applications in different industrial sectors. Bromine-based flame retardants are highly used in automotive components, electronics, and constructive materials. In the oil and gas industry, bromine compounds are used for completion fluids and drilling fluids. It is also used to produce many drugs, like antiseptics and sedatives, in the pharmaceutical industry. Bromine use has increased in many sectors, including chemical, agriculture, and residential applications. Increased demand for consumer electronics and construction contributed to the increased demand for bromine.

North America is estimated to be the fastest-growing during the forecast period of 2024-2034. The United States is the leading country for the growth of the bromine market in the North American region. The United States imports a high range of bromine-based chemicals like bromine salts such as sodium bromide, potassium bromide, calcium bromide, ammonium bromide, and also potassium bromate and sodium bromate.

The bromine market is referred to as a competitive landscape dominated by a few key players because of the concentrated nature of bromine production and its critical applications in many industrial sectors. The bromine is a chemical element with atomic number 35, which has an irritating smell, a choking, and a dark red fuming toxic liquid. It is a halogen group member and occurs chiefly in the form of salts in brines and seawater. The benefits of bromine include being used in catalyst production, as a fire retardant, sanitation, and agriculture, as an alternative to chlorine in the swimming pool, as it is better for sensitive skin, etc., helping the market’s growth.

How is AI Revolutionizing the Bromine Market?

Artificial intelligence (AI) plays an important role in the chemical industry. For bromine, AI offers many benefits, including AI can improve safety by providing real-time alerts and monitoring hazardous conditions to prevent accidents; it can improve energy consumption at the time of bromine production, which helps to make the process more cost-effective and sustainable, help to monitor bromine quality in real-time to meet the standard requirement, etc. help to the growth of the bromine market.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.17 Billion |

| Market Size in 2023 | USD 3.80 Billion |

| Market Size in 2024 | USD 3.97 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.51% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Derivative, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Used in many industries

The bromine is used in a wide range of industries like construction, electronics, home furniture and appliances, food and beverages, oil and gas drilling, pharmaceuticals, and textiles, which drive the growth of the bromine market. It is also used in urban mining, energy storage, power production, and many others. In many industries, bromine is used for specialty rubbers, catalysts for plastics, production of pharmaceuticals, energy generation and storage, protection of crops, oil drilling, mercury emissions reduction, and water treatment.

Toxic effects of bromine

The toxic effects of bromine include skin burns and irritation if bromine gas or liquid comes in contact with skin, watery eyes, dizziness, irritation of mucous membranes like inside nose, mouth, etc., headache, breathing trouble, coughing, unstable cardiac rhythms, abnormal or metallic test, nausea and vomiting, dizziness, pulmonary edema or fluid build up in the lungs, irritation of the lungs, etc. can hamper the growth of the bromine market.

Collaboration and implementing regulatory policies

Collaboration in companies offers many benefits, including increased knowledge, problem-solving, more effective, advanced solutions, improved relationships, varied perspectives, increased productivity, new ideas, etc., which helps the growth of the bromine market. Implementation of regulatory policies, guidelines, and standards governing the transportation, use, and production of bromine and its derivative in different industrial sectors and regions with environmental considerations and safety regulations.

The organobromine segment dominated the bromine market in 2023. The study of organobromine includes organic compounds which contain carbon bonded with bromine. The organobromine also known as organobromide. It also includes naturally occurring bromomethane, and it has many industrial applications. The organobromine compounds are used as fire retardants. Organobromine balance between cost and reactivity. These are intermediate in reactivity between organoiodine and organochlorine. Eosinophil peroxidase uses bromine ions to kill specific bacteria and parasites. These compounds are used for making anticancer drugs, in water treatment, etc.

The hydrogen bromide segment is expected to be the fastest-growing during the forecast period. The benefits of hydrogen bromine (HBr) include its ability to be used for the production of alkyl bromides and inorganic bromides, which helps the growth of the bromine market. It is also used as a catalyst for many organic chemistry reactions. To form bromoalkenes, hydrogen bromide is used in reaction with alkynes by anti-Markovnikov rule or peroxide reaction. It is used as a reagent to open epoxides and lactones. Hydrobromic acid is a good reagent for organobromine compound preparation. By using hydrogen bromide, specific ethers can be cleaved. Hydrobromic acid is used as a catalyst in some of the alkylation and extraction of ores processes. The properties of hydrogen bromide include it is soluble in water and forms hydrobromic acid; in pure form, it is a colorless gas, it is a heteronuclear diatomic molecular compound, reacts exothermically with hydrogen carbonates and carbonates to generate carbon dioxide, reacts exothermically and rapidly with all kinds of bases.

Product List:

| BROMINATING AGENTS | ALKYL/ACYL BROMIDES | INORGANIC BROMINE COMPOUNDS |

| Bromine | n-Propyl Bromide | Calcium bromide solution (52%) |

| Phosphorous Tribromide | Sodium bromide solution (45%) | |

| Hydrobromic Acid |

The flame retardant segment dominated the bromine market in 2023. Bromine is used as a flame retardant because of its high atomic mass and a high range of polymers and applications. Bromine-based flame retardants play an important role in reducing fires' impact on property, people, and the environment, enabling longer escape times in fire cases and longer response times. Bromine is considered the most efficient halogenated flame retardant as it effectively captures free radicals produced at the time of the combustion process. It bonds with carbon and enables it to interfere at a favorable point at the time of combustion. In the electronic industries, brominated flame retardants (BFRs) are used frequently. BFRs are used in 4 main applications in computers, such as components such as electrical cables, plastic covers, connectors, and printed circuit boards. BFRs are also used in many products like domestic kitchen appliances, upholstery, paints, pillows, carpets, plastic covers of television sets, etc.

The oil & gas drilling segment is anticipated to be the fastest-growing during the forecast period. The bromine is used in oil and gas exploration and production industries. It is used in the form of highly saturated solutions known as CBFs (Clear Brine Fluids). Clear brine fluids, including zinc bromide, calcium bromide, and sodium bromide, are used in the oil and gas drilling industries for workover fluids, packers, solid-free completion, and high density, which help the growth of the bromine market. Bromine used in clear brine fluids increases both the productivity and efficiency of oil and gas wells. Gas and oil are hydrocarbons that are stuck in porous stone, and to access these hydrocarbons, a hole must be drilled into the area in which they are held, known as the pay zone.

The salient statistics of the United States: Bromine Mineral Commodity Summaries 2024

Import for consumption, elemental bromine and compounds, and exports of elemental bromine and compounds.

Segments Covered in the Report

By Derivative

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client