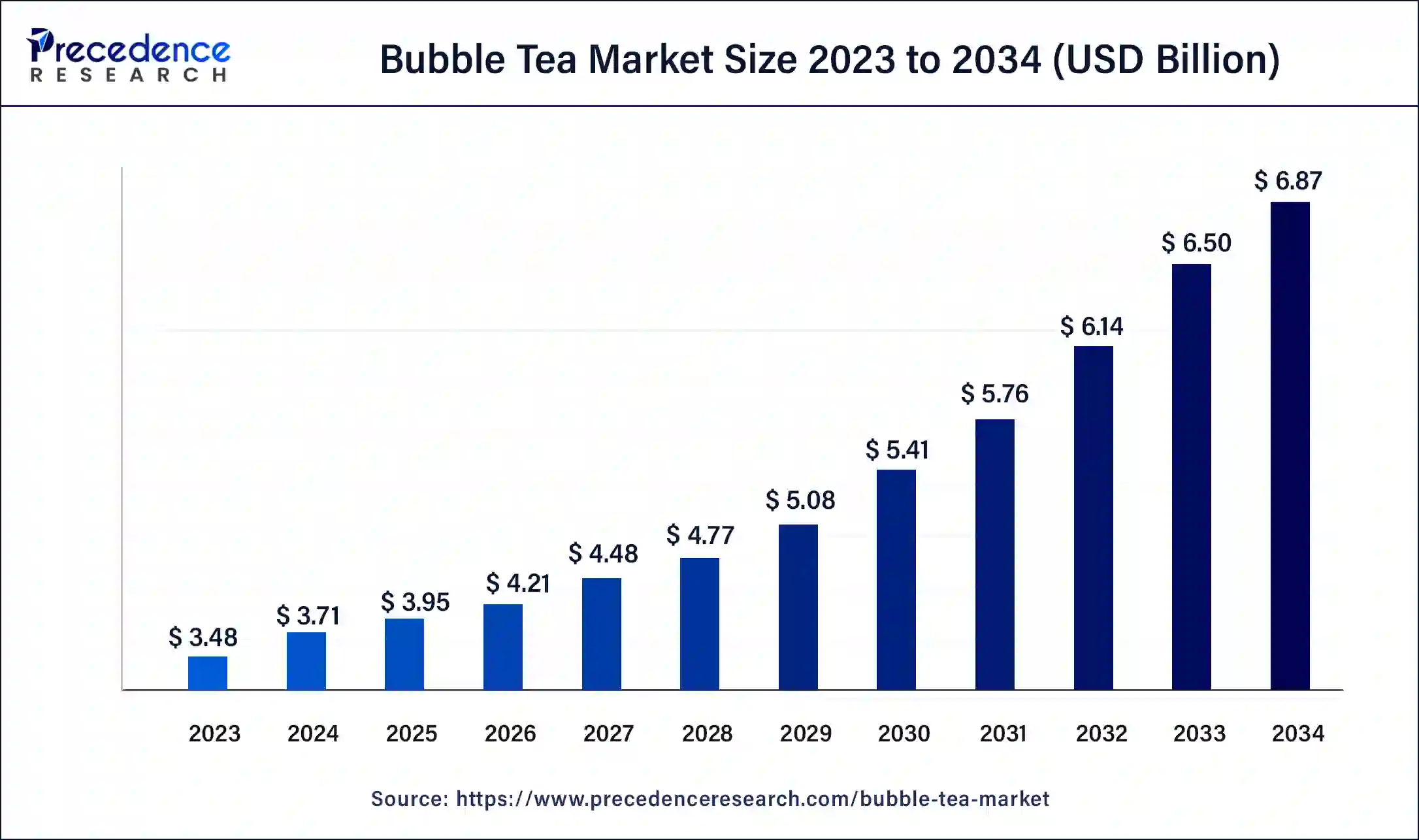

The global bubble tea market size was USD 3.48 billion in 2023, estimated at USD 3.71 billion in 2024 and is anticipated to reach around USD 6.87 billion by 2034, expanding at a CAGR of 6.36% from 2024 to 2034.

The global bubble tea market size accounted for USD 3.71 billion in 2024 and is predicted to reach around USD 6.87 billion by 2034, growing at a CAGR of 6.36% from 2024 to 2034.

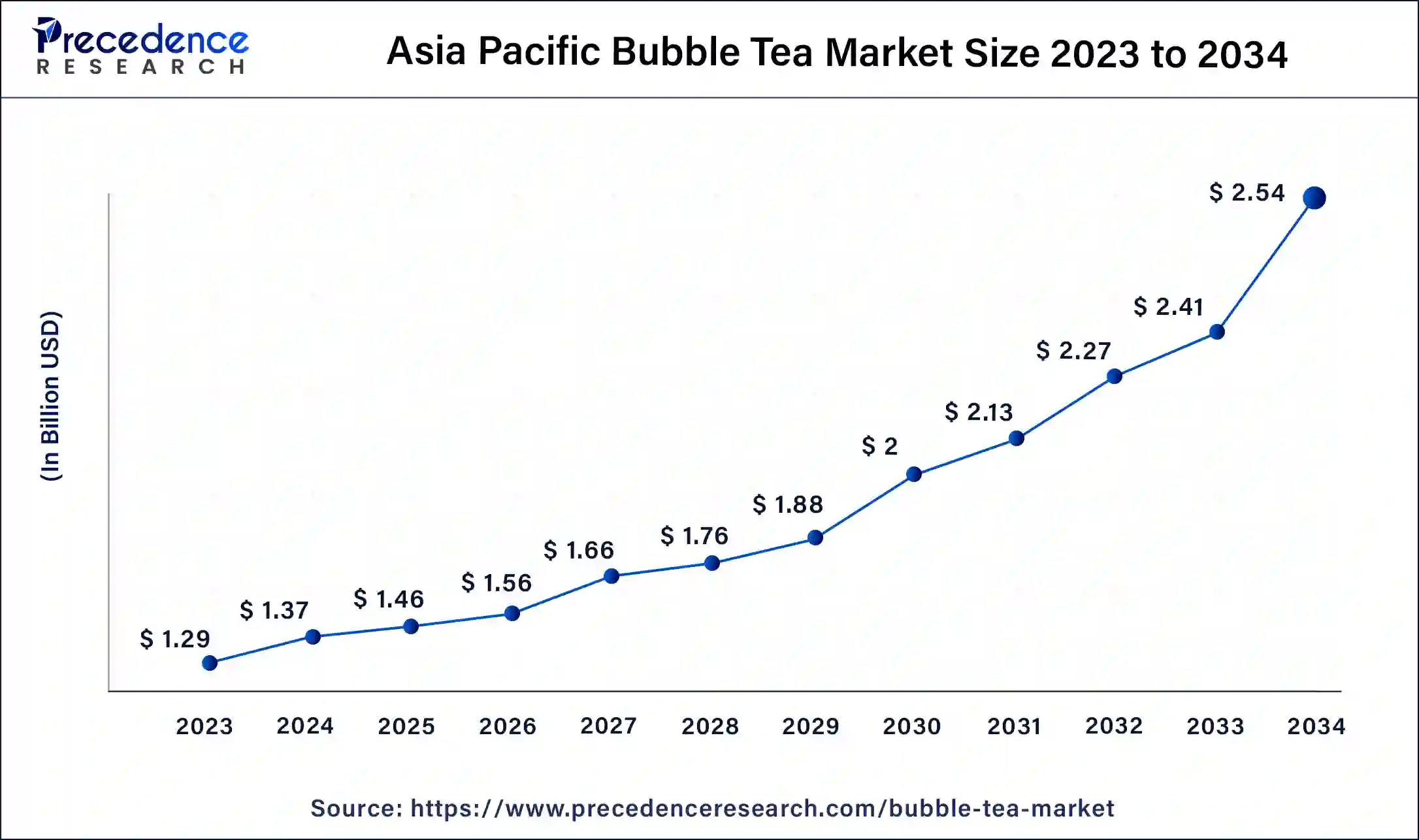

The Asia Pacific bubble tea market size was valued at USD 3.71 billion in 2024 and is expected to be worth around USD 6.87 billion by 2034, at a CAGR of 6.36% from 2024 to 2034.

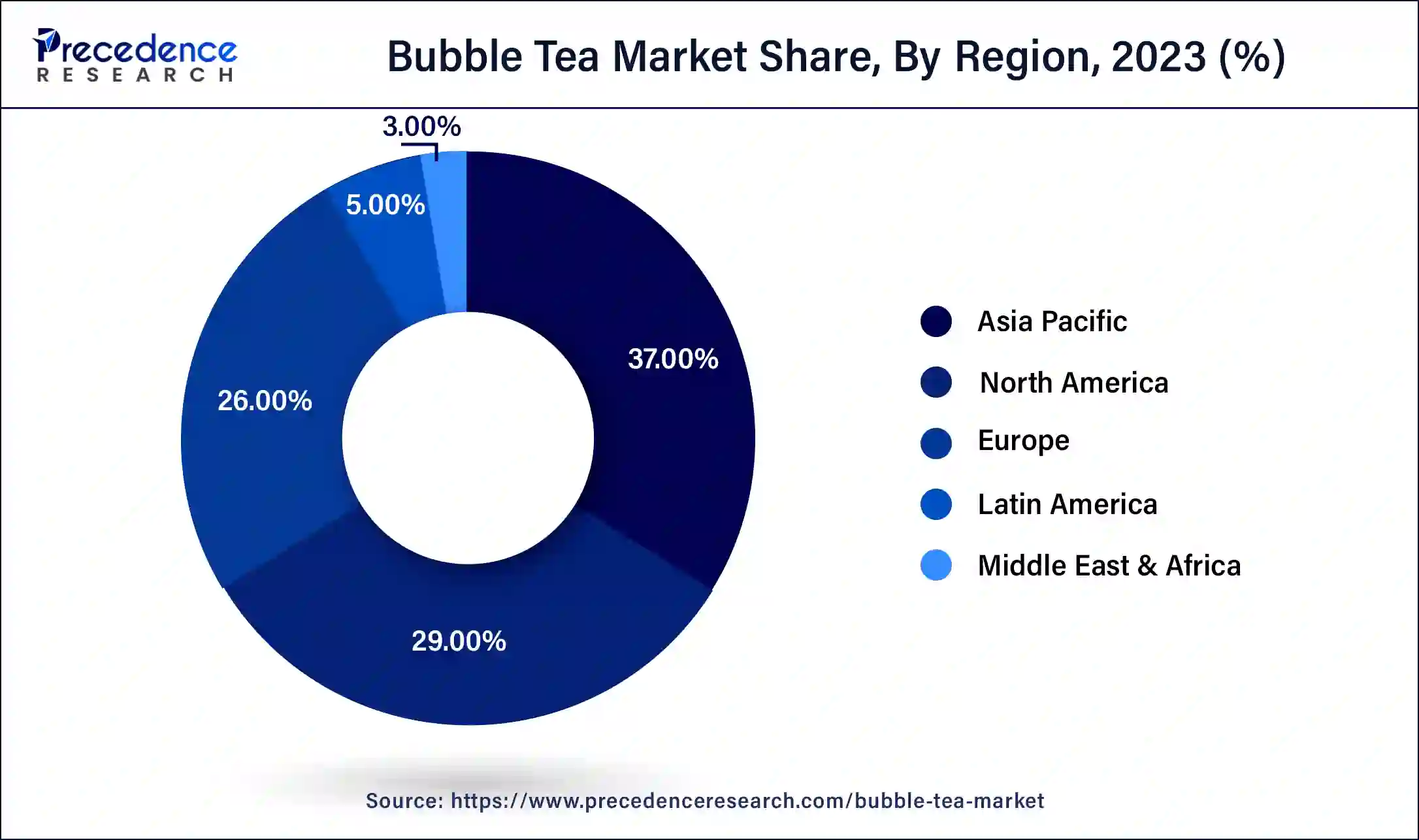

Asia Pacific holds the largest share of over 37% in 2023. Bubble tea originated in Taiwan, and the major consumer base for bubble tea in the country has fueled the market growth in Asia Pacific. Indonesia and Thailand are the largest markets in Southeast Asia for bubble tea. Being the third largest market for bubble tea in Southeast Asia, Vietnam remains an attractive market during the forecast period.

At the same time, the market in Singapore shows a significant increase due to rising spending power in the country. Enough room for small and large-scale players in the region with the availability of low-cost raw materials is another supportive factor for the growth of the bubble tea market in the Asia Pacific.

The presence of major key players in the region has contributed to the growth of the bubble tea market in Asia Pacific. Gong Cha, Chatime, Bubble Tea House Company, Coco Fresh, CuppoTee company and teatime are a few of the significant players headquartered in Asia Pacific.

North America is emerging as the second-largest bubble tea market due to the younger generation's increased consumption of caffeinated beverages. The rapid adoption of new food and beverage products by North America's food and beverage industry has supported the emergence of various Asian-based food and beverages. The growing popularity of Asia-based food and beverages in North America is expected to boost the growth of the bubble tea market during the forecast period.

The comparatively lower tea consumption in Latin America creates an obstacle to the bubble tea market's development. Similarly, the bubble tea market in the Middle East and Africa shows steady growth. However, the changing food consumption trend due to globalization is expected to show a shift in the bubble tea market in Latin America, the Middle East and Africa.

Invented in Taiwan in the late 90s, bubble tea is a cold and frothy drink generally made with cold milk with tapioca pearls known as ‘Boba’. Bubble tea has marked its significance in the food and beverage industry with its unique taste and wide range of flavors. Bubble tea consists of tea, milk, ice, and various flavors.

The presence of tapioca pearls in bubble tea has grown its popularity in recent years, especially among the young generation. Tapioca pearls, the main ingredient of bubble tea, are made of tapioca starch which is derived from cassava. These tapioca pearls are then sweetened with honey and brown sugar to make them soft and chewy. The increased sales of bubble tea are attributed to the proven health benefits of bubble tea. The pairing of sweet and sour tastes with the presence of refreshing tea has developed the popularity of bubble tea across the globe in a brief span.

The global bubble tea market is expected to witness a significant shift during the forecast period owing to the increasing popularity of fancy drinks in urban areas across the globe. Considering the rising health concerns, consumers are turning away from carbonated and alcoholic beverages to drinks made with natural ingredients; this factor is expected to boost the popularity of bubble tea across the globe. Changing preferences of beverage consumption and easy availability of bubble tea across restaurants and coffee shops are fueling the growth of the bubble tea market.

The rapidly growing adoption of cross-continental food and beverages in many countries is another factor boosting the market’s growth. Moreover, the rising adoption of healthy beverages and the availability of a wide range of flavors in bubble tea are promoting the development of the global bubble tea market. However, factors such as the availability of cheap alternatives of beverages in the market and the presence of added sugar in bubble tea are likely to hinder the growth of the bubble tea market.

| Report Coverage | Details |

| Market Size in 2023 | USD 3.48 Billion |

| Market Size in 2024 | USD 3.71 Billion |

| Market Size by 2034 | USD 6.87 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.36% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Component, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Proven health benefits of bubble tea

Variants in bubble tea, such as black and green tea, are ideal for supporting the immune system and reducing inflammation. Green bubble tea is high in flavonoids, boosting heart health by lowering blood cholesterol. Oolong is another prominent base ingredient used in the crafting of bubble tea; oolong contains theanine which can improve cognitive functioning by reducing anxiety.

Although the added excess sugar and preservatives in bubble tea may be harmful to human health, bubble tea is proven healthy when consumed with the right ingredients. While the population is turning down carbonated and alcoholic beverages, these proven health benefits of bubble tea are posed to drive the growth of the global bubble tea market by increasing consumption.

Presence of artificial preservatives and other harmful ingredients in bubble tea

In order to extend the profit opportunities, multiple operators add preservatives to the tapioca pearls or boba. Such preservatives are proven hazardous to human health. Along with this, added sugar, sweeteners and colors to the boba tea are linked to several harmful and adverse effects on human health.

The Foundation of Consumer, Thailand recently tasted 25 different brands of bubble tea, and it was found that some of the brands have added 19 teaspoons of sugar to each serving of bubble tea. Apart from the sugar content, the researchers have found the presence of heavy metals and preservatives along with sorbic and benzoic acids in the beverage.

These harmful ingredients are linked to heart diseases, diabetes and obesity. As the majority of the population is shifting to a healthy lifestyle, the presence of such hazardous ingredients in bubble or boba tea is observed to act as a restraining factor for the market’s growth.

Increasing the crafting of ready-to-drink bubble tea

Traditionally, bubble or boba tea is made by blending all ingredients and adding tapioca pearls with other toppings in it. With the advancements and innovations in the market, consumers deserve to experience a simple and quick bubble tea. Here, crafting ready-to-drink bubble tea can offer lucrative opportunities to the market players. Ready-to-drink bubble tea is easy to consume and provided in bottles, which makes them travel-friendly.

The rising preferences for on-the-way or pick-up beverages demand ready-to-drink bubble tea to enhance convenience for consumers. For instance, in April 2022, a New York-based startup company that focuses on crafting Asian-inspired food and beverages, BubLuv Inc, announced the launch of its highly anticipated BubLuv Bubble Tea.

BubLuv Bubble Tea is the first ready-to-drink with no added sugar or preservatives. The company has stated that the drinks are now available in three exciting flavors at their official online store- Matcha Soy Latte, Passionfruit Oolong Guava and Black Milk Tea.

Covid-19 Impacts:

The sudden outbreak of Coronavirus disrupted the entire global economy by shutting down industries for a prolonged period. Similarly, the pandemic adversely affected the global bubble tea market. Strict regulations during the Covid-19 pandemic forced restaurants, cafes and shops to shut down; this showed massive losses for the bubble tea market due to declining demand. Major regions, including North America and Europe, are dependent on Asian countries such as Taiwan, Vietnam, Singapore, India and China, as the base ingredients required in the preparation of bubble tea are imported from these Asia countries.

The massive spread of the virus in these countries halted export services for an extended period in order to contain the spread of Coronavirus. The disruption in import and export facilities resulted in a lack or shortage of raw materials required to craft bubble tea. The critical period of the Covid-19 pandemic changed consumer behavior which caused declined visits to restaurants/cafes along with reduced consumption of fancy beverages. However, since the governments started easing the lockdown and restrictions, the companies in the bubble tea market started recovering at a pace.

The black tea segment dominates the market generating more than 47% of the revenue share in 2023. Black tea as a base ingredient was authentically used in Taiwan for bubble or boba tea; the rising preferences for authenticity in food and beverages have boosted the growth of the black tea segment. Moreover, black tea contains polyphenols, which act as antioxidants for the body by reducing bad cholesterol. Such proven health benefits have grown the demand for black tea as a base ingredient in the global bubble tea market.

At the same time, the green tea segment is expected to witness significant growth due to growing awareness about the unmatched health benefits of green tea across the globe. Green tea also offers a subtle variant in the flavor of bubble tea by adding a nutty and earthy taste to the beverage.

The flavor segment is expected to witness growth at a CAGR of 8.5% during the forecast period. With its unique appearance, packaging and tapioca pearls in bubble tea, the flavor component has grabbed consumer attention; operators usually prefer adding flavored syrups, powders and purees or fresh fruits in bubble tea to enhance its taste. Fruit flavors added to bubble tea offer the beverage a sweet, sour and exciting taste. With the improvement in the beverage, the market players have started adding advanced flavors the bubble tea, such as a flavored latte or Japanese matcha flavor in the bubble tea.

The sweetener remains an attractive segment in the global bubble tea market during the forecast period. Sweetener is added to the bubble tea in order to enhance its flavor by skipping the actual sugar. Some sweeteners even add viscosity and texture to bubble tea. As consumers are becoming more alert about their calorie intake, adding sweeteners can significantly replace sugar.

Segments Covered in the Report:

By Product

By Component

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client