September 2024

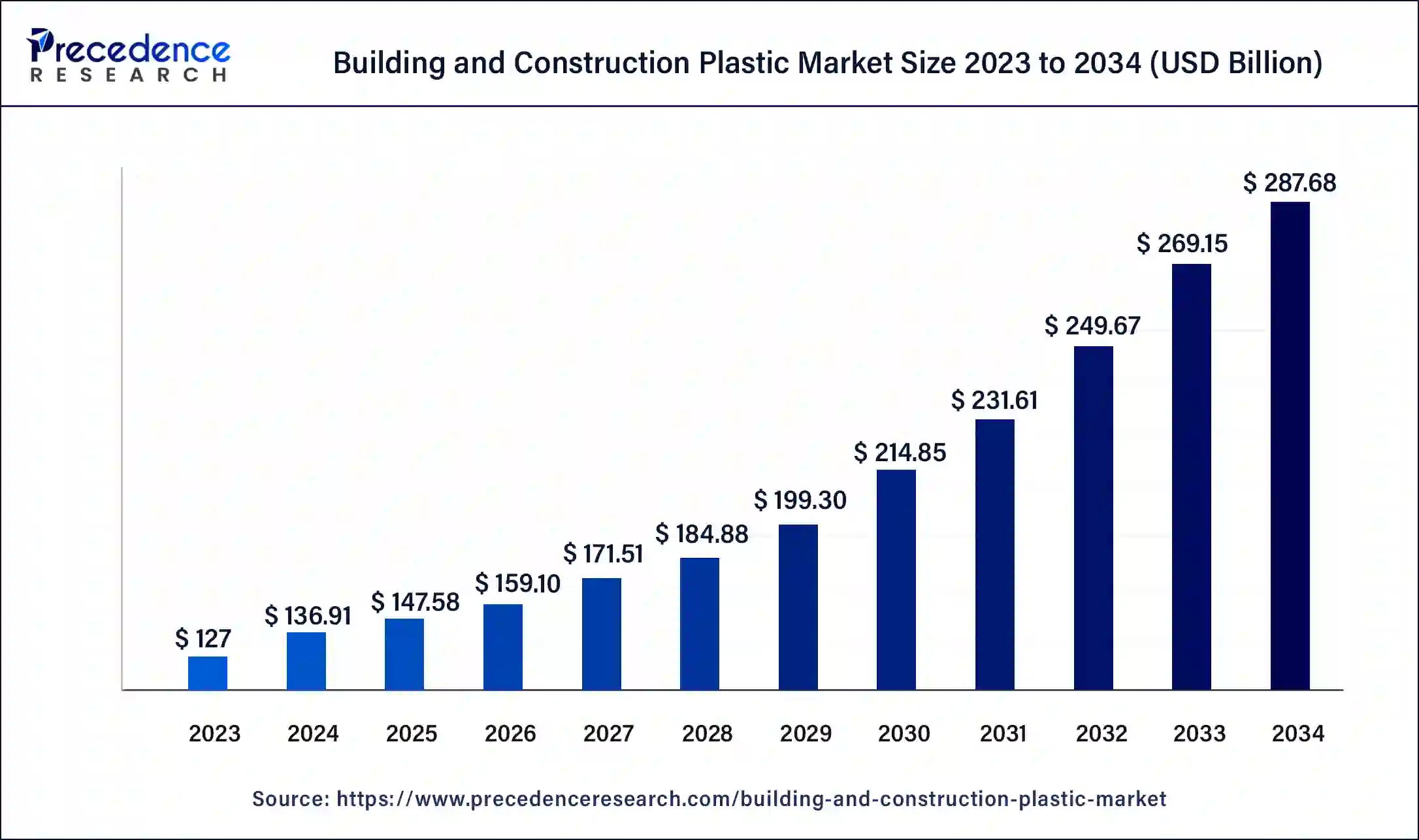

The global building and construction plastic market size was USD 127 billion in 2023, estimated at USD 136.91 billion in 2024 and is anticipated to reach around USD 287.68 billion by 2034, expanding at a CAGR of 7.71% from 2024 to 2034.

The global building and construction plastic market size accounted for USD 136.91 billion in 2024 and is predicted to reach around USD 287.68 billion by 2034, growing at a CAGR of 7.71% from 2024 to 2034.

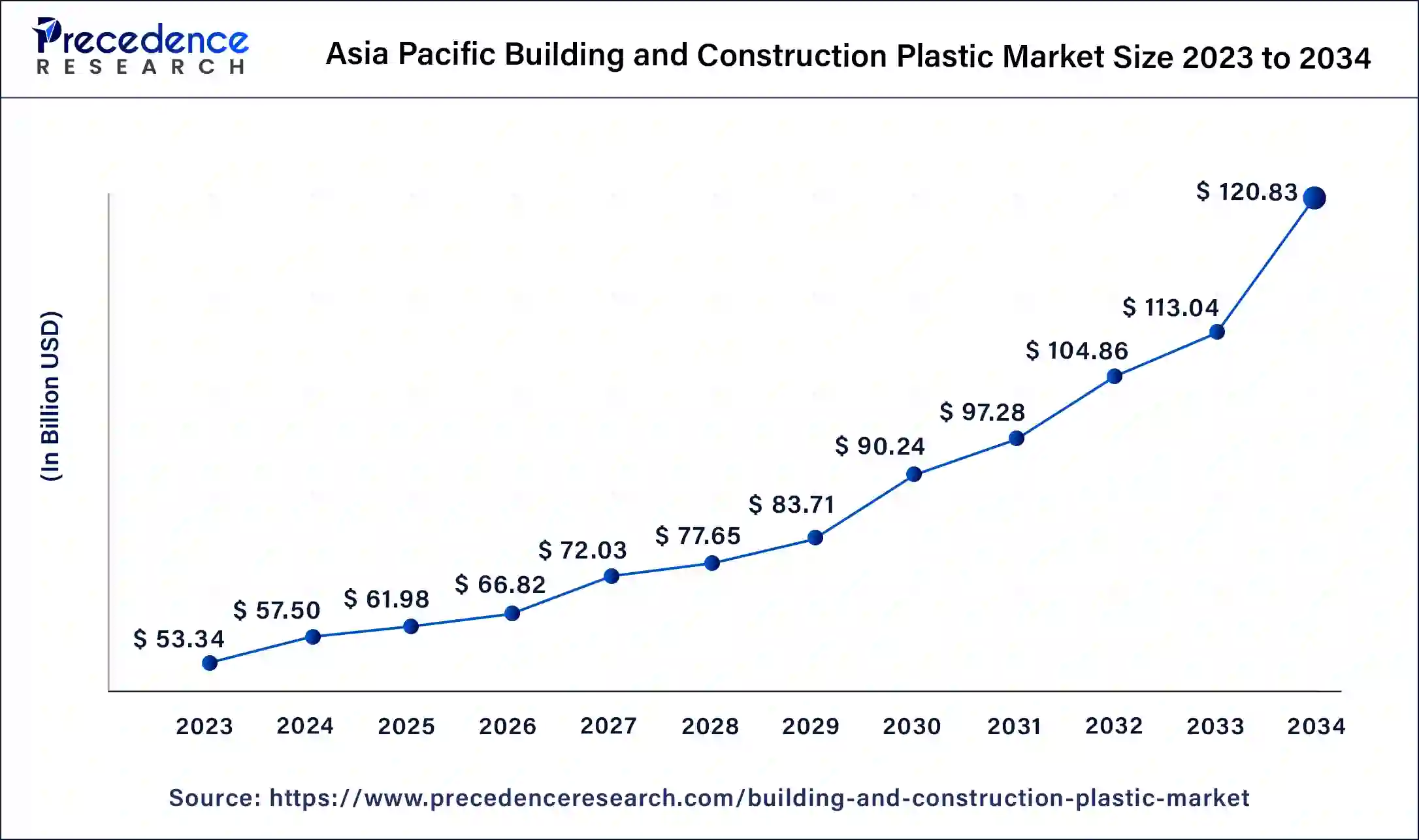

The Asia Pacific building and construction plastic market size was valued at USD 53.34 billion in 2023 and is expected to be worth around USD 120.83 billion by 2034, at a CAGR of 8% from 2024 to 2034.

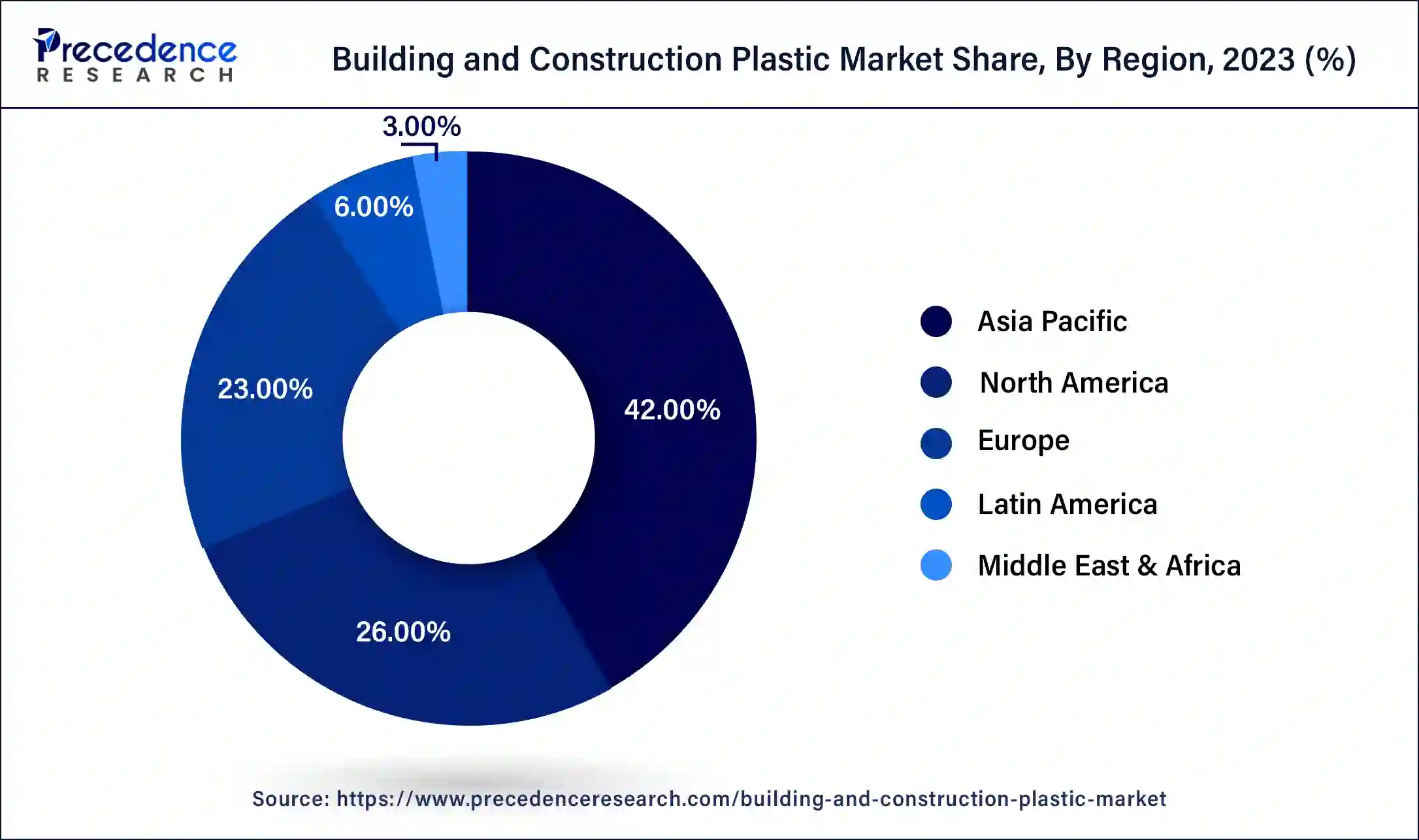

North America dominated the building and construction plastic market and accounted for the largest revenue share in 2023. Growth of this region is mainly operated by rapid expansion of construction sector across the countries such as Canada and the U.S. In addition to this, ongoing trend of renovation of old buildings is projected to encourage market growth in these regions. Moreover, the number of initiatives undertaken by Plastics Industry Association and National Association of Plastic Industries (ANIPAC), the industry trade group support growth and development of plastics along with its end applications. Furthermore, surging demand for commercial building and government investments across the public infrastructure projected to boost the demand for the building and construction plastic in upcoming years.

The other hand, Asia Pacific is projected to witness the fastest growth rate throughout the forecast period. Over the past several years, growing population andrapid urbanization in the countries such as China and India has led to rise in infrastructure spending. Moreover, China is the major producer of polyurethanes and thermoplastics plastic materials. Hence, it accounted for the significant market share in Asia-Pacific building and construction plastic market.

Growth of building and construction plastic market is mainly driven by upsurge in residential and non-residential construction activities along with theincrease in demand for plastics owing to low cost. In addition to this, a lucrative physical properties such as high strength, easy to transport, and light in weight is expected to boost growth in demand for the building and construction plastic. On the other hand, significant growth in population coupled with an increased has led to rising in building construction; thus, significantly boosting growth of the market. Furthermore, a number of government initiatives to enhance building structures is projected to create lucrative growth opportunities for the market in upcoming years.

However, China’s slowing economy along with the prohibition of PVC products in green building may hamper growth of the market. On the contrary, there is rising trend of usage of recycled plastics in construction. This factor is anticipated to be opportunistic for growth of the market during forecast period.

COVID-19 Impact

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. The pandemic had considerably affected the construction industry, including ongoing building projects. For instance, construction projects are being delayed or even construction sites in several countries have shut down. Such disruption has been reflected in financial indexes; for instance, since February 2020, the public engineering, construction, and building materials (ECB) companies witnessed slight dropped in their revenues.

Moreover, due to the global recession, construction firms are faced with supply chain disruption, cancelled projects, and other short-term issues. For instance, approximately 40% of the U.S. construction firms reported layoffs by the end of April. Hence, disruption in construction industry has hampered growth of the global building and construction plastic market during the COVID-19 pandemic.

| Report Coverage | Details |

| Market Size by 2034 | USD 287.68 Billion |

| Market Size in 2023 | USD 127 Billion |

| Market Size in 2024 | USD 136.91 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.71% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application Type, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The polyvinyl chloride (PVC) dominated the market with around 42.3% share n 2023 in terms of revenue of the total market. PVC has properties such aslight in weight and the ability to be molded and assembled in a variety of shapes. This is a versatile thermoplastic material with wide ranging applications in the manufacturing of majority consumer goods. In building and construction sector, it is mainly being use for fabrication of both rigid and flexible products. Its extensive range of applications includes pipes, irrigation, electrical conduits, tubes & fittings for water distribution, sewers, door frames & windows, gutters & downspouts, fencing & decking, roofing, and conveyor belts used for chemical processing, food processing, and wall & floor covering.

However, Polyurethane is anticipated to witness highest growth rate during the forecast period due to its quality to mold into any of the unusual shape.

The pipes & ducts dominated the market with around 37.23% share in 2023, in terms of revenue of the total market. Plastic pipes systems are mainly used within the building as well as on the outer premises applications such as water service, plumbing, fire protection, snow melting, hydronic heating & cooling, and geothermal piping systems. The aforementioned applications primarily drives growth of this segment.

However, insulation segment is anticipated to witness highest growth rate during the forecast period. Rising usage of plastic composites as an insulation among the walls & roofs boosts growth of this segment. The insulation offers benefits such as sound deadening, fire protection, and thermal insulation.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved quality building and construction plastic products. Moreover, they are also focusing on maintaining competitive pricing.

For instance, in December 2019, BASF launched MasterTop XTC, the next generation of high-performance flooring systems, for the construction industry. Formulated with the advanced XolutecTM technology, MasterTop XTC provides an easy-to-clean floor surface with exceptional resistance to impact and abrasion.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2025

November 2024

November 2024