September 2024

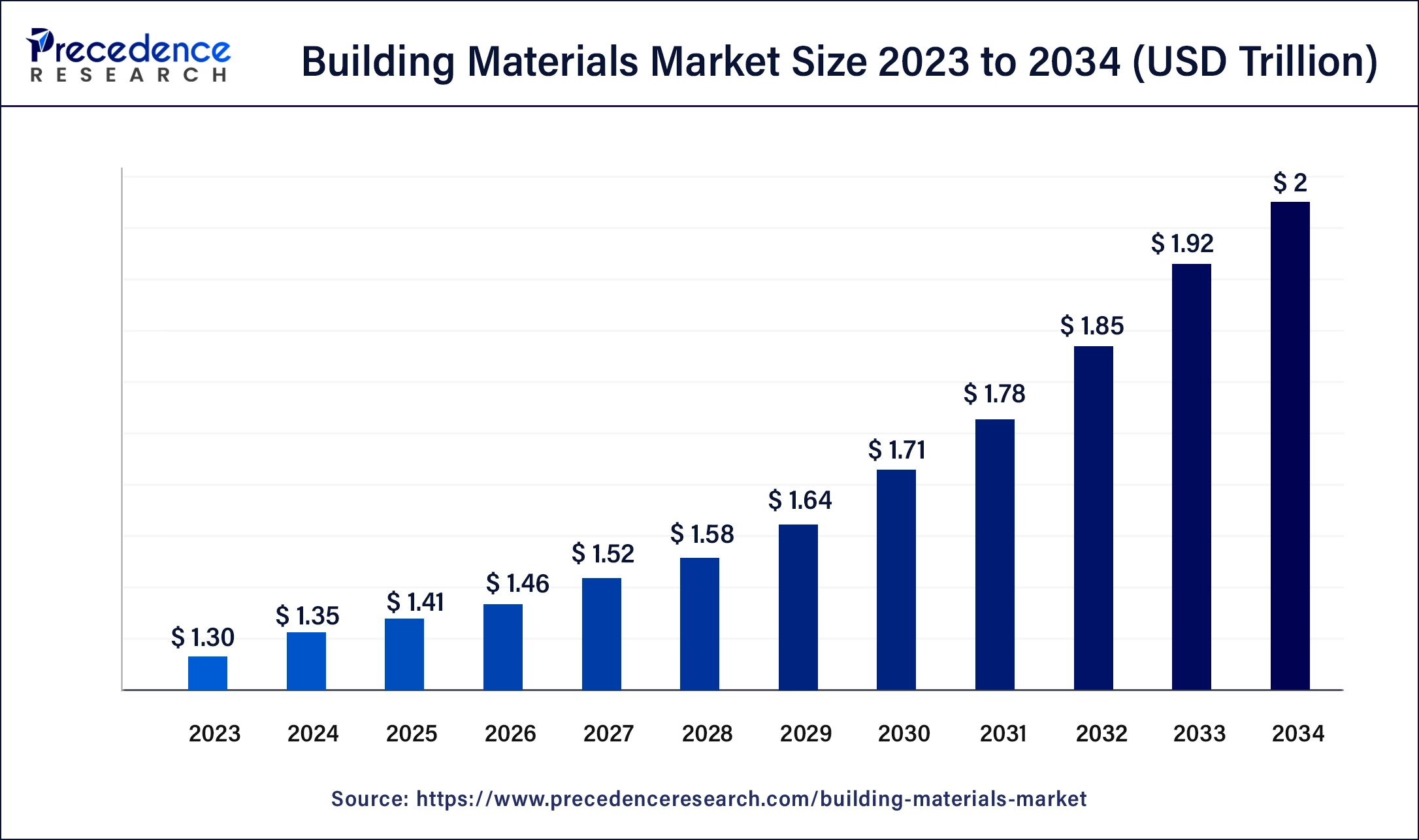

The global building materials market size was USD 1.30 trillion in 2023, calculated at USD 1.35 trillion in 2024 and is projected to surpass around USD 2 trillion by 2034, expanding at a CAGR of 4% from 2024 to 2034.

The global building materials market size accounted for USD 1.35 trillion in 2024 and is expected to be worth around USD 2 trillion by 2034, at a CAGR of 4% from 2024 to 2034.

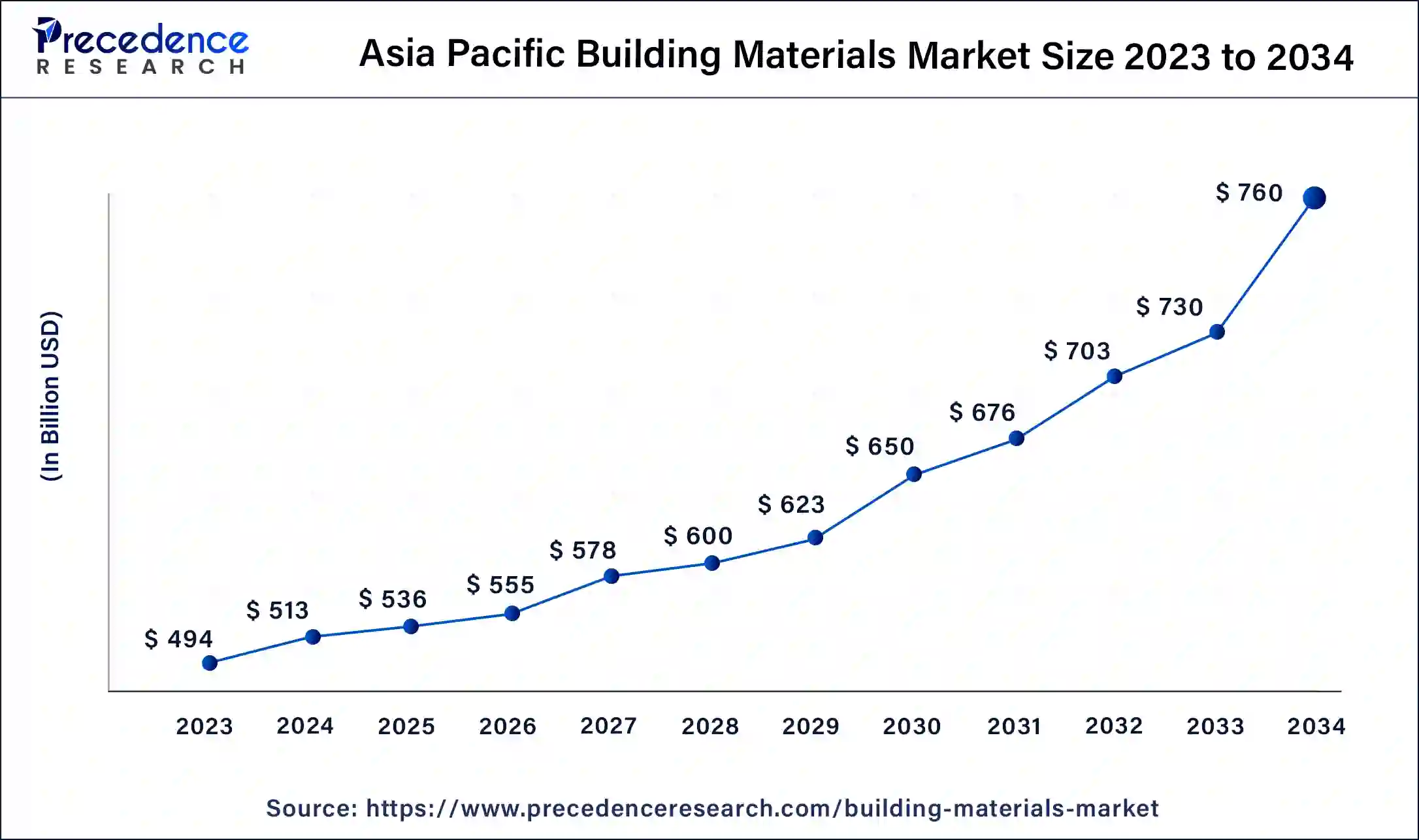

The Asia Pacific building materials market size was estimated at USD 494 billion in 2023 and is predicted to be worth around USD 760 billion by 2034, at a CAGR of 4.2% from 2024 to 2034.

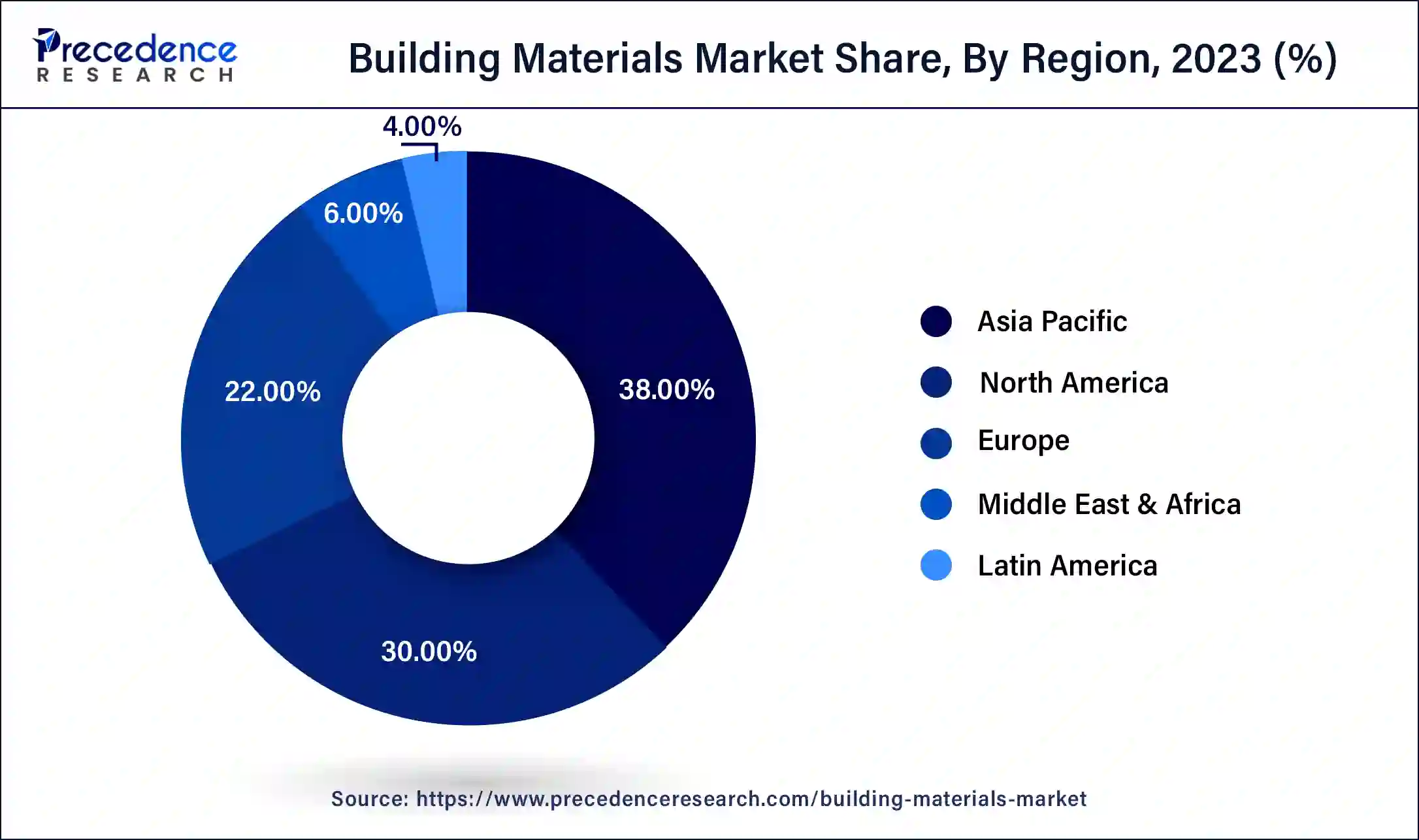

Asia-Pacific holds a major share of 38% in the building materials market due to rapid urbanization, population growth, and robust construction activities in countries like China and India.

The region's expanding middle class and increased disposable income drive the demand for residential and commercial spaces. Additionally, government infrastructure investments contribute to market growth. The construction boom, coupled with a rising focus on sustainable building practices, positions Asia-Pacific as a key player in the building materials industry, attracting substantial investments and fostering market dominance.

North America is projected to witness rapid growth in the building materials market due to increased construction activities, infrastructure development, and a surge in demand for sustainable and energy-efficient materials. The region's commitment to stringent building codes and environmental regulations is driving innovation in eco-friendly solutions. Moreover, a robust economy, urbanization, and the need for modernized infrastructure contribute to the market's upward trajectory. The growing emphasis on technology adoption and digitalization further positions North America as a key player in the evolving landscape of the building materials industry.

Europe is experiencing notable growth in the building materials market due to a surge in construction activities, driven by urbanization, infrastructure development, and sustainable building practices. Stringent environmental regulations and a rising demand for energy-efficient and eco-friendly materials contribute to market expansion. Moreover, a focus on innovative construction technologies and the need for resilient and aesthetically pleasing materials further stimulate growth. The region's commitment to green building initiatives and the adoption of advanced construction methods position Europe as a dynamic and growing market in the building materials sector.

Building materials encompass a diverse array of substances used in construction to create structures ranging from residential homes to towering skyscrapers. These materials can be broadly categorized into natural, synthetic, and composite types. Natural materials, such as wood, stone, and clay, are derived directly from the Earth and have been fundamental to construction for centuries. They are appreciated for their aesthetic appeal and sustainability. Synthetic materials, such as plastics and metals, are man-made and often prized for their durability, versatility, and cost-effectiveness. Lastly, composite materials combine various elements to leverage the strengths of each constituent part, enhancing overall performance.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.30 Trillion |

| Market Size in 2024 | USD 1.35 Trillion |

| Market Size by 2034 | USD 2 Trillion |

| Growth Rate from 2024 to 2034 | CAGR of 4% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Population growth and urbanization dynamics

The increase in population and movement toward urban living significantly boosts the demand for building materials. As more people come to cities and towns, there's a greater need for homes and other structures. This results in more construction projects, driving up the requirement for various building materials. The urbanization process involves developing cities, which includes constructing tall buildings, offices, and homes, leading to a higher demand for diverse building materials that cater to both structural and design needs.

Furthermore, as cities grow, there's a need for additional infrastructure like roads and bridges, further escalating the demand for construction materials. The combination of population growth and urbanization creates a dynamic scenario for the building materials market. This prompts industry players to continually produce and innovate construction materials to meet the evolving needs of a rapidly urbanizing world.

Environmental concerns

Environmental concerns pose significant restraints on the market demand for building materials. As awareness of sustainability and ecological impact grows, there is an increasing emphasis on environmentally friendly construction practices. This shift in consumer preferences and regulatory landscape demands that building materials adhere to strict environmental standards. Manufacturers face the challenge of developing and adopting processes that minimize carbon footprints, reduce waste, and use renewable resources.

Additionally, the need for materials with lower environmental impact extends beyond compliance; it directly influences consumer choices and project specifications. Stricter environmental regulations can lead to higher compliance costs for manufacturers, impacting overall production expenses. The pressure to innovate and create eco-friendly alternatives may require substantial investments in research and development. Consequently, companies in the building materials market must navigate these environmental constraints, striking a balance between regulatory compliance, sustainable practices, and meeting the evolving expectations of environmentally conscious consumers.

Renewable and recycled material adoption

The adoption of renewable and recycled material is creating significant opportunities in the building materials market. As sustainability becomes a focal point in construction practices, the demand for eco-friendly alternatives has surged. Materials such as bamboo, reclaimed wood, and recycled steel offer environmentally responsible choices, catering to a growing market of conscientious consumers and businesses. Additionally, the use of recycled materials not only aligns with environmental goals but also addresses concerns about resource depletion. Companies exploring these alternatives not only contribute to reducing waste but also position themselves favorably in a market where sustainable and recycled building materials are increasingly valued for their positive ecological impact.

The cement segment had the highest market share of 31% in 2023. The cement segment in the building materials market pertains to the production and utilization of cement, a crucial binding agent in construction. This segment encompasses various types of cement, such as Portland, blended, and specialty cements, each serving distinct construction needs. Trends in the cement sector include a growing demand for sustainable and low-carbon alternatives. Innovations like green cement, which reduces carbon emissions during production, align with the industry's environmental concerns. Additionally, the adoption of advanced technologies for efficient cement production reflects an evolving landscape in the building materials market.

The concrete bricks segment is anticipated to expand at a significant CAGR of 4.7% during the projected period. Concrete bricks, a prominent segment in the building materials market, refer to building units made from a mixture of cement, sand, and aggregates. These bricks exhibit superior strength and durability, making them a preferred choice for various construction projects. A notable trend in the concrete bricks segment involves the growing popularity of eco-friendly variants incorporating recycled materials. Manufacturers are increasingly adopting sustainable practices, aligning with the market's emphasis on environmentally responsible construction materials, and meeting the rising demand for greener building solutions.

According to the end-user, the residential segment held a 30% revenue share in 2023. Within the building materials market, the residential segment pertains to materials utilized in the creation and refurbishment of homes. A noteworthy trend in this category involves a heightened inclination toward sustainable and energy-efficient materials, indicating an escalating awareness of environmental concerns within the homeowner community. This change has led to an increased desire for construction materials that align with eco-friendly principles, such as repurposed wood, windows optimized for energy efficiency, and insulation solutions mindful of environmental impact.

The residential sector places significant importance on attributes like longevity, visual appeal, and ecological sensitivity, influencing the selection of state-of-the-art building materials for home construction and renovation initiatives.

The industrial segment is anticipated to expand fastest over the projected period. The industrial segment in the building materials market refers to the usage of materials in various industrial applications, such as manufacturing facilities and warehouses. A trend in this segment involves a growing demand for durable and low-maintenance materials, especially in the construction of industrial structures. Companies are increasingly opting for materials that enhance efficiency, withstand industrial wear and tear, and align with environmental sustainability goals, reflecting a shift towards eco-friendly and resilient building solutions in the industrial sector.

Segments Covered in the Report

By Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2025

November 2024

November 2024