September 2024

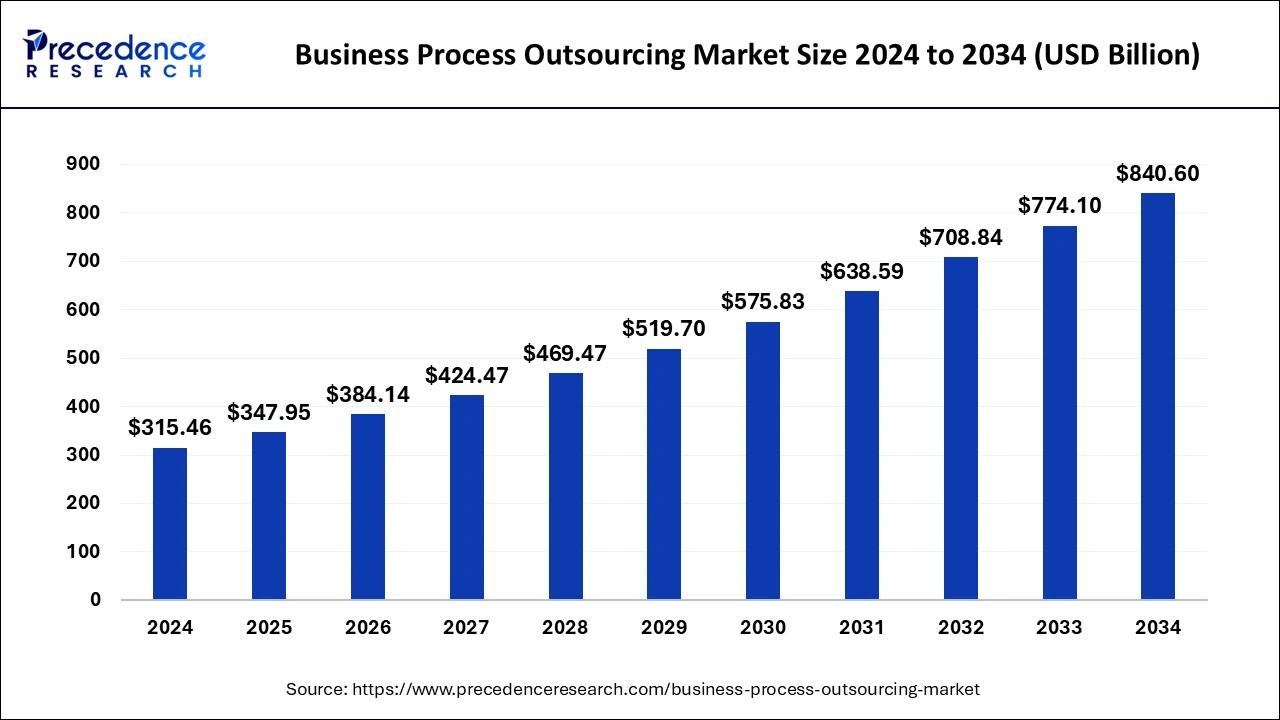

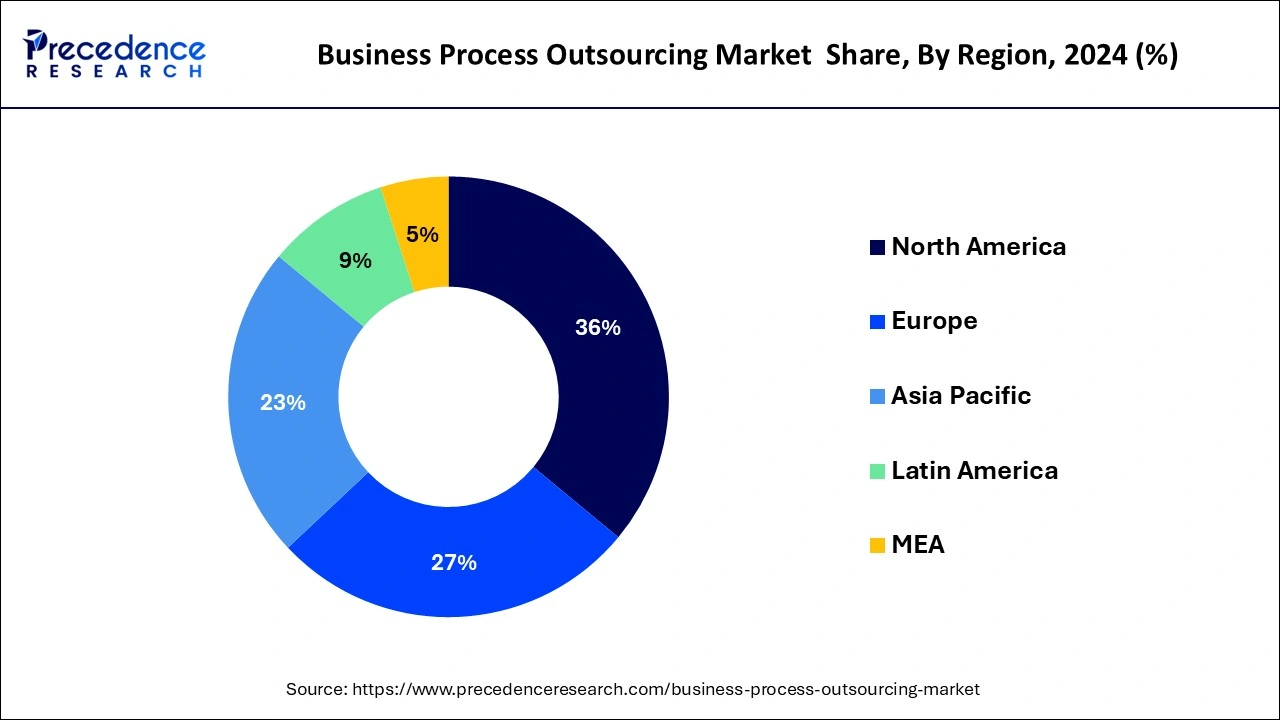

The global business process outsourcing market size is accounted at USD 347.95 billion in 2025 and is forecasted to hit around USD 840.60 billion by 2034, representing a CAGR of 10.30% from 2025 to 2034. The North America market size was estimated at USD 113.57 billion in 2024 and is expanding at a CAGR of 10.31% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global business process outsourcing market size was calculated at USD 315.46 billion in 2024 and is predicted to reach around USD 840.60 billion by 2034, expanding at a CAGR of 10.30% from 2025 to 2034. The growing acceptance of BPO services in telecommunication and IT services is raising the demand for the market.

With features such as optimization and automation, artificial intelligence enhances several business operations, resulting in improved efficiency, enhanced customer experience, and decreased charges. It has tools like robotic process automation that help with repetitive tasks and automate routines such as customer queries, data entry, and invoice processing. It decreases the possibility of human error, which helps accelerate the process. By introducing virtual assistants and chatbots to this market, AI can provide support at any time to resolve customers’ inquiries.

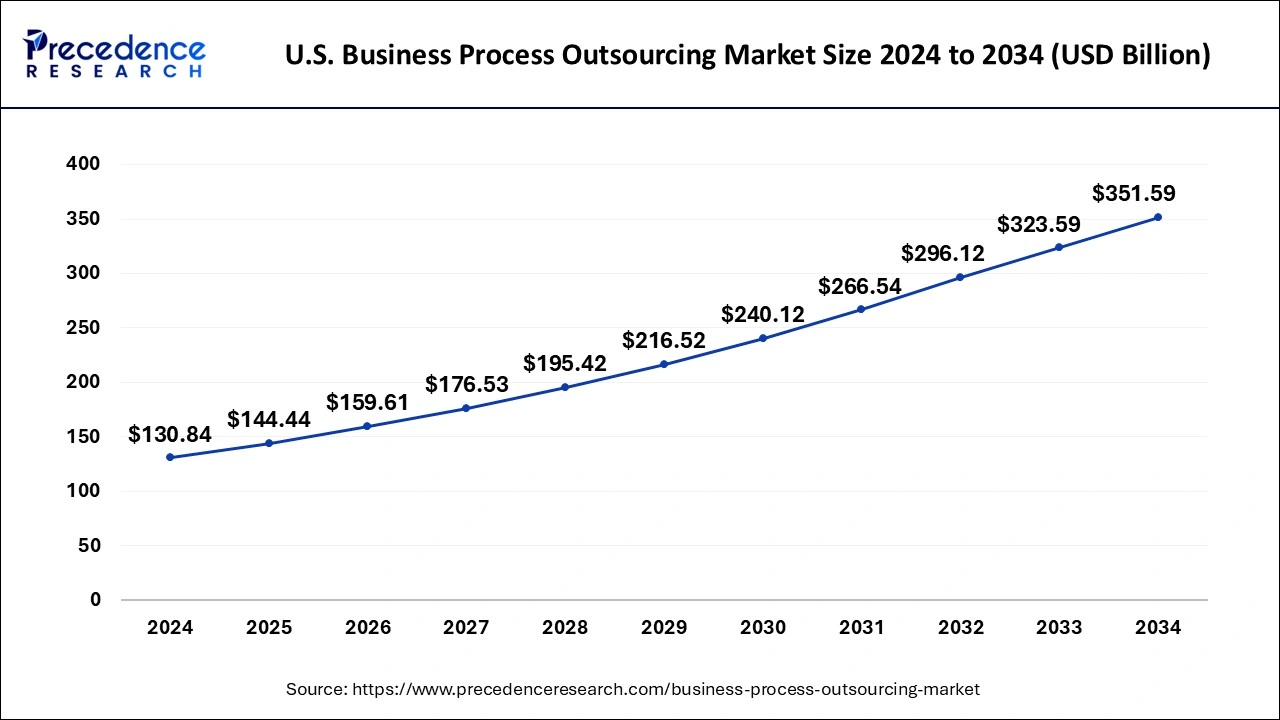

The U.S. business process outsourcing market was exhibited at USD 130.84 billion in 2024 and is projected to be worth around USD 351.59 billion by 2034, growing at a CAGR of 10.39% from 2025 to 2034.

North America region accounted market share of 36% in 2024. The increased adoption of cloud enablement and digital services, which necessitate frequent assistance and maintenance for corporate operations, was related to the increase in growth.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. The government entities are likely to make major expenditures in infrastructure development, which will assist to improve the region’s existing business process outsourcing ecosystems.

| Report Coverage | Details |

| Market Size in 2025 | USD 347.95 Billion |

| Market Size in 2034 | USD 840.60 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.30% |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End Use, Outsourcing Type, Deployment Model, Organization Size, Ownership, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The cost control is one of the main advantages of business process outsourcing. In most cases, third party business process outsourcing services are less expensive than hiring individuals to perform it in-house. There are also a variety of cost-cutting opportunities in terms of international tax methods and the cost of establishing services in a particular country. Another advantage is that in-house staff may concentrate on core operations rather than having to handle all human resources and payroll work, or whatever else is outsourced.

The security of business process outsourcing is a major problem for the growth of the business process outsourcing market. Many businesses process outsourcing arrangements need the organization handing over essential or sensitive data to the supplier to a great extent. As the supplier has access to a portion of their data supply chain, they must trust the vendor to a degree. The compliance with national or industry standards is also an issue that comes up from time to time.

Another issue with the business process outsourcing is the amount of control clients must hand over the third-party providers. The cost barriers, where third party service businesses abruptly boost the cost of services owing to some benchmark, are a source of concern.

When businesses refer to business process outsourcing firms, they frequently speak to the kind of business functions and tasks that will be outsourced. The business process outsourcing services are classified into two categories based on the demands of the firm. Those two categories are back-office outsourcing and front office outsourcing.

The back-office outsourcing is a type of outsourcing that focuses on in-house business functions such as data collection, internet research, data entry, order processing, data analysis, quality assurance, payment processing, billing, and information technology services. The front office business process outsourcing refers to the outsourcing of customer facing tasks like sales, marketing, customer service, technical support, and grievance redressal.

In 2024, the customer services segment accounted revenue share of 33%. The growing number of service centers throughout the world that requires both online and offline technical help is responsible for the customer services segment’s strong market share.

The human resource services segment, on the other hand, is predicted to develop at the quickest rate in the future years. The increasing demand for resources across several sub-segments such as recruiting and relocation, payment processing, and administration is projected to help the segment grow.

The IT and telecommunications segment accounted revenue share of 36% in 2024. The rise in the number of IT companies and the rising industrialization are both contributing to the segment’s growth. Several telecommunications procedures are being outsourced by telecom firms around the globe in order to lower their overall expenses. Various business tasks are outsourced by telecom enterprises.

The BFSI segment is fastest growing segment of the business process outsourcing market in 2022. The business process outsourcing has long been a reliable tool for improving the cost efficiency of financial institutions’ operations, the quality of their services, and the flexibility of their business processes.

By Service Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

November 2024

May 2025