July 2024

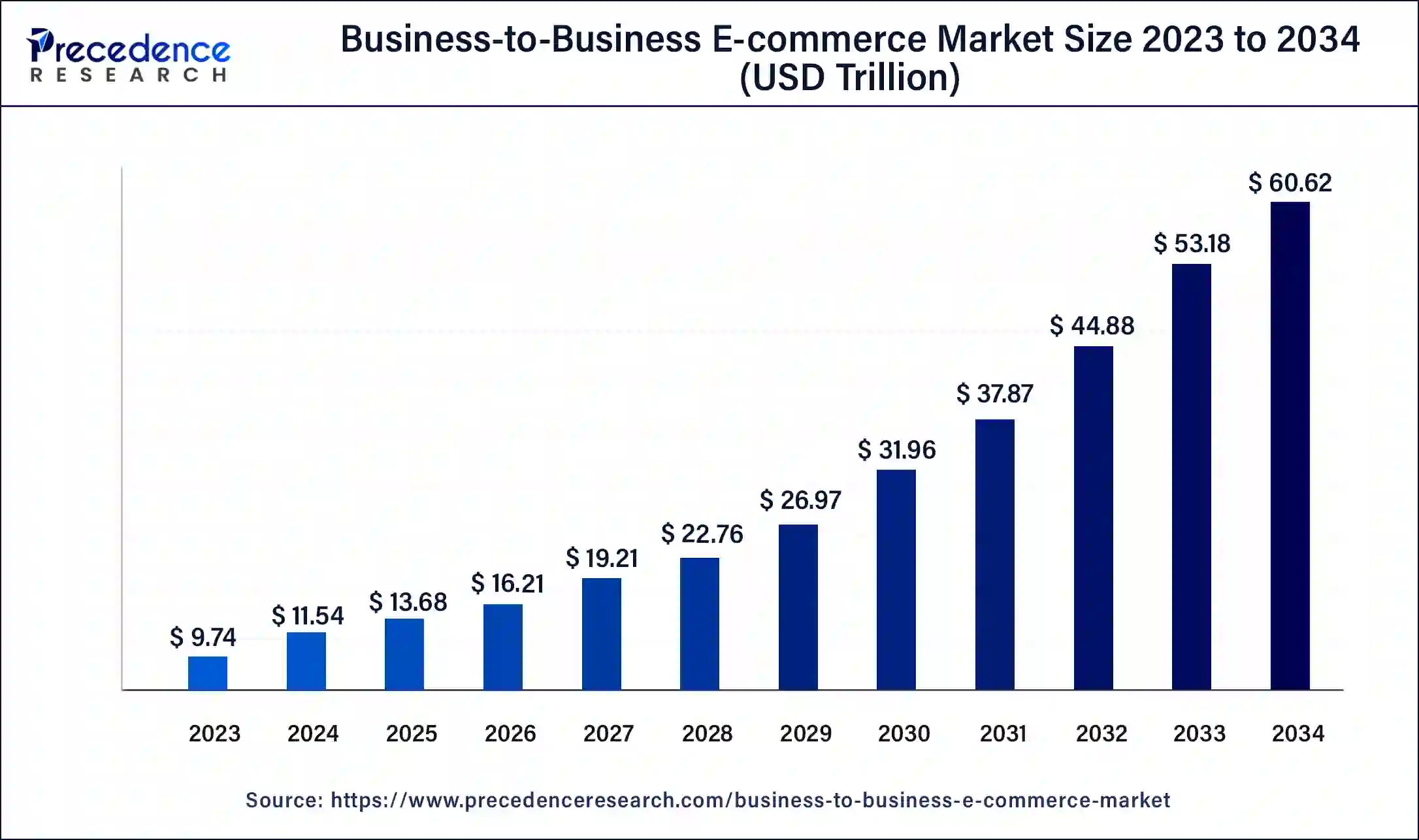

The global business-to-business e-commerce market size was USD 9.74 trillion in 2023, estimated at USD 11.54 trillion in 2024 and is anticipated to reach around USD 60.62 trillion by 2034, expanding at a CAGR of 18.04% from 2024 to 2034.

The global business-to-business e-commerce market size accounted for USD 11.54 trillion in 2024 and is predicted to reach around USD 60.62 trillion by 2034, growing at a CAGR of 18.04% from 2024 to 2034.

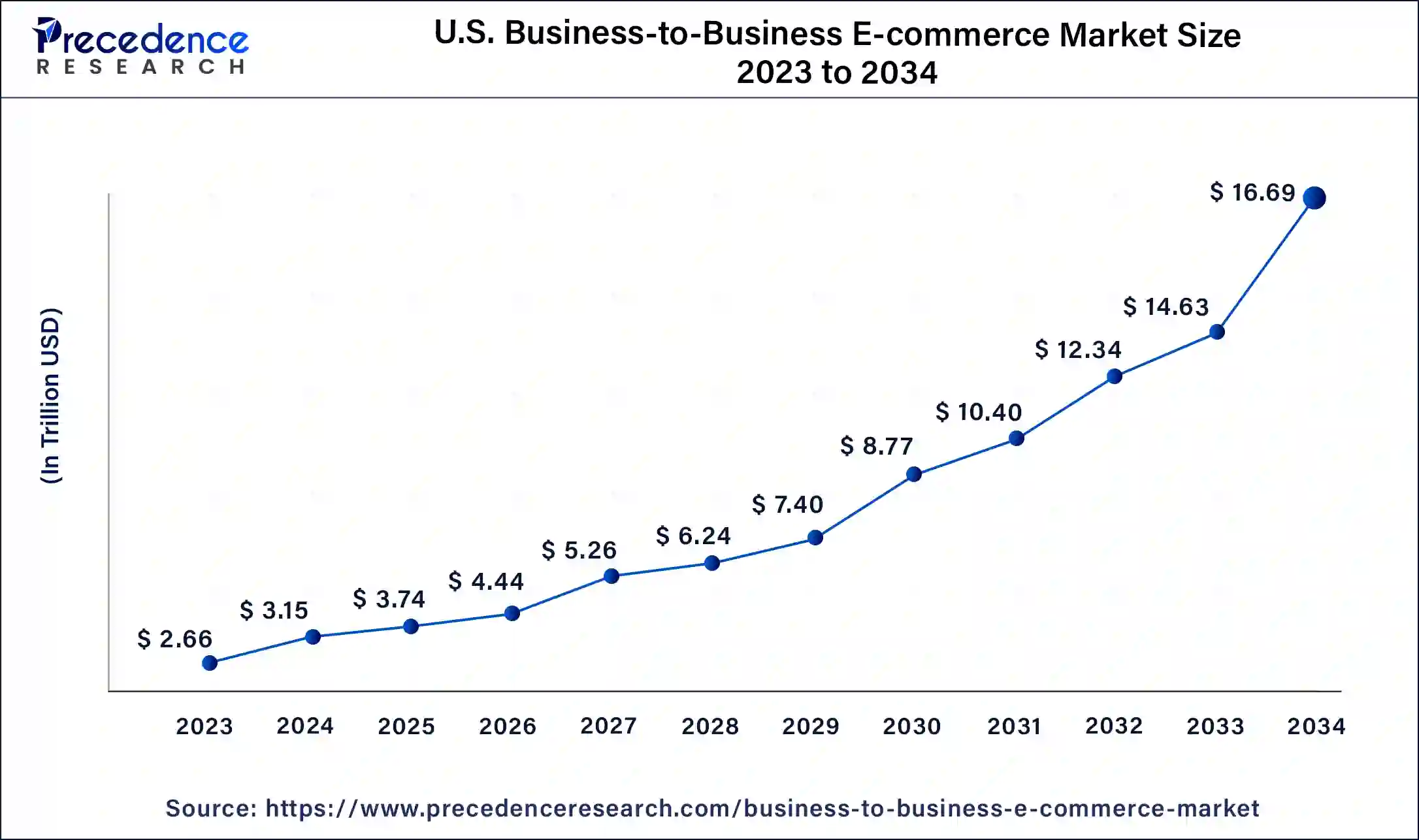

The U.S. business-to-business e-commerce market size was valued at USD 2.66 trillion in 2023 and is expected to reach USD 16.69 trillion by 2034, growing at a CAGR of 18.13% from 2024 to 2034.

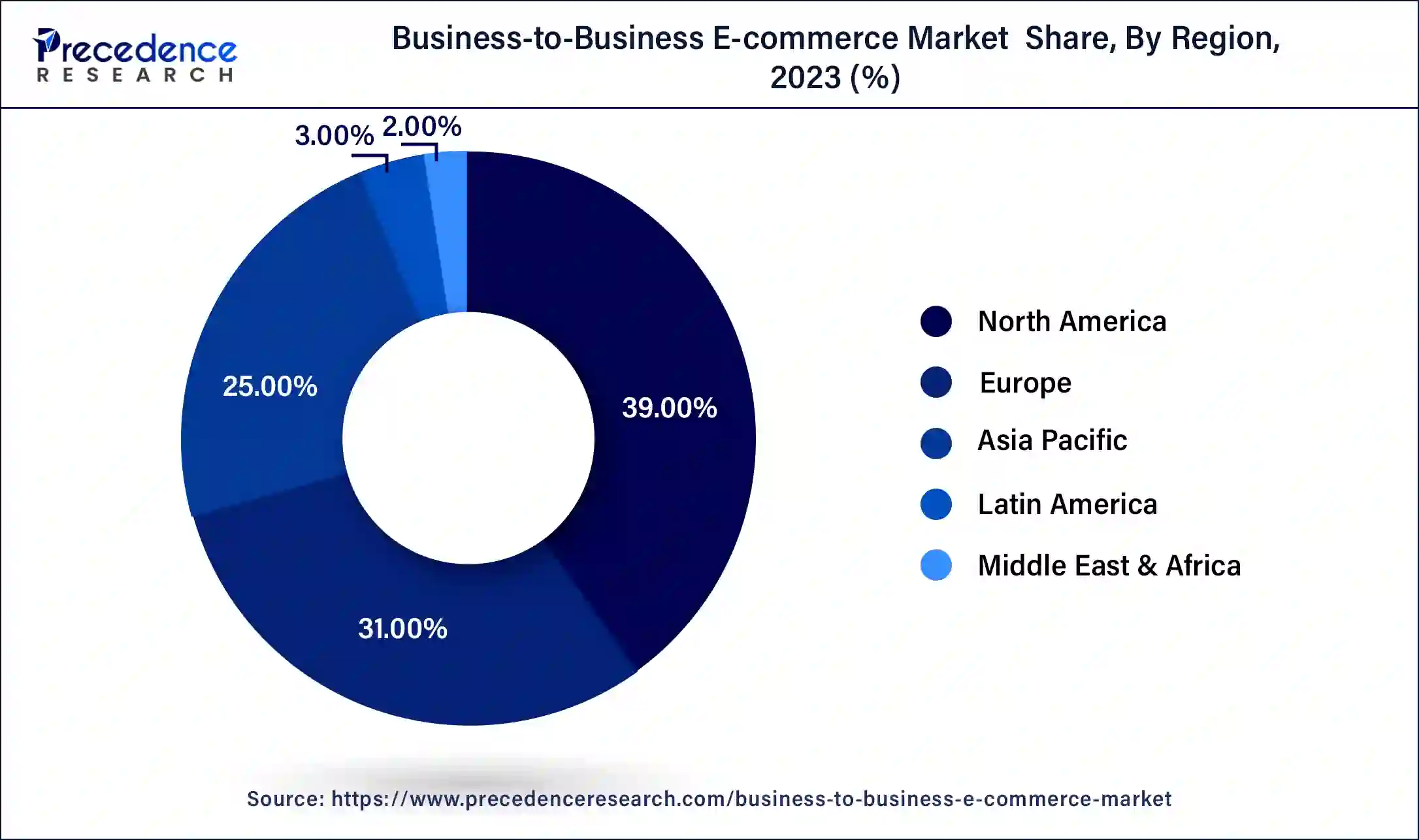

North America has held the largest revenue share of 39% in 2023. In North America, the B2B e-commerce market is characterized by a robust adoption of digital technologies. The region exhibits a mature and sophisticated B2B e-commerce landscape, driven by established businesses embracing online platforms for procurement. Key trends include a focus on AI and machine learning integration, ensuring operational efficiency, and a surge in cross-industry collaboration through B2B marketplaces. The presence of major tech hubs fosters continuous innovation, making North America a dynamic hub for B2B E-commerce evolution.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific business-to-business e-commerce market is experiencing exponential growth, fueled by the region's burgeoning digital economy. Rapid industrialization, coupled with a large and diverse business landscape, propels the adoption of B2B E-commerce platforms. Key trends include an emphasis on mobile-first solutions, catering to the region's mobile-savvy businesses. Cross-border trade expansion is notable, driven by the growing connectivity among Asia-Pacific countries. The influence of emerging markets and the proactive adoption of advanced technologies position Asia-Pacific as a vital player shaping the future of B2B E-commerce.

In Europe, the business-to-business e-commerce market showcases a harmonious blend of traditional business practices and digital innovation. The region witnesses a steady transition towards online procurement, with a focus on enhancing user experiences and ensuring compliance with evolving regulations. Key trends include a growing emphasis on sustainability in B2B transactions, coupled with the integration of advanced technologies like AI. Europe's diverse and interconnected business landscape continues to drive the evolution of B2B E-commerce towards more efficient and sustainable practices.

The business-to-business e-commerce market involves online buying and selling goods and services between businesses. This digital platform streamlines transactions, procurement processes, and company collaboration, enabling efficient and transparent trade. B2B E-commerce platforms cater to various industries, facilitating bulk purchases, negotiation, and order fulfillment. The increasing adoption of digital technologies drives the market's growth, the need for cost-effective and streamlined procurement processes, and the demand for enhanced connectivity and collaboration within the global business ecosystem.

The business-to-business e-commerce market is characterized by platforms offering features like electronic data interchange (EDI), online catalogs, and payment solutions. The integration of advanced technologies, such as artificial intelligence and blockchain, further enhances transaction security and efficiency. The market's evolution responds to the escalating demand for digitization, scalability, and improved supply chain management in the business-to-business landscape.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 18.04% |

| Market Size in 2023 | USD 9.74 Trillion |

| Market Size in 2024 | USD 11.54 Trillion |

| Market Size by 2034 | USD 60.62 Trillion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 20324 |

| Segments Covered | Deployment, Enterprise Size, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital transformation demand and evolving customer expectations

The surge in the business-to-business e-commerce market is propelled by the dual forces of digital transformation demand and evolving customer expectations. As businesses increasingly recognize the imperative of digital transformation, B2B e-commerce emerges as a cornerstone for modernizing procurement processes and fostering operational efficiency. Companies seek digital solutions to streamline transactions, enhance collaboration, and gain real-time insights into their supply chains.

Simultaneously, evolving customer expectations play a pivotal role in driving demand. Businesses are witnessing a shift in B2B buyer behavior influenced by the seamless experiences provided by B2C e-commerce. Buyers now expect personalized, user-friendly interfaces, efficient order processing, and transparent communication. B2B e-commerce platforms that cater to these evolving expectations not only meet the demands of modern business practices but also position themselves as leaders in driving market demand amidst a transformative digital landscape.

Security concerns and dependence on traditional relationships

The business-to-business e-commerce market faces restraints in the form of security concerns and lingering dependence on traditional relationships. Security remains a critical issue as businesses transition to digital platforms. Concerns about data breaches, cyber threats, and the protection of sensitive business information hinder the widespread adoption of B2B e-commerce. The reluctance to trust digital platforms with crucial data acts as a barrier, particularly for industries that prioritize confidentiality and data security.

Additionally, the B2B sector has historically relied on traditional relationships built on personal connections and established networks. The reluctance to shift away from these familiar and trusted methods poses a challenge for the rapid adoption of B2B e-commerce. Businesses may be hesitant to fully embrace digital platforms due to a preference for face-to-face interactions and established business relationships, slowing down the pace of transition and impacting the overall market demand for B2B e-commerce solutions.

Integration of AI & machine learning, blockchain for transparency and security

Integration of AI and machine learning in business-to-business e-commerce significantly enhances market demand by revolutionizing operational efficiency and decision-making processes. Machine learning algorithms offer personalized recommendations, improving user experiences and increasing engagement on B2B platforms. This intelligent automation fosters seamless transactions, reducing errors and enhancing overall productivity.

Blockchain integration further propels market demand by addressing critical concerns of transparency and security. Blockchain ensures the immutability of transaction records, creating a transparent and auditable ledger. This technology enhances trust among B2B stakeholders, as it eliminates the risk of fraud and provides a secure environment for sensitive data. As businesses prioritize secure and transparent transactions, the incorporation of blockchain in B2B E-commerce becomes a vital driver, fostering a heightened demand for platforms that prioritize cutting-edge technologies to meet the evolving needs of the business landscape.

According to the deployment, the Intermediary-oriented segment held a 42% revenue share in 2023. Intermediary-oriented B2B E-commerce involves platforms that act as intermediaries or middlemen, connecting multiple buyers and suppliers. These platforms facilitate transactions, negotiations, and collaboration among businesses. The trend in intermediary-oriented deployment includes the rise of B2B marketplaces that bring together a diverse range of suppliers and buyers on a centralized platform, fostering increased visibility, competition, and streamlined transactions.

The supplier-oriented segment is anticipated to expand at a significant CAGR of 20.1% during the projected period. Supplier-oriented B2B e-commerce platforms prioritize the needs and offerings of individual suppliers. These platforms empower suppliers to showcase their products or services directly to potential buyers, often allowing for customized storefronts. The trend in supplier-oriented deployment centers around enhancing supplier visibility, providing tools for effective product showcasing, and offering features that enable suppliers to manage their B2B relationships more efficiently.

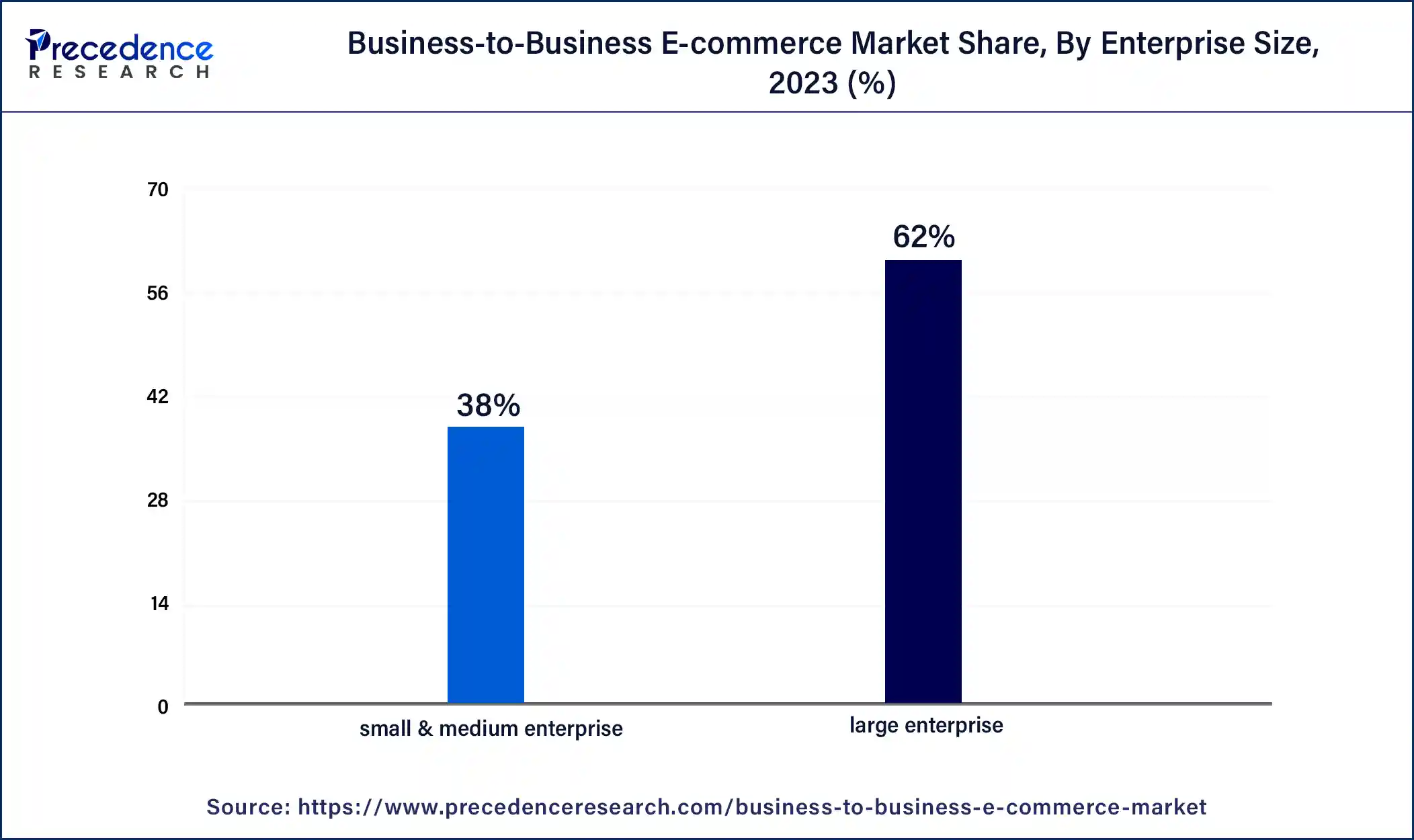

Based on the enterprise size, the large enterprise segment held the largest market share of 62% in 2023. Large Enterprises in the business-to-business e-commerce market exhibit a robust integration of sophisticated platforms to manage extensive procurement operations. Trends among large enterprises include the deployment of comprehensive ERP integrations, blockchain for enhanced transparency, and AI-driven analytics for strategic decision-making. These enterprises focus on creating seamless, end-to-end digital ecosystems to optimize complex supply chain networks, ensuring efficiency, scalability, and compliance with evolving industry standards.

On the other hand, the small & medium enterprise segment is projected to grow at the fastest rate over the projected period. Small and Medium Enterprises in the business-to-business e-commerce market represent a growing segment leveraging digital platforms for streamlined transactions. SMEs benefit from cost-effective procurement, access to a wider supplier network, and simplified order fulfillment. Trends indicate increased adoption of cloud-based B2B solutions, personalized user experiences, and AI-driven tools tailored to the specific needs and scale of SMEs, fostering their competitiveness in the digital marketplace.

In 2023, the home & kitchen segment had the highest market share of 29% on the basis of the end user. In the business-to-business e-commerce market, home & kitchen applications witness a surge in demand. Businesses within this sector leverage online platforms for bulk procurement of kitchenware, appliances, and home essentials. The trend leans towards personalized and sustainable products, and B2B platforms cater to these preferences, offering a diverse range of items. The convenience of digital transactions and the ability to connect with a myriad of suppliers contribute to the flourishing trend of home & kitchen B2B e-commerce.

The consumer electronics segment is anticipated to expand at the fastest rate over the projected period. B2B e-commerce in consumer electronics experiences dynamic growth with businesses seeking efficient ways to source electronic components and devices. The trend emphasizes cutting-edge technologies, such as AI-powered devices and sustainable electronics. B2B platforms become hubs for businesses to explore the latest innovations, negotiate deals, and ensure a streamlined supply chain for consumer electronics. The adoption of these trends reflects the industry's commitment to staying ahead in a rapidly evolving tech landscape through B2B e-commerce solutions.

Segments Covered in the Report

By Deployment

By Enterprise Size

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

January 2025

December 2024

September 2024