December 2024

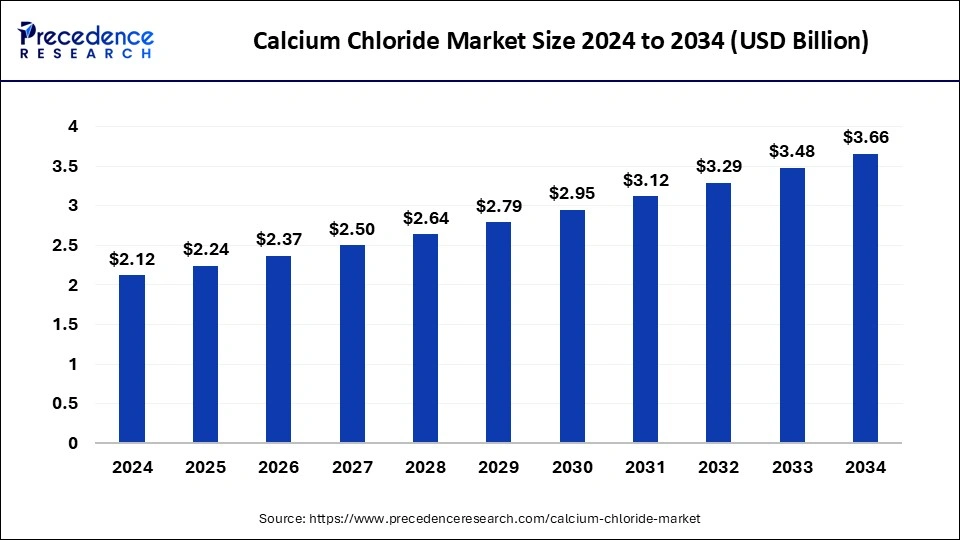

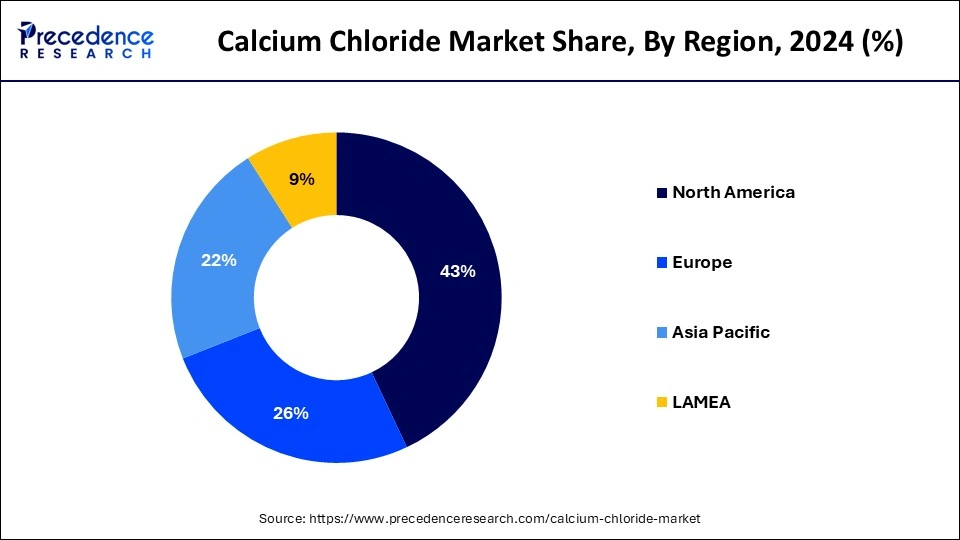

The global calcium chloride market size is accounted at USD 2.24 billion in 2025 and is forecasted to hit around USD 3.66 billion by 2034, representing a CAGR of 5.61% from 2025 to 2034. The North America market size was estimated at USD 910 million in 2024 and is expanding at a CAGR of 5.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global calcium chloride market size was calculated at USD 2.12 billion in 2024 and is predicted to increase from USD 2.24 billion in 2025 to approximately USD 3.66 billion by 2034, expanding at a CAGR of 5.61% from 2025 to 2034. The calcium chloride market is expanding thanks to improvements in manufacturing procedures and the creation of more economical and efficient calcium chloride products.

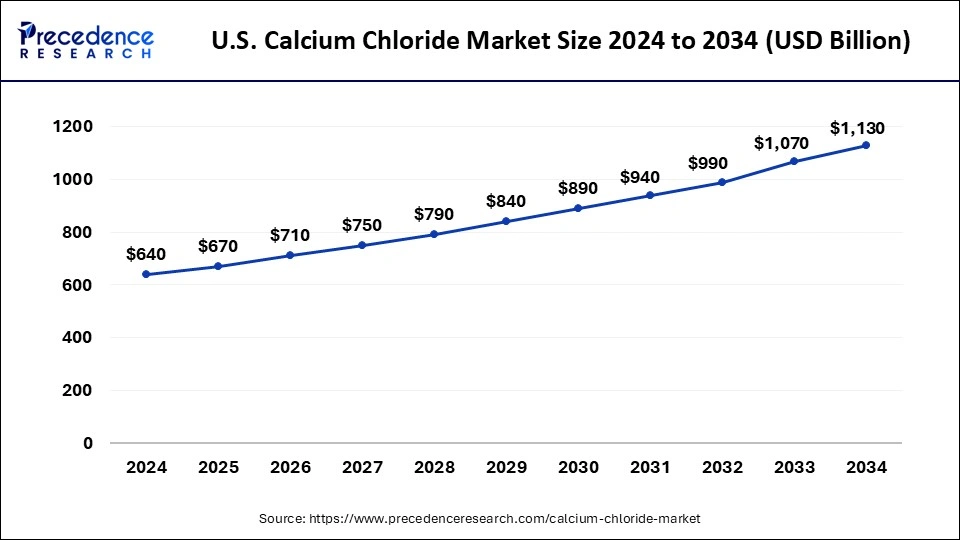

The U.S. calcium chloride market size was evaluated at USD 640 million in 2024 and is projected to be worth around USD 1,130 million by 2034, growing at a CAGR of 5.85% from 2025 to 2034.

North America held the largest share of the calcium chloride market in 2024. On unpaved roads, calcium chloride is frequently used to reduce dust and de-ice roadways. It is favored in areas with severe winters, such as Canada and the northern United States, due to its efficiency at low temperatures. Calcium chloride is utilized in the oil and gas sector as a completion fluid and in drilling fluids to increase well productivity. The need for calcium chloride has increased due to a rise in shale gas production and exploration in North America. In the building sector, calcium chloride is used as a concrete accelerator. The demand for calcium chloride is being driven by the growth in construction activities, especially in the residential and commercial sectors.

Asia Pacific is expected to host the fastest-growing calcium chloride market during the forecast period. The Asia Pacific calcium chloride market is impacted by a number of variables, including end-use industry demand, local economic conditions, and technical developments. In many industrial applications, including dust management, de-icing, and desiccant use, calcium chloride is frequently utilized. The need is being driven by the expanding industrial sector in Asia Pacific, especially in nations like China, India, and Japan. It is used on agricultural land as a fertilizer and to improve the quality of the soil, with agriculture receiving more and more attention. With ongoing projects involving urbanization and infrastructure development, the construction industry in the region is expanding. Concrete is utilized in the construction business more frequently because it is accelerated with calcium chloride.

The global industry that produces, distributes, and sells calcium chloride, a chemical substance having the formula CaClâ‚‚, is referred to as the calcium chloride market. Calcium chloride is mostly used to de-ice roads and manage dust on unpaved ones. Because of its hygroscopic properties, it is useful for absorbing moisture and melting ice. Concrete acceleration uses calcium chloride to shorten the time it takes for concrete to set, particularly in cold weather. It aids in maintaining the stability of the well and increasing the density of the drilling fluid during drilling operations in the oil and gas sector.

Calcium chloride finds extensive application in the food sector as a firming agent and preservative, as well as a drying and de-icing agent. Additionally, it is used in the pharmaceutical, concrete accelerating, and oil and gas industries for drilling fluids. De-icing roads and highways is one of the most common uses for calcium chloride, particularly in areas with cold winters. Due to its hygroscopic nature and capacity to absorb moisture, it is used in the production of plastics, textiles, and water treatment procedures. Urbanization, the expansion of infrastructure, the rise in processed food consumption, and strict environmental laws that encourage the use of calcium chloride over other chemicals all have an impact on the calcium chloride market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.66 Billion |

| Market Size in 2025 | USD 2.24 Billion |

| Market Size in 2024 | USD 2.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.61% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Grade, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for packaged foods

A common food preservative is calcium chloride. It prolongs shelf life and helps keep fruits and vegetables in cans from spoiling by maintaining their firmness. Food acidity is controlled with calcium chloride, which improves flavor stability and preservation. This is especially crucial for pickled foods and drinks. Calcium chloride is utilized in the manufacturing process of several food products to enhance texture. To keep cheese, tofu, and some baked goods consistent and high-quality, they are frequently added. The food industry's need for the calcium chloride market is being driven by consumers' preference for packaged foods that are quick and ready to eat, which is a result of their busy lifestyles.

Corrosive nature

Transportation vehicles, pipes, and metal containers can all corrode when exposed to calcium chloride. Because of the need to employ materials resistant to corrosion, producers and distributors will incur higher expenses. Ecosystems may be impacted by calcium chloride discharge, which can contaminate water and soil. This has affected the calcium chloride market growth and operating costs by resulting in higher environmental restrictions and the requirement for mitigating measures.

Calcium chloride is caustic and can be harmful to both humans and animals if they come into touch with it. This raises expenses even further by requiring additional safety precautions in handling and application. Because of its corrosive nature, there is a rising trend toward less corrosive substitutes, including magnesium chloride or other dust control and de-icing solutions that are better for the environment.

Oil and gas industry

The oil and gas industry has significant applications for the calcium chloride market. Drilling fluids are made denser by adding calcium chloride, which aids in regulating the pressure inside the wellbore. It is a component of completion fluids, which are used to remove drilling mud and get the wellbore ready for gas or oil production. Calcium chloride aids in good management and keeps undesirable fluids from entering the well. In order to speed up the setting period and aid in the faster development of compressive strength, calcium chloride is added to the cement slurry during cementing operations. Natural gas is dehydrated using calcium chloride, which eliminates water vapor and stops hydrate formation, which can clog pipelines.

The industrial grade segment held the largest share of the calcium chloride market in 2024. In colder climates, it is frequently used to deice roads and highways; in dry ones, it is used to manage dust. Because calcium chloride shortens the time it takes for concrete to set, it is essential in building projects where quick curing is needed. It is used as an addition in drilling fluids for oil and gas to regulate viscosity and lessen formation damage. It is utilized in many different chemical processes, including those that produce calcium salts, compounds for water treatment, and medications. Oil and gas exploration operations, infrastructure development, and regulatory regulations pertaining to safety standards and environmental effects all have an impact on the industrial-grade calcium chloride market.

The pharmaceutical grade segment is expected to grow at the fastest rate in the calcium chloride market during the forecast period. The calcium chloride market's pharmaceutical grade sector is mostly composed of high-purity calcium chloride products that adhere to strict quality criteria for use in pharmaceutical applications. Because calcium chloride may control pH and preserve electrolyte balance, it is utilized in hemodialysis solutions, intravenous fluids, and medication formulations, among other pharmaceutical operations. Calcium chloride of pharmaceutical grade is in high demand because of its vital function in guaranteeing product safety and quality in medicinal applications.

The de-icing & dust control segment dominated the calcium chloride market in 2024. One important market for calcium chloride applications is de-icing and dust management. Because calcium chloride can easily melt ice and reduce the freezing point of water, it is frequently used as a de-icing agent for roads, highways, and airport runways during the winter. It also serves as a dust suppressant on mining sites and unpaved roads by stabilizing the surface through the absorption of moisture from the air and the ground. The compound's hygroscopic qualities, which enable it to draw moisture and keep working even in cold temperatures, are advantageous to this market area. The segment is seeing expansion due to factors such as urbanization, increased infrastructure development, and stricter environmental regulations that encourage sustainable and effective dust control solutions.

The food & beverage segment is expected to grow rapidly in the calcium chloride market over the studied years. Food goods use calcium chloride as a firming agent. It supports the preservation of fruits' and vegetables' firmness and texture, particularly in processed and canned meals. It is used to reduce the pH during the fermentation process in beer brewing and to modify the hardness and texture of cheeses like tofu. Pickling and brining solutions contain calcium chloride to keep fruits and vegetables crisp. Calcium chloride is a preservative and flavor enhancer in several food products. In certain dietary products, it also acts as a source of calcium, an important vitamin.

By Grade

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

February 2025

October 2024