January 2025

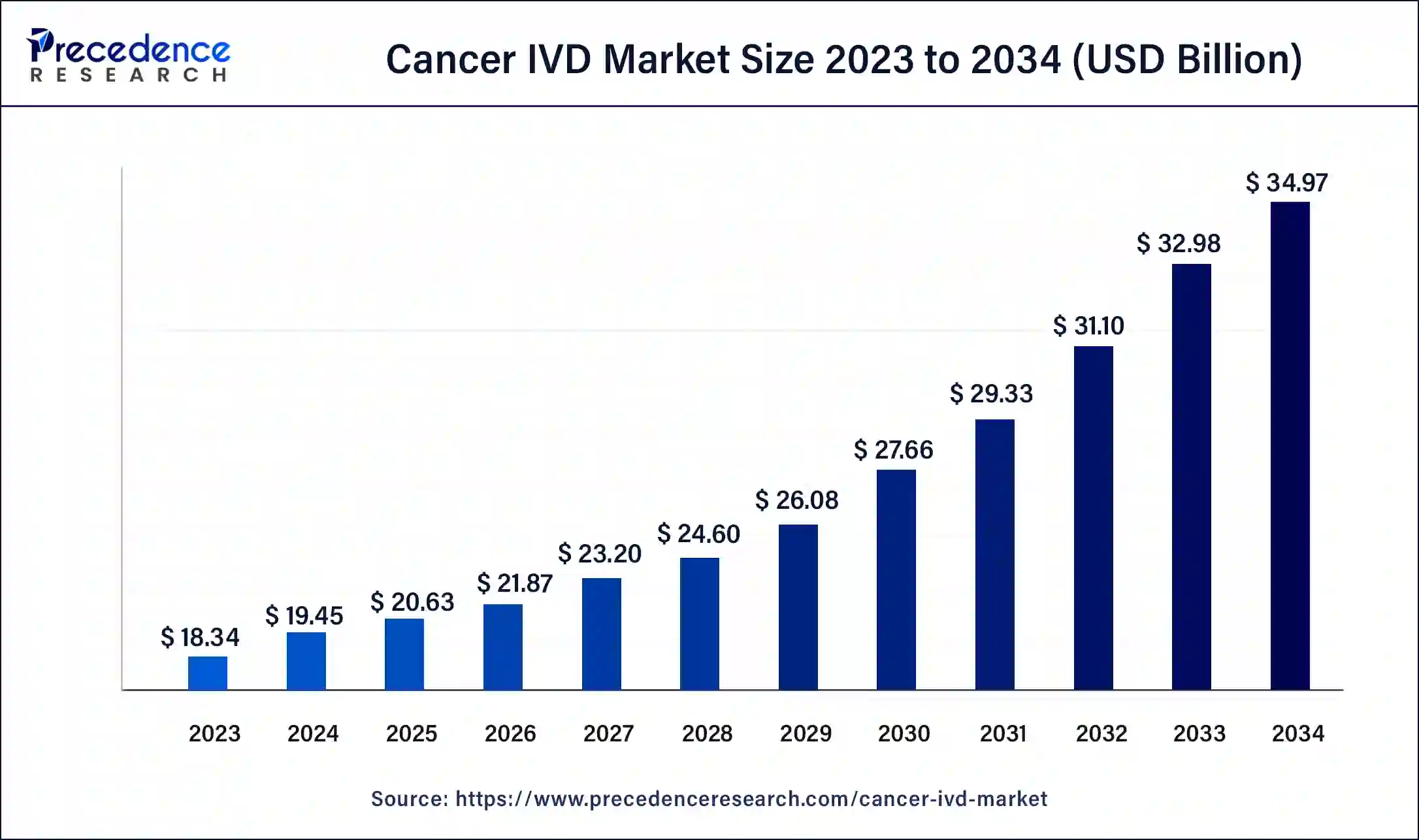

The global cancer IVD market size surpassed USD 18.34 billion in 2023 and is estimated to increase from USD 19.45 billion in 2024 to approximately USD 34.97 billion by 2034. It is projected to grow at a CAGR of 6.04% from 2024 to 2034.

The global cancer IVD market size is expected to be worth USD 19.45 billion in 2024 and is anticipated to reach around USD 34.97 billion by 2034, growing at a solid CAGR of 6.04% over the forecast period 2024 to 2034. The North America cancer IVD market size reached USD 6.60 billion in 2023. The rising cancer incidences, advancement of technologies, enhancement in the healthcare sector, and increased awareness among patients drive the market growth.

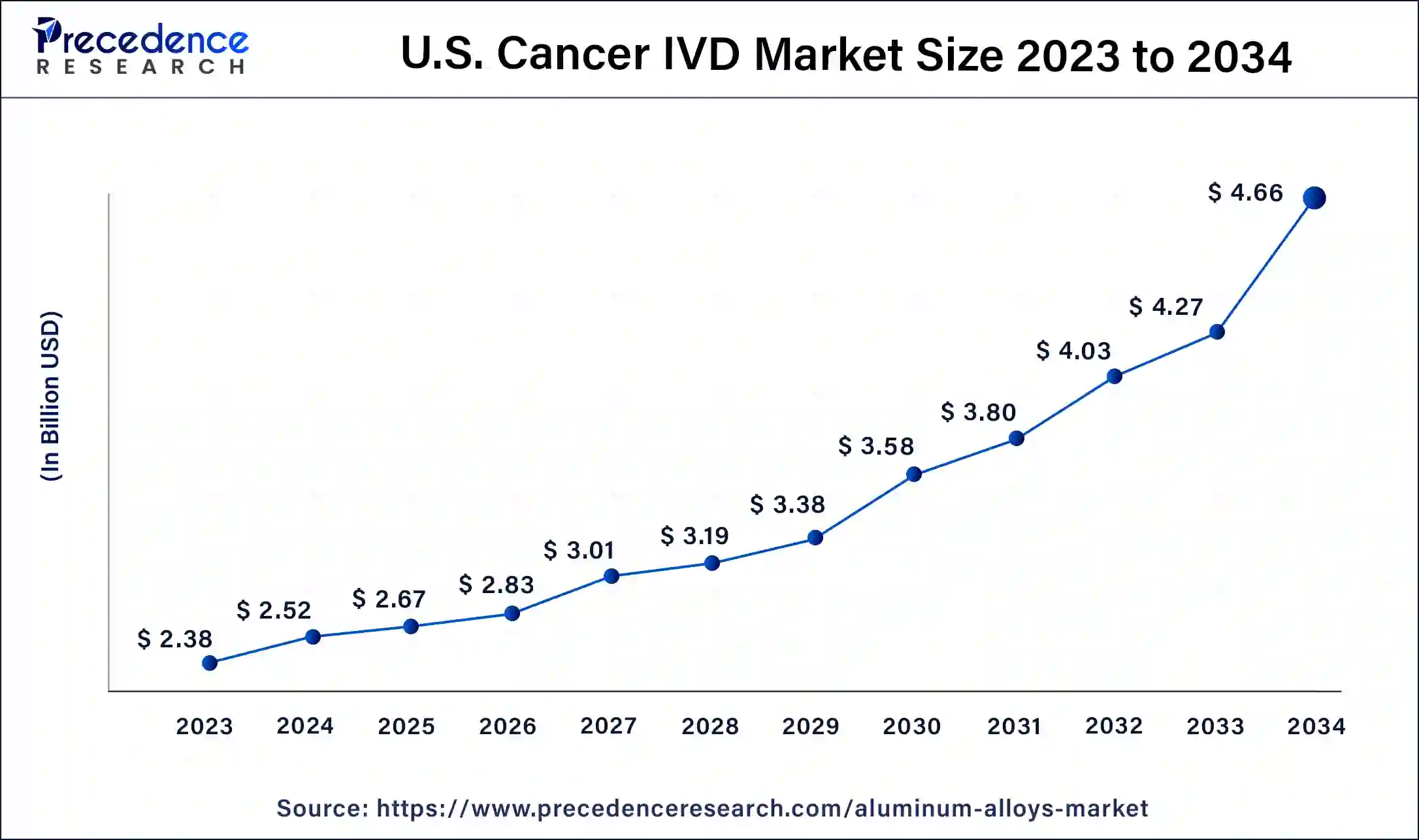

The U.S. cancer IVD market size was exhibited at USD 2.38 billion in 2023 and is projected to be worth around USD 4.66 billion by 2034, poised to grow at a CAGR of 6.29% from 2024 to 2034.

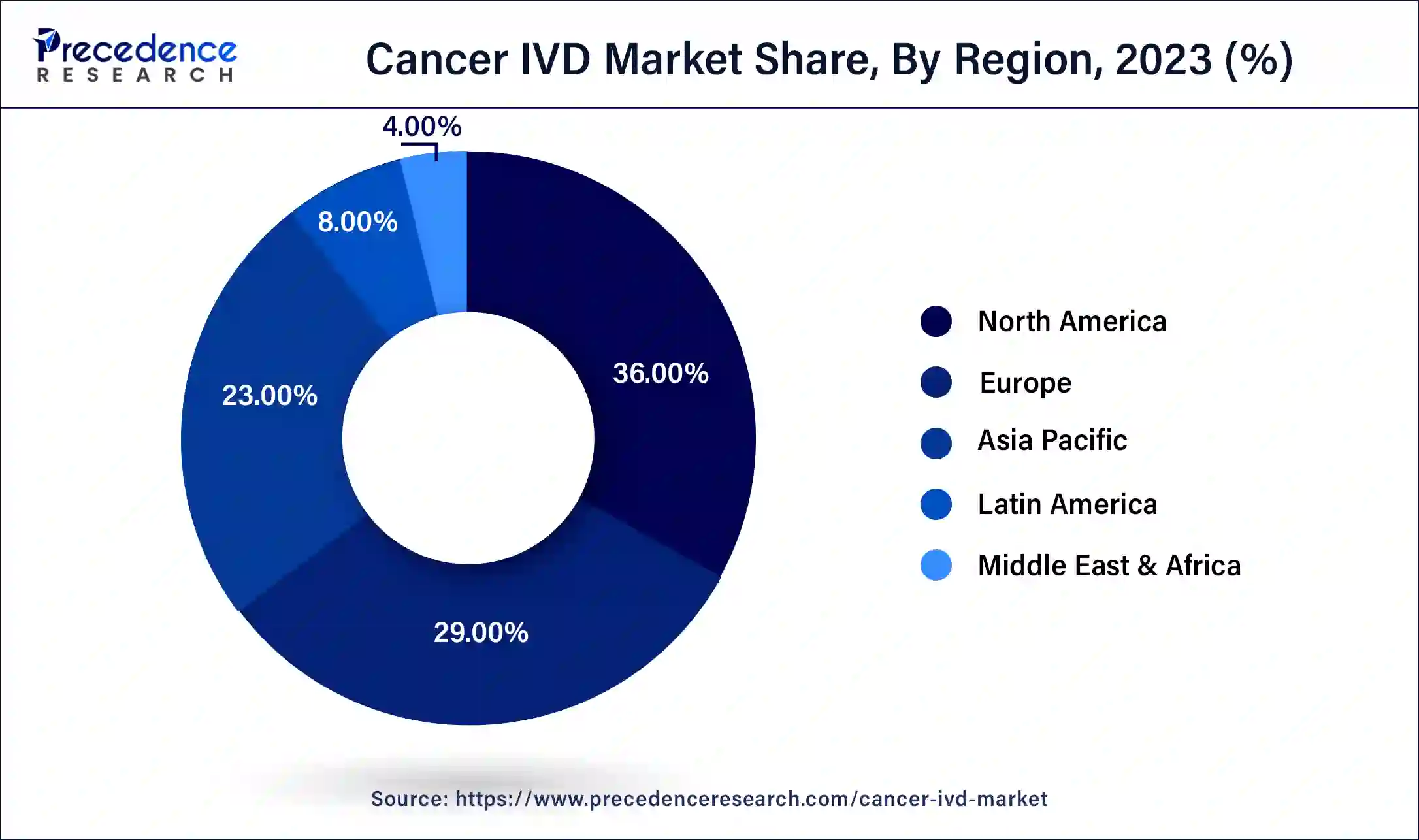

North America led the global cancer IVD market in 2023 due to the efficient healthcare infrastructure, high investment in R&D, and stringent regulatory system. Great healthcare networks and high incidences of cancer help to improve the market. Additionally, the favorable government regulations in the United States and Canada accelerate the development of the new in vitro cancer diagnostic tool.

Asia Pacific is anticipated to grow notably in the cancer IVD market during the forecast period due to factors such as increased incidence of cancer, developments in the healthcare infrastructure, and an increase in healthcare spending. Asia Pacific countries, such as China, India, South Korea, and Japan, are expected to have increasing public concern with the early diagnosis of cancer, and the development of diagnostic tools also affects the market in the region.

In vitro diagnostics (IVD) tests are performed on blood samples, urine samples, stool samples, or tissue samples that provide medical information used to diagnose conditions from mild infections to life-threatening cancers. IVDs can also be used self-administered by patients mostly for monitoring of chronic diseases. In vitro diagnostics offer the opportunity to detect cancer early for more effective and timely treatment. IVDs are specific tests or medical devices that examine specimens taken from the human body and provide essential data for screening, diagnosis, and treatment.

List of cleared or approved companion in-vitro cancer diagnostic devices

| Diagnostic Name | Manufacturer | Indication-sample Type |

| XT CDx | Tempus Labs, Inc. | Colorectal Cancer (CRC) - Tissue (Matching Blood/Saliva) |

| Vysis ALK Break Apart FISH Probe Kit | Abbott Molecular Inc. | Non-Small Cell Lung Cancer (NSCLC) – Tissue |

| Ventana PD-LI (SP263) Assay | Ventana Medical Systems, Inc | Non-Small Cell Lung Cancer (NSCLC) – Tissue |

| Agilent Resolution ctDx FIRST assay | Resolution Bioscience, Inc. | Non-Small Cell Lung Cancer (NSCLC) – Plasma |

| Bond Oracle HER2 IHC System | Leica Biosystems | Breast Cancer – Tissue |

| BRACAnalysis CDx | Myriad Genetic Laboratories, Inc. | Ovarian Cancer - Whole Blood |

| BRACAnalysis CDx | Myriad Genetic Laboratories, Inc. | Breast Cancer - Whole Blood |

| cobas 4800 BRAF V600 Mutation Test | Roche Molecular Systems, Inc. | Melanoma – Tissue |

| FoundationFocus CDxBRCA Assay | Foundation Medicine, Inc. | Ovarian Cancer – Tissue |

| Dako c-KIT pharmDx | Dako North America, Inc. | Gastrointestinal Stromal Tumors – Tissue |

Artificial Intelligence (AI) innovatively improves the cancer IVD market. AI tools are aimed at improving pathology understanding and providing better outcomes for cancer patients via targeted treatment based on precision medicine. AI is set to become an important asset necessary in the diagnosis as well as the treatment of patients in the medical device industry.

The strength of AI is in interrupting disease diagnosis and showing high efficiency when examining large volumes of data, in contrast to the recognition of tumors with the help of traditional methods based on the study of medical images, which take a lot of time and are influenced by human error.

| Report Coverage | Details |

| Market Size by 2034 | USD 34.97 Billion |

| Market Size in 2023 | USD 18.34 Billion |

| Market Size in 2024 | USD 19.45 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.04% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product and Service, Technology, End-users, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing prevalence of cancer

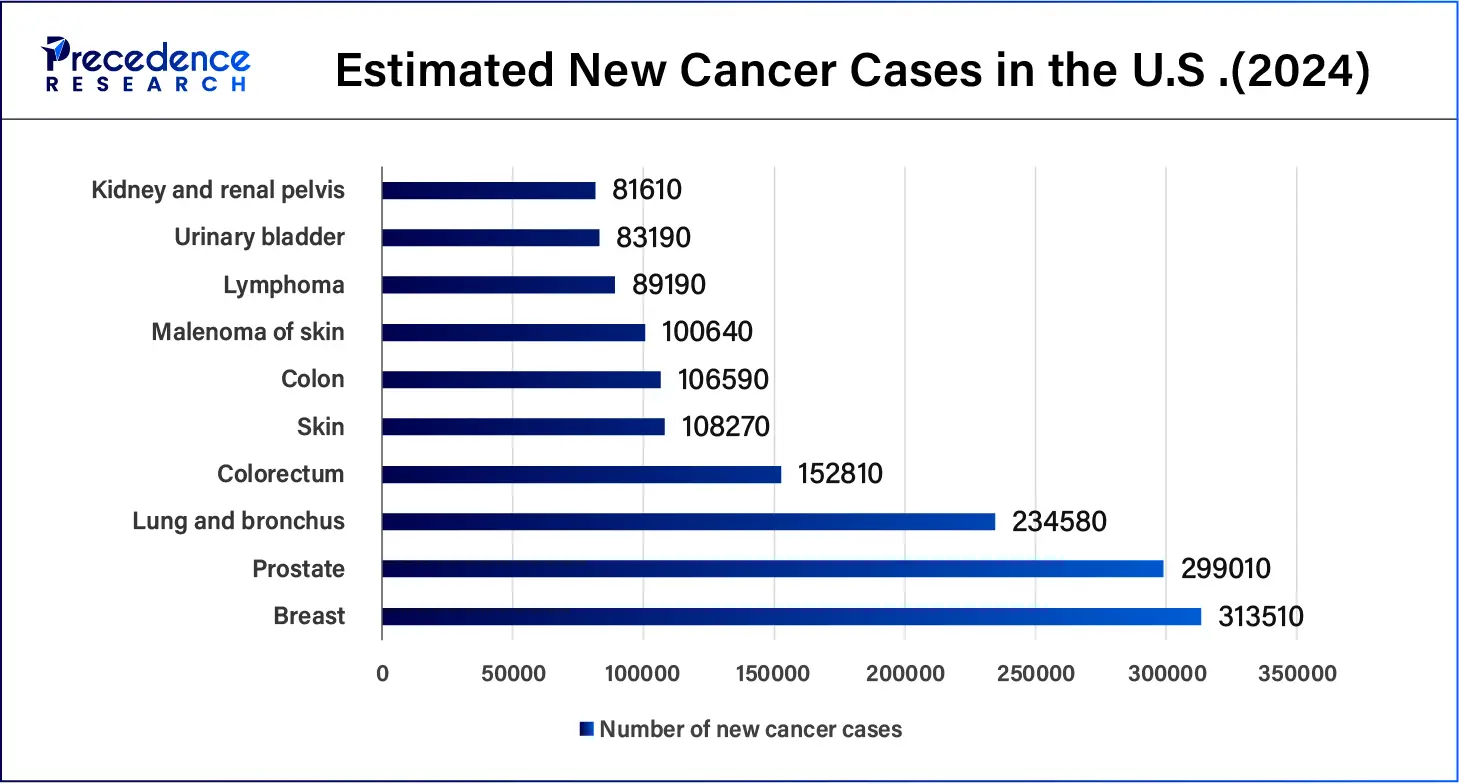

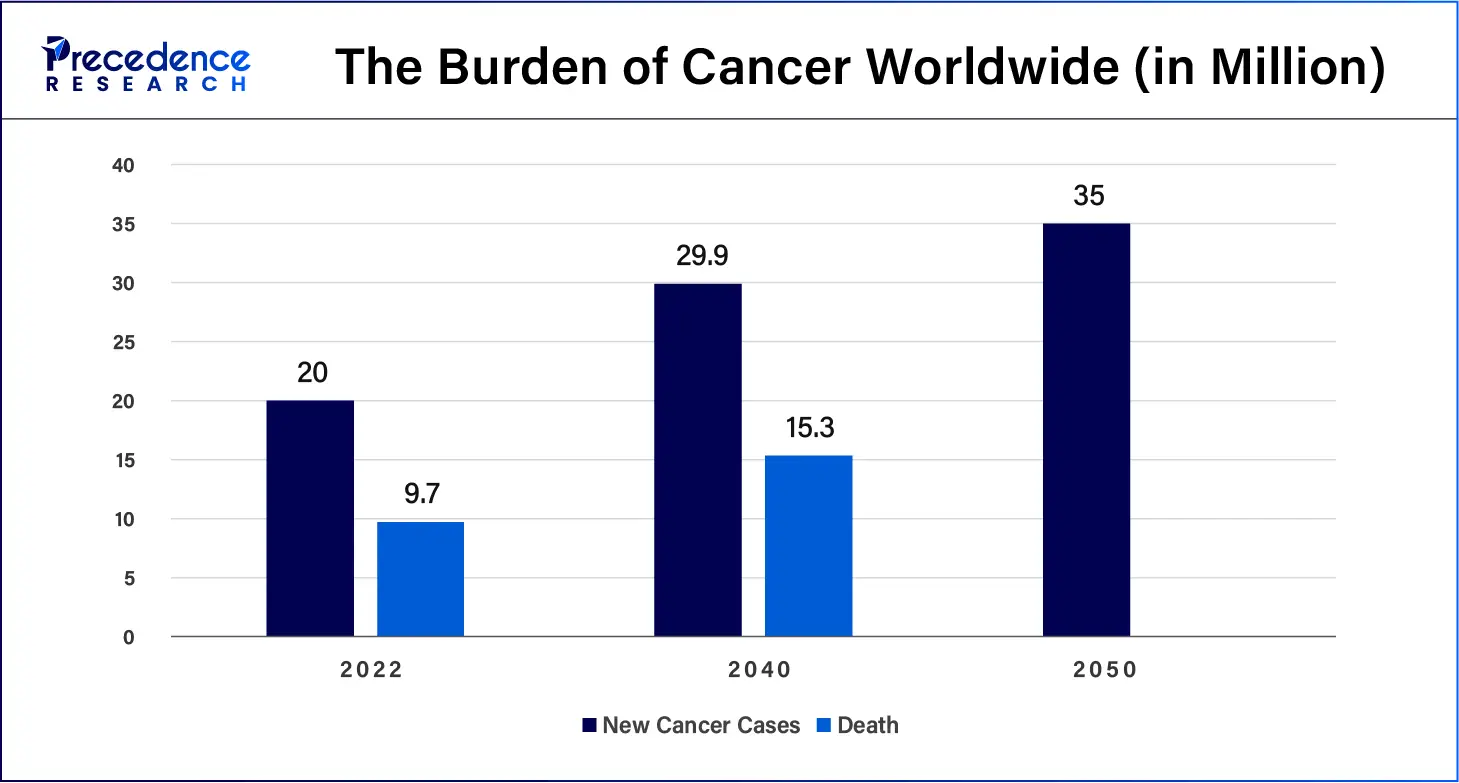

The global incidence of cancer continues to rise, hence making people more interested in diagnostic procedures, thus fueling the growth of the cancer IVD market. The rapidly growing cancer burden reflects both population aging as well as changes in people’s exposure to risk factors, several of which are associated with socioeconomic development. Tobacco, alcohol, and obesity are key factors behind the increasing incidence of cancer, with air pollution still a key driver of environmental risk factors. Cancer rates are highest in countries whose populations have the highest life expectancy, education level, and standard of living.

Regulatory hurdles

Regulatory compliance can act as a limiting factor for the cancer IVD market. Rigorous approval processes that are demanded by regulatory authorities such as the FDA and other regulatory bodies are usually time-consuming and increase costs. Requirement for an extended clinical trial to prove the precision and accuracy of the devices that also add on in the expanses.

Increasing investment and developing mergers and acquisitions

Increasing investment and high levels of mergers and acquisitions are projected to boost the demand for the cancer IVD market. This leads to improved research and development, resulting in the innovation of diagnostic technologies that aid in the early identification and monitoring of cancer. This has the effect of increasing capital investment for new product development and growth of product portfolios. Also, there is a high frequency of mergers and acquisitions, specifically in the development and utilization of improved and innovative platforms.

the reagents segment accounted for the largest share of the cancer IVD market in 2023. Reagents are special biological/chemical solutions that can react with target substances or samples. The reagents segment is gradually developing because of the growth of cancer incidence rates and the need for effective and early diagnostics. The reagents segment is emerging primarily due to the increase in the frequency of cancer diseases and the need for their early detection.

the service segment is expected to witness significant growth in the cancer IVD market during the forecast period. It also embraces the support services for the upkeep of the diagnostic tools and equipment, data and information process and analysis, and education and training programs ranging from the upgrade of the health care experts. These services are critically important for diagnosis, treatment planning, and integrating newer technologies efficiently into clinical practice, thereby contributing to improving patient care for cancer.

the clinical chemistry segment registered the biggest share of the cancer IVD market in 2023. Clinical chemistry uses chemical processes to measure levels of chemical components in body fluids and tissues. The tumor markers and disease status, as well as the treatment plans, require the use of clinical chemistry tests. Developments in clinical chemistry applied to cancer examinations improve the test’s sensitivity and specificity, which positively affect diagnostic accuracy. In response to the increasing demand for early diagnosis and individualized approaches to therapy, the segment of clinical chemistry remains at the forefront of the development of the market.

the immunochemistry/immunoassay segment is expected to grow significantly in the cancer IVD market during the forecast period. Immunoassay techniques have become the dominant test method in the clinical quantitative detection of tumor markers. The objective diagnostic tools include immunoassays such as ELISA and chemiluminescent immunoassays (CLIAs) that have been proven to produce high specificity and sensitivity for tumor markers and disease prognosis.

the hospitals segment dominated the cancer IVD market in 2023. Cancer tests can also be carried out in hospitals, and they are well-equipped and staffed by well-trained personnel. They have estimated that the further development of health care and infrastructure coupled with favorable initiatives are expected to primarily help in improving the hospital facilities. Therefore, the IVD tests which are conducted in the hospital have become popular. They include screening and diagnostic procedures as well as treatments.

the patient self-testing segment is anticipated to grow significantly in the cancer IVD market during the forecast period. This segment is progressing due to the continued improvement in technology and greater awareness by consumers as self-testing is becoming easier and more accurate. The growing incidence of cancer as well as rising the geriatric population has increased the demand for self-testing IVD devices.

Segments Covered in the Report

By Product and Service

By Technology

By End-users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

September 2024

October 2024