January 2025

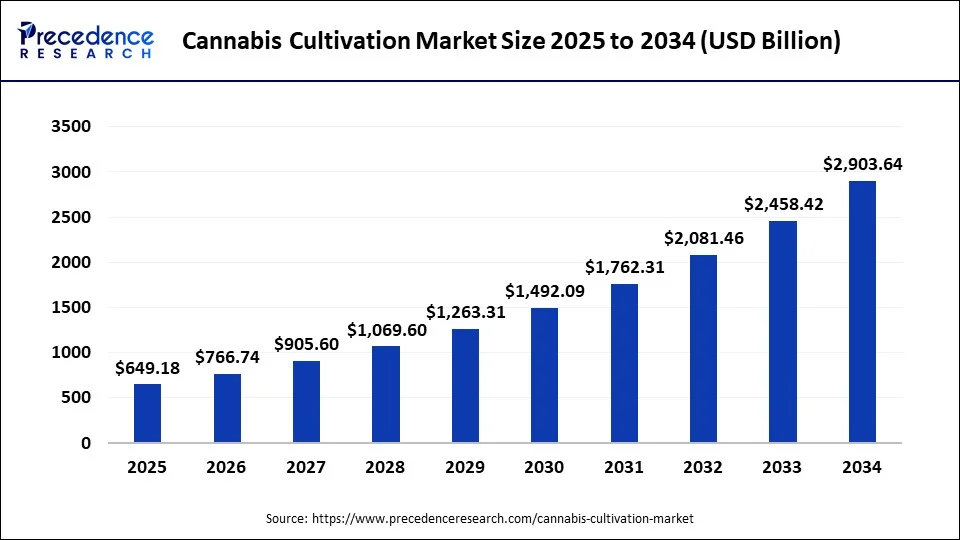

The global cannabis cultivation market size accounted for USD 549.64 billion in 2024, grew to USD 649.18 billion in 2025 and is expected to be worth around USD 2,903.64 billion by 2034, registering a healthy CAGR of 18.11% between 2024 and 2034.

The global cannabis cultivation market size is estimated at USD 549.64 billion in 2024 and is anticipated to reach around USD 2,903.64 billion by 2034, expanding at a CAGR of 18.11% between 2024 and 2034. The rising adoption of cannabis in medical sectors is expected to boost the growth of global cannabis cultivation market.

Native to South Asia, the cannabis plant is utilized in various industries, including medicinal and recreational purposes. Cannabis cultivation includes the process of preparing, producing, and harvesting the cannabis required for multiple purposes. Different parts of cannabis plants, such as roots, flowers, stems, sugar leaves and seeds, have received significant attention from medical and recreational industries.

Mentioned parts of the cannabis plant carry long and short cellulose fibers, herbal properties, proteins, and essential fatty acids. Cultivators are focusing on distillation and processing during cannabis cultivation to boost production. With the increasing demand for cannabis and improving technology for cultivation, the global cannabis cultivation market is projected to accelerate in the upcoming years.

The global cannabis cultivation market is expected to witness a significant shift during the analyzed period owing to the increased medical importance of cannabis in recent years. Many geographical areas have recently started legalizing the cultivation, production, and distribution of cannabis with stricter laws and regulations.

The rising legalization of cannabis cultivation is another primary driver for the market’s growth. The increasing prevalence of chronic disease and neurological disorders is observed to fuel the growth of medical cannabis during the forecast period.

Moreover, the growing requirements for hemp cannabis from the nutraceutical and food industries, along with the adoption of cannabis in the cosmetic industry, are considered to fuel the growth of the global cannabis cultivation market.

At the same time, the rising investments in the cultivation sector, availability of capital for cannabis cultivation facilities, the addition of key players, and growing focus on business activities such as mergers, acquisitions and partnerships are accelerating the growth of the cannabis cultivation market globally.

| Report Coverage | Details |

| Market Size in 2024 | USD 549.64 Billion |

| Market Size by 2034 | USD 2,903.64 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 18.11% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Biomass and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The rising demand of medical marijuana

Medical marijuana is typically cannabis used in the medical sector to treat various diseases. In recent years, many countries and states have legalized medical marijuana by considering its health benefits. Netherlands, Georgia, France, Portugal and Canada have stepped into the legalization of medical cannabis or marijuana. Rapid legalization has boosted the demand for medical marijuana in the global market, which drives the growth of the cannabis cultivation market. Medical marijuana is widely used to ease symptoms, including nausea and vomiting.

Moreover, medical marijuana qualifies for the treatment of HIV/AIDS, glaucoma and muscle spasms. The increasing prevalence of chronic diseases has highlighted the importance of cannabis in the medical sector.

The THC content in marijuana helps in treating/managing neurological disorders. With the rising cases of depression, anxiety, Alzheimer's and other neurological issues, the demand for medical marijuana is considered to boost rapidly. Considering the need for medical marijuana, prominent pharmaceutical companies have entered the market by producing cannabis-derived pills, powders and oil for medical purposes.

Difficulties in cannabis shipping and distribution

As the laws regarding cannabis cultivation, production, and distribution become stricter, the shipping of cannabis-derived products has become more complex. Every country/state has set different guidelines and rules for collecting and distributing cannabis. For example, it is legal to ship cannabis with up to 0.2% THC concentration in European Union. In contrast, Australia allows cannabis with 0.005% or less THC concentration.

On the other hand, the U.S. has allowed the shipping of cannabis or marijuana with up to 0.3% THC. Considering such different regulations in shipping cannabis, it becomes difficult for cultivators to expand their business internationally. However, small-scale cultivators are not involved in the distribution phase, and the difficulties in cannabis shipping may be problematic for large-scale cultivators engaged in production and distribution.

Deployment of genetic engineering in cannabis cultivation to boost the production

The technological innovations in cannabis cultivation procedures highlight the bright future of the global market. Genetic engineering allows the modification of the characteristics. With the invention in the agricultural sector, cannabis cultivators have started deploying genetic engineering to enhance production; genetic engineering in cannabis cultivation allows the crossing of cannabis strains in order to achieve a desirable trait.

Technological advancements have allowed cultivators to achieve the desired product in a matter of weeks. Cultivators are capable of resisting the effects of climate change on cannabis crops, and the deployment of genetic engineering is observed to offer to strengthen the production of cannabis without failure.

Cannabis indica and cannabis sativa are two major competitive types of the cannabis cultivation market. Both cannabis indica and cannabis sativa have plenty of medical uses, which have highlighted their importance in the medical field.

The cannabis indica segment holds a dominating share of the global cannabis cultivation market. Cannabis indica has a higher concentration of cannabidiol, which is believed to offer more calming and relaxing effects. Cannabis indica is widely used for managing poor appetite, insomnia and anxiety.

The cannabis sativa is another fastest-growing segment of the global cannabis cultivation market. Due to the typical amount of tetrahydrocannabinol in cannabis sativa, it is believed to cause uplifting and offer pain management. Cannabis sativa is widely used in the production of fiber and oil, and another proven use of sativa is it can be used as an additive in food products. Commercially, cannabis sativa seeds are used in the production of edible/cooking oil.

The hemp segment dominates the global cannabis cultivation market; the hemp segment accounted for a revenue share of 78% in 2023. Hemp is commercially legal biomass owing to its low THC content, and it is utilized in the production of commercial products such as food, ropes, paper and even clothing. Along with this, hemp is also used in treating multiple skin infections, and the rising demand for hemp-based products from various industries will maintain the segment’s dominance.

Moreover, the increasing adoption of hemp cultivation is expected to boost the growth of the hemp segment during the forecast period. For instance, in June 2022, the Tamil Nadu government in India expressed that it is actively considering legalizing hemp cultivation for industrial and medical purposes.

Marijuana is the fastest-growing segment of the global cannabis cultivation market. Many states have recently started allowing the use of medical marijuana in treating multiple diseases and managing pain. The changing perception towards marijuana will fuel the segment’s growth.

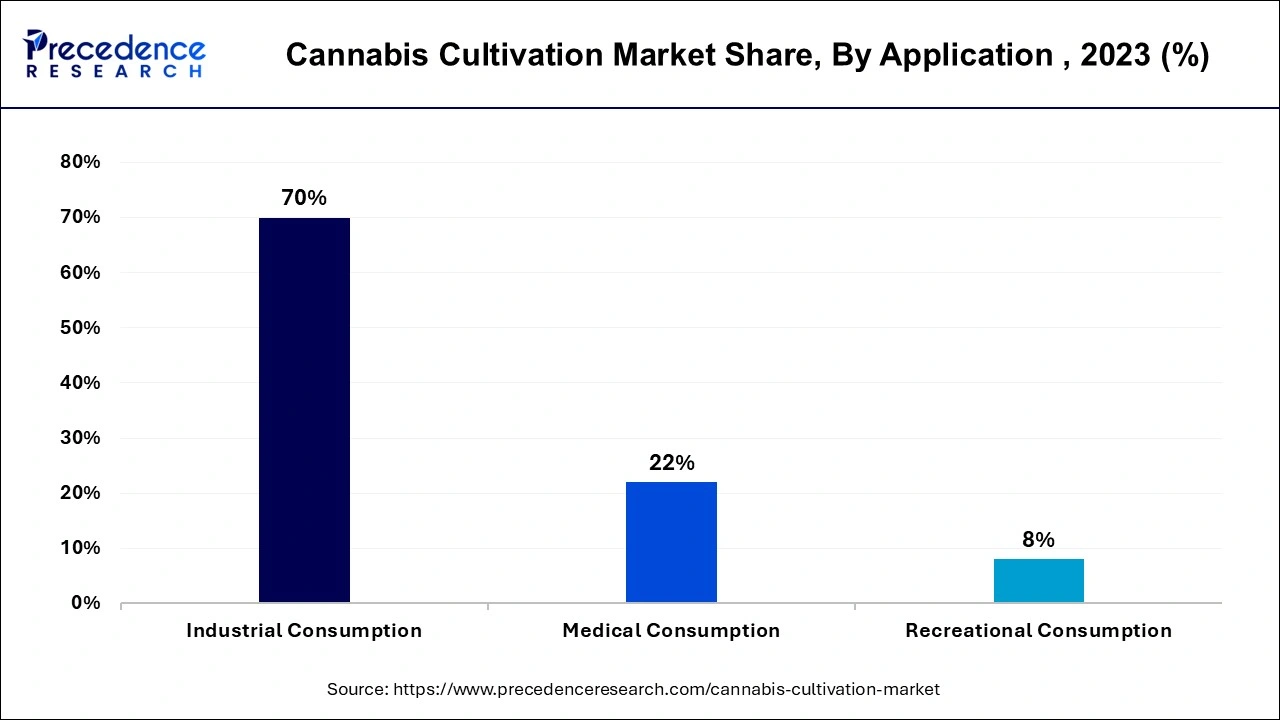

The industrial consumption segment dominates the market by acquiring more than 70% of the total revenue share of the global cannabis cultivation market. The hydrating, anti-aging, anti-sebum and antioxidant properties have reserved a significant position for cannabis in the global cosmetic industry.

The rising demand from the cosmetic industry for cannabis has boosted the growth of the industrial consumption segment. Moreover, cannabis continues to play a vital role in the pharmaceutical industry owing to its soothing and stimulating properties. The expansion of cosmetics, personal care and pharmaceutical products will maintain the growth of the industrial consumption segment.

At the same time, the medical consumption segment is expected to be the most attractive segment during the forecast period. The rising demand for sativa cannabis from the medical sector as medical marijuana is uplifting the segment’s growth. Cannabis or medical marijuana are widely utilized to manage and control symptoms such as nausea and vomiting and lessen pain post-surgery. Moreover, the development of the segment is attributed to the rising legalization of cannabis cultivation, specifically for medical use in many countries.

North America accounted for the largest revenue share in the global cannabis cultivation market. The rising prevalence of neurological disorders has increased the demand for cannabis from the medical industry in North America. The availability of production lands, large consumption volume, new product launches and the presence of major key players in the region are a few other factors to fuel the cannabis cultivation market in North America. The State of California is expected to dominate the cannabis cultivation market in North America.

Asia Pacific is the fastest-growing region of the global cannabis market, and the medical application of cannabis will maintain its dominance throughout the analyzed period in Asia Pacific. To highlight the importance of cannabis, India has been utilizing cannabis in various traditional remedies. On the other hand, the complicated regulations on cannabis in Japan and China will hamper the growth of the cannabis cultivation market in Asia Pacific.

Europe is another significant marketplace for cannabis cultivation. The legalization of cultivation, utilization and consumption of cannabis in various countries of Europe is supplementing the growth of the cannabis cultivation market in Europe. For instance, in October 2022, the German government planned to legalize the home cultivation of cannabis while allowing three plants per adult. Moreover, France has legalized the use of cannabis in various industries. Also, medical cannabis is legal in France and Portugal.

The cannabis cultivation market in Latin America shows steady growth as the region is still dependent on exporting cannabis for specific medical purposes. The reformed drug laws in 2021 UAE made the regulations on the use of cannabis stricter; this is observed to limit the growth of cannabis cultivation in the Middle East.

On the other hand, in 2023, the president of South Africa addressed improving the cultivation of hemp cannabis to recover the economy post Covid pandemic; this is expected to boost the market’s growth in Africa during the forecast period. Along with South Africa, many other African countries are keen to embrace the production of cannabis to boost their economies.

In recent years, the increased demand for cannabis cultivation has welcomed multiple new players in the market, a few of the prominent companies involved in the global cannabis cultivation market are-

Segments Covered in the Report:

By Type

By Biomass

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

October 2024

June 2023