September 2024

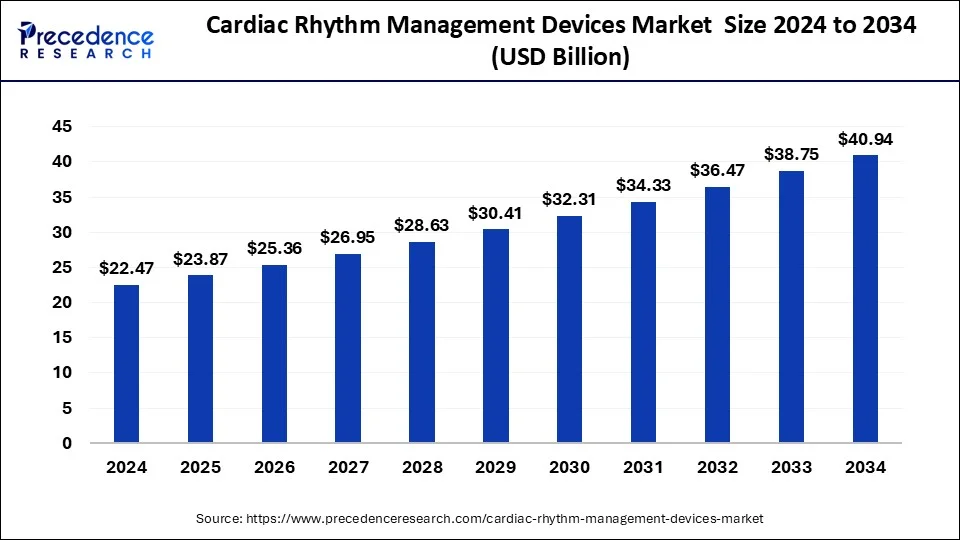

The global cardiac rhythm management devices market size accounted for USD 23.87 billion in 2025 and is forecasted to hit around USD 40.94 billion by 2034, representing a CAGR of 6.18% from 2025 to 2034. The North America market size was estimated at USD 10.34 billion in 2024 and is expanding at a CAGR of 6.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cardiac rhythm management devices market size was calculated at USD 22.47 billion in 2024 and is predicted to increase from USD 23.87 billion in 2025 to approximately USD 40.94 billion by 2034, expanding at a CAGR of 6.18%.

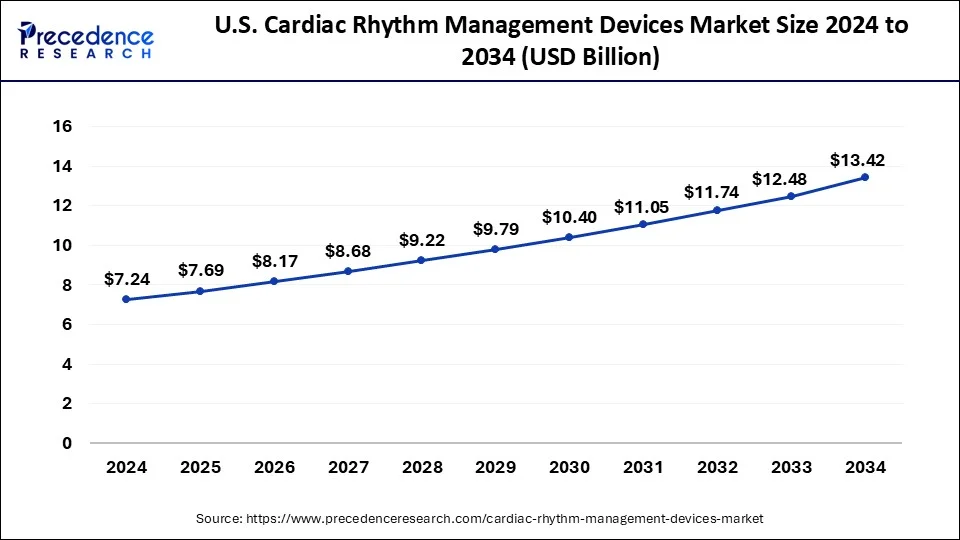

The U.S. cardiac rhythm management devices market size was exhibited at USD 7.24 billion in 2024 and is projected to be worth around USD 13.42 billion by 2034, growing at a CAGR of 6.37%.

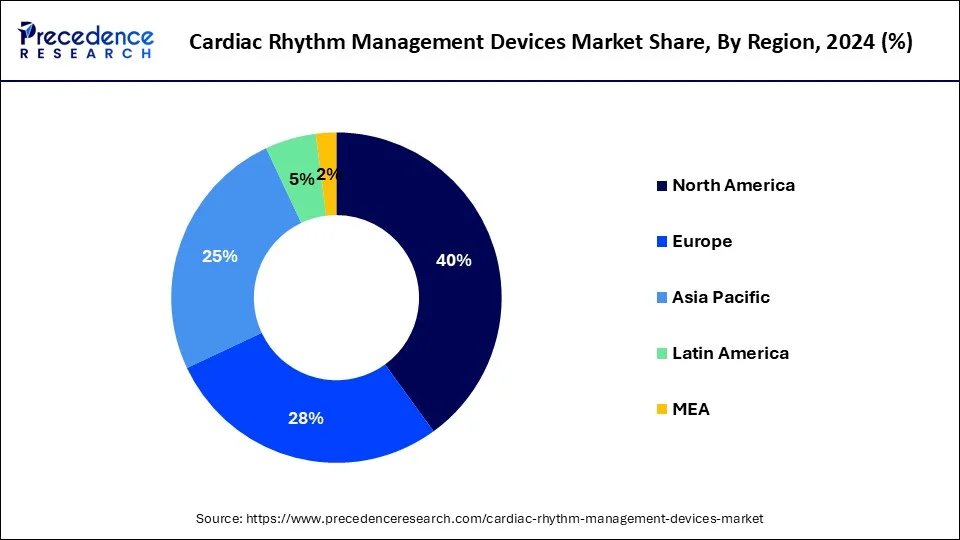

North America led the market with the biggest market share of 46% in 2024, leveraging advanced technologies and widespread adoption across various healthcare settings. However, within the realm of cardiac rhythm management, specific considerations and procedures take precedence, driving the market's dynamics in the region.

Adaptive-rate devices, capable of sensing vibration, impedance changes, or the QT interval, present advancements in pacing technology. Nevertheless, concerns regarding mechanical or physiological interference leading to inappropriate high-rate pacing have surfaced. As a precautionary measure, it is recommended to disable adaptive-rate pacing, even in the absence of electrocautery usage during surgical procedures.

Key segments within the United States cardiac rhythm management devices market include Cardiac Resynchronization Therapy (CRT), Implantable Cardioverter Defibrillator (ICD), Implantable Loop Recorder Procedures, and Pacemaker Implant Procedures.

North America's prominence in the cardiac rhythm management devices market underscores its commitment to advancing cardiovascular care and ensuring optimal patient outcomes. With a focus on innovation, collaboration between healthcare professionals, and technological advancements, the region continues to lead the way in shaping the future of cardiac rhythm management.

The cardiac rhythm management devices market offers products, comprising pacemakers and implantable cardioverter defibrillators (ICDs), constitute integral tools in treating and managing arrhythmia-related conditions. These devices, along with associated leads and accessories, play a crucial role in regulating heart rhythm and improving overall patient health. Pacemakers administer electrical impulses to normalize heartbeats, while ICDs monitor heart activity and intervene when detecting abnormal rhythms, ensuring prompt restoration of a normal rhythm when necessary.

The cardiac rhythm management devices market is witnessing ongoing evolution, encompassing innovations such as cardiac resynchronization therapy and loop recorders. This evolution is facilitating broader usage and effectiveness, with general practitioners increasingly participating in patient follow-up and management. The numerous benefits offered by cardiac rhythm management devices, and concerns regarding potential complications necessitate open communication between patients and implanting physicians.

Post-implantation, patients can anticipate leading normal, active lives, with occasional caution warranted in specific situations, such as proximity to electromagnetic interference from appliances. As these devices continue to advance, they remain pivotal in enhancing patient outcomes and quality of life within the realm of cardiac care.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.18% |

| Market Size in 2025 | USD 23.87 Billion |

| Market Size by 2034 | USD 40.94 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Utilizing clinical magnets for cardiac rhythm management devices

The increasing indications for permanent pacemaker and implantable cardioverter defibrillator (ICD) implantation have led to a rise in patients with cardiac rhythm management devices (CRMDs). However, these devices may occasionally exhibit inappropriate responses to electromagnetic interference or lead noise over-sensing, potentially jeopardizing patient care. Temporary reprogramming of CRMDs using device programmers can mitigate these issues but requires technically qualified personnel and device-specific expertise, leading to delayed care and resource utilization.

By enhancing understanding and promoting the effective use of clinical magnets, healthcare providers can optimize patient care, minimize device-related complications, and contribute to the growth of the cardiac rhythm management devices market. Alternatively, clinical magnets offer a solution by enabling the modification of pacing modes in pacemakers and suspending tachycardia therapies in ICDs when appropriately positioned over the device site. By enhancing understanding and promoting the effective use of clinical magnets, healthcare providers can optimize patient care, minimize device-related complications, and contribute to the growth of the market.

Advancing cardiac rhythm management

Cardiovascular implantable electronic devices (CIEDs) play a vital role in managing patients with brady- and tachyarrhythmias or heart failure, complementing optimal pharmacotherapy. However, despite technological strides, gaps persist in CIED patient management, notably concerning the rising incidence of lead- and pocket-related long-term complications, including cardiac device–related infective endocarditis, demanding meticulous attention. Comprehensive patient care mandates remote monitoring of those with CIEDs, ensuring proactive intervention and holistic management.

Embracing innovation, novel technologies integrated into smartwatches offer a convenient avenue for long-term atrial fibrillation (AF) screening, particularly in high-risk populations. Timely detection of AF holds the potential to mitigate stroke risk and other AF-related complications, underscoring its pivotal role in fostering growth within the cardiac rhythm management devices market.

High cost

The development of cardiac rhythm management devices market has been accompanied by increased costs, particularly evident in the median implantation cost of cardiac resynchronization therapy (CRT) devices over time. Device cost stands as a critical input parameter, intricately linked with device longevity. Notably, costs associated with CRT-defibrillator (CRT-D) therapy surpass those of CRT-pacemaker (CRT-P) therapy significantly. This disparity in costs between CRT-D and CRT-P therapies poses a constraint on market growth within the cardiac rhythm sector. As higher costs potentially limit accessibility and adoption rates, addressing this discrepancy becomes paramount in fostering sustained market expansion and ensuring broader patient access to advanced cardiac rhythm management technologies.

Embracing technological advancements

Cardiac rhythm management (CRM) devices are not just confined to monitoring and managing cardiac issues; they are evolving to encompass restoration, repair, and healing functions. As the medical industry and healthcare sector move towards complete digitization, there lies a significant opportunity to capitalize on the demand for efficient, near real-time data reporting technologies offered by cardiac rhythm devices. By embracing these innovative solutions, hospitals can enhance patient care, streamline workflows for healthcare providers, and ultimately optimize operational efficiency.

The increasing demand for such advanced monitoring devices presents a lucrative opportunity for investment. Acting swiftly to integrate these technologies into healthcare practices can position institutions at the forefront of cardiac care delivery, ensuring they remain competitive in an evolving market landscape. Thereby, the factor of technological advancements is observed to offer a lucrative opportunity to the cardiac rhythm management devices market.

In the dynamic landscape of the cardiac rhythm management devices market, the defibrillators segment stood as a dominant force in 2024. Defibrillators play a pivotal role in restoring normal heart rhythm by administering an electric charge or current to the heart. In cases of sudden cardiac arrest (SCA), where the heart rhythm ceases, prompt intervention with CPR (cardiopulmonary resuscitation) and a defibrillator is critical for survival. Implantable or wearable defibrillators further enhance patient care by addressing dangerous arrhythmias, effectively correcting irregular heart rates or rhythms.

These devices offer a lifeline to individuals at risk of cardiac events, providing reassurance and potentially life-saving intervention. The widespread presence of automated external defibrillators (AEDs) in public spaces underscores the importance of accessibility and immediate response in emergency situations. AEDs empower bystanders to intervene effectively in cases of SCA, significantly improving the chances of survival. As technological advancements continue to drive innovation within the cardiac rhythm market, defibrillators remain at the forefront, offering versatile solutions to address cardiac emergencies and save lives.

The arrhythmias segment held the largest share of the cardiac rhythm management devices market in 2024. The aging population is more susceptible to cardiac arrhythmias due to age-related changes in the heart's electrical conduction system. With the global population aging rapidly, the prevalence of arrhythmias is expected to rise, driving the demand for cardiac rhythm management devices that can effectively address the unique needs of elderly patients. Continuous advancements in cardiac rhythm management technologies have led to the development of sophisticated devices with enhanced capabilities for diagnosing and treating arrhythmias. These devices offer improved accuracy, reliability, and functionality, enabling clinicians to tailor treatment strategies based on individual patient needs and preferences.

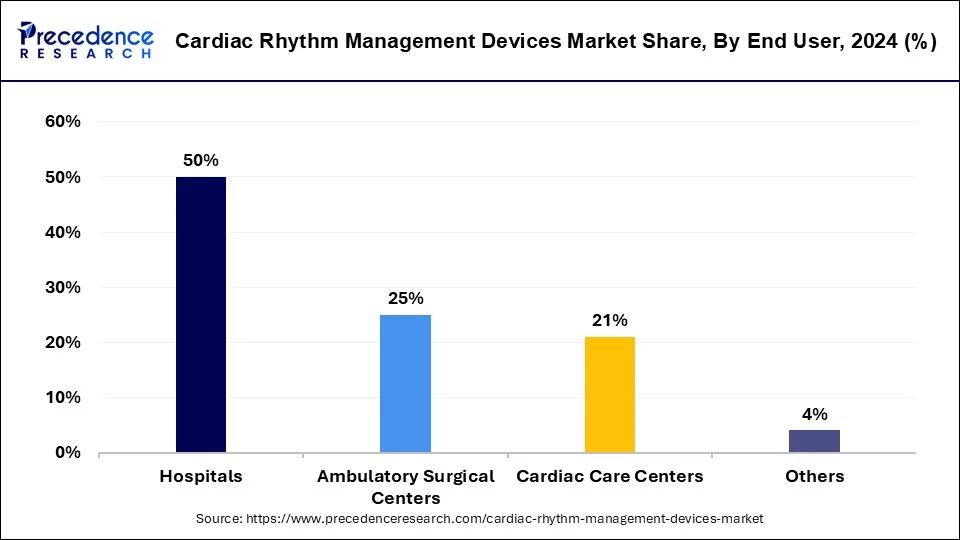

The hospitals segment led the cardiac rhythm management devices market share of 50% in 2024. The evident requirement of health monitoring devices in hospitals create a significant growth factor for the segment to grow. The rapid adoption of devices with advanced technologies in hospitals along with the number of admitted patients post-surgery in such environments drives the growth of the segment.

The ongoing penetration of advanced wireless cardiac rhythm management devices create a large consumer-base at hospitals. This is observed to be another growth factor for the segment to expand in the upcoming period. Admitted patients post-surgery require continuous monitoring, cardiac rhythm management devices carry the capability to transfer the required data to hospital data storage.

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2023

August 2024

August 2024