January 2025

Cardiology Information System Market (By Mode of Operation: Web-based, Cloud-based, On-site; By System: Cardiovascular Information Systems, Cardiology Picture Archiving and Communication Systems; By Component: Software, Hardware, Services; By Application; By End-Use) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

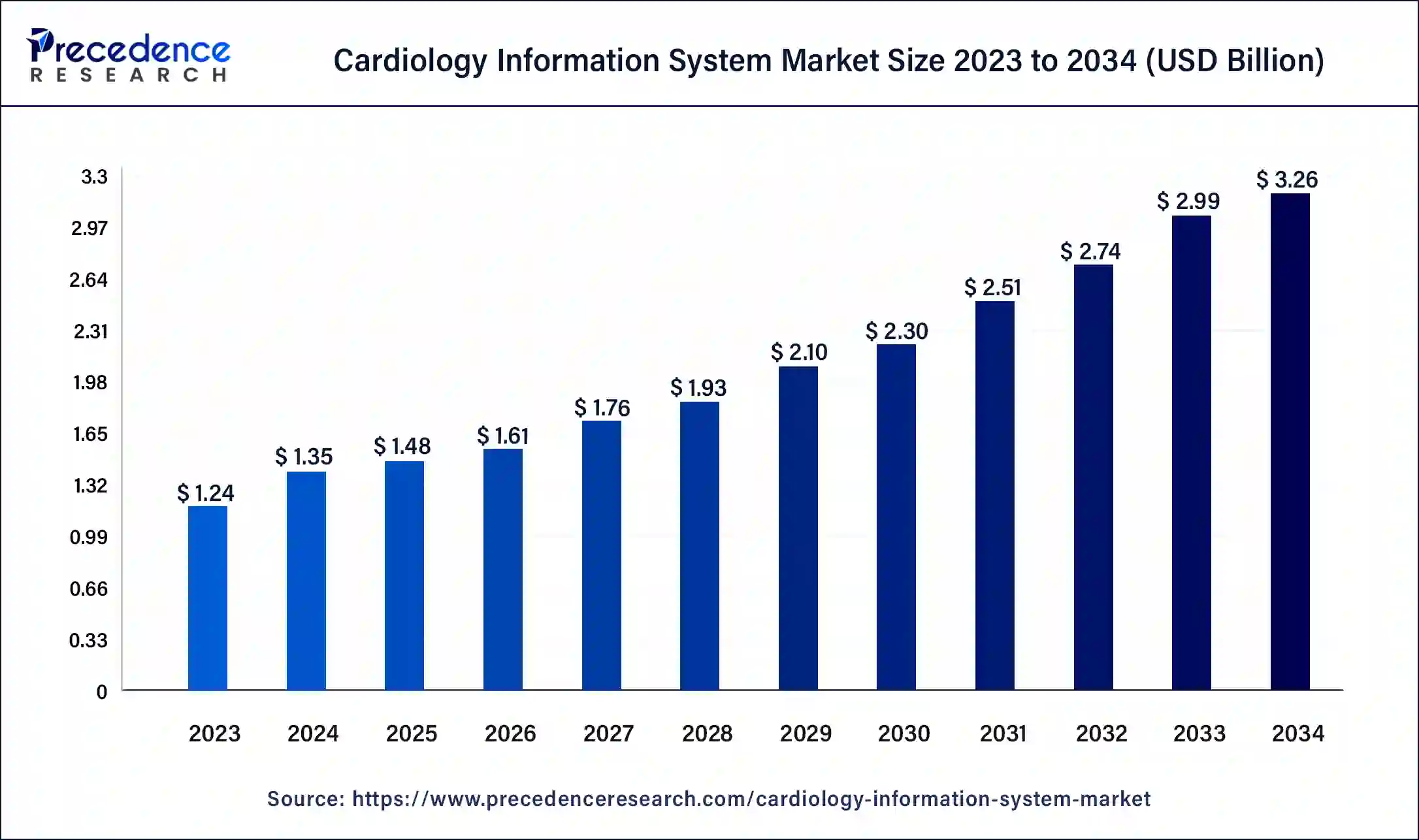

The global cardiology information system market size was USD 1.24 billion in 2023, calculated at USD 1.35 billion in 2024 and is expected to reach around USD 3.26 billion by 2034. The market is expanding at a solid CAGR of 9.20% over the forecast period 2024 to 2034. The North America cardiology information system market size reached USD 410 million in 2023. The rising demand for an efficient software platform for the management of cardiovascular diseases management platform is driving the growth of the market.

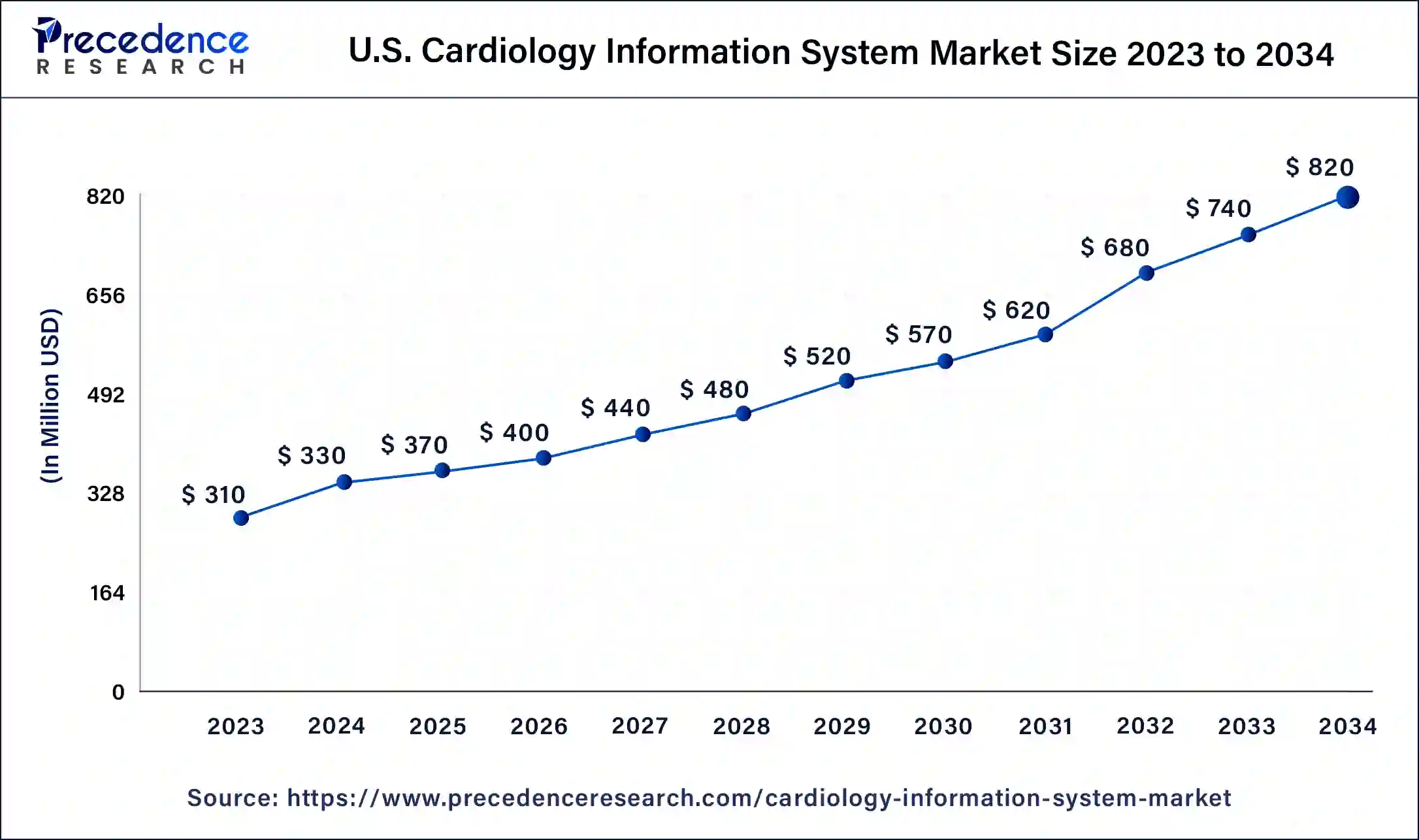

The U.S. cardiology information system market size was exhibited at USD 310 million in 2023 and is projected to be worth around USD 820 million by 2034, poised to grow at a CAGR of 9.24% from 2024 to 2034.

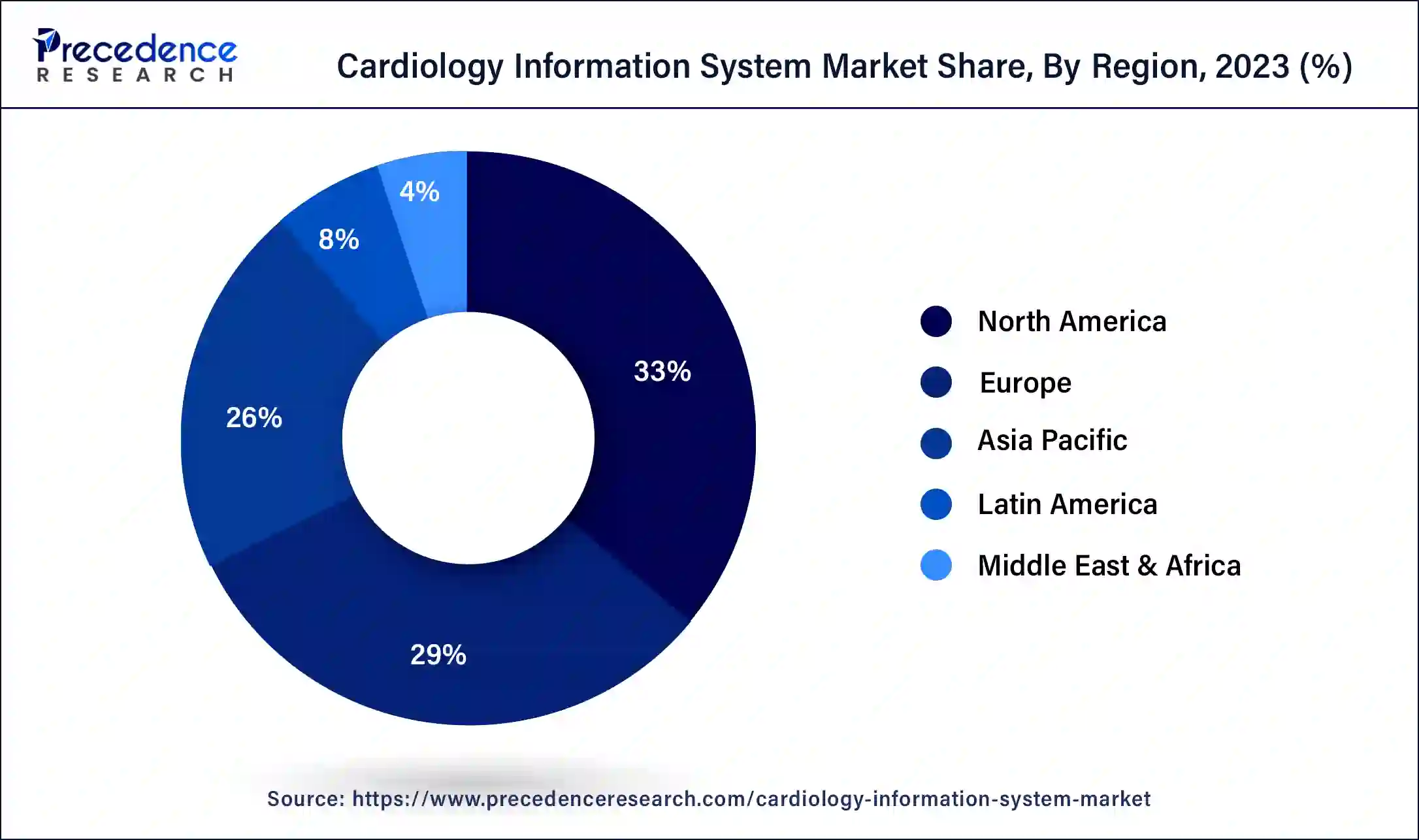

North America dominated the market with the largest cardiology information system market share in 2023. The growth of the market is attributed to the rising cases of cardiovascular diseases in the elderly population due to the aging factors and weaker immune systems that drive the number of cases in the region. The rising number of cases results in large clinical databases, patient health history, and other data that drive the demand for the software platform to streamline the management of data that drives the adoption of the cardiology information system in the region. Additionally, the rising healthcare infrastructure and the higher integration of technologies in healthcare facilities are further fueling the growth of the market in the region.

Asia Pacific is expected to grow at the fastest rate during the forecast period. The growth of the market is owing to the rising population and the increasing demand for healthcare facilities due to the rising penetration of several diseases in the population. The increasing rate of cardiovascular diseases among the population due to the changing lifestyle preferences that drive the number of cases and rise in the clinical data drives the demand for the data management software platform that drives the growth of the cardiology information system market in the region.

The cardiology information system is the software that is specially designed for efficiently storing, managing, and analyzing the rising number of clinical data of patients with cardiovascular diseases. It is used in the storage and analysis of clinical data for treating, diagnosing, and managing diseases. It is a specialized software program that is customized for cardiac surgeons, cardiologists, and other medical professionals who are associated with heart-related conditions. The cardiology information system helps in maintaining and managing the operation workflow and patient care by combining several aspects of cardiology. It automates tasks like reporting and scheduling and helps reduce the paperwork. The rising cases of cardiovascular disease globally are driving the growth of the cardiology information system market.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.26 Billion |

| Market Size in 2023 | USD 1.24 Billion |

| Market Size in 2024 | USD 1.35 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.20% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Mode of Operation, System, Component, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of cardiology information systems by hospitals

There has been a rise in the adoption of the cardiology information system by several cardiologists and cardiac practices to improve and streamline the workflow that drives the growth of the market. The rising implementation of CIS solutions in hospitals and various healthcare organizations automates and streamlines the workflow of the cardiology departments. It helps in scheduling, communication, and billing. The CIS helps in corporate patient care by enabling actions and communication between cardiologists.

The CIS solution automatically provides insights to the radiologist for reviewing the medical images, notifies nursing staff of the right time for transferring the patients to the recovery area, and allows cardiologists to make any required changes in the patient’s conditions. Thus, the higher adoption of the cardiology information system by healthcare institutes and professionals drives the growth of the cardiology information system market.

High cost

The increased cost of the installation and the services associated with the cardiology information system due to the higher integration of modern technologies into the solution and the high cost of the treatment for heart-related diseases that restraints the growth of the cardiology information system market.

Integration of artificial intelligence and advanced analytics

The rising advancement and integration of modern technologies like advanced analytics and artificial intelligence into the cardiology information system helps in allowing risk stratification, predictive analytics, and decision-making. AI-powered CIS solutions help physicians make informed decisions in patient treatment by using predictive analytics to improve patient outcomes and minimize the burden on healthcare professionals. Additionally, other advancements in healthcare, such as remote monitoring, mobile applications, cloud-based solutions, and others, are further contributing to the growth opportunity for the cardiology information system market.

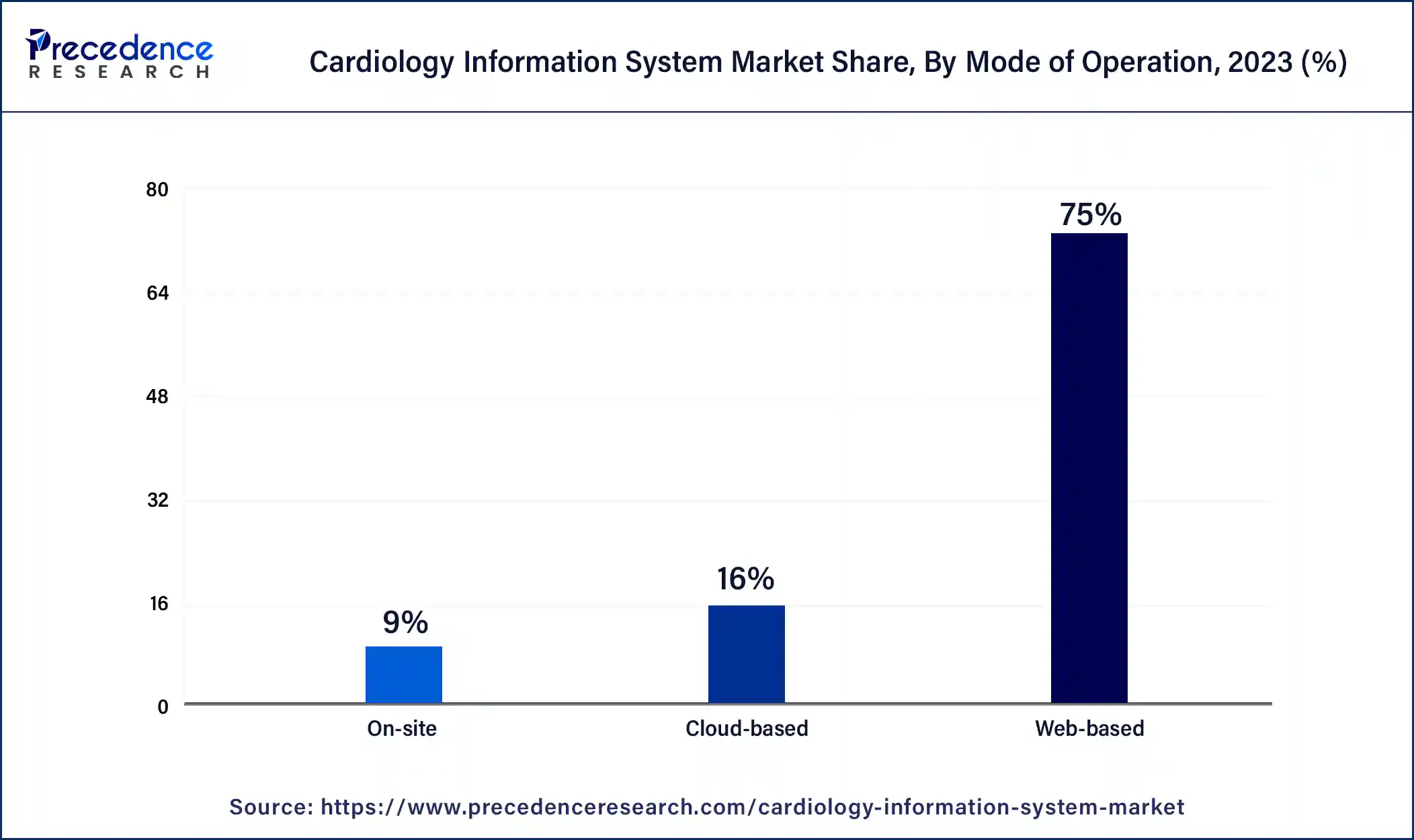

The web-based segment dominated the cardiology information system market with the largest share in 2023. The growth of the segment is owing to the rising implementation of web-based operations for cardiology treatment due to its beneficial properties that make them suitable for enabling services in any condition.

The web-based operation works remotely from any remote location with the penetration of the internet. Web-based CIS can be accessible by a good connection to the internet by any remote electronic device like laptops, computers, smartphones, tablets, and others. Web-based CIS minimized the requirement of the on-premise setup in healthcare settings. It is the most affordable type of operation that minimizes the overall cost of the operations.

The cardiovascular information system (CVIS) segment accounted for the largest share of the cardiology information system market in 2023. The increasing number of cardiovascular diseases in the elderly population and the rising adoption of several treatment and diagnostic procedures that create a vast amount of clinical data of the patient causes a higher demand for efficient software systems for the management of the database, which drives the demand for the cardiovascular information system.

The CVIC enables image management properties that allow retrieval, storage, viewing, and further analysis of several cardiovascular diseases. The cardiovascular information system is used by several cardiologists to streamline the treatment process of patients and allow them to review medical reports and images for better decision-making regarding patient health.

The software segment held the dominant share of the cardiology information system market in 2023. The rising adoption of the cardiology information system by the cardiologist and the wide range of cardiology departments, hospitals, clinics, and others for managing and streamlining operations. Cardiology information systems are customized with various templates, workflow, and formats for matching cardiology preferences and practices.

The cardiology information system helps in managing the operational workflow and enhances patient care. This software helps improve cardiology practices, such as maintaining patient data management, diagnostic and reporting, clinical decision support, workflow management, integration with other health information systems, and quality improvement.

The echocardiography segment dominated the cardiology information system market with the largest share in 2023. Echocardiography is one of the diagnostic procedures in which the machine uses sound waves to capture the image of the heart and identify the blood flow through the heart and heart valves. Echocardiography is commonly known as the heart ultrasound or heart sonogram. Echocardiography labs are highly using the cardiology information system for storing, retrieving, and managing 2D, 3D, and Doppler images.

The hospital segment dominated the cardiology information system market in 2023. The growth of the segment is attributed to the rising adaptation of hospitals and other healthcare institutes for the diagnosis and treatment of any type of disease and the increasing preference for the adoption of hospitals by patients with heart-related issues.

The rising cases of cardiovascular disease among the population due to the changing lifestyle is driving the number of databases of the patient’s history, and other health-related data is driving the growth of the cardiology information system market in the hospital sector. Hospitals utilize several imaging procedures, such as cardiac Magnetic Resonance Imaging (MRI), echocardiography, nuclear imaging, and CT angiography. All these procedures create a large amount of patient data that drives the demand for cardiology information systems for the management of clinical data and drives the growth of the market.

Segments Covered in the Report

By Mode of Operation

By System

By Component

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2023

January 2025

January 2025