December 2024

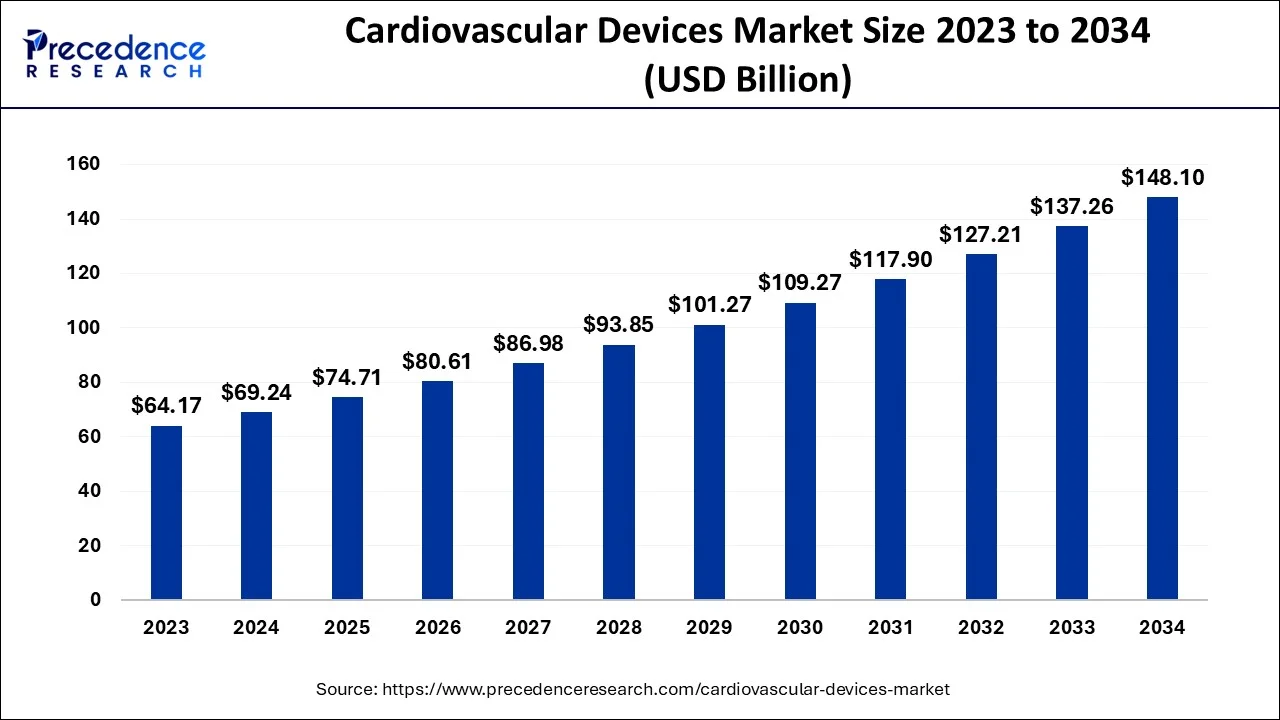

The global cardiovascular devices market size accounted for USD 69.24 billion in 2024, grew to USD 74.71 billion in 2025 and is projected to surpass around USD 148.10 billion by 2034, representing a healthy CAGR of 7.90% between 2024 and 2034. The North America cardiovascular devicesmarket size is calculated at USD 32.54 billion in 2024 and is expected to grow at a fastest CAGR of 8.01% during the forecast year.

The global cardiovascular devices market size is estimated at USD 69.24 billion in 2024 and is anticipated to reach around USD 148.10 billion by 2034, expanding at a CAGR of 7.90% from 2024 to 2034.

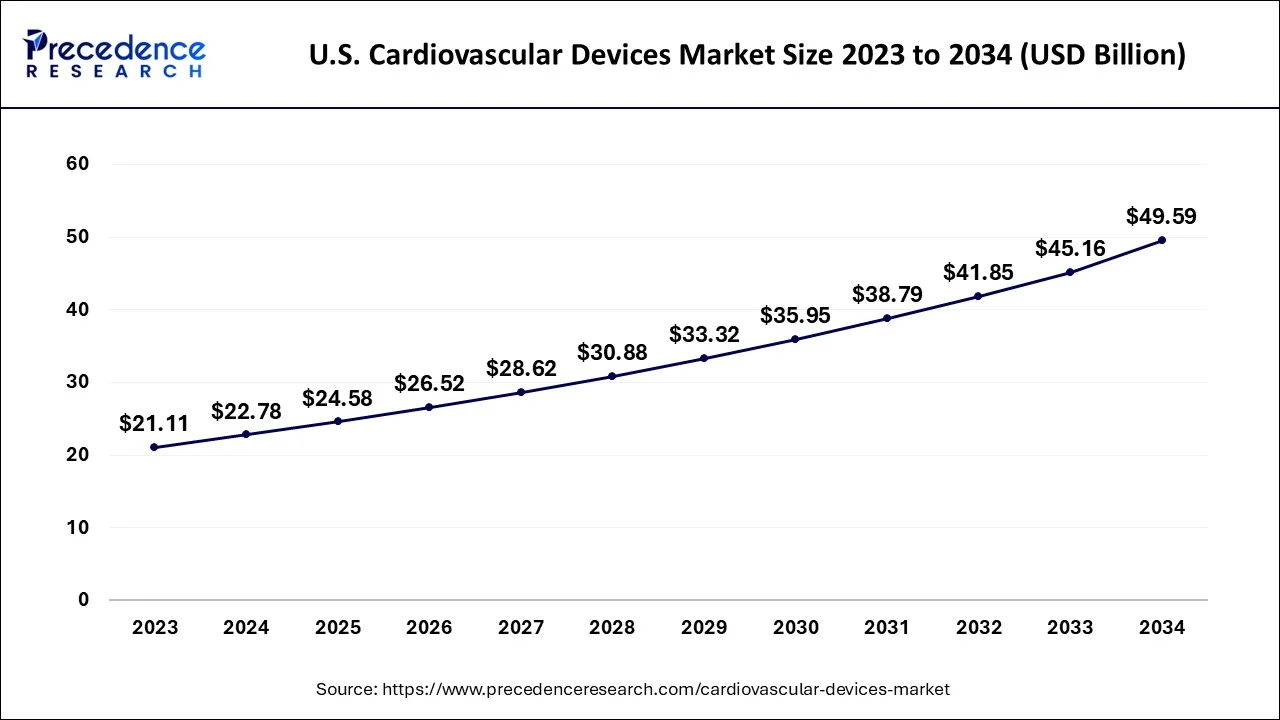

The U.S. cardiovascular devices market size accounted for USD 22.78 billion in 2024 and is predicted to be worth around USD 49.59 billion by 2034, growing at a CAGR of 8.08% from 2024 to 2034.

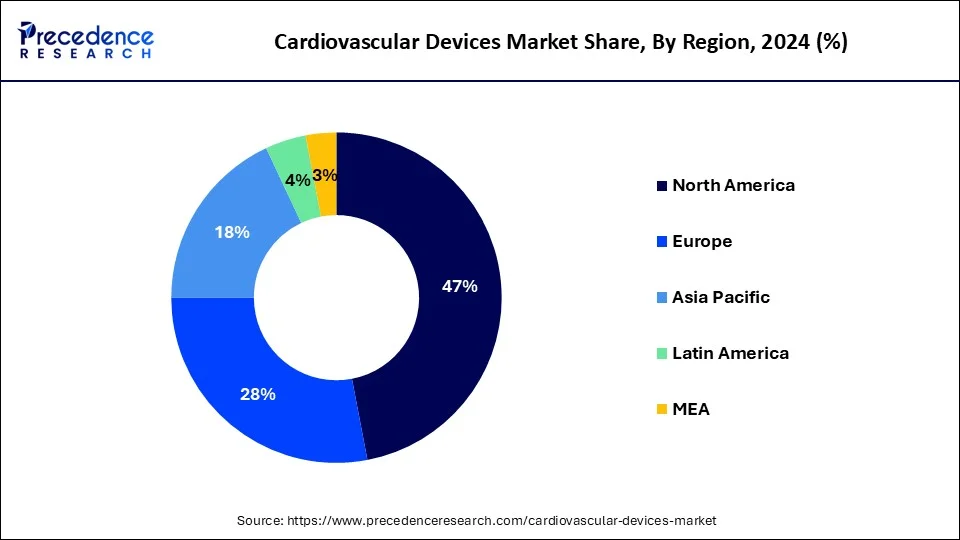

North America dominated the global cardiovascular devices market in 2023. The presence of several top manufacturers in the region along with the growing burden of cardiovascular diseases in US is augmenting the demand for the cardiovascular devices in the region. According to the American Heart Association, around 18.6 million deaths were associated with the cardiovascular diseases in US in 2019. The increased healthcare expenditure and improved access to the healthcare facilities has significant contributions in the market growth. Moreover, the higher adoption rate of the innovative medical devices among the population has driven the demand for various cardiovascular devices. The presence of developed and advanced healthcare infrastructure in North America coupled with the favorable reimbursement policies has fostered the demand for the various diagnostic devices and surgeries in North America.

Asia Pacific is estimated to be the fastest-growing market during the forecast period. Asia Pacific is characterized by the presence of huge population, rising prevalence of cardiovascular diseases, rising healthcare expenditure, and rising investments by the government towards the development of sophisticated healthcare infrastructure in the region that are expected to drive the growth of the cardiovascular devices market in the region. According to the World Health Organization, around 75% of the cardiovascular diseases related deaths occur in low and middle income countries. The rising accessibility to healthcare services and rising affordability are fueling the adoption of the cardiovascular devices in Asia Pacific region. Moreover, the rapidly growing geriatric population in the region is further expected to influence the demand for the cardiovascular devices. According to the United Nations, around 80% of the global geriatric population is expected to live in low and middle income countries by 2050.

The global cardiovascular devices market is significantly driven by the growing prevalence of chronic cardiovascular diseases across the globe. According to the World Health Organization, cardiovascular diseases are the leading cause of death across the globe. Cardiovascular diseases results in around 17.9 million deaths each year, globally. The major causes of the cardiovascular diseases include high consumption of salt in diet, increased consumption of tobacco, rising prevalence of smoking, and higher alcohol consumption. The cardiovascular diseases can be treated effectively by detecting it early. Therefore, the rising demand for the early diagnosis of the cardiovascular diseases is expected to drive the growth of the global cardiovascular devices market. Moreover, an alarming rise in obese population and physical inactivity is increasing the risks of cardiovascular diseases, which is expected to augment the demand for the cardiovascular devices across the globe. Growing geriatric population across the globe is another major factor behind the market growth. The old age people have higher chances of developing cardiovascular related diseases. According to the United Nations, the global geriatric population is estimated to reach at around 2 billion by 2050.

The new product launches with innovative and new features is expected to boost the demand for the cardiovascular devices. For instance, in February 2021, Remo Care Solutions introduced a new AI based remote monitoring device for the cardiac patients that analyzes the cardiovascular conditions of the patients in real-time. The growing demand for the efficient and innovative cardiovascular devices to reduce the deaths related to the cardiovascular diseases is significantly driving the growth of the global cardiovascular devices market. Moreover, the integration of the latest technologies like artificial intelligence (AI) in the cardiovascular devices is improving the patient care services and reducing the mortality of the cardiac patients. The rising investments by the top market players in the development and clinical trials of advanced cardiovascular devices is opening new growth avenues that will foster the market growth in the forthcoming years.

| Report Coverage | Details |

| Market Size in 2024 | USD 69.24 Billion |

| Market Size by 2034 | USD 148.10 Billion |

| Growth Rate from 2024 to 2034 | 7.9% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Device, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

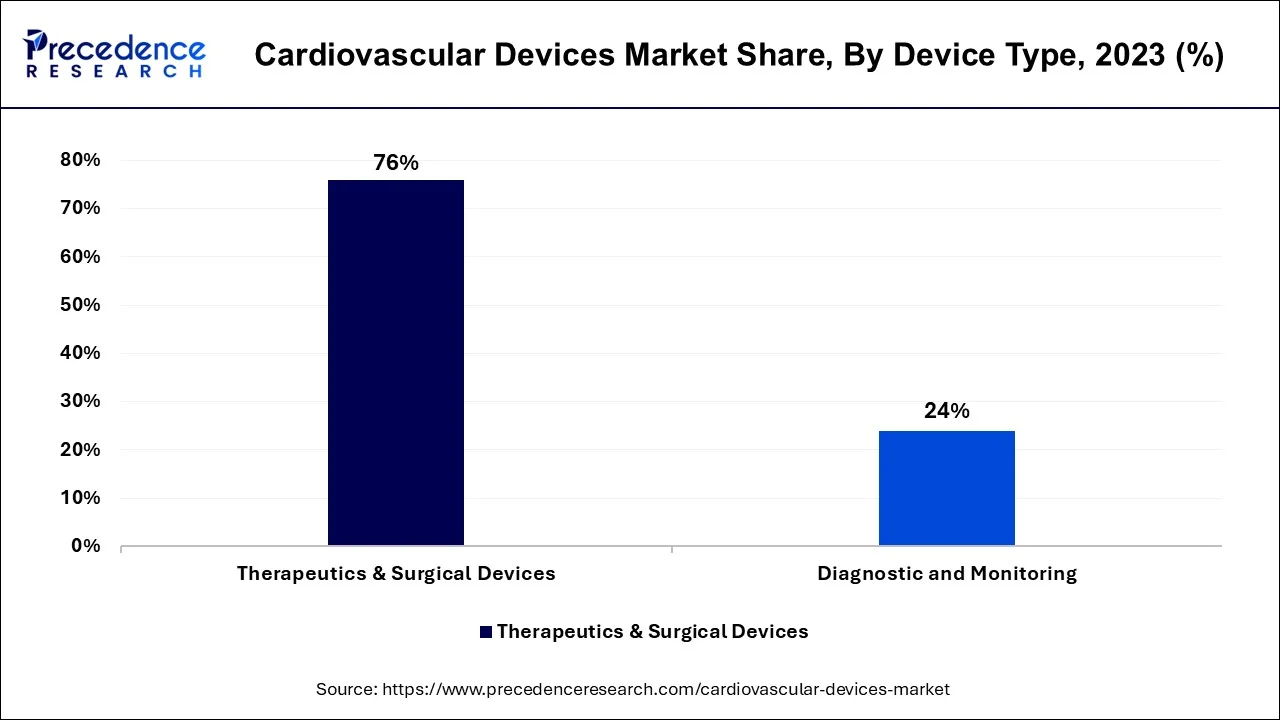

The therapeutics & surgical devices segment dominated the market with a 76% revenue share in 2023. This is attributed to the increased number of bypass surgeries across the globe. The increased demand for cardiac rhythm management devices, stents, and catheters has pumped the revenue generation of this segment. The increased awareness regarding the cardiovascular diseases and easy availability of the devices has fostered the segment’s growth.

On the other hand, the diagnostic and monitoring is estimated to be the most opportunistic segment during the forecast period. The rising demand for the early diagnosis of the cardiovascular diseases is fueling the growth of this segment. The rising awareness among the population regarding the benefits of the early detection of CVDs and effective treatment availability are the major factors behind the growth of the diagnosis and monitoring segment.

Based on the application, the coronary artery disease segment dominated the global cardiovascular devices segment in 2023. The increased prevalence of the coronary artery diseases has fueled the sales of the coronary stents in the market. The rising popularity of the stents in the treatment of coronary artery disease is expected to sustain the dominance of this segment throughout the forecast period.

The cardiac arrhythmia is estimated to be the most opportunistic segment during the forecast period. This is attributable to the rising demand for the pacemakers. The growing investments in the development of innovative pacemakers with innovative features are expected to drive the market growth in the upcoming years. For instance, Medtronic launched a pacemaker that has BlueSync technology, in India.

Segments Covered in the Report

By Device Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

March 2025

October 2024

February 2025