December 2024

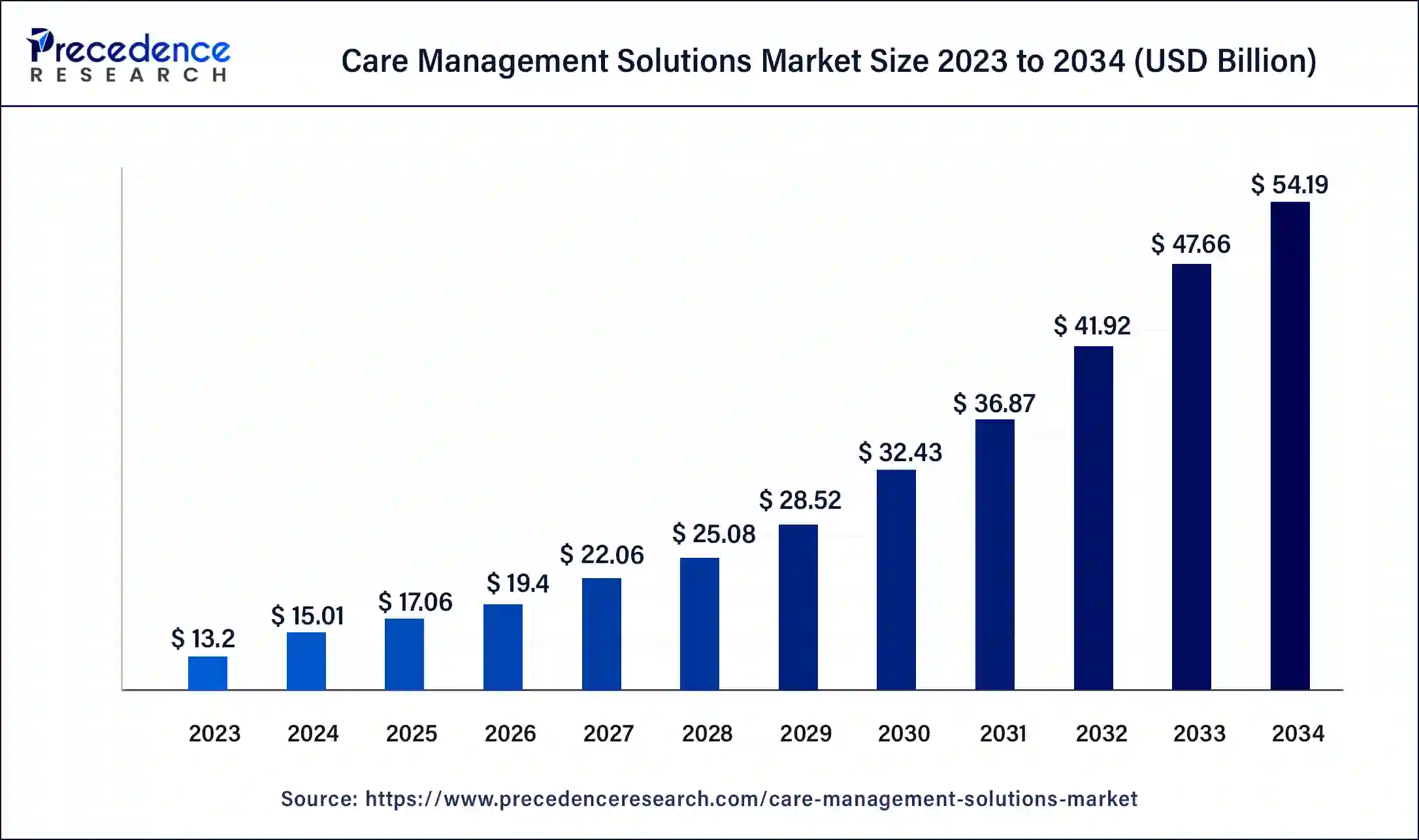

The global care management solutions market size was USD 13.2 billion in 2023, calculated at USD 15.01 billion in 2024 and is expected to reach around USD 54.19 billion by 2034, expanding at a CAGR of 13.7% from 2024 to 2034.

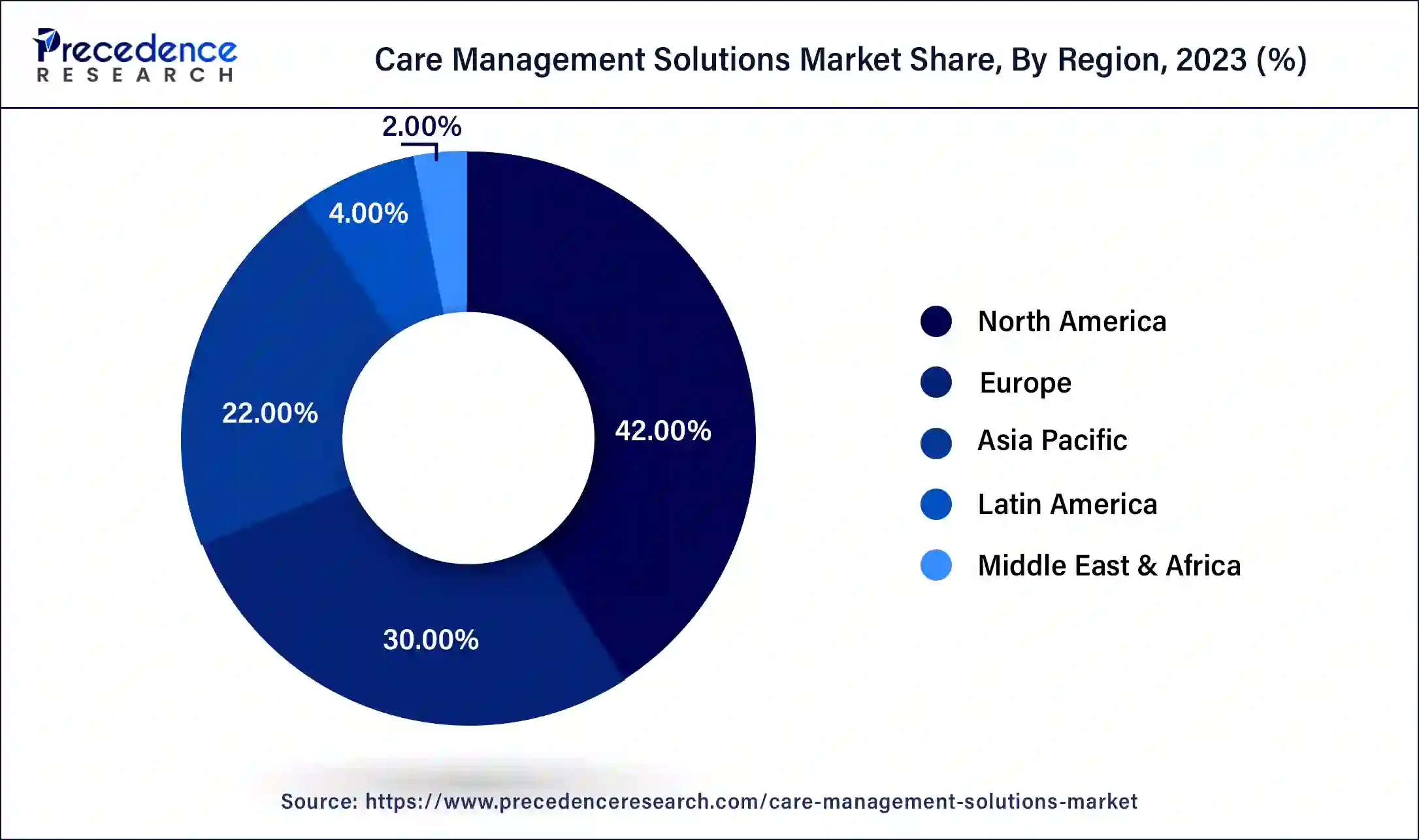

The global care management solutions market size accounted for USD 15.01 billion in 2024 and is expected to reach around USD 54.19 billion by 2034, expanding at a CAGR of 13.7% from 2024 to 2034. The North America care management solutions market size reached USD 5.54 billion in 2023.

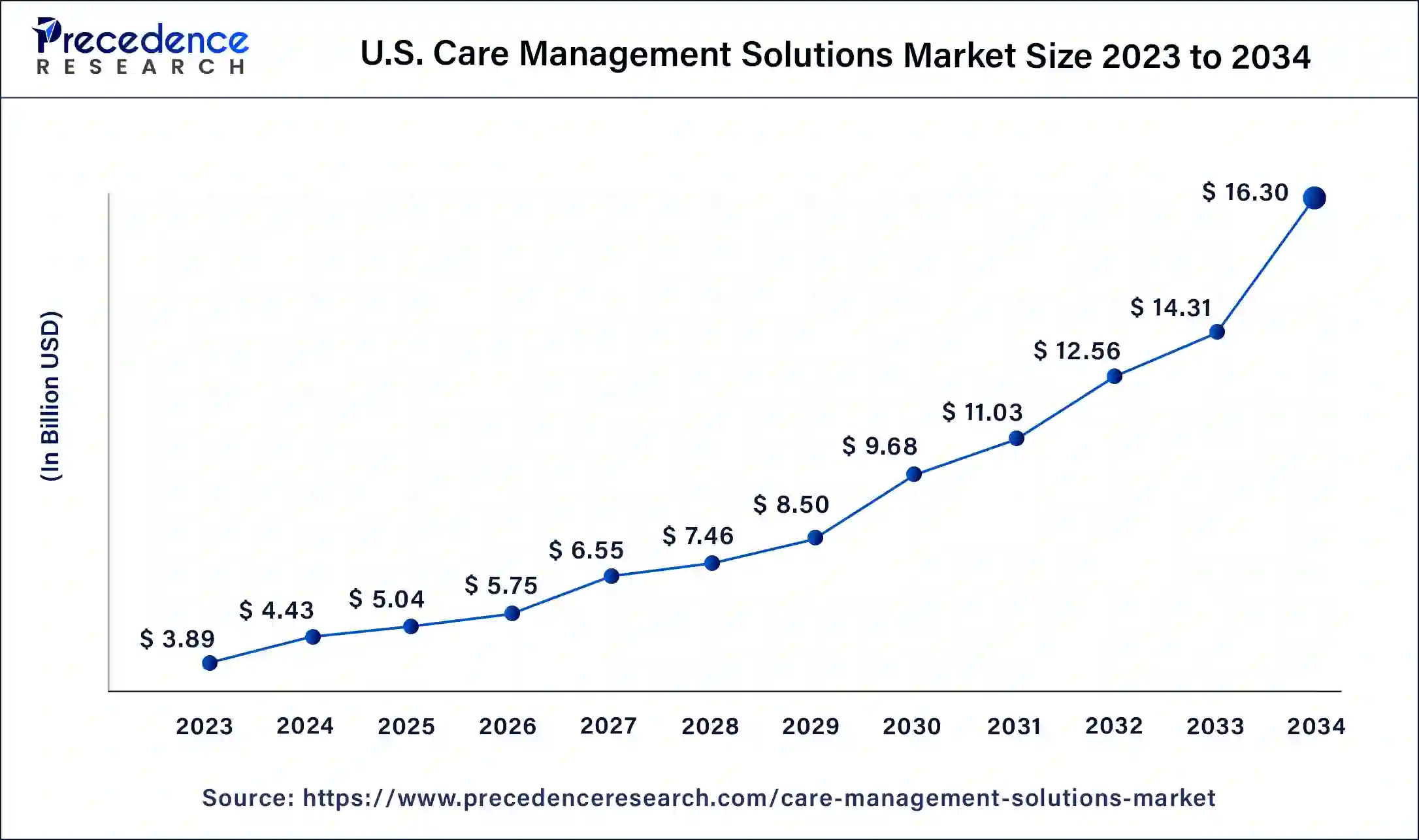

The U.S. care management solutions market size was estimated at USD 3.89 billion in 2023 and is predicted to be worth around USD 16.30 billion by 2034, at a CAGR of 13.9% from 2024 to 2034.

North America holds the dominant market share and is anticipated to sustain its dominance during the fourth coming time period. Owing to the IT results advancements and arise in affordable and scalable results demand in order to curb the cost of healthcare. Furthermore, Asia-Pacific is expected to record fastest growth rate in the care management solution market, in the upcoming time period, due to growing government enterprises and the adding growing population.

Asia Pacific also presents economic openings in the market. Enhancement of healthcare installations due to rapid economic development witnessed in arising countries similar as China, Japan, South Korea, and India is one of the high impacts rendering market driver. Rising interest and investments by prominent key market players and ongoing cooperative efforts are also responsible for regional growth.

Care management solution offer holistic care operation software to give better quality of care, make better opinions and to achieve stylish possible health. These results are patient-centric and aid in better population health & medical operation. The care management solution aid in easy data access for the physicians at distant locales and give with information on collaboration & care, cooperative care planning, complaint & application operation. The care management solution allows identifying and covering the high- threat populations. Also, these results helping in determining the applicable situations of care and managing interventions. In addition, the growth of the care management solution market can be attributed to the growing senior population, adding frequentness of habitual conditions, and rising operation of case-centric results by the healthcare providers. Also, perfecting advancements in IT results and big data capabilities add new openings for the global care management solution market over the cast period.

In addition, numerous initiatives have been taken worldwide in order to move the risk borne burden via healthcare payers to providers. This shift promotes the healthcare information technology (HCIT) solutions adoption (like care management solutions) in order to reduce unnecessary costs and enhance the efficiency of healthcare delivered. Furthermore, value-based care is further promoted via alternative models of payment like bundled payments, consumer incentives, and physician incentives, are few among others. These payment models are designed in order to motivate the healthcare providers to accept the responsibility of care delivered, thus this is causing a leading shift of risk from payers to providers.

While shocking, the US is reported to have some of the worst metarnal health issues in the advanced world. A new care model of metarnal and infant health is heralded, and VBC and care operation could make a major, positive impact. Marketable insurers like UnitedHealthcare, Humana, and Cigna have announced programs to test maternal health packets in specific markets. These packets further include obstetric and primary care through to 60 to 90 days perinatal, and thus influence providers to came across settings and stages of a woman’s health. For 2020, it’s possible to see the launch of a public demonstration of motherly packets through the Center for Medicare & Medicaid Innovation.

The major market players are adopting strategies such as collaboration, merger, acquisition, partnership, and joint venture to increase their market share and attract target market on a large scale. In addition, the market players are also collaborating with government agencies, to launch new technologically enhanced products in the care management solutions market.

Furthermore, one of the key drivers driving the expansion of the global care management solutions market is technological developments and introduction of innovative products in the market. The government is also providing subsidies and tax benefits for the development of care management solutions.

| Report Coverage | Details |

| Market Size in 2023 | USD 13.2 Billion |

| Market Size in 2024 | USD 15.01 Billion |

| Market Size by 2034 | USD 54.19 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 13.7% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Mode of Delivery, End User, Application, Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

On the basis of component, the market is divided into services and software, where software accounted for the dominant market share in 2023 and is likely to retain its dominance through the forecast year 2034. The segment is further poised to be the fastest growing segment during the forecast period, as it is comfortable to use and affordability of software is another factor boosting its demand in the market. In addition, the software segment further provide efficient and coordinated care. it enables the providers to diagnose the patients more effectively, minimize the chances of errors during surgery, monitor vitals and medications of the patient, and generate digital records for clinical research.

On the basis of mode of delivery, the market is segmented into cloud-based, web-based, and on premise. The web-based segment accounted for the largest share in 2023 while cloud-based offerings are expected to register the fastest growth rate during the forthcoming time period. In addition, the scale up of cloud-based solutions are easy depending on patient base, deliver higher flexibility, and are more affordable than other delivery modes. Therefore, such factors are responsible largely for sudden growth of the segment till the forecast period 2034. Furthermore, rise in adoption of electronic health records by healthcare providers to improve security, accessibility, and storage capabilities is have been further observed which have led cloud-based offerings to be a massive cost savings solution.

On the basis of end use, the market is classified into healthcare payers, healthcare providers, and others which include employers and governments. Furthermore, healthcare providers has the majority of the market share during the year 2023 due to rising demand regarding rising increasing need for faster services, improved quality of healthcare, patient-centric care, and up surging patient base.

The key players of the healthcare system rely majorly on clinical models and statistical models. Where huge data analysis aids them in identifying members of certain chronic conditions and helps them to formulate the most relevant care management programs essential for the patients. It further helps them rise the healthcare management programs efficiency.

Segments Covered in the Report

By Component

By Mode of Delivery

By End User

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

January 2024

September 2024