November 2024

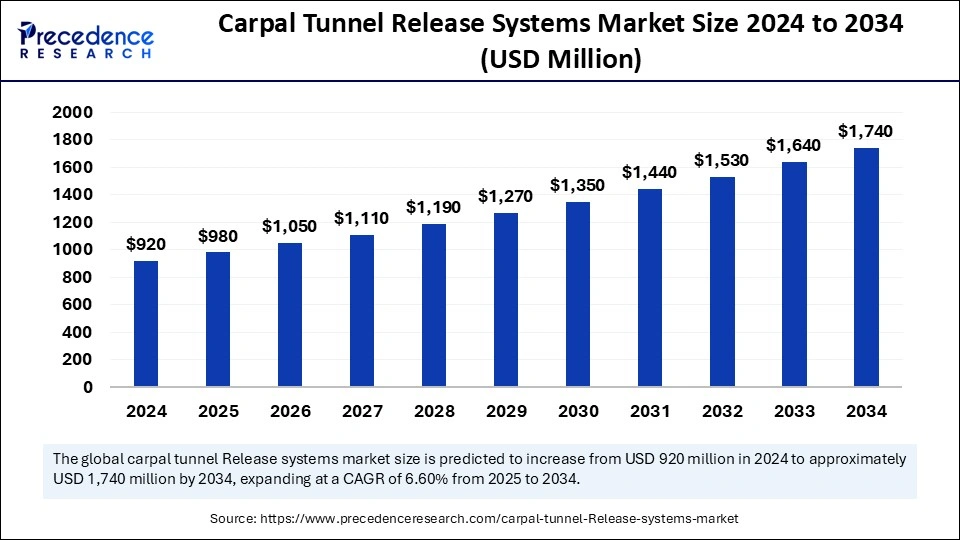

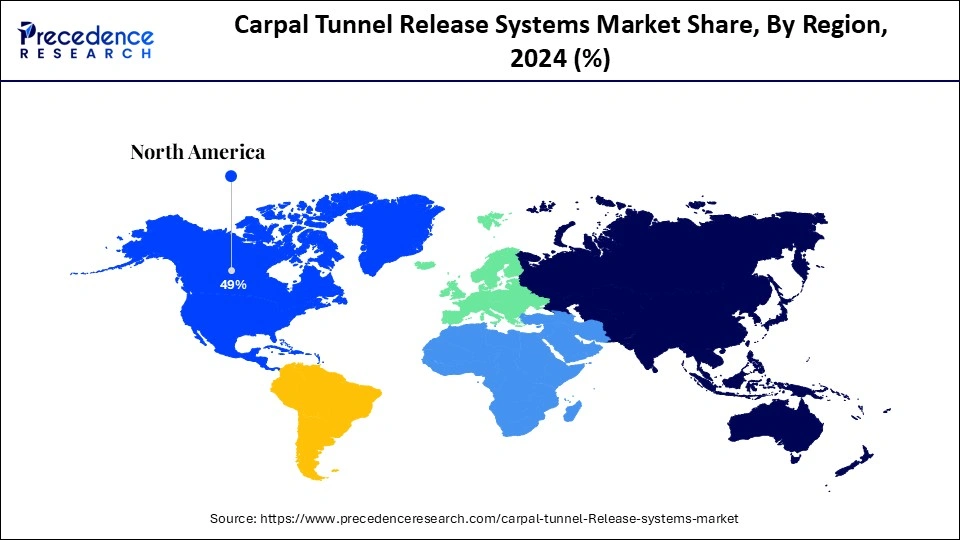

The global carpal tunnel release systems market size is calculated at USD 980 million in 2025 and is forecasted to reach around USD 1,740 million by 2034, accelerating at a CAGR of 6.60% from 2025 to 2034. The North America market size surpassed USD 450.80 million in 2024 and is expanding at a CAGR of 6.68% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global carpal tunnel release systems market size accounted for USD 920 million in 2024 and is predicted to increase from USD 980 million in 2025 to approximately USD 1,740 million by 2034, expanding at a CAGR of 6.60% from 2025 to 2034. The carpal tunnel release systems market growth is attributed to advancing minimally invasive techniques, rising occupational risk factors, and increasing adoption of high-precision surgical solutions.

Medical procedures are achieving advanced functional enhancements through artificial intelligence systems, as surgeons utilize Artificial Intelligence for surgical solution development and operation. In the carpal tunnel release systems market, robotic-assisted systems surgeons achieve precision surgery with faster operations, alongside lower human error risks.

The analysis of big medical datasets by surgical team members through machine learning algorithms leads to patient-specific treatment options. Predictive analytics plays a critical role in detecting surgical complications ahead of operations, which enables doctors to take action proactively.

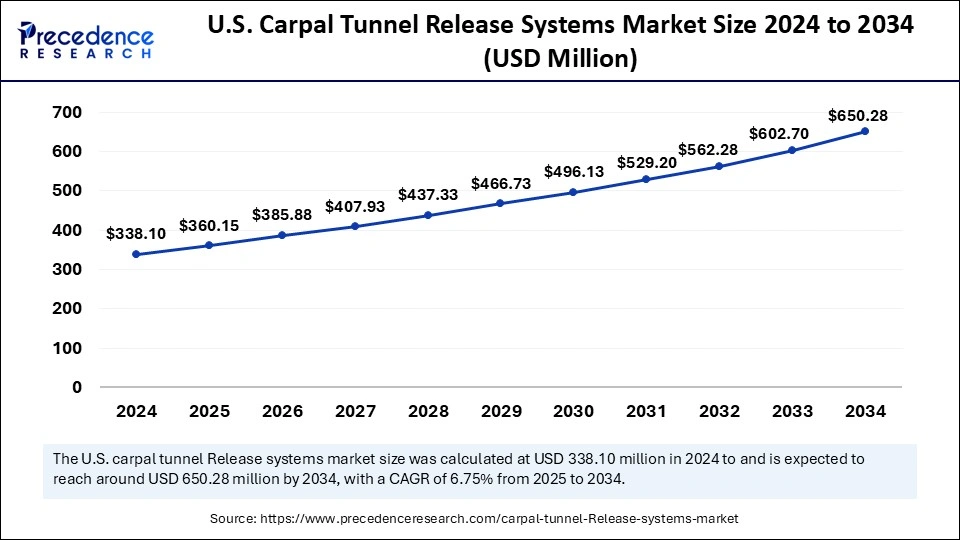

The U.S. carpal tunnel release systems market size was exhibited at USD 338.10 million in 2024 and is projected to be worth around USD 650.28 million by 2034, growing at a CAGR of 6.75% from 2025 to 2034.

North America accounted for the largest carpal tunnel release systems market share in 2024 due to the widespread presence of carpal tunnel syndrome (CTS) affecting many people in this area, as the workforce is manual labor and the aging of the population. The abundance of innovative healthcare services facilitates early detection and treatment of carpal tunnel syndrome, which leads to extensive system adoption. Furthermore, the ongoing technological developments in surgery and the significant participation of leading market companies both work together to keep North America at the forefront of this market.

CTE is considered one of the most prevalent work-related musculoskeletal disorders in Canada, particularly since employees who perform repetitive manual work are likely to develop this condition. The national healthcare system for CTS diagnosis and treatment offers entire coverage, which enables both non-operative and surgical procedures alongside proper care access to patients.

Asia Pacific is projected to host the fastest-growing carpal tunnel release systems market in the coming years, owing to the rising medical knowledge about CTS, along with better healthcare facilities in China and India. Different occupations emerging from economic development and urbanization with repetitive hand tasks drive up the numbers of people getting CTS. The carpal tunnel release procedures in this region are expected to experience an increase due to government initiatives that improve both the accessibility and affordability of healthcare services. Ribonucleic acid and carpal tunnel release procedures are achieving market growth expansion through the growing medical tourism industry and its affordable surgical intervention offerings in Asia Pacific.

CTS has become a major health risk throughout China based on physician-accredited statistics that show prevalence in the population. The growth of CTS cases is directly related to various impacts of industrial development alongside growing professions that require hand repetition. The occupational risk factors linked to CTS affect dental healthcare workers operating in India under similar conditions of industrial development. They work on developing their health care systems to detect and properly treat CTS, as it affects their workforce. Furthermore, the prevalence of CTS remains high throughout the region due to the workplace conditions, which improve the need for specialized healthcare actions.

The high number of people suffering from carpal tunnel syndrome (CTS) serves as a significant driver for the carpal tunnel release systems market. According to the ScienceDirect report from 2023, carpal tunnel syndrome is the most common entrapment neuropathy, significantly affecting the quality of life for many individuals. The rising number of cases demands new methods to address this medical condition successfully.

The carpal tunnel release systems function as medical equipment that cuts the transverse carpal ligament to reduce median nerve pressure, thus managing symptoms and protecting against nerve deterioration. Modifications in carpal tunnel release systems have advanced technology enough to create endoscopic carpal tunnel release procedures that deliver better outcomes than traditional surgeries by speeding up recovery times and producing fewer complications.

The FDA authorized in 2024 the VECTR – Video Endoscopic Carpal Tunnel Release System to facilitate minimally invasive procedures that release carpal ligaments or fascia during endoscopic carpal tunnel release surgeries. The rising sense of CTS awareness among patients has triggered both preventive measures and the market demand for efficient treatment solutions, which supports growth in the carpal tunnel release system business.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,74 Million |

| Market Size in 2025 | USD 980 Million |

| Market Size in 2024 | USD 920 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.60% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising prevalence of carpal tunnel syndrome

The increasing prevalence of carpal tunnel syndrome is anticipated to drive demand for advanced release systems, thus fuelling the carpal tunnel release systems market. A rising number of individuals are experiencing nerve compression in the wrist due to repetitive hand movements, prolonged computer use, and conditions such as diabetes and arthritis. The trend of CTS development stems from hand repetitions and computer overuse combined with pre-existing health problems, such as diabetes and arthritis.

Healthcare providers currently focus on rapid nerve damage identification along with ideal therapeutic approaches aimed at stopping permanent nerve damage. Endoscopic carpal tunnel release, among other minimally invasive surgical approaches, gains popularity since patients desire both decreased recovery periods and enhanced surgical comfort. Furthermore, the growing CTS prevention demand will further fuel the market in the coming years.

High procedure costs

Expensive surgical interventions, particularly endoscopic carpal tunnel release, pose financial challenges for patients and healthcare systems, thus hindering the market. People tend to limit their medical care access as cost requirements become evident in areas where health insurance is scarce. Increased costs stemming from specialized surgical equipment and advanced medical imaging systems, together with rehabilitation care, escalate total healthcare expenses. The limited budget capability of ambulatory surgical centers and hospitals restricts their purchase of modern equipment for innovation.

Rising investments in healthcare infrastructure

Governments and private organizations are allocating substantial funds to upgrade medical facilities and improve access to specialized surgical care, which further creates immense opportunities for the players competing in the market. The collection of significant funds by governments and private organizations enables medical infrastructure improvements to increase specialized surgical treatment accessibility.

Modern ambulatory surgery centers are expanding access to advanced carpal tunnel release procedures through their increasing number of centers. Through current funding initiatives, medical device producers gain support to develop innovative surgical systems, which speed up their market introduction. The approval process for innovative medical technologies speeds up regulatory institutions to provide market growth. Furthermore, the market expansion of carpal tunnel release systems is supported through investments in new treatment solutions and regulatory improvements, which improve both accessibility and affordability of procedures.

The European Medicines Agency started a pilot procedure in 2023 by establishing expert panels that review high-risk medical devices for manufacturers through scientific advisory services before finishing their first three procedures.

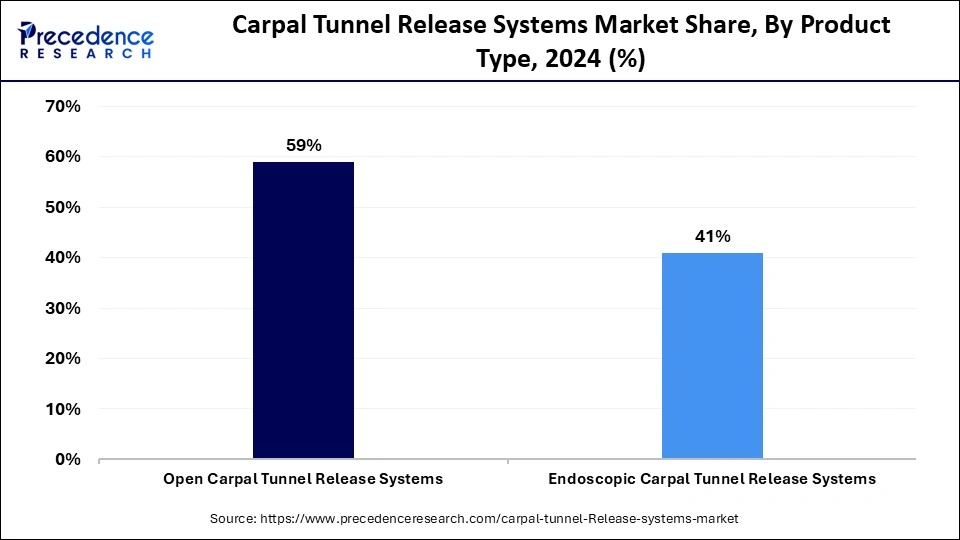

The open carpal tunnel release systems segment held a dominant presence in the carpal tunnel release systems market in 2024. The surgical technique requires surgeons to perform a cut that extends up to 2 inches across the wrist to cut the carpal ligament, which reduces median nerve pressure. The simple procedure combined with proven clinical data makes OCTR a preferred method for surgeons. People suffering from OCTR surgery need to recover for longer times while dealing with higher levels of postoperative discomfort than what occurs with minimally invasive surgical procedures.

The endoscopic carpal tunnel release systems segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034. Endoscopic carpal tunnel release allows surgeons to view the transverse carpal ligament through small incisions using an endoscope to minimize scar tenderness and decrease work recovery time beyond OCTR. The evidence shows that ECTR provides surgical patients with both reduced discomfort and speedier healing processes. Furthermore, the increasing interest in minimally invasive techniques relates to patient expectations for minimal recovery time and better aesthetic results, which drives professionals to predict increased usage of ECTR procedures in medical settings.

The hospitals segment accounted for a considerable share of the carpal tunnel release systems market in 2024, as they maintain large facilities together with skilled medical staff, which permits them to perform many carpal tunnel release operations. Hospitals have the capability to address intricate surgical cases by providing quick multidisciplinary medical access and top-level postoperative treatment through their sophisticated facilities. Hospitals function as educational centers by teaching new surgical treatments that encompass both open and endoscopic carpal tunnel release methods to provide surgeons with the most contemporary advances in surgical practice. Furthermore, the hospitals maintain their essential position in carpal tunnel release surgery delivery, as their dedication to education and continuous innovation development.

The ambulatory surgical centers segment is anticipated to grow with the highest CAGR during the studied years. The surgical approach has changed toward minimally invasive procedures, which matches well with ASC operational design, as it results in reduced recovery periods and lower operating costs. Patients decide to use ASCs because outpatient environments offer convenient settings along with reduced waiting periods. Medical technology advancements allow ASCs to undertake hospital-based procedures, which lifts their ability to expand their medical services. Carpal tunnel release systems in ASCs expand their market share with an increasing focus on healthcare delivery economics. Furthermore, the growth of outpatient care models in healthcare policy supports ASCs to take a major position in surgical service delivery.

By Product Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

March 2024

January 2025