January 2025

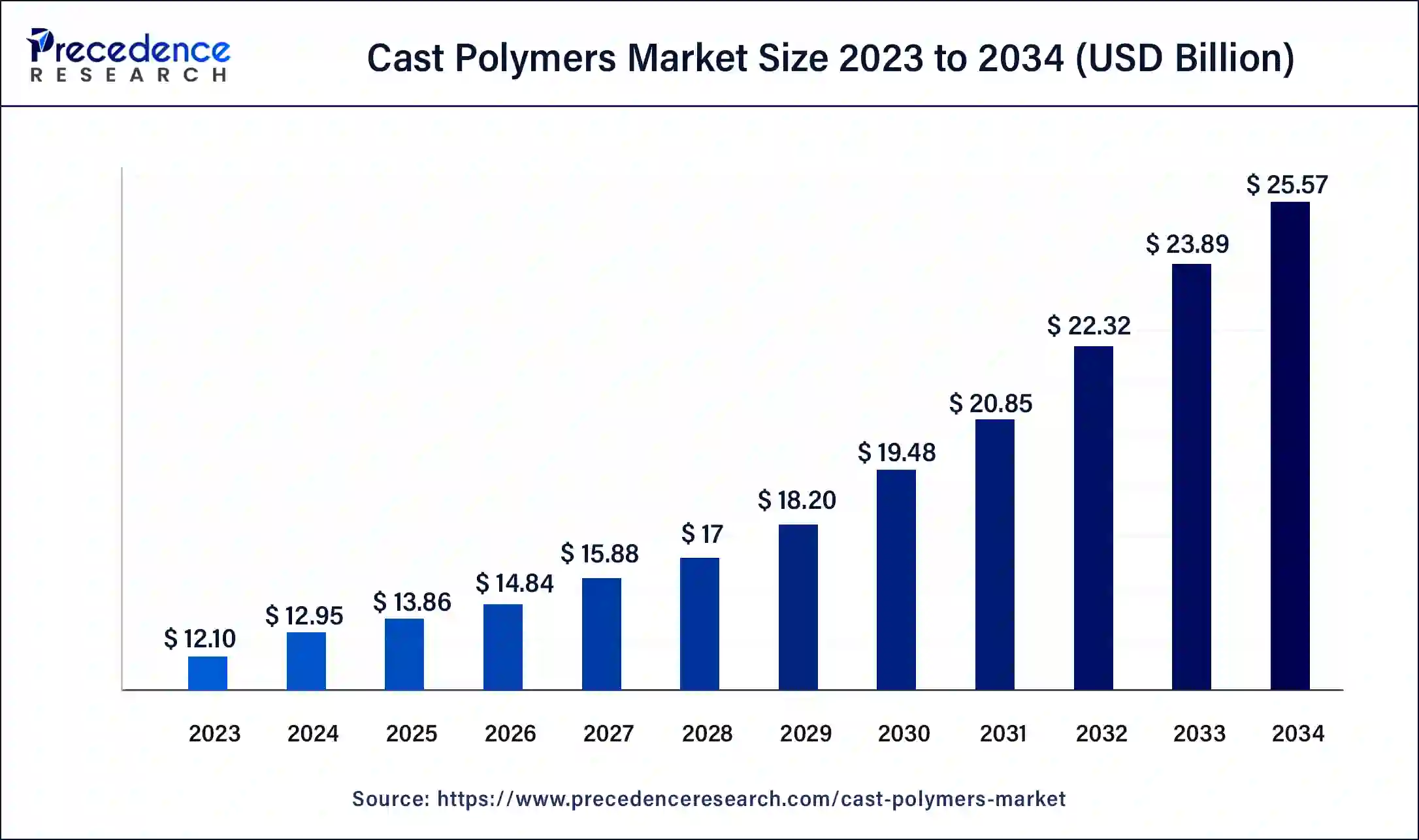

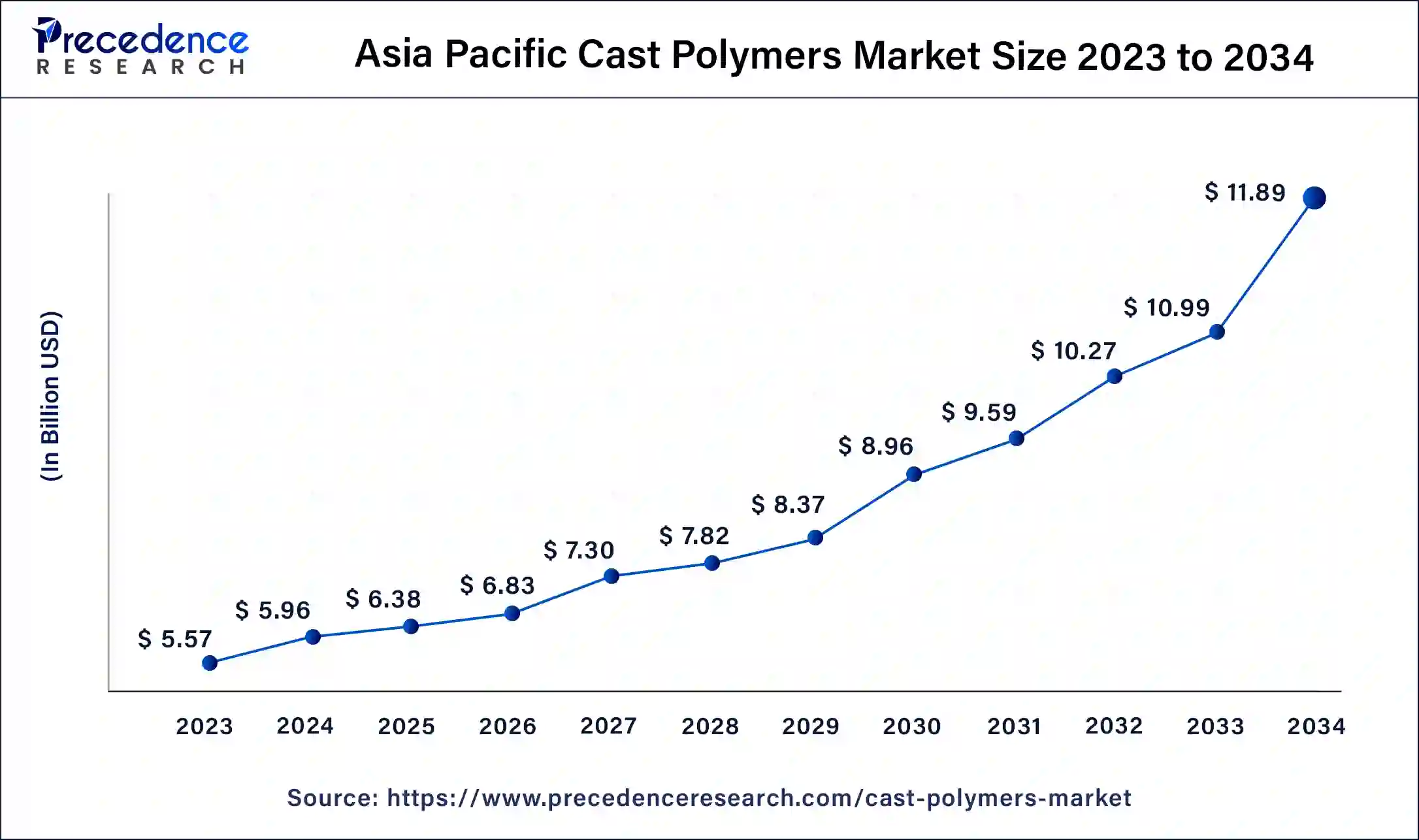

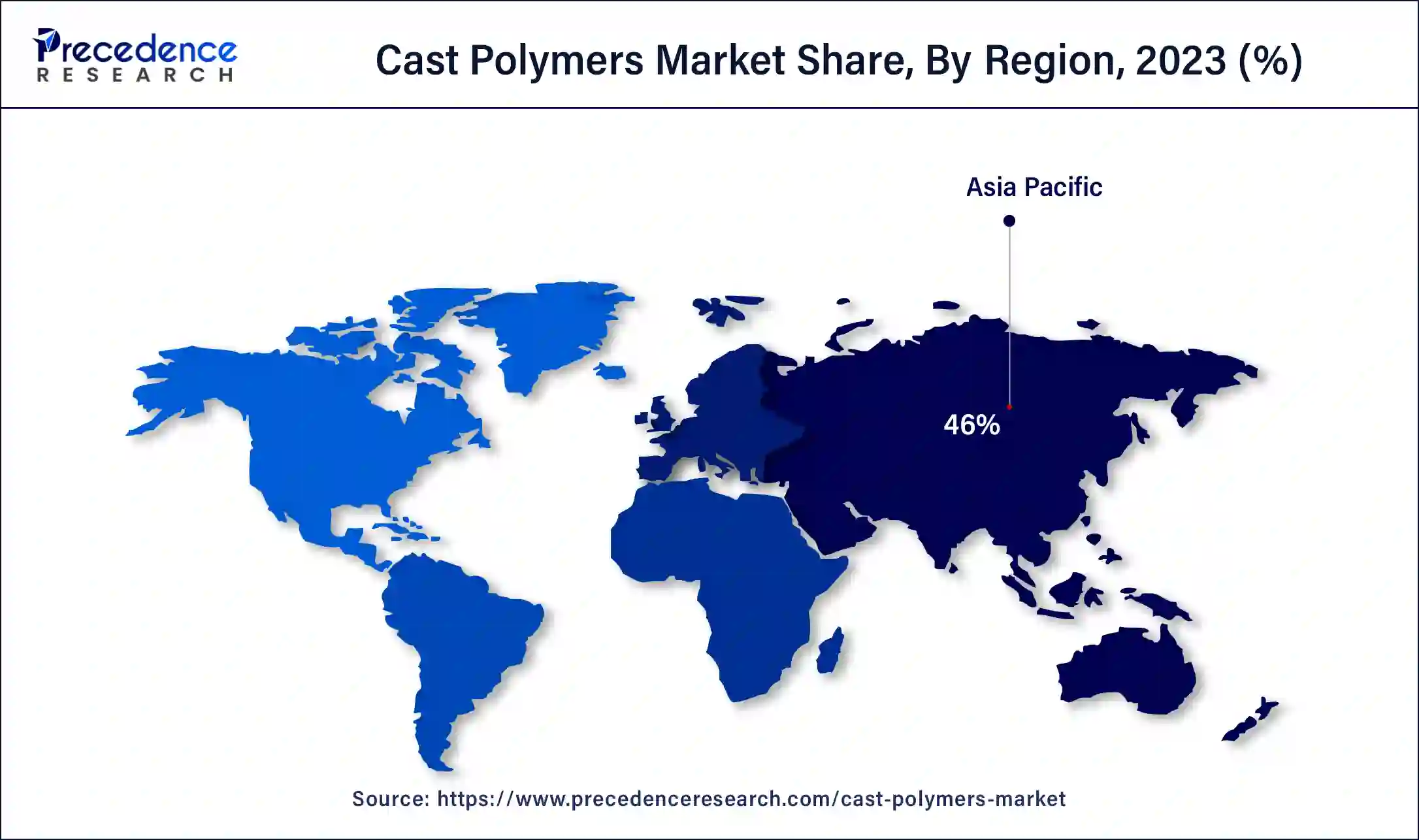

The global cast polymers market size is calculated at USD 13.86 billion in 2025 and is predicted to reach around USD 25.57 billion by 2034, accelerating at a CAGR of 7.04% from 2025 to 2034. The Asia Pacific cast polymers market size surpassed USD 6.38 billion in 2025 and is expanding at a CAGR of 7.13% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cast polymers market size was estimated at USD 12.95 billion in 2024 and is predicted to increase from USD 13.86 billion in 2025 to approximately USD 25.57 billion by 2034, expanding at a CAGR of 7.04% from 2025 to 2034. The increasing trend of luxury houses among rich people around the world has driven the growth of the cast polymers market.

The cast polymers market has experienced several developments, including rising developments in technologies associated with molding methods. Nowadays, cast polymer manufacturing companies have started AI in their manufacturing facility to increase the efficiency of workers and enhance the quality control process. Also, the introduction of AI in the casting process helps to reduce the errors in the finished products made from cast polymers.

The Asia Pacific cast polymers market size was exhibited at USD 5.96 billion in 2024 and is projected to be worth around USD 11.89 billion by 2034, poised to grow at a CAGR of 7.13% from 2025 to 2034.

Asia Pacific led the global cast polymers market in 2024. The growing emphasis on developing the construction industry in countries such as China, India, Japan, South Korea, Taiwan, and some others has increased the demand for cast polymers to cater to different customers. Also, the rising development in the infrastructural sector, along with the ongoing trend of bungalows and farmhouses, boosts the market growth.

The availability of raw materials such as alumina trihydrate, calcium carbonate, resins, and natural stone that are crucial for the production of cast polymers has contributed to industrial growth. Moreover, the rise in the number of schools and hospitals has increased the demand for cast polymer-based products in this region, thereby boosting market growth.

This region comprises several local companies of cast polymers, such as Swan Corporation and Link Composites Pvt. Ltd, Kyodo Chemical Co., Ltd., Zhong tian, Hyundai L&C, and others are constantly developing cast polymer products for numerous end-users in Asia Pacific, which in turn is expected to foster the growth of the cast polymers market.

North America is expected to grow at the fastest CAGR in the cast polymers market during the forecast period. The rise in the number of residential constructions in Canada and the U.S. has increased the demand for cast polymers. Also, the trend of luxurious corporate offices and premium financial institutions has increased the application of engineered stone and solid surfaces.

The development of new airports and the construction of new hotel chains increase the demand for Countertops, Sinks and Basins, Shower Pans, Vanity Tops, Walls Tub Surrounds, and some others, which, in turn, increases the demand for the cast polymers market. Moreover, the refurbishment of old government buildings, along with the rising disposable income of people.

North America hosts various market players in cast polymers, such as Dupont, Angstrom Engineering Inc., Huber Engineered Materials, and some others that are constantly engaged in developing high-grade cast polymers for different requirements. Moreover, these market players are adopting several strategies, such as partnerships, acquisitions, collaborations, launches, and business expansions, that are driving the growth of the cast polymers market in this region.

The cast polymers market is an important industry in the chemical sector. This industry deals in manufacturing and developing cast polymers to cater to the needs of various consumers. The cast polymers are manufactured using various materials, including alumina trihydrate, calcium carbonate, resins, and natural stones. There are different types of cast polymers, such as solid surfaces, engineered stones, and cultured marble.

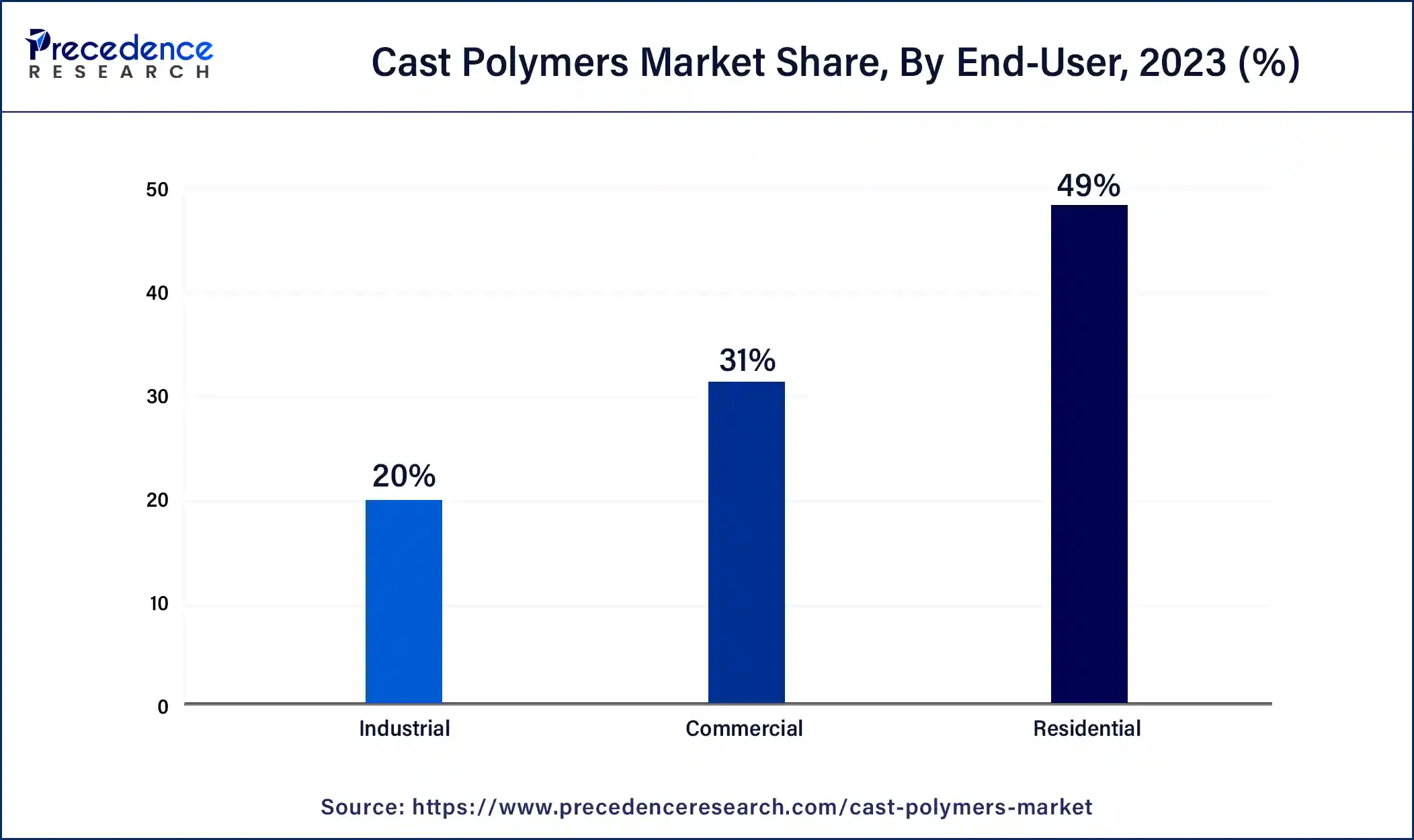

Cast polymers are used for various applications including countertops, vanity tops, sinks and basins, shower pans and walls, tub surrounds and others. The cast polymer industry comprises of several end-users consisting of residential, commercial and industrial. This market is expected to grow exponentially with the growth in construction and chemical industries.

The International Cast Polymer Association (ICPA) aims to enhance knowledge regarding the value of cast polymer to the industry. This organization arranged a 3-day program named ‘Polycon’ that will be held in the U.S. during October 2024.

| Report Coverage | Details |

| Market Size by 2034 | USD 25.57 Billion |

| Market Size in 2025 | USD 13.86 Billion |

| Market Size in 2024 | USD 12.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.04% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Type, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising trend of cultured marble

The growing demand for aesthetics and good looks in homes has increased the application of cultured marble in residential. These marbles are used for several applications, including vanity tops, bathtubs, wall panels, shower stalls, tables, and some others. Also, the use of cultured marble has increased in residential and commercial settings due to its durability and affordability. Thus, the increasing trend of cultured marble is expected to drive the growth of the cast polymers market during the forecast period.

High production costs and scarcity of raw materials

The cast polymers market faces numerous problems in its daily operations. The production cost of cast polymer-based products is very high, which causes the prices of the finished products to increase drastically, which, in turn, hampers industrial growth. Also, the raw materials required for molding cast polymers are rarely found in a few places on the earth.

Bio-based cast polymers

The research and development activities associated with the bio-based cast polymers market have increased in recent times. These materials are mainly derived from renewable sources such as plant wastes or algae. Some of the most important types of bio-based cast polymers include polyhydroxyalkanoates (PHAs), polylactic acid (PLA), cellulose, polybutylene succinate, and chitosan.

The alumina trihydrate segment held a notable share of the cast polymers market in 2024. The application of alumina trihydrate has increased as a smoke suppressant filler and flame retardant in polymers for manufacturing carpet backing and rubber products. Moreover, the popularity of alumina trihydrate in the polymer industry has increased due to its low cost and versatility.

Additionally, the advantages of alumina trihydrate, such as inertness, non-toxic, halogen-free, and low abrasiveness, along with the ability of alumina trihydrate in polymer processing at temperatures below 220’C is helpful for industrial growth. Furthermore, the rising application of alumina trihydrate on flooring applications associated with EPDM, PVC, and other polymers has shaped the industry in a positive way.

The engineered stone segment held a significant share of the cast polymers market in 2024. The rising demand for engineered stones in kitchen and bathroom surfaces of houses has gained prominent attraction. Also, the growing use of engineered stone in manufacturing cast polymer products, including cultured onyx, cultured marble, and cultured granite, is integral for the market growth.

Moreover, the ability of engineered stones to provide enhanced resistance against knocks and scratches, along with their moisture-repellent capacity, has benefitted the industry in a positive way. Furthermore, the demand for engineered stones has increased due to their enhanced looks and superior durability as compared to natural stones.

The solid surface segment is expected to grow at a notable rate in the cast polymers market during the forecast period. The rising application of polymer-molded solid surfaces in manufacturing kitchen countertops has gained the utmost attention. Also, there are several benefits of solid surface products, such as less maintenance, waterproofing, and durability, and others have contributed significantly to industrial growth.

Moreover, the solid surfaces are manufactured using a combination of limestone and marbles with polymer resins that make it easier to clean and offer superior hygiene, which attracts customers at a growing pace. Furthermore, solid surfaces have a high resistance capacity against denting, abrasion, chipping, and staining.

The countertops segment dominated the cast polymers market in 2024. The rising trend of investing in remodeling and refurbishing buildings has increased the demand for countertops, thereby increasing the demand for cast polymers. Also, the ongoing fascination of designer kitchens among women has increased the demand for kitchen countertops.

Moreover, the growing demand for spacious and aesthetic bathrooms from the residential and commercial sectors has increased the application of bathroom countertops. Furthermore, the increasing demand for countertops from restaurants and research laboratories is crucial for the industrial development of cast polymers.

The vanity tops segment holds a significant share of the global cast polymers market. The growing use of sink-integrated tops and vessel tops in bathrooms has increased the demand for vanity tops. Also, the application of vanity tops in making remodeling of the bathrooms easier, less expensive, and quicker has been integral for industrial growth. Moreover, the companies are manufacturing stylish vanity tops to attract global customers.

The residential segment dominated the cast polymers market in 2024. The rise in the number of residential buildings around the world has increased the demand for cast polymers. Also, the growing application of solid surfaces in manufacturing kitchen and bathroom products due to less maintenance and increased durability is crucial for industrial growth. Moreover, the rising demand for luxurious aesthetics and enhanced looks in modern houses has increased the application of cast polymer-based products. Furthermore, the increasing use of cast polymers is due to lower costs than natural stone products, along with the upsurge in demand for grout-free house construction.

The commercial segment is expected to grow at a notable rate in the cast polymers market during the forecast period. The increase in the number of hospital buildings around the world has increased the demand for cast polymers. Also, the rising application of cast polymer-based products in the construction of luxurious hotels has contributed significantly to the market growth. Moreover, the growing demand for various types of sinks in modern schools is prominent for the industry to prosper in a positive direction. Furthermore, there is an upsurge in demand for designer cast polymer products due to the construction of several airports.

By Material

By Type

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

December 2024

November 2024