February 2025

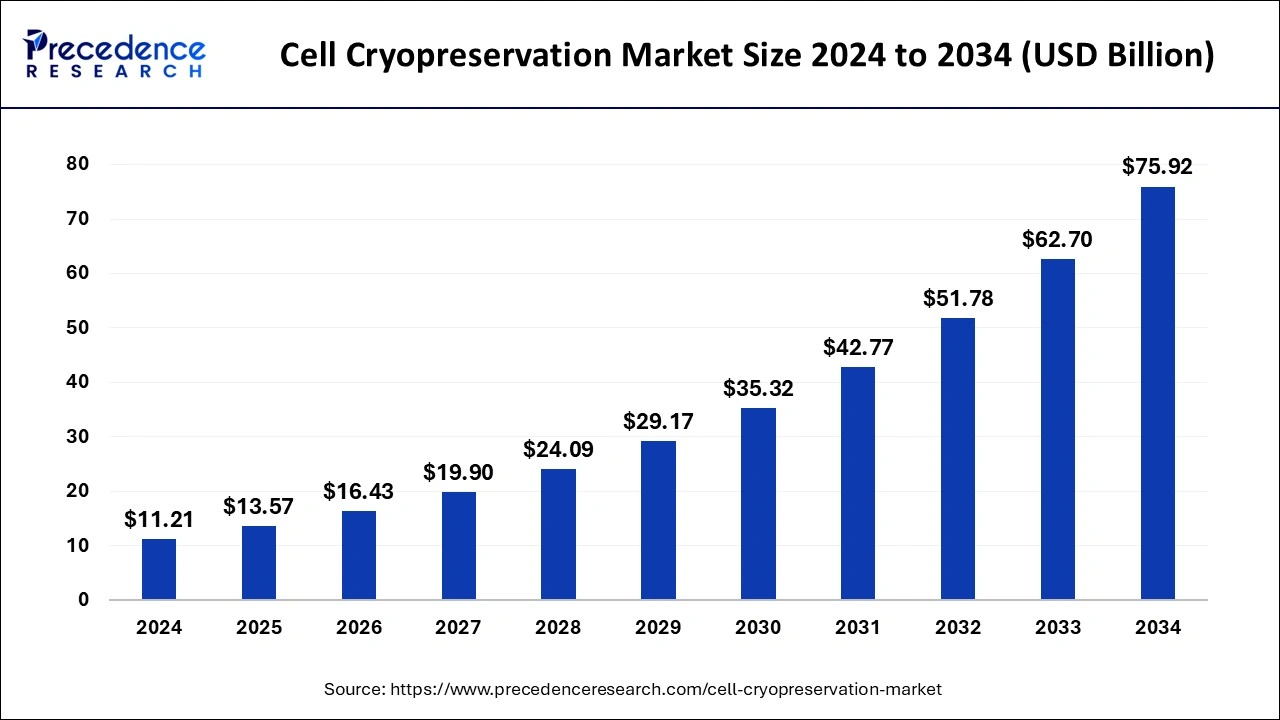

The global cell cryopreservation market size is calculated at USD 13.57 billion in 2025 and is forecasted to reach around USD 75.92 billion by 2034, accelerating at a CAGR of 21.08% from 2025 to 2034. The North America cell cryopreservation market size surpassed USD 4.48 billion in 2024 and is expanding at a CAGR of 21.24% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cell cryopreservation market size was estimated at USD 11.21 billion in 2024 and is anticipated to reach around USD 75.92 billion by 2034, expanding at a CAGR of 21.08% from 2025 to 2034. The prolonged advantages in preserving fertility and cells for research and development, protecting cell quality and efficacy, and developing new biologics like vaccines accelerate the progress of the cell cryopreservation market.

Artificial intelligence, advanced sensors, machine learning algorithms, and other AI-driven systems allow the continuous and real-time monitoring of storage environments which can detect slight changes and optimal conditions. AI can predict threshold levels of liquid nitrogen and provide early warnings to staff members. The use of AI-enhanced cryopreservation monitoring systems reduces sample damage. A regulatory compliance and data management are offered by AI monitoring. AI technology offers reliability and safety in cryopreservation methods.

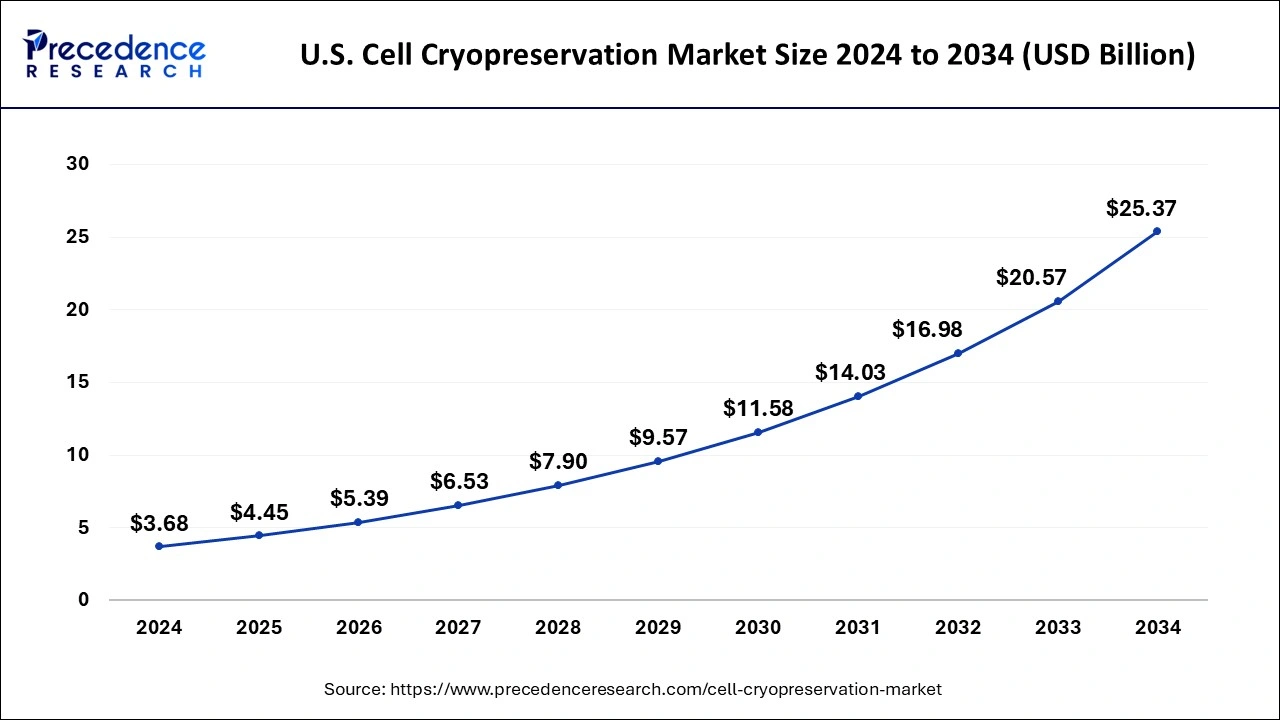

The U.S. cell cryopreservation market size was evaluated at USD 3.68 billion in 2024 and is predicted to be worth around USD 25.37 billion by 2034, rising at a CAGR of 21.29% from 2025 to 2034.

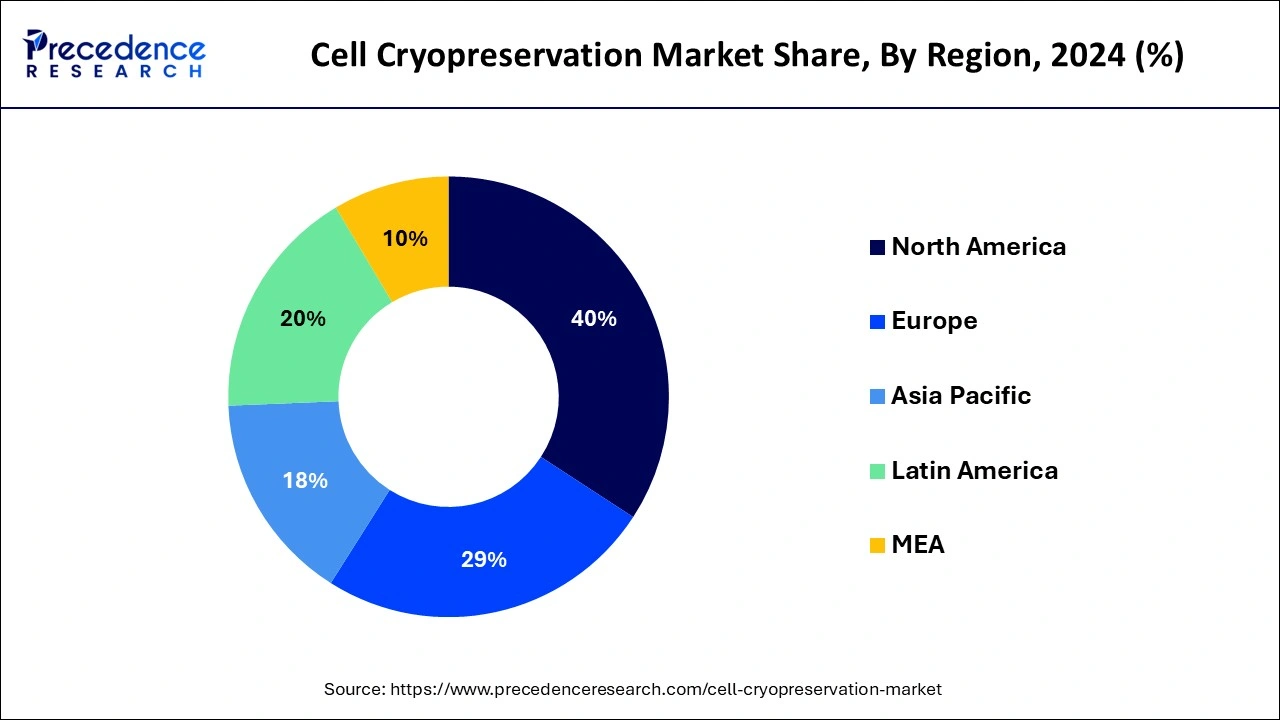

North America dominated the global cell cryopreservation market with the largest market share of 40% in 2024. In North America, the cell cryopreservation market is marked by a strong emphasis on technological innovation and extensive research in cryopreservation methods. The region witnesses a surge in demand for advanced freezing techniques and cryoprotectants, driven by a robust biomedical research sector and the increasing adoption of personalized medicine. Strategic collaborations between industry players and research institutions contribute to the rapid evolution of cryopreservation technologies in North America.

The presence of several cryopreservation product manufacturers in the North American region is driving the market’s growth remarkably. Moreover, advanced medical infrastructure, developed economies, and established supply channels propel the demand and need for cryopreservation solutions. The preservation of cells allows the design and development of innovative products in healthcare due to the rising incidence of diseases and the expansion of the elderly population in this region. The growing demand for personalized pharmaceuticals surges the need for efficient cell storage solutions.

Asia Pacific is estimated to expand the fastest CAGR of 22.1% during the forecast period. Asia-Pacific exhibits dynamic trends in the cell cryopreservation market, with a notable focus on expanding biobanking activities and the growing influence of regenerative medicine. The region experiences a rise in demand for cryopreservation solutions in emerging economies, driven by a flourishing healthcare sector and increasing awareness of stem cell applications. Asia Pacific showcases a trend towards the adoption of automated cryopreservation systems, reflecting a forward-looking approach to technological integration in the field of cell preservation.

The growing adoption of cell cryopreservation technologies, especially in China and Japan drives the market’s growth in the Asia Pacific region. The large regional population, the rising incidence of chronic diseases, the growing elderly population, and the growth in fertility cases are the major rationales behind the success of the cell cryopreservation industries in this region. The wide applications of this technique in protecting stem cells, oocytes, embryonic cells, sperm cells, and hepatocytes accelerate this market significantly.

In Europe, the cell cryopreservation market reflects a progressive landscape with a strong emphasis on sustainable practices. The region sees a surge in research collaborations and investments, fostering advancements in cryopreservation technologies. Growing adoption of serum-free cryopreservation methods and adherence to stringent regulatory standards define Europe's approach. The market is characterized by a commitment to ethical and high-quality cell preservation practices, aligning with the region's focus on advancing biomedical sciences.

Advancements in cryoprotectants and freezing techniques significantly boost the cell cryopreservation market by enhancing cell viability during freezing processes. Improved formulations mitigate cellular damage, broaden the scope of applications, and foster the development of more effective cryopreservation solutions. This, in turn, stimulates market growth, meeting the increasing demands of diverse biomedical disciplines.

The cell cryopreservation market involves the preservation of cells at extremely low temperatures, typically below -130°C, to maintain their viability for various applications, such as regenerative medicine, drug discovery, and biobanking. This process prevents cellular damage and allows for long-term storage.

Key players in the market provide cryopreservation solutions, including specialized freezing equipment, cryoprotectants, and services. The market's growth is driven by increasing applications in stem cell research, organ transplantation, and vaccine development, with a focus on preserving cells' functional integrity and enabling their use in diverse biomedical fields.

The cell cryopreservation refers to preserving cells, tissues, organelles, or any biological constructs in cool conditions or very low temperatures to maintain their viability and efficiency. This market is achieving high demand and success by the use of cryoprotective agents and temperature control equipment. Thermo Fisher Scientific Inc., GE Healthcare, BioLife Solutions Inc., Takara Bio Inc., Cardinal Health Inc., etc. are the prominent industries in this market. In October 2024, Nucleus Biologics announced the launch of a chemically defined cryomedia set named NB-KUL™ DF which is DMSO-free and aims to redefine cryopreservation standards.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 21.08% |

| Market Size in 2025 | USD 13.57 Billion |

| Market Size by 2034 | USD 75.92 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing biobanking activities and advancements in cellular therapies

Growing biobanking activities and advancements in cellular therapies are significant drivers surging the demand for the cell cryopreservation market. The expanding biobanking landscape, where biological samples are stored for research and clinical purposes, necessitates effective cell cryopreservation methods to maintain the viability and functionality of diverse cell types over extended periods. Biobanks serve as repositories for valuable cellular materials, including stem cells and tissues, driving the need for robust cryopreservation solutions to ensure the long-term integrity of stored specimens.

Advancements in cellular therapies, particularly in CAR-T cell therapies, further amplify the demand for cell cryopreservation. Cellular therapies involve the manipulation and infusion of patient-specific or donor-derived cells, requiring precise preservation methods to maintain their therapeutic efficacy. As cellular therapies expand, the reliance on cryopreservation for preserving these specialized cells grows, reflecting a symbiotic relationship between the cell cryopreservation market and the evolving landscape of biobanking and cellular-based therapeutic innovations.

Cell damage concerns and technical complexity

Cell damage concerns pose a significant restraint for the cell cryopreservation market. The process of freezing and thawing cells inherently carries the risk of cellular damage, impacting their structural integrity and functionality. Cryoprotectants, while essential for preventing ice crystal formation, can introduce additional stress on cells. Ensuring minimal damage during cryopreservation is a complex challenge, particularly for delicate cell types crucial in biomedical applications. Addressing these concerns is pivotal for maintaining the viability and efficacy of preserved cells, as damaged cells may compromise the success of applications in regenerative medicine, drug development, and biobanking.

Technical complexity represents a formidable obstacle in the widespread adoption of cell cryopreservation methods. The intricacies involved in precisely controlling freezing and thawing rates, selecting optimal cryoprotectants, and customizing protocols for diverse cell types make the process technically challenging. Standardizing cryopreservation procedures across different cell lines and applications is intricate due to the diverse requirements of various cells. This complexity not only hinders uniform practices but also necessitates specialized expertise, limiting the accessibility and ease of implementation for researchers and organizations seeking to leverage cryopreservation technologies.

Advancements in cryoprotectants and freezing techniques

Advancements in cryoprotectants and freezing techniques are key drivers propelling the demand for the cell cryopreservation market. Continuous research and development efforts in cryoprotectant formulations and freezing methodologies are revolutionizing the field, ensuring enhanced cell viability and functionality post-thaw. Innovative cryoprotectants with improved properties, such as reduced cytotoxicity and increased permeability, contribute to minimizing cellular damage during the freezing and thawing process.

These advancements cater to the evolving needs of diverse applications, including regenerative medicine, stem cell research, and cellular therapies. The ability to preserve cells with greater efficiency and minimal damage not only expands the scope of cryopreservation across various biomedical disciplines but also aligns with the growing demand for precision medicine. As cellular-based therapies gain prominence, the market experiences a surge in demand for advanced cryopreservation techniques, reflecting the pivotal role these innovations play in ensuring the therapeutic efficacy of preserved cells in groundbreaking medical interventions.

The consumables segment held 44% revenue share in 2024. Consumables in the cell cryopreservation market refer to the materials used in the cryopreservation process, including cryovials, cryobags, and labels. These consumables are designed to ensure the safe and efficient storage of cells during freezing and thawing. Trends in consumables involve the adoption of specialized containers with improved insulation properties and the development of eco-friendly, single-use options to address sustainability concerns in the cryopreservation workflow.

The cell freezing media segment is anticipated to expand at a significant CAGR of 23.5% during the projected period. Cell freezing media in the cell cryopreservation market are formulations designed to protect cells during the freezing process. These media typically contain cryoprotectants and other additives to minimize ice crystal formation and cellular damage.

Trends in cell freezing media include the use of serum-free formulations, allowing for more defined and controlled cryopreservation conditions. Additionally, there is a focus on optimizing media compositions to enhance post-thaw cell viability and functionality, catering to the evolving needs of various applications in biobanking and biomedical research.

The stem cells segment held the largest market share of 37% in 2024. In the cell cryopreservation market, the preservation of stem cells is a critical application. Cryopreservation of stem cells, renowned for their regenerative capabilities, is integral to applications in regenerative medicine and therapeutic interventions.

A notable trend encompasses the formulation of specialized cryopreservation protocols tailored to distinct types of stem cells. These protocols are designed to uphold the viability and functionality of stem cells throughout the freezing and thawing processes. This trend significantly contributes to the progression of regenerative therapies, ensuring that preserved stem cells retain their regenerative potential, thereby fostering advancements in the field of regenerative medicine.

On the other hand, the sperm cells segment is projected to grow at the fastest rate over the projected period. Cell cryopreservation plays a vital role in preserving sperm cells, primarily utilized in reproductive medicine. The market trend focuses on optimizing cryopreservation techniques for sperm cells, addressing factors such as motility and DNA integrity. This aligns with the increasing demand for assisted reproductive technologies, offering solutions for fertility preservation and aiding in various reproductive interventions.

The IVF clinics segment generated the biggest market share of 39% in 2024. In the cell cryopreservation market, IVF clinics are significant end-users, utilizing cryopreservation to store embryos, eggs, and sperm for assisted reproductive technologies. A notable trend involves the increasing adoption of vitrification, a rapid freezing technique, for improved cell survival rates during thawing. This trend aligns with the rising demand for fertility preservation and the broader acceptance of in vitro fertilization methods.

The biobanks segment is expected to grow at a double digit CAGR of 24.2% over the projected period. Biobanks play a crucial role by storing diverse cell types for research and therapeutic purposes. A trend in biobanking involves incorporating automated cryopreservation systems for streamlined and standardized cell storage, enhancing the efficiency of large-scale storage initiatives. This trend addresses the challenges related to manual processes and supports the growing demand for well-preserved cell samples in various research domains.

By Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025