February 2025

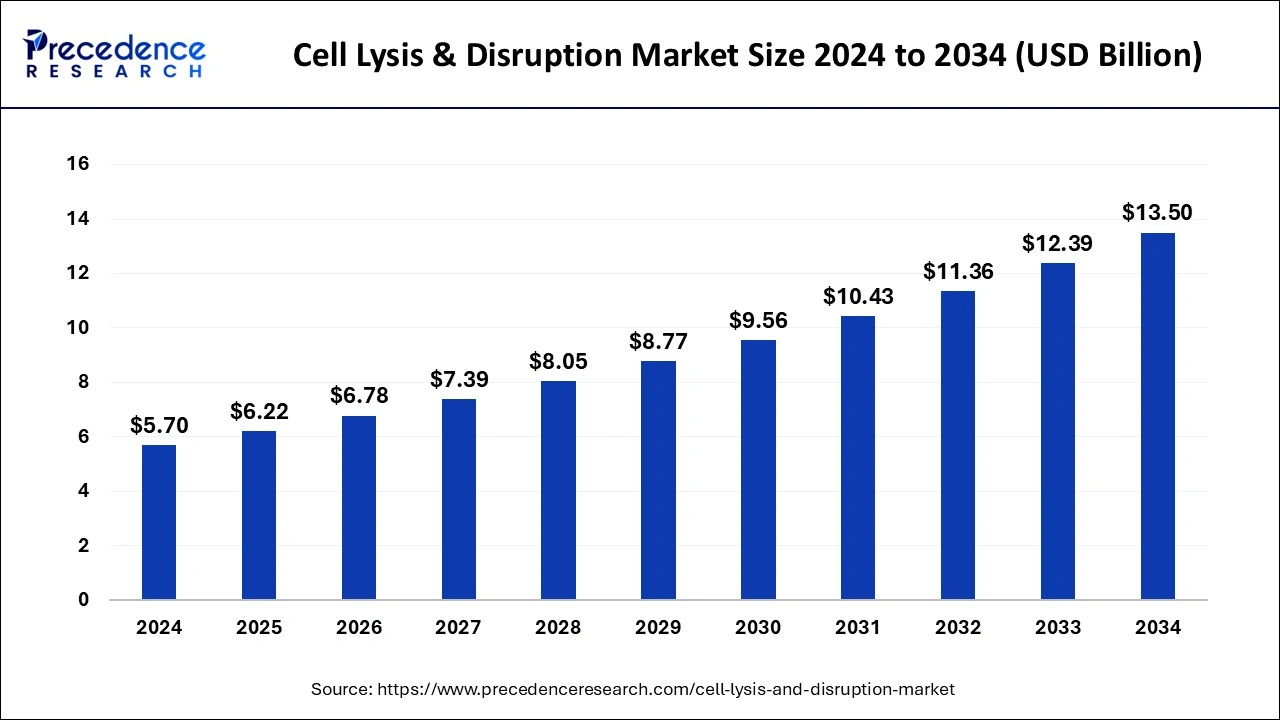

The global cell lysis & disruption market size is evaluated at USD 6.22 billion in 2025 and is forecasted to hit around USD 13.50 billion by 2034, growing at a CAGR of 9.00% from 2025 to 2034. The North America market size was accounted at USD 2.34 billion in 2024 and is expanding at a CAGR of 9.11% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cell lysis & disruption market size accounted for USD 5.70 billion in 2024 and is expected to exceed around USD 13.50 billion by 2034, growing at a CAGR of 9% from 2025 to 2034.

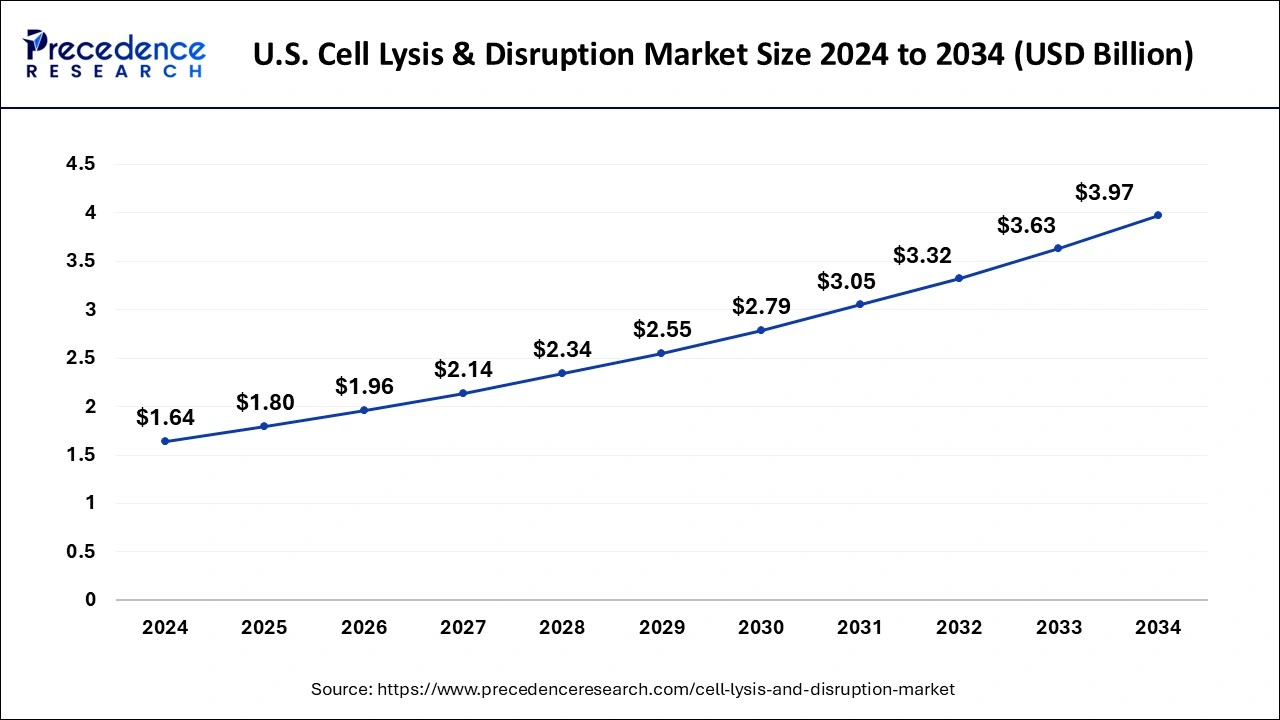

The U.S. cell lysis & disruption market size exhibited at USD 1.64 billion in 2024 and is projected to be worth around USD 3.97 billion by 2034, growing at a CAGR of 9.24% from 2025 to 2034.

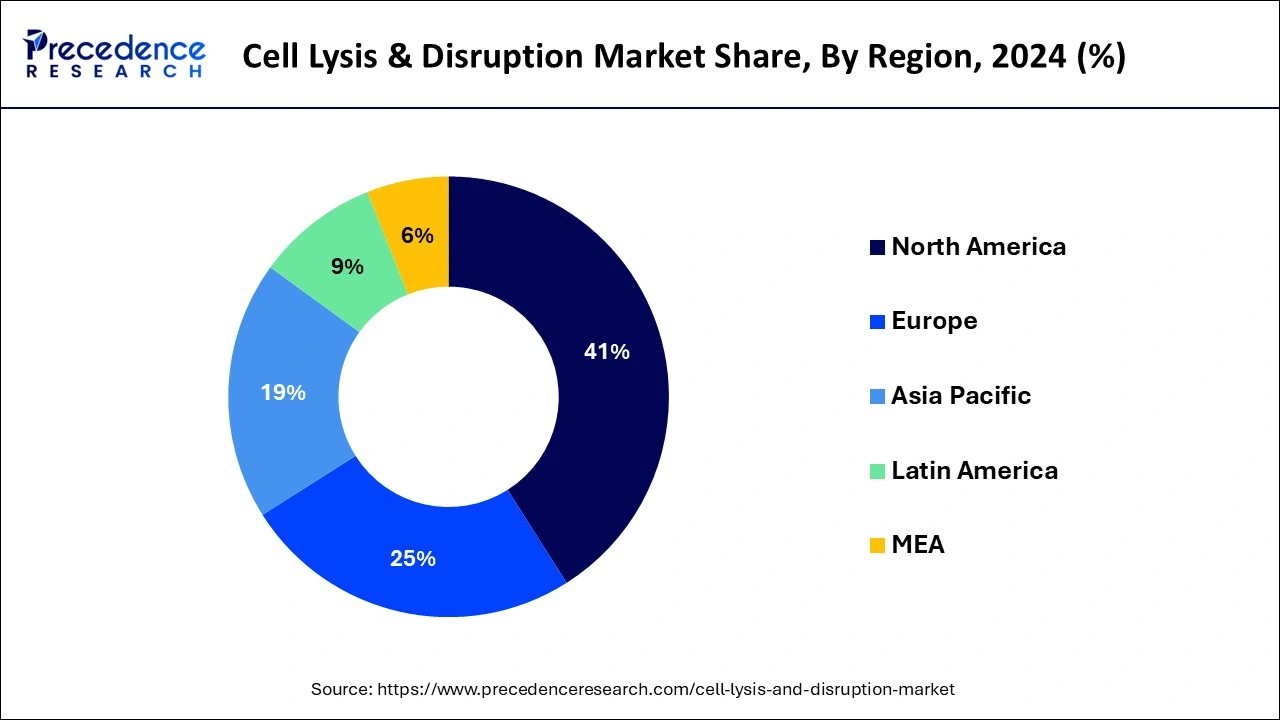

Based on the region, North America dominated the largest revenue share of 41% in 2024. This is attributable to the rapid growth of the biopharmaceutical industry in the region. Moreover, rising investments coupled with the presence of numerous contract research organizations in North America has supported the growth of the cell lysis and disruption market in the region. Moreover, the development of precise and personalized medicines depending on the disease has fostered the market growth in US and Canada.

Asia Pacific is estimated to be the most opportunistic market during the forecast period. The rising interest of the top biotechnology companies in the emerging markets. Markets such as China, Japan, and South Korea are characterized by the quick adoption of innovative technologies. Further, the development of personalized cancer treatment is gaining traction in these markets that would boost the growth of the market in the forthcoming years.

Cell lysis & disruption is essential for the diagnosis of the pathogens and immunoassays for diagnosis labs, drug screening, for the study of protein structure, understanding protein function, diagnosis of cancer, determining messenger ribonucleic acid transcriptome, and studying the composition of lipids, nucleic acids, and proteins. The global cell lysis and disruption market is primarily driven by the growing adoption biotechnology in the field of agriculture, pharmaceuticals, and bio-service industries across the globe. Further, the increased government initiatives to support the higher adoption of biotechnology based screening options and treatments are propelling the growth of the cell lysis and disruption market.

The growing prevalence of cancer among the global population is expected to fuel the market growth during the forecast period. According to the International Agency for Research on Cancer, in 2020, there were around 19.3 million cancer cases and around 10 million cancer deaths recorded. Cell lysis is very essential for the diagnosis of cancer and development of drugs for the treatment of cancer. Therefore the rising cases of cancer and growing prevalence of other infectious diseases is resulting in the utilization of cell lysis and disruption in the research and study on the development of various therapy for the development of treatments. Further, growing application of cell lysis and disruption in the academics and research organizations for the research and development activities is boosting the demand for the cell lysis and disruption, all over the globe.

| Report Coverage | Details |

| Market Size in 2025 | USD 6.22 Billion |

| Market Size by 2034 | USD 13.50 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 9.00% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Cell Type, Application, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

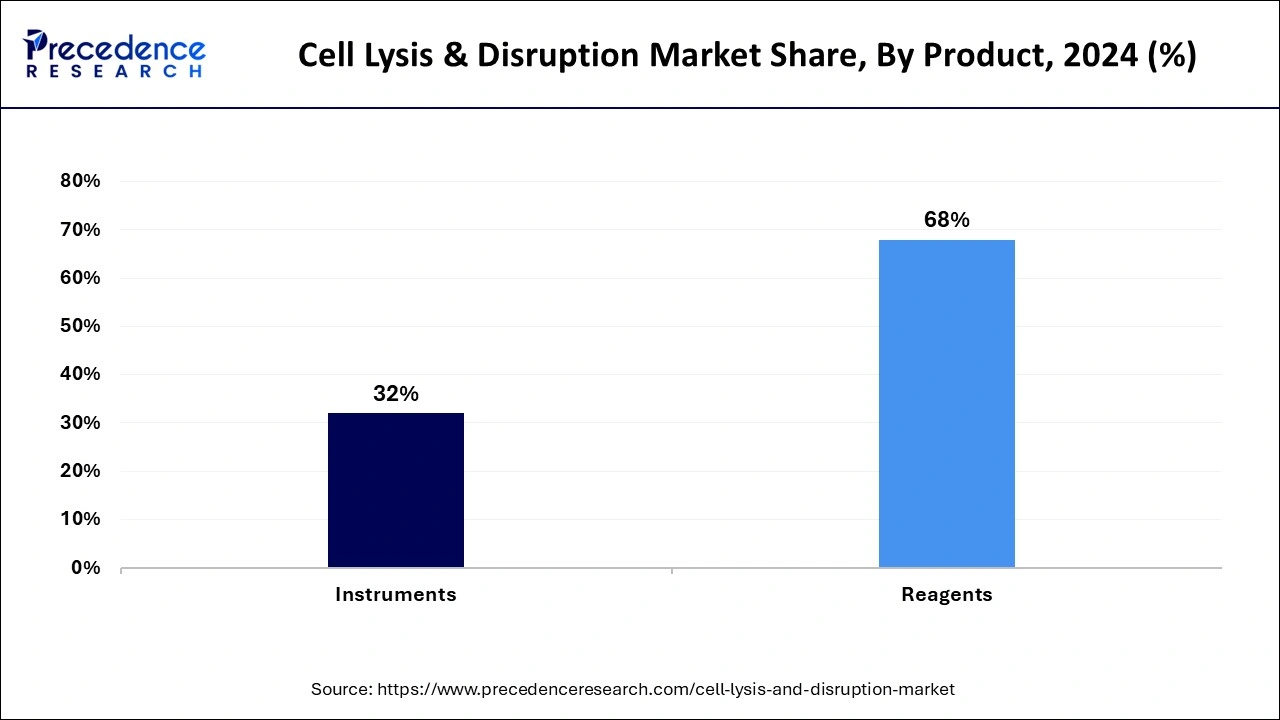

By product, the reagents segment led the market with a 68% revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the increased demand and consumption, rising prevalence of diseases, rising investments for conducting cell-based researches is fostering the growth of this segment. Moreover, growing uses of detergent and enzymes reagents is expected to sustain the demand for the reagents cell lysis segment during the forecast period.

On the other hand, the instrument segment is estimated to be the most opportunistic segment during the forecast period owing to the growing uses of instrument such as sonicators and homogenizers in the fractionation of cell. Moreover instruments are very helpful in the extraction of proteins in big amount from the complex tissues of mammals. Instruments like blender are very helpful for the large volumes and samples.

By cell type, the mammalian cells segment led the global cell lysis market with a 47% revenue share in 2024 and is anticipated to retain its dominance in near future. This is attributable to the high and extensive usage of mammalian cells in the manufacturing of biopharmaceuticals like vaccines, gene therapies, and therapeutic proteins. Moreover, the development of reagents to work efficiently and specifically on the mammalian cells for the research on cancer is a major factor boosting the growth of the segment.

On the other hand, the bacteria segment is expected to grow at a faster pace during the forecast period owing to the growth in the investments to conduct research studies on the bacteria cells due to the growing uses of bacteria cells in the development of various medicines.

By application, the protein isolation segment held a 34% revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the growing application of protein isolation in immunoprecipitation, proteomics, and western blotting. Further, the rising demand for the efficient techniques that can prevent oxidation while extracting mammal protein is expected to boost the segment growth in the upcoming years.

On the other hand, the downstream processing segment is expected to be the most opportunistic segment during the forecast period owing to the rising demand for the bio products like vaccines, antibiotics, and antibodies. The growing demand for the downstream processing for the development of the COVID-19 vaccines propelled the growth of this segment in 2020 at a rapid pace.

By end use, the pharma & biotechnology companies segment led the global cell lysis market with a remarkable revenue share of over 31.6% in 2024 and is anticipated to retain its dominance throughout the forecast period. The presence of numerous biopharmaceutical companies that employs the cell lysis and disruption system for studying about the bioprocesses and molecular biology has significantly contributed towards the growth of this segment.

On the other hand, the academic and research institutions segment is expected to be the fastest-growing segment throughout the forecast period. This is attributed to the rapid growth of the biotechnology and rising government support and increasing investments by the private players to boost up the research and developmental activities in the field of cell lysis technology that would fuel the growth of the biopharmaceutical industry.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved services. Moreover, they are also focusing on maintaining competitive pricing.

In January 2021, Thermo Fisher Scientific completed the acquisition of Henogen S.A. This acquisition enhanced the production capabilities of vaccines, gene therapies, cell therapies, and cell lysis & disruption.

This type of developmental strategies are positively contributing towards the market growth and paving the way for the key players to exploit the prevailing and upcoming market opportunities.

Segments Covered in the Report

By Product

By Cell Type

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025