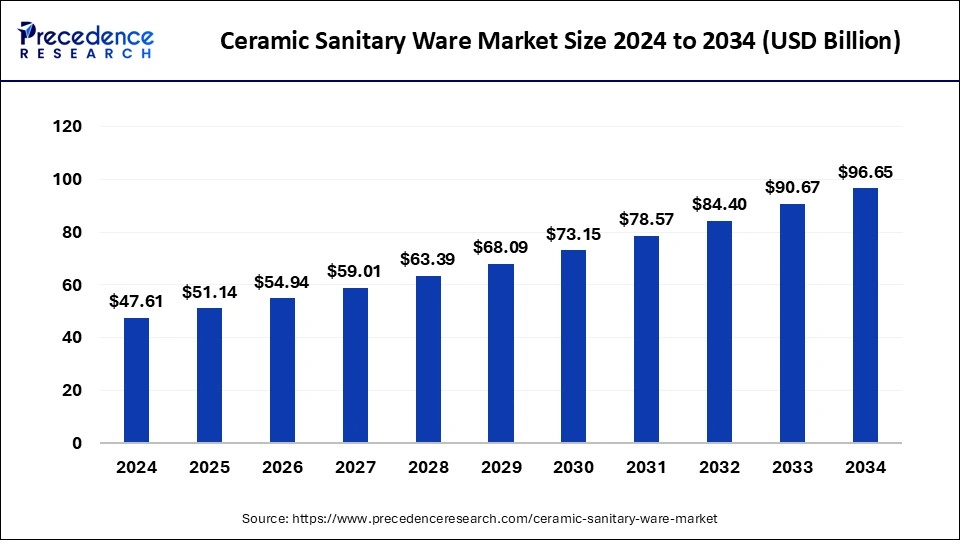

The global ceramic sanitary ware market size is accounted at USD 51.14 billion in 2025 and is forecasted to hit around USD 96.65 billion by 2034, representing a CAGR of 7.34% from 2025 to 2034. The Asia Pacific market size was estimated at USD 25.71 billion in 2024 and is expanding at a CAGR of 7.44% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ceramic sanitary ware market size accounted for USD 47.61 billion in 2024 and is predicted to increase from USD 51.14 billion in 2025 to approximately USD 96.65 billion by 2034, expanding at a CAGR of 7.34% from 2025 to 2034. The growing popularity of ceramic materials in the construction industry because of their cost-effectiveness can drive the ceramic sanitary ware market.

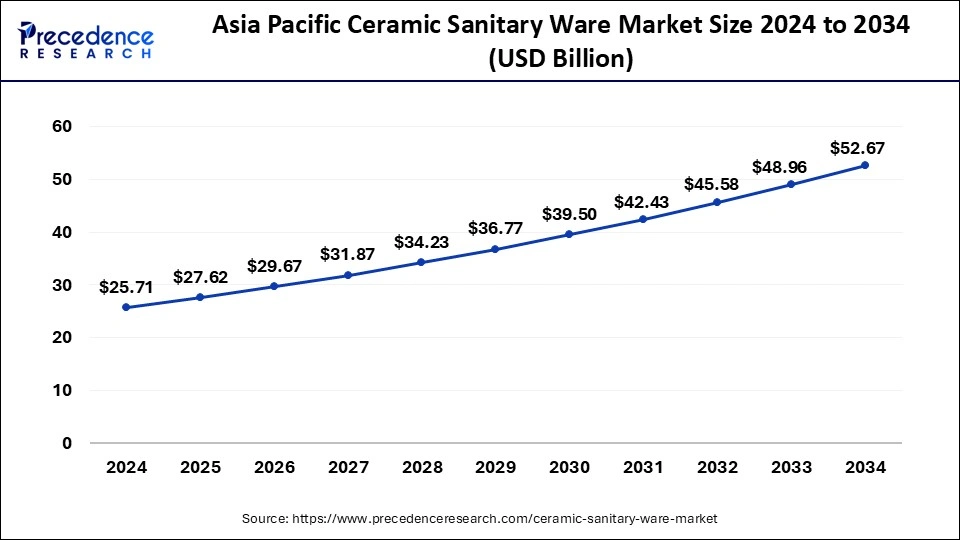

The Asia Pacific ceramic sanitary ware market size was evaluated at USD 25.71 billion in 2024 and is projected to be worth around USD 52.67 billion by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

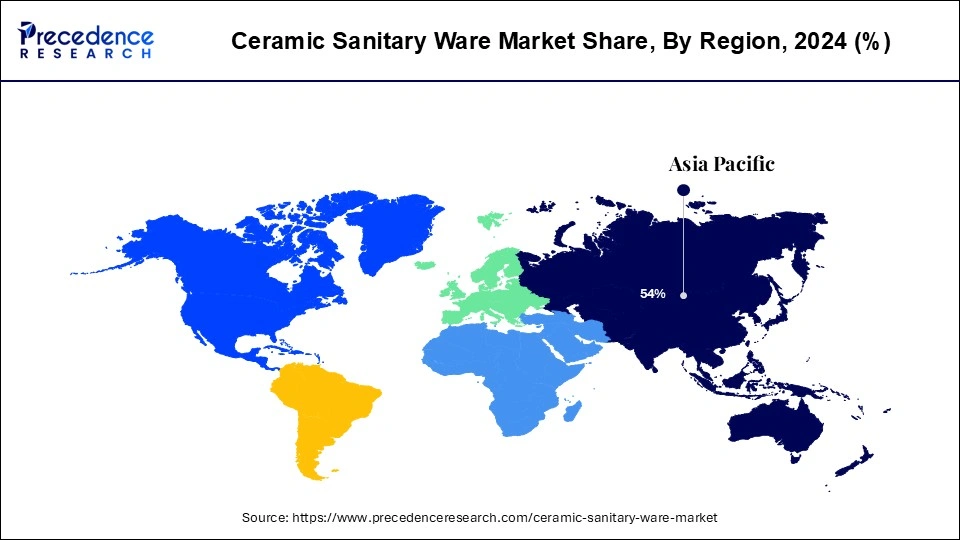

Asia Pacific held the largest share of the ceramic sanitary ware market in 2024. Various countries in the region are investing heavily in infrastructure development projects, such as the construction of airports, hotels, hospitals, and shopping centers. These projects require extensive plumbing installations, including ceramic sanitary ware products, which drive market growth. The aesthetic designs and hygienic properties of ceramic sanitary ware align well with these preferences, which makes Asia Pacific a leading market for this product.

Key players in Asia Pacific are focused on product innovation and launches. These product launches align with increasing consumer demand for aesthetically pleasing and technologically advanced sanitary ware products. The focus on smart features, sustainability, and customization reflects market trends towards convenience, water conservation, and personalized home decor.

North America is observed to grow at a significant rate in the ceramic sanitary ware market during the forecast period. The market dominance of the region can be attributed to the presence of established players, particularly in the United States and Canada. Consumers in North America have a preference for luxury and premium bathroom products. Ceramic sanitary ware, known for its durability, aesthetic appeal, and hygiene benefits, fits well within this market segment. The trend of home renovation and remodeling is strong in North America.

The key players in the ceramic sanitary ware market of these countries are expected to remain favorable for the industry. Furthermore, the glossy surface and availability of products in various color variants in the U.S. and Canada are anticipated to attract buyers over the next few years. Major home improvement and retail chains, such as Home Depot, Lowe’s, and Menards, have extensive networks across North America, making ceramic sanitary ware readily available to consumers.

Europe is estimated to grow at a notable rate in the ceramic sanitary ware market during the forecast period. This growth is largely supported by the overall economic condition of the countries of the region. A significant growth of the construction industry combined with the development of the hospitality infrastructure affects the development of the market in countries like the UK. Owners of properties with significant historical value are updating to modern technologies to enhance property value and comfort, increasing the demand for new and stylish ceramic sanitary ware. Furthermore, ceramic sanitary ware can be highly durable while simultaneously catering to aesthetic preferences and environmental ideologies.

Homeowners and builders of residential properties drive significant demand for ceramic sanitary ware. The residential segment includes new constructions, renovations, and upgrades of bathrooms and kitchens. Commercial establishments such as hotels, hospitals, office buildings, shopping malls, and restaurants require high-quality sanitary ware for their facilities. The overall rising demand for such applications creates a significant factor in the ceramic sanitary ware market's growth.

Ceramic sanitary wares, including toilets, sinks, bidets, and urinals, are highly valued for their durability, ease of cleaning, and aesthetic appeal. These products are crafted from ceramic materials by shaping and firing non-metallic substances to produce hard, non-porous surfaces that resist stains and microorganisms. The products in the ceramic sanitary ware market used in residential, commercial, and public restrooms, ceramic sanitary ware requires minimal maintenance.

The ability of ceramic sanitary ware to withstand harsh chemicals and scratches ensures its longevity and continued attractiveness. It can also be produced in various styles and colors to match different interior design preferences. Major companies in the ceramic sanitary ware market include Roca Sanitario S.A., Toto Ltd., Kohler Co., Villeroy & Boch AG, Duravit AG, and LIXIL Group Corporation. These companies are known for their innovation, quality, and extensive product ranges.

| Report Coverage | Details |

| Market Size by 2034 | USD 96.65 Billion |

| Market Size in 2025 | USD 51.14 Billion |

| Market Size in 2024 | USD 47.61 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 7.34% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The growing trend of smart homes

The global ceramic sanitary ware market is anticipated to grow substantially due to various factors. Shifting interior design preferences in residential buildings are boosting demand for sanitary ware products. Additionally, increasing focus on infrastructure development and the growing trend of smart homes worldwide is expected to fuel market expansion during the forecast period. The residential replacement and remodeling segment is a major factor further contributing to this growth, as homeowners increasingly replace older sanitary ware with newer products that offer enhanced aesthetics and improved functionality.

Crawling's defects

Crawling defects in ceramics are expected to be a significant challenge and negatively impact market growth during the forecast period. Ceramic sanitary ware products are glazed with vitreous substances to achieve a glossy finish, which is fused into the product through firing. During this process, some areas of the sanitary ware might appear unglazed, or the glaze thickness may be uneven across the surface. This defect, known as a crawling defect, is commonly found in ceramic sanitary ware products and creates a notable issue for the ceramic sanitary ware market.

Changing consumer preferences

Consumers today are attracted to modern homes with stylish and visually appealing bathrooms, which is a major factor driving the growth of the ceramic sanitary ware market. The increasing demand for sophisticated, elegant, and customized bathrooms, driven by changing consumer preferences and evolving tastes, can boost the need for ceramic sanitary ware products. Furthermore, this market benefits from the wide availability of ceramic sanitary ware in various designs, colors, and finishes that can be customized to match diverse interior styles and meet aesthetic preferences.

The toilet sinks & water closets segment dominated the ceramic sanitary ware market in 2024. The rapid pace of urbanization, particularly in developing countries, has led to a surge in new housing developments and urban infrastructure projects. This urban expansion increases the demand for sanitary ware, particularly toilets and sinks, as they are standard requirements in all new constructions. As standards of living improve globally, there is a growing preference for aesthetically pleasing and high-quality bathroom fixtures. Consumers are increasingly seeking modern, stylish, and hygienic options, which boosts the demand for ceramic sanitary ware, especially in the toilet sinks and water closets segment.

The washbasins segment is projected to grow at the fastest rate in the ceramic sanitary ware market during the forecast period. This is due to the increasing demand for replacing conventional sanitary products with innovative and advanced ceramic sanitary ware with aesthetic appeal. Washbasins, typically comprising a bowl-shaped basin and a faucet for water supply, are plumbing fixtures used for washing hands and face. Technical improvements, such as water-saving flush systems and improved sanitary features, make toilets a significant and evolving segment of the industry. The market expansion is expected to be significantly influenced by the introduction of new products with contemporary designs.

The residential segment dominated the ceramic sanitary ware market in 2024. The residential segment is driven by increased urbanization and improving living standards, which elevates the demand for high-quality, aesthetically pleasing bathroom fixtures in homes. The ongoing development of home building and remodeling projects also contributes to the growth of this market. Moreover, customer demand for innovative and sustainable sanitary equipment further propels this segment.

The commercial segment is anticipated to grow at the fastest rate in the ceramic sanitary ware market over the projected period. This can be linked to the expansion of commercial properties and the hospitality industry globally, which is a major factor contributing to the growth of this segment. The hospitality sector prefers ceramic sanitary ware products due to their low maintenance costs. This preference for ceramic sanitary ware in the hospitality industry is driven by its cost-effectiveness in maintenance.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client