July 2024

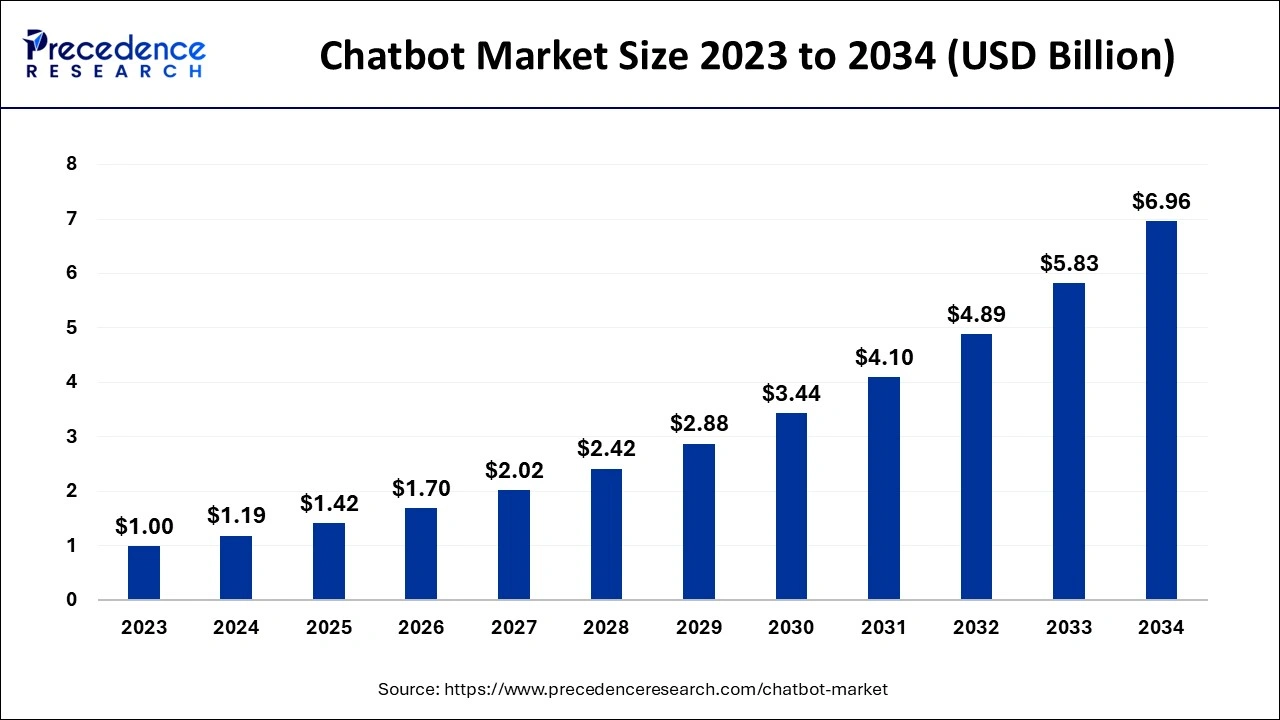

The global chatbot market size accounted for USD 1.19 billion in 2024, grew to USD 1.42 billion in 2025 and is projected to surpass around USD 6.96 billion by 2034, representing a healthy CAGR of 19.29% between 2024 and 2034. The North America chatbot market size is calculated at USD 490 million in 2024 and is expected to grow at a fastest CAGR of 19.42% during the forecast year.

The global chatbot market size is estimated at USD 1.19 billion in 2024 and is anticipated to reach around USD 6.96 billion by 2034, expanding at a CAGR of 19.29% between 2024 and 2034.

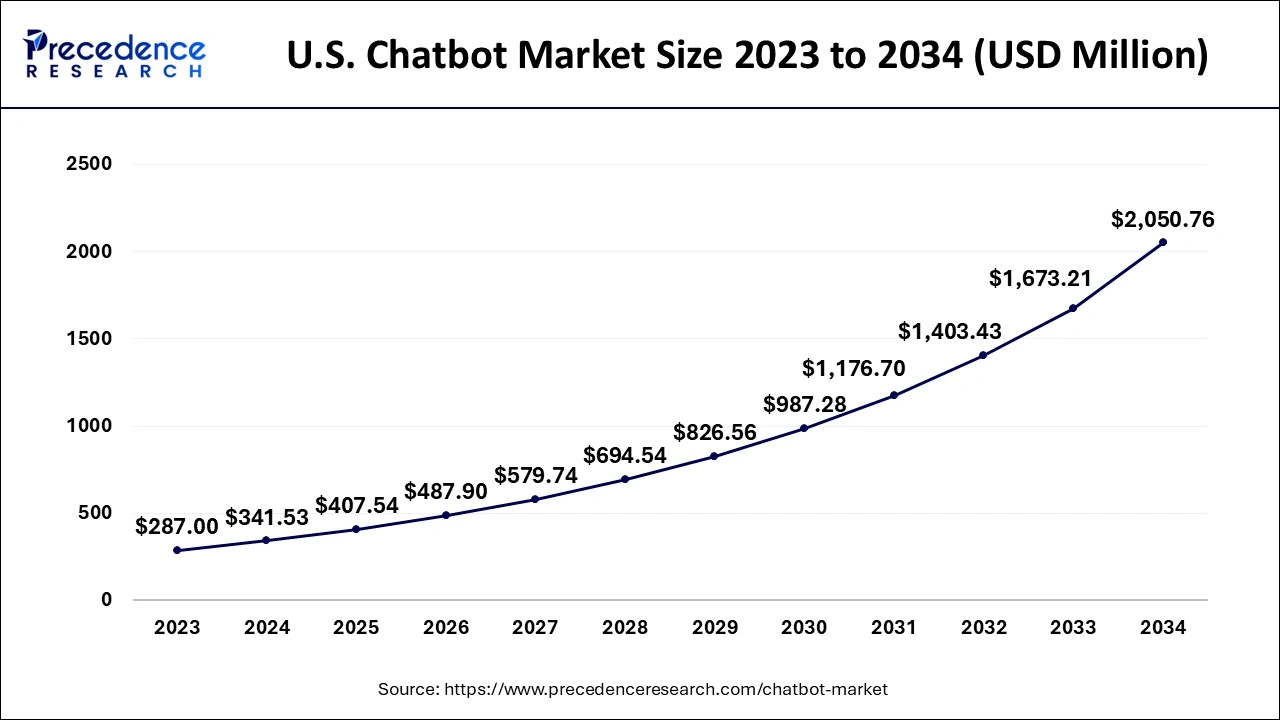

The U.S. chatbot market size is exhibited at USD 341.53 million in 2024 and is predicted to be worth around USD 2050.76 billion by 2034, growing at a CAGR of 19.46% between 2024 and 2034.

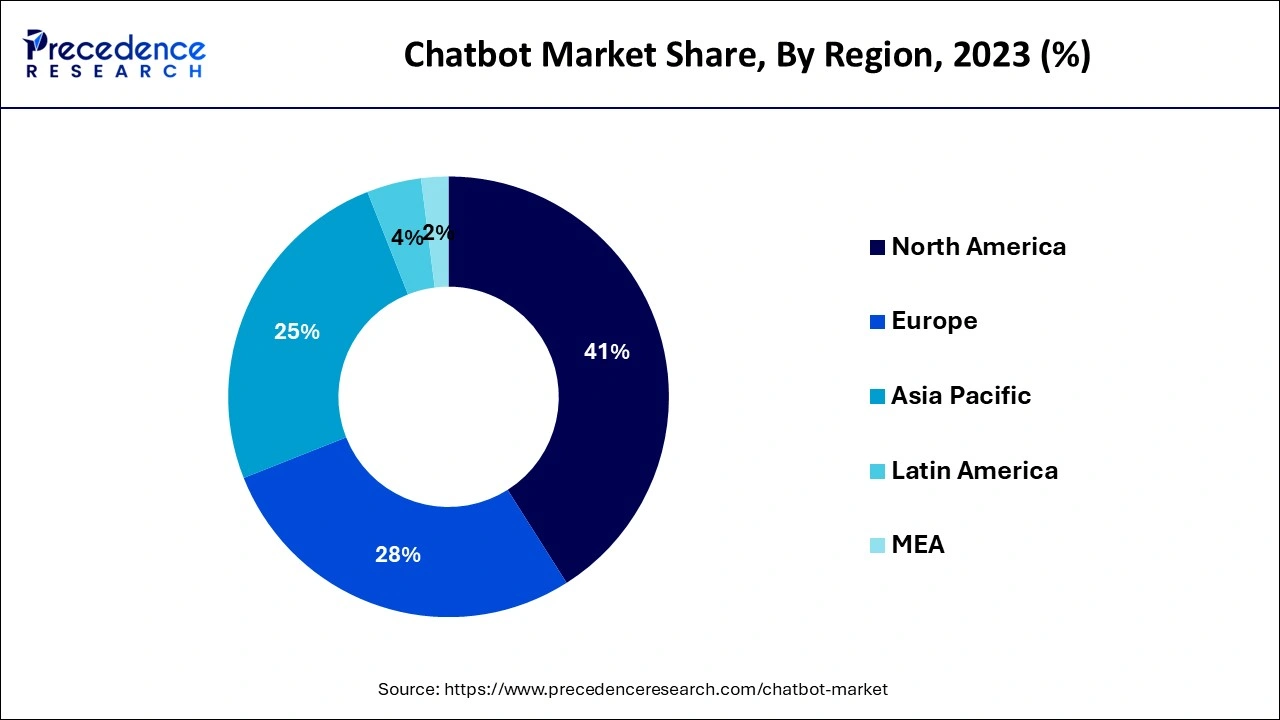

In 2023, North America dominated the global chatbot market with the highest market share of about 41% and was expected to continue to dominate during the forecast period. The rise in mobile and web-based chatbots' penetration across multiple platforms drives this growth. Increased adoption of chatbot technologies for effective customer engagement and improved customer service is also expected to drive the future market demand for chatbots in North America.

The market in the US is expected to grow significantly due to the increased adoption of mobile applications and the lucrative presence of start-up vendors in the country.

A chatbot is a computer program that uses artificial intelligence (AI) and natural language processing (NLP) to understand customer queries and automate responses, stimulating human conversation. Chatbots help to reduce operational costs while increasing overall efficiency. Chatbots have introduced several advantages, including 24x7 support and parallel discussions. The market is expected to be driven by several innovations in artificial intelligence and machine learning technologies.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.19 Billion |

| Market Size by 2034 | USD 6.96 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 19.29% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By End User, By Application, By Type, By Product and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The surge in demand for uninterrupted customer assistance

A chatbot is a computer program that imitates human conversations with users through text messages on chat to respond to queries, provide product information and perform other functions. Many companies are experimenting with digital customer service platforms to replace traditional customer service methods, and they can respond to customer inquiries and automate routine tasks. Due to their ability to process large amounts of data and react quickly to online communication between companies and consumers, chatbots are gaining popularity in digital businesses.

According to a research study, 32% of customers expect a reply within 30 minutes, and 50% of user requests return unsettled, while 52% of customers hang up on representatives from customer service before their issue is resolved. This implies that customers expect customer service departments to respond quickly to their questions, or companies risk losing such customers.

The increased use of chatbot technology aids in customer relationship management (CRM), and it also helps to improve response time, which reduces workload. Integration of machine learning and natural language processing (NLP) with conversational AI chatbots aids in understanding human communication, reduces customer churn, and provides 24/7 support to boost sales and lead generation.

Chatbots are now considered an essential component of any customer service solution. According to Outgrow infographics, they are increasing the use of chatbots resulting in a more than 30% reduction in customer service operatis. As a result, 69% of users prefer to use chatbots to get quick answers to common questions.

Lack of awareness

Lack of awareness and other challenges, such as complex chatbot management, may obstruct market growth and hamper the global chatbot market throughout the forecast period. Furthermore, awareness about the benefits of AI chatbots may be necessary for worldwide adoption. Large organizations are adopting chatbot solutions; however, small and medium enterprises have limited the adoption due to high costs associated with their maintenance and a need for more skilled resources.

Rising adoption of self-learning chatbots to deliver a humanlike conversational experience

In recent years, businesses have been advancing the development of self-learning chatbots. As a result, they are implementing several integrated technologies, including cloud-based deployment, an interference engine, a natural language processor (NLP), and an application programming interface (API).

These self-learning chatbots can quickly adapt to changing environments and conditions as they can learn from previous conversations, actions, decisions, and experiences. Furthermore, businesses are collaborating to provide integrated self-service technology to customers. For instance, in February 2020, Creative Virtual announced a collaboration with Spitch AG to jointly develop speech recognition and conversational AI, particularly in omnichannel solutions. The partnership provides a multilingual voice bot to improve sales and customer experience. Thus, the above factors are expected to create favorable opportunities for the global chatbot market in the coming years.

COVID-19 Impact

During the outbreak of the COVID-19 pandemic, the global chatbot market witnessed an increase in growth rate, owing to its deployment by various industries such as banking and insurance, healthcare, and retail for responding to customer queries and other tasks.

Various organizations have increasingly deployed chatbots to respond to customer queries and other related information. Due to the imposed lockdowns, various organizations adopted remote working, and companies became heavily reliant on chatbots to reduce the burden of customer queries due to the limited availability of customer service employees.

In 2023, the marketing segment accounted for the largest market share of about 56%. Chatbots use AI to process language and interact with humans. Many chatbots have been added to messenger apps like Facebook, Skype, Slack, and other social media networking sites. Moreover, chatbot programmers incorporate payment gateways directly with the associate and use these messaging platforms for payment services.

One of the market's significant opportunities is to charge nominal fees as commission. Furthermore, chatbots are widely used in digital marketing to keep existing customers informed about new products and services, even though they allow for direct customer interaction.

In 2023, the standalone segment accounted for the largest market share of about 55.70%. Consumers nowadays use visual assistant apps like Google Assistant, Amazon's Alexa, and Apple's Siri in standalone messaging platforms. This is expected to result in a significant increase in demand for standalone chatbots.

In 2023, the bot-for-service segment dominated the market holding the largest share of about 36%. In this era of automation, many businesses automate routine and mundane tasks to save money. Sales and customer service are the primary areas focusing on automating, which will significantly reduce costs by utilizing chatbots.

Chatbots powered by artificial intelligence a becoming increasingly popular. Chatbots in businesses will drastically reduce labor costs by automating a portion of customer service and sales, resulting in significant savings for businesses. Customers prefer quick responses from customer service over waiting days for an answer, and responding through a chatbot reduces the likelihood of losing a customer significantly. E-commerce companies can use chatbots for returns and exchanges.

Chatbot Market Share, By Vertical, 2022 (%)

| Vertical Segments | Revenue Share (2022) |

| Healthcare | 19.5% |

| Retail | 5.7% |

| Banking, Financial Services and Insurance (BFSI) | 15% |

| Media and Entertainment | 19.5% |

| Travel & Tourism | 13.8% |

| E-commerce | 21% |

| Others | 5.5% |

In 2023, the eCommerce segment accounted for the largest market share of about 21%. eCommerce chatbots are used for 'conversational commerce' or conversational interfaces, which include chatbots, online messaging, and voice assistants, among others, to provide clients with a fast and satisfying shopping experience.

Conversational commerce combines the convenience and efficiency of eCommerce portals with personalized service for customers. eCommerce bots are an effective lead-generation tool for merchants. Moreover, they engage pliant visitors on a retailer's app, website or other digital platforms with intelligent prompts and convert them into prospects. When shopping online, most customers look for deals and discounts.

An eCommerce chatbot can alert prospects to discounts and promotional offers through discount codes, and coupons, and/or redirect them to the appropriate sections of the portal.

In 2023, the large enterprises' segment accounted for the highest market share of about 51%. Multiple large enterprises build their chatbots with a set of rules and are expected to improve their chatbots in the future to achieve advanced operations. Most chatbot development tools are based on the machine learning model, allowing businesses to create an AI applications interface to deliver actionable business data.

Furthermore, market advancements in artificial intelligence have significantly shifted usage from online social networks to mobile-based messaging apps.

By End User

By Application

By Type

By Product

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024