March 2025

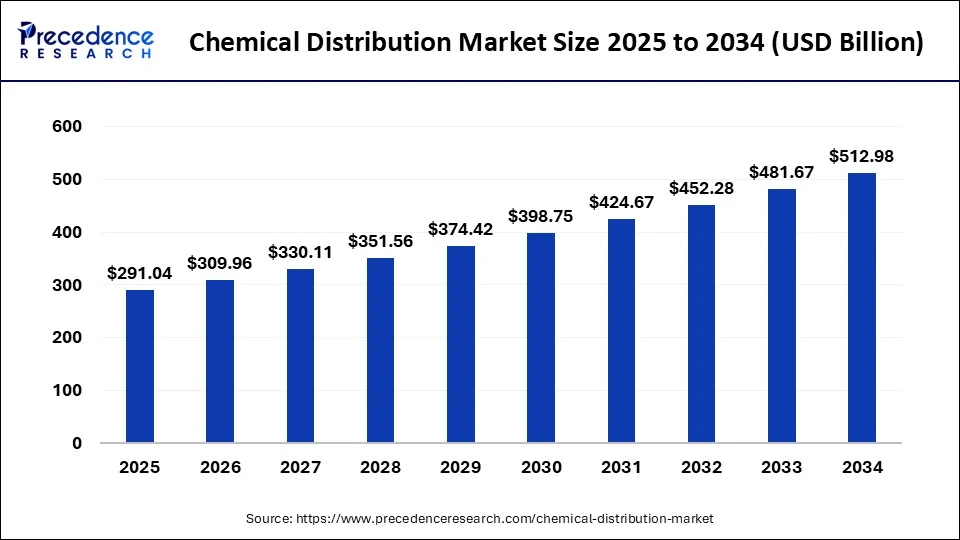

The global chemical distribution market size was USD 256.60 billion in 2023, calculated at USD 273.28 billion in 2024 and is projected to surpass around USD 512.98 billion by 2034, expanding at a CAGR of 6.5% from 2024 to 2034.

The global chemical distribution market size accounted for USD 273.28 billion in 2024 and is expected to be worth around USD 512.98 billion by 2034, at a CAGR of 6.5% from 2024 to 2034. The market growth is primarily attributed to the rising consumption of chemicals in various industries.

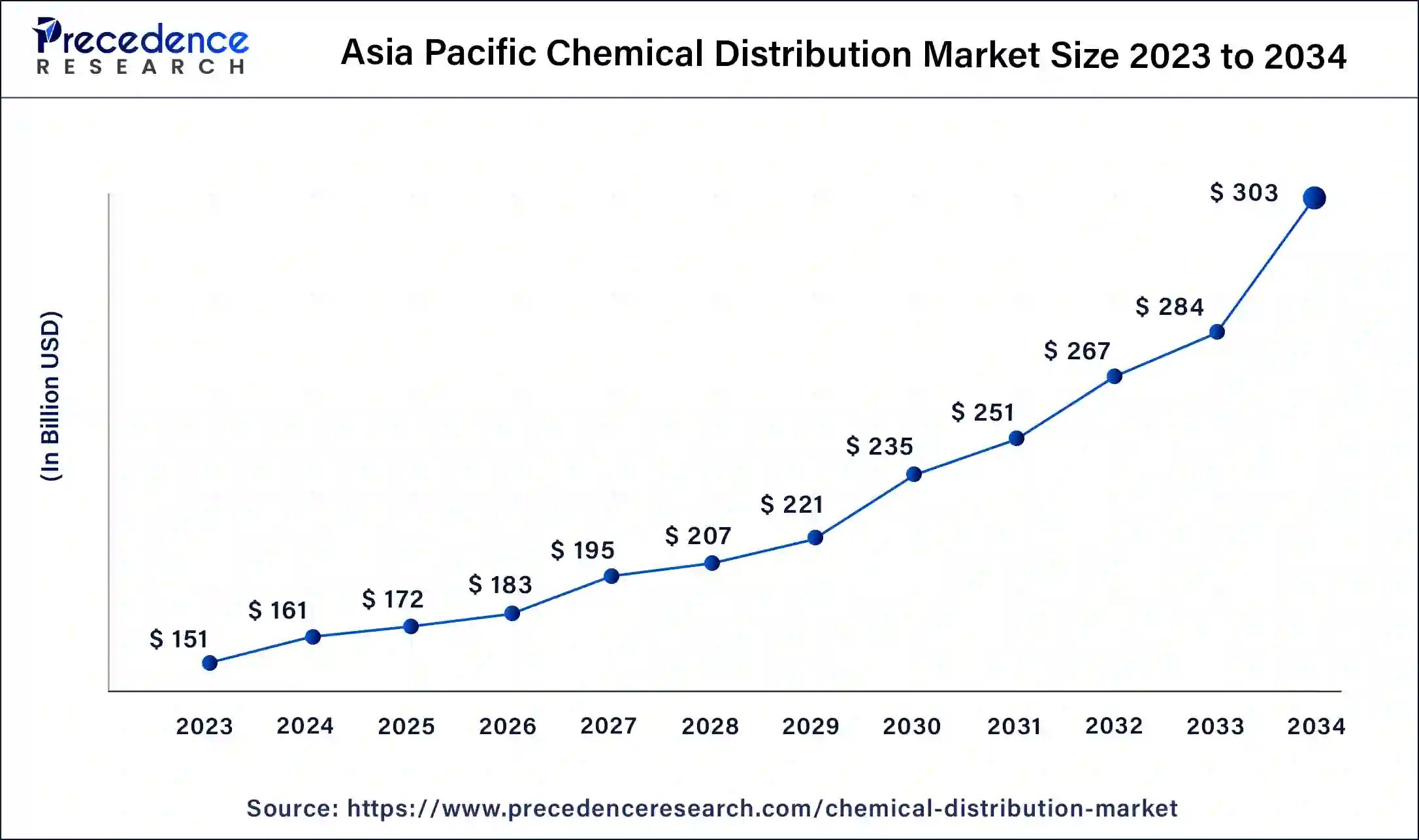

The Asia Pacific chemical distribution market size was estimated at USD 151 billion in 2023 and is predicted to be worth around USD 303 billion by 2034, at a CAGR of 6.7% from 2024 to 2034.

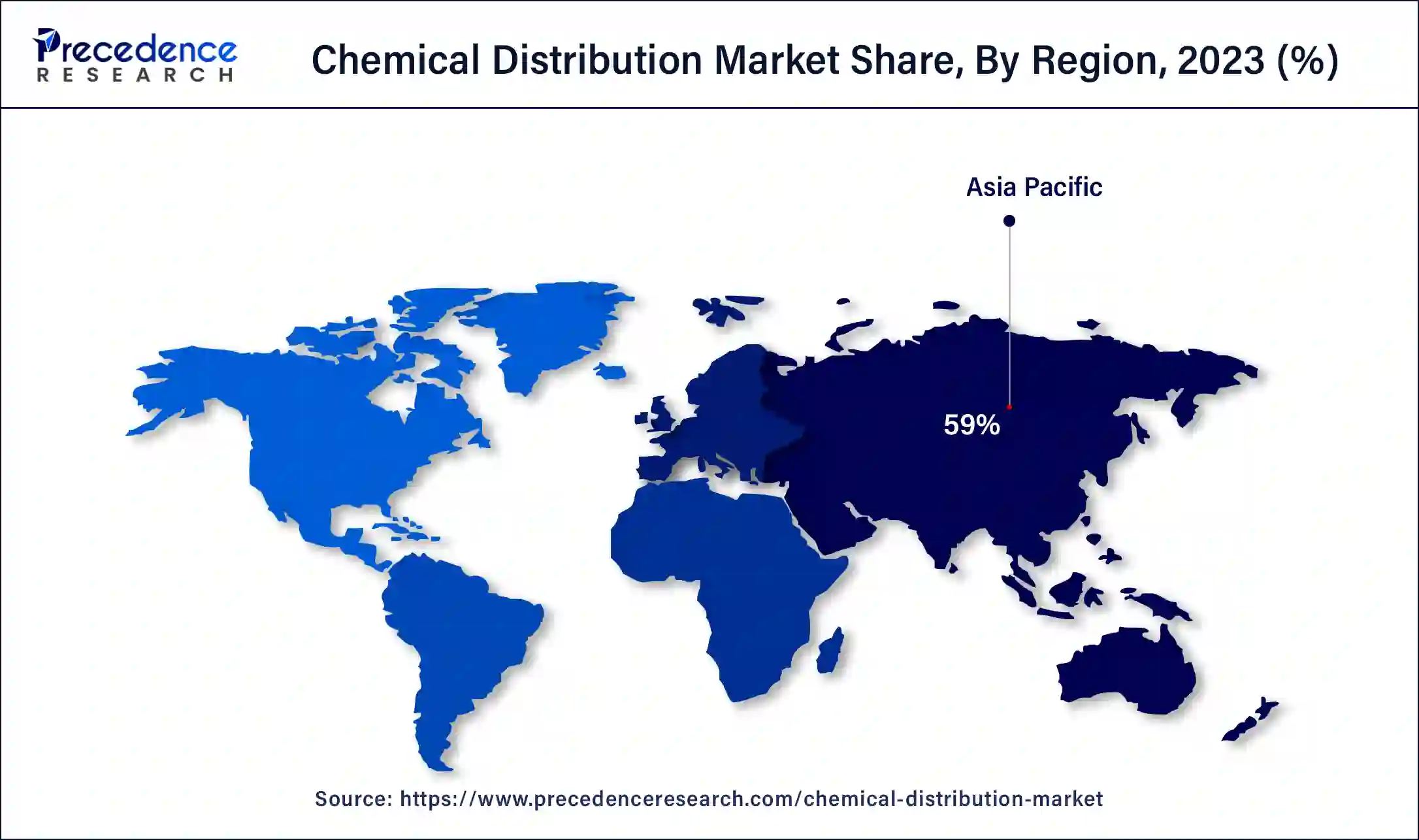

Asia Pacific dominated the global chemical distribution market in 2023 and is projected to sustain its dominance during the forecast period. The rapid growth of the industries in the major Asia Pacific economies such as China, Japan, India, South Korea, and Australia has significantly played a crucial role in the growth and development of the chemical distribution market in the past. Moreover, rapid industrialization in the region and the expansion of the chemical industry contributed to the market growth.

North America is expected to witness a significant growth in the upcoming years. The North America chemical distribution market is highly influenced by the presence of top players such as IMCD, Univar, and Brenntag, which holds largest market share in. The rapidly growing automotive, construction, and pharmaceutical industries in the region is expected to drive the growth of the market in North America. Moreover, the rising expenditure by the chemical companies for expansion of production units boosts the market.

The increasing chemical consumption in various end-use industries, such as plastics, polymers & resins, pharmaceuticals, and construction, drives the chemical distribution market. The chemical companies produce and supply the necessary raw materials to businesses in the industrial and manufacturing sectors. These raw materials are distributed or sold directly by producers to end-users. The distribution of specialty and commodity chemicals by third parties is expected to increase due to the rising outsourcing of value-added services, such as technical training, inventory management, waste removal, blending, packaging, and logistics. Additionally, the increasing consumer preferences toward high-quality products are expected to drive the growth of the chemical distribution market.

The chemical distribution market is growing at a sustainable rate owing to the innovative measures adopted by the chemical distributors to tackle the bottlenecks of the supply chain systems. The rising consumption of chemicals across various end use industries such as automotive, agriculture, construction, pharmaceuticals, and textiles is exponentially boosting the growth of the global chemical distribution market. The need for the chemical distributors emerged owing to the complexities faced by the chemical manufacturers. The chemical distributors offers convenience to the producers and helps to expand in the new markets, by eliminating supply chain complexity. The value-added services offered by the chemical distributors like inventory management is fostering the demand for the chemical distribution services among the chemical manufacturers. The chemical distributors are considered to be an essential part of the manufacturer’s go-to-market strategy. The chemical distributors effectively reduces the cost of distribution and helps the chemical manufacturers to supply their products to new and developing markets at a convenient cost. The availability of wider variety of chemicals and its increased usage in huge number of different industries is boosting the growth of the global chemical distribution market.

The chemical distribution services serve as an important link for the producers to reach to the smaller customers that are situated in less developed regions. The chemical distributors helps the chemical manufacturers to reach to new markets that helps in the growth of the global chemical industry. Today, developing markets like Asia Pacific, Middle East, Latin America, and Africa are critically important as these regions offers immense growth opportunities to the chemical industry. The chemical industry is also a prominent contributor to the GDP of developed and developing markets. For instance, the chemical industry contributed around 3.5% of the Europe’s GDP, 2.9% in North America, and 7.3% in Asia Pacific. Hence, the exponential growth of the chemical industry is boosting the growth of the global chemical distribution market.

| Report Highlights | Details |

| Market Size in 2023 | USD 256.60 Billion |

| Market Size in 2024 | USD 273.28 Billion |

| Market Size by 2034 | USD 512.98 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.5% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, End User Type, Region Type |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Increasing demand for chemicals

The increasing demand for chemicals in various industries, such as agriculture, automotive, construction, and manufacturing, is a major factor driving the growth of the market. Chemical providers play an important role in supplying a wide range of chemicals to address the burgeoning demands of industries. Moreover, key players competing in the market are increasing their production capacities to meet the overall increasing demand for chemicals. For instance,

Additionally, chemical distribution companies offer high-quality services, such as logistics, transportation, packaging, and storage, which help streamline complicated supply chains for end-users and manufacturers. Chemical providers offer technical support, customized packaging solutions, and inventory management to improve supply chain flexibility and efficiency, further contributing to the market's growth.

Logistics challenges and supply chain disruptions

Supply chain disruptions due to transportation bottlenecks, geopolitical tensions, and natural disasters may impact the delivery and availability of chemicals to consumers, thus restraining the market. Chemical distributors must manage diversified suppliers and inventory risks and implement contingency plans to ensure continuity of supply and mitigate disruptions.

Increasing emphasis on eco-friendly chemicals

The increasing focus on the distribution and development of eco-friendly and sustainable chemicals creates lucrative opportunities in the market. Factors such as the increasing regulations and guidelines for chemical usage and increased environmental pollution across various regions encourage chemical manufacturers to develop sustainable chemicals. Key raw materials that are used in the production of chemicals are subject to strict environmental regulations. Hence, it is necessary to identify products that are economical and sustainable.

Impact of AI on the chemical distribution market

Implementing AI in chemical distribution requires a strategic and thoughtful approach to ensure successful adoption and seamless integration. AI analyzes a vast amount of data and streamlines logistics operations, thereby optimizing supply chains. It also predicts future demand and identifies faults in equipment used in chemical distribution facilities. By optimizing processes, AI can help companies reduce waste and adopt greener practices.

Based on product, the commodity chemicals segment dominated the global chemical distribution market, accounting for the largest market share in 2023. The segment growth is primarily attributed to the high consumption of commodity chemicals across various industries, such as food & beverages, pharmaceuticals, agriculture, electronics, and construction. Almost every industry uses commodity chemicals to manufacture a wide range of goods.

The specialty chemicals segment is anticipated to expand at the fastest growth rate during the forecast period. The use of specialty chemicals is highly under the scrutiny of the government, and they are used for special applications across different industries. The rising usage of specialty chemicals in the polymer and pharmaceutical industries is expected to drive the growth of this segment.

Based on end use, the construction segment dominated the global chemical distribution market in 2023 and is expected to sustain its dominance during the forecast period. The segment growth is attributable to the rising construction activities worldwide. The rising industrialization and urbanization in developing regions and the rising demand for specialty chemicals in the construction industry further contributed to the segmental growth.

The pharmaceuticals segment is expected to be the fastest-growing segment during the forecast period due to the rising usage of chemicals. The rapid expansion of the biopharmaceutical industry in developed regions, such as North America and Europe, is expected to drive the segment. Pharmaceutical industry heavily uses chemicals to dispose of pharmaceutical wastes.

Segments Covered in the Report

By Product

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

September 2024

November 2024