List of Contents

Chemical Vapor Deposition Market Size and Forecast 2025 to 2034

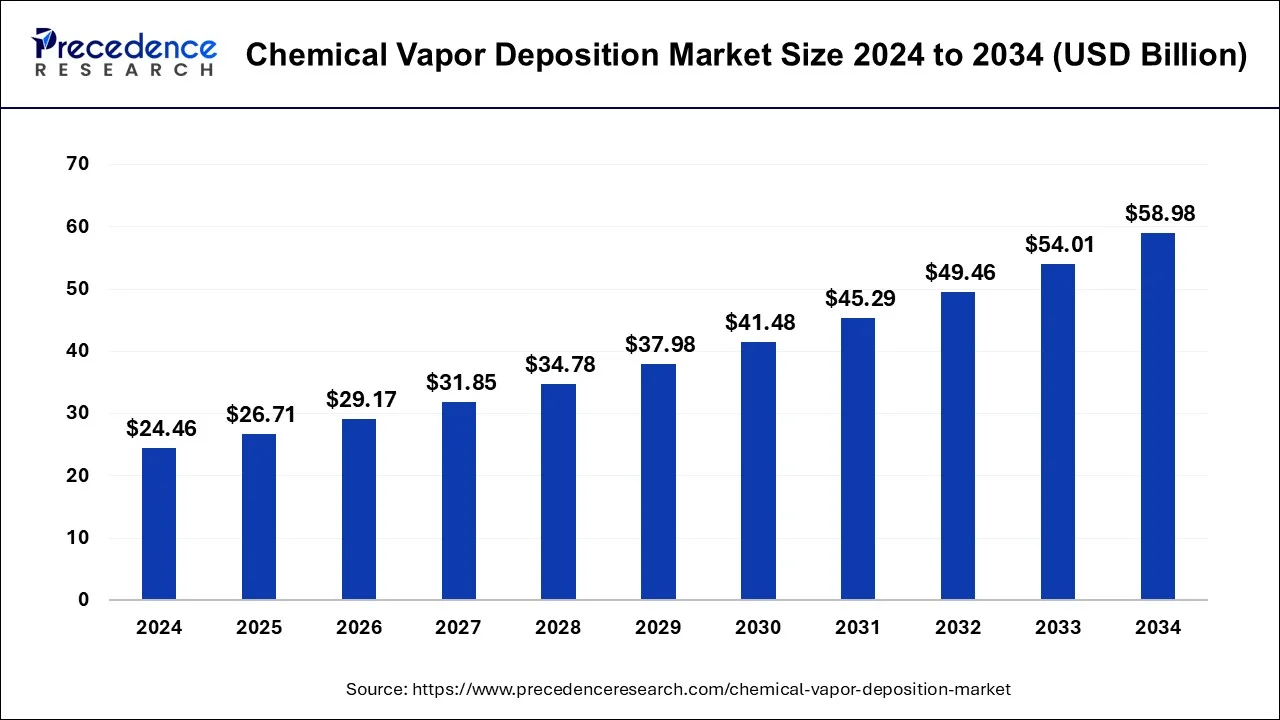

The globalchemical vapor deposition market size was estimated at USD 24.46 billion in 2024 and is predicted to increase from USD 26.71 billion in 2025 to approximately USD58.98 billion by 2034, expanding at a CAGR of 9.20% from 2025 to 2034.

Chemical Vapor Deposition Market Key Takeaways

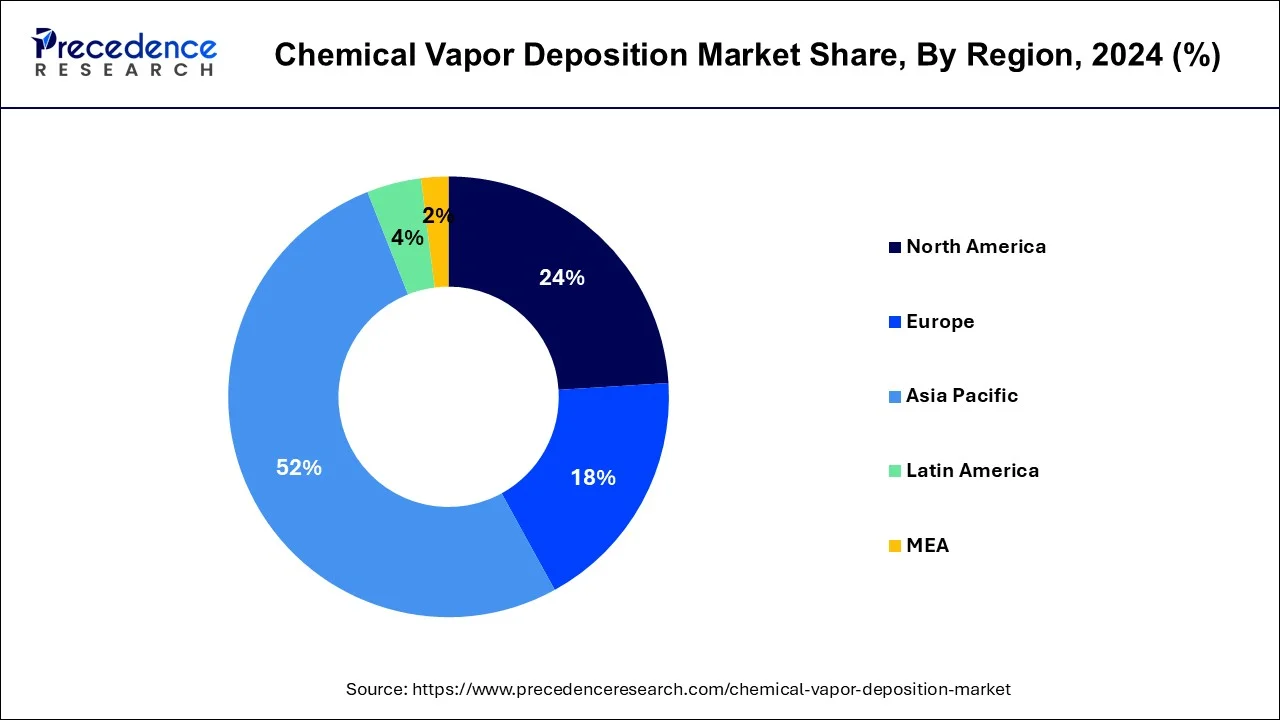

- Asia Pacific led the global market with the highest market share of 52% in 2024.

- By End-use, the microelectronics segment contributed the largest revenue share in 2024.

- By Category, CVD equipment recorded the largest market share in 2024.

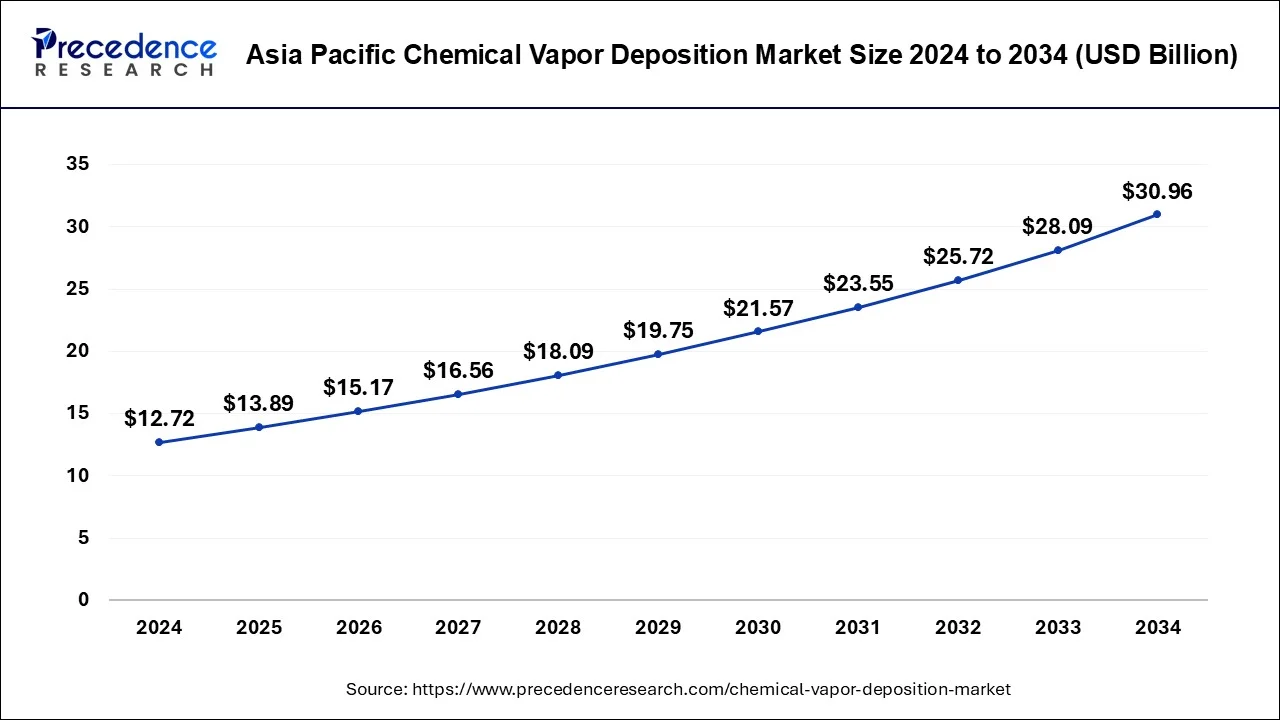

Asia Pacific Chemical Vapor Deposition Market Size and Growth 2025 to 2034

The Asia Pacific chemical vapor deposition market size was estimated at USD 12.72billion in 2024 and is predicted to be worth around USD 30.96 billion by 2034, at a CAGR of 9.30% from 2025 to 2034.

Asia Pacific progressed as noticeable market for largest regional chemical vapor deposition on account of firm growth of plentiful end-use industries in the region. Extremely growing demand from industries such as medical equipment, semiconductor, data storage & solar devices are the foremost end-use areas motivating the growth of CVD in the regional market. For instance, topmost three global solar PV manufacturing players such as JA Solar, JinkoSolar, and Trina Solar are headquartered in China. On May, 2018, the Chinese government declared subsidy cutbacks for photovoltaic power generation, extensively known as the “531 Policy”. Additionally, In Asia Pacific, India is considered to have a promptly growing electronics system design manufacturing industry, in that way propelling the growth of CVD market in this region. Further, high inclination for high-end technological devices and the decreasing electronics prices are also driving the demand.

North America has established its position as second leading market in the global CVD industry. Supportive governmental regulatory provision for inspiring domestic level private investment in the state is expected to lift the local semiconductor industry, which in return is anticipated to trigger the growth of CVD industry in North America during the forecast period.

Chemical Vapor DepositionMarket Growth Factors

Since past few years, developments in electronics, optics, and electrochemistry have unlocked new opportunities in the CVD diamond market. Specifically, the market has earned substantial revenues from widespread utilization of CVD in optoelectronic and electronic devices. The utmost persuasive influence of CVD diamonds is their less cost comparatively natural diamonds. Over the previous few years, producers in the CVD diamond market have been prosperous in developing CVD diamonds with exceptional properties by enhancing on popularly utilized techniques including thermal assisted and microwave plasma assisted technologies and arc–jet torch technique. Numerous manufacturers are also investigating on the possibility of new, innovative electron emission materials.

Extremely budding demand from microelectronics sector products including laptops, mobiles, and storage devices among other has confidently affected the development of this vapor deposition technology market. Flourishing demands in electrochemical application are significant to large part of the returns in the CVD diamond market. Numerous consumer electronics companies are exploiting the outstanding conductivity and thermal resistance properties.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 24.46 Billion |

| Market Size in 2025 | USD 26.71Billion |

| Market Size by 2034 | USD 58.98 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.2% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Category Type, End User Type, Region Type |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

End-use Insights

Among different end-users of CVD, microelectronics is estimated to be the largest application segment in the industry by 2034, with whole share of over 16% in the same year. Utilization of this technology for coating components of electronic devices like capacitors integrated circuits, and resistors projected to lead to improved product cycle. These characteristics of chemical vapor deposition coatings are likely to enhance substantial demand for this technology during near future. Plasma assisted CVD method is one of numerous associated techniques employed to deposit thin films of diamond that have attractive tribological properties with very great hardness and small friction. At present, microwave plasma's are of extensive interest for the activated manufacture of diamond films. Other compounds that are dumped by PACVD comprise silicon nitride, quartz, silicon and titanium nitride as dielectrics, insulating layers and thin film substrates in electronic applications

Category Insights

In 2024, CVD equipment emerged as major category segment with significant revenue share of the market. This equipment shows a foremost role in development of high performance thin solid coatings. The coatings have plentiful usages in numerous operations comprising optical, mechanical and chemical operations in numerous industrial manufacturing processes.

Chemical vapor deposition equipment grasps the major share of the complete market as it have noteworthy role for the end-use sectors and helps in manufacturing numerous types of solid film deposition. The industrial services comprise integration of numerous other chemical vapor deposition processes like plasma, vacuum, atom layering, and combustion CVD.

Chemical Vapor Deposition Market Companies

- CVD Equipment Corporation

- Lam Research Corporation

- Intevac, Inc

- Aixtron SE

- ASM International NV

- Richter Precision Inc

- Plasma-Therm

- Applied Materials Inc.

- Veeco Instruments Inc.

- IHI Ionbond AG

- OC Oerlikon Corporation AG

- ULVAC Inc.

Segments Covered in the Report

By Category

- CVD Services

- CVD Equipment

- CVD Materials

By End-use

- Solar Products

- Cutting Tools

- Microelectronics

- Data Storage

- Medical Equipment

- Others

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client