April 2025

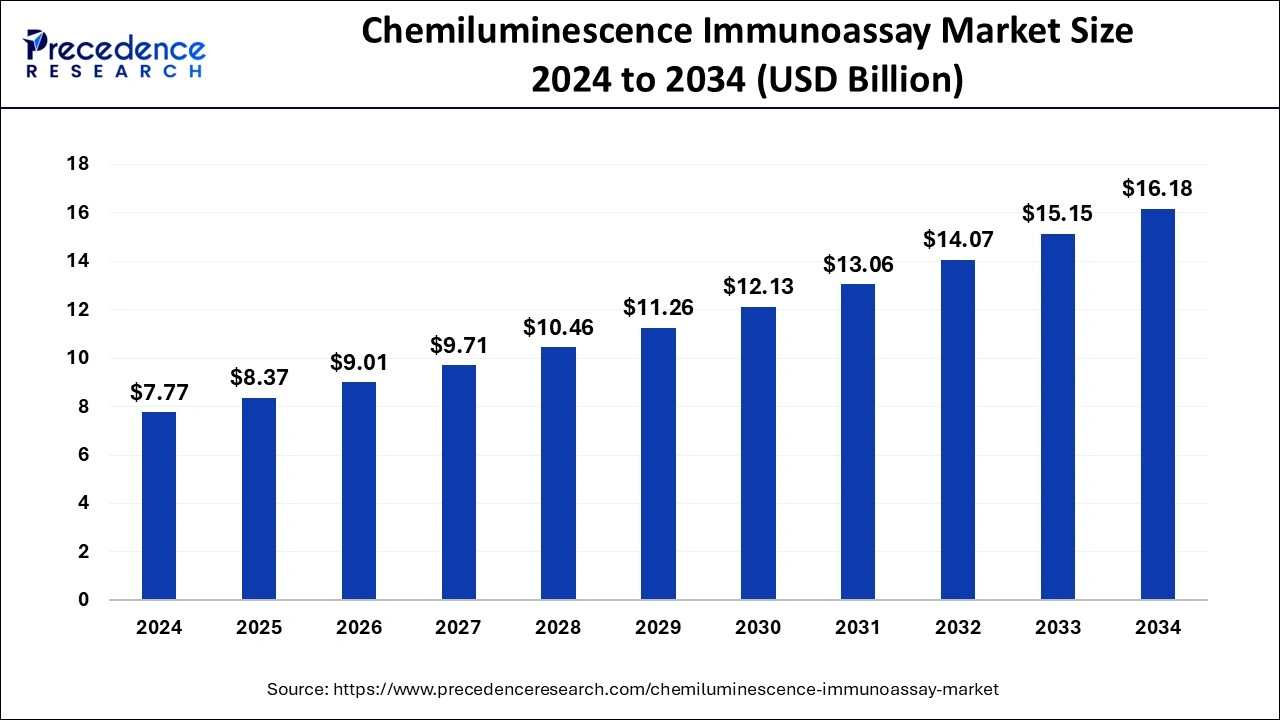

The global chemiluminescence immunoassay market size is calculated at USD 8.37 billion in 2025 and is forecasted to reach around USD 16.18 billion by 2034, accelerating at a CAGR of 7.98% from 2025 to 2034. The North America chemiluminescence immunoassay market size surpassed USD 4.04 billion in 2024 and is expanding at a CAGR of 8.11% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global chemiluminescence immunoassay market size was estimated at USD 7.77 billion in 2024 and is anticipated to reach around USD 16.18 billion by 2034, expanding at a CAGR of 7.98% from 2025 to 2034. The chemiluminescence immunoassay market is experiencing significant growth due to the increasing emphasis on early disease detection. Furthermore, rising investments in drug discovery and development contributes to market expansion.

The integration of AI algorithms in chemiluminescence immunoassay improves the accuracy and efficiency of diagnostic processes. AI-powered advancements enhance data interpretation and decrease human errors. AI can quickly analyze vast amounts of data, providing faster and more accurate results. This allows healthcare professionals to make timely decisions. Moreover, integrating AI technologies in the manufacturing processes of CLIA automates and optimizes workflows, decreases overall operational costs, and enables high-throughput testing.

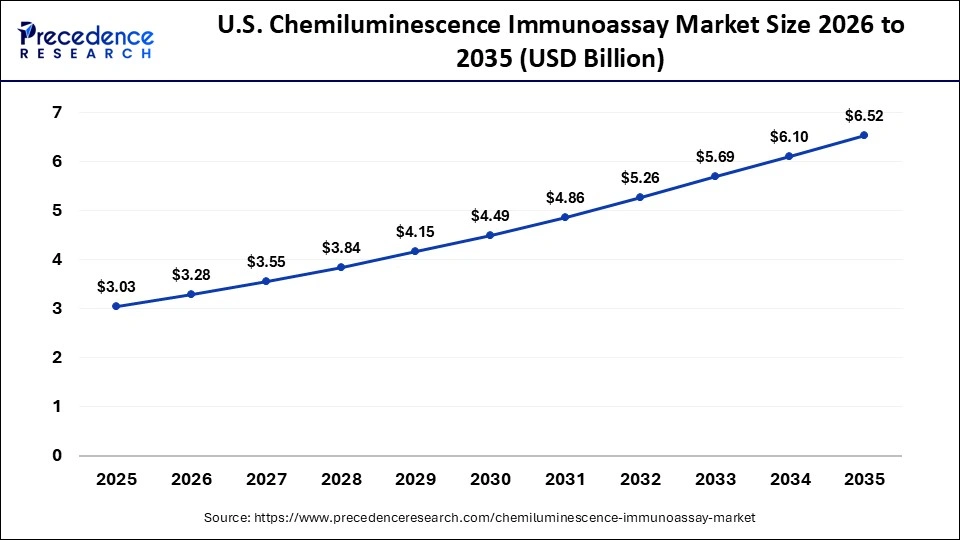

The U.S. chemiluminescence immunoassay market size was evaluated at USD 2.8 billion in 2024 and is predicted to be worth around USD 6.1 billion by 2034, rising at a CAGR of 8.20% from 2025 to 2034.

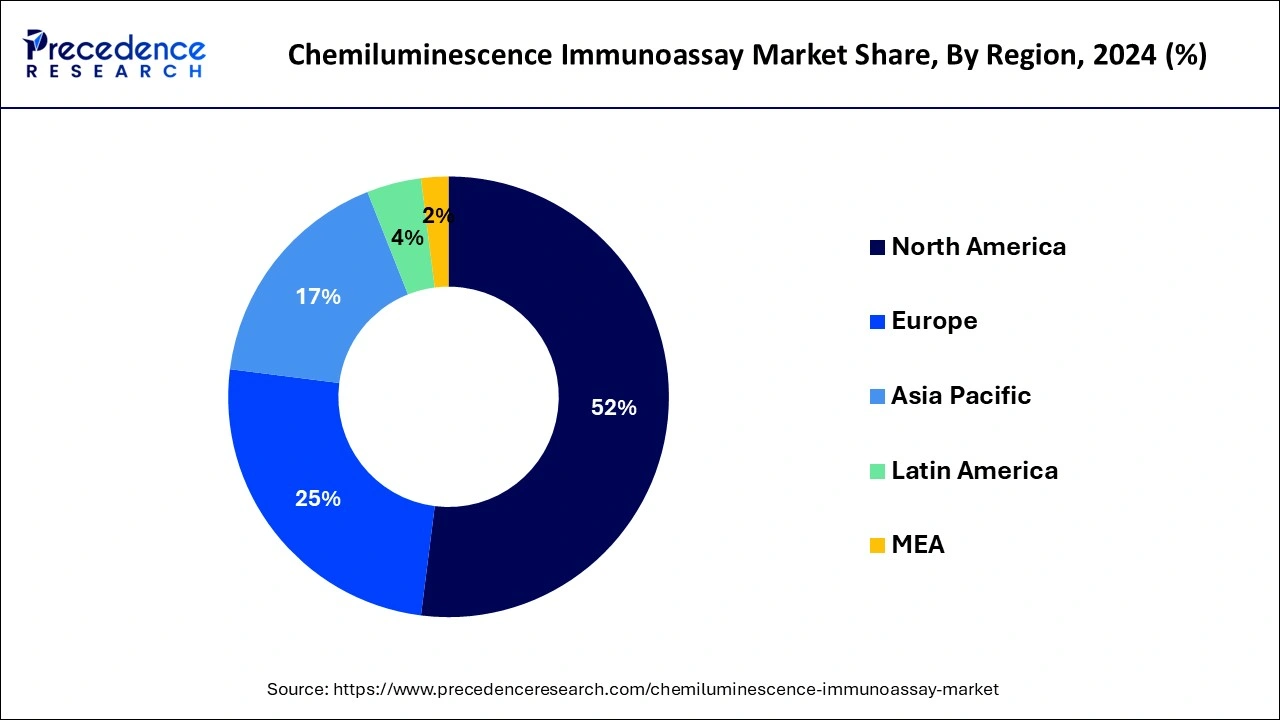

North America seized the substantial market stake globally in 2024 and is projected to mirror this trend during the assessment period. Significant influences backing to its governance are the existence of established healthcare infrastructure, high acceptance of cutting-edge chemiluminescence immunoassay solutions, and snowballing pervasiveness of chronic diseases among others. Additionally, augmented availability of novel CLIA systems in the U.S. on account of existence of crucial market participants like Beckman Coulter, Inc., Abbott Laboratories, Roche and DiaSorinis further likely to subsidize the growth of the market in the North America.

Asia Pacific is prospective to be an extremely profitable market for the chemiluminescence immunoassay analyzers market and it is anticipated to develop at a rapid growth rate throughout the estimate period. Huge population base and escalation in occurrence of infectious and chronic diseases augments requirement for diagnostic testing in the APAC. Besides, promising government initiative to progress healthcare infrastructure is expected to supplement the growth of the market.

Diagnostic technology is budding rapidly, and over the last decade, considerable progress has been made in the identification of antibodies, progressively impending this sort of diagnostic to that of automated clinical chemistry laboratory. The number of tests integrating chemiluminescence immunoassay analyzers practices is estimated to be magnified due to technological advancements in disease diagnosis and the upsurge in demand for treatment monitoring and precautionary diagnosis. Subsequently, the requirement for high throughput facilities is also increasing. Furthermore, large-scale laboratories are capturing the benefit of service and quality constraints confronted by small and mid-volume laboratories to seize a bigger chunk of the market by means of CLIA methods.

Companion diagnostics comprise assays or tests proposed to support healthcare providers in making treatment decisions for patients on the basis of the finest response to therapy. The co-development of companion diagnostics along with therapeutic products has the potential to meaningfully modify the drug development process and commercialize drug candidates by getting safer drugs with improved therapeutic effectiveness cost-effectively and quickly. With an increase in the demand for high-priced specialist therapies and safer drugs, the market for chemiluminescence immunoassay is expected to showcase a high growth potential.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.77 Billion |

| Market Size in 2025 | USD 8.37 Billion |

| Market Size by 2034 | USD 16.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.98% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Application Type, and By End User Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

With the rising number of cases of chronic diseases, such as cancer and diabetes, the demand for CLIA is increasing. CLIA, a powerful diagnostic technique, plays a crucial role in detecting disease patterns in patients with cancer and diabetes. The growing global population, coupled with an increase in chronic diseases, is significantly driving up the demand for these essential diagnostic tools. In response to this heightened demand, ongoing research and development in CLIA technology is fostering the innovation of new products with enhanced performance and efficiency. Innovations in this field may include improved sensitivity, which requires convenient testing to achieve accurate diagnostic tests.

Despite their widespread use, price fluctuations influenced by geopolitical events and global economic conditions can lead to significant variations in production costs, consequently impacting the overall profitability of companies operating within the CLIA market. Furthermore, the chemiluminescence immunoassay industry is characterized by strict regulatory requirements, which can potentially increase the costs of product development, and this will cause hindrance in the market, consequently affecting the profitability of numerous players ranging from large multinational corporations to smaller regional companies vying for market share.

There are substantial opportunities for the growth of CLIA in the healthcare sector. The integration of CLIA with conventional drug development, particularly in areas such as chronic disease and veterinary diagnostics, presents a promising avenue for development. This holistic approach can enhance patient comfort, reduce reliance on pharmaceuticals, and improve quality of life. Continued research and development aimed at scientifically validating the efficacy and safety of CLIA also play a crucial role in addressing existing concerns. By establishing robust clinical evidence and integrating CLIA into mainstream drug development and research practices, the credibility of this natural treatment can be significantly enhanced, fostering greater acceptance and use to research and monitor therapeutic response.

Numerous applications of chemiluminescence immunoassay market comprises of disorders, endocrine infectious diseases, oncology, cardiovascular disorders, hepatitis and retrovirus, allergy, drug discovery & development autoimmunity, and others. Endocrine gathered considerable market share in terms of revenue in 2024 and it is predicted to reflect this tendency throughout the estimate period. Foremost influences accountable for the governance of this application segment are incessant inventions in test offerings and extensive product offerings of chief and local manufacturers.

Among different product segments analyzed in this research study, consumables segment garnered substantial share in 2024. This segment is predicted to hold its domination over the prediction period. This growth can be credited to augmented requirement for consumables including stains and reagents in the area of endocrinology, therapeutic drug monitoring, and disease analysis.

In terms of several end-users, hospitals grasp majority of the market chunk and reported prime revenue share in 2023. This governance is credited to the cumulative need for chemiluminescence immunoassay solutions in hospitals and intensifying hospital visits on account of mounting occurrence of infectious diseases and cancer. Correspondingly, the growing hospitalization owed to outburst of novel coronavirus is anticipated to increase the requirement for chemiluminescence immunoassay solutions in the hospital segment. Snowballing amount of applications of automated CLIA analyzers in oncology, therapeutic drug monitoring, and companion diagnostics and emergence of integrated modules of automated CLIA analyzers are projected to fuel the growth of hospitals segment throughout the estimate period.

By Product

By Application

By End-use

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

February 2025

March 2025