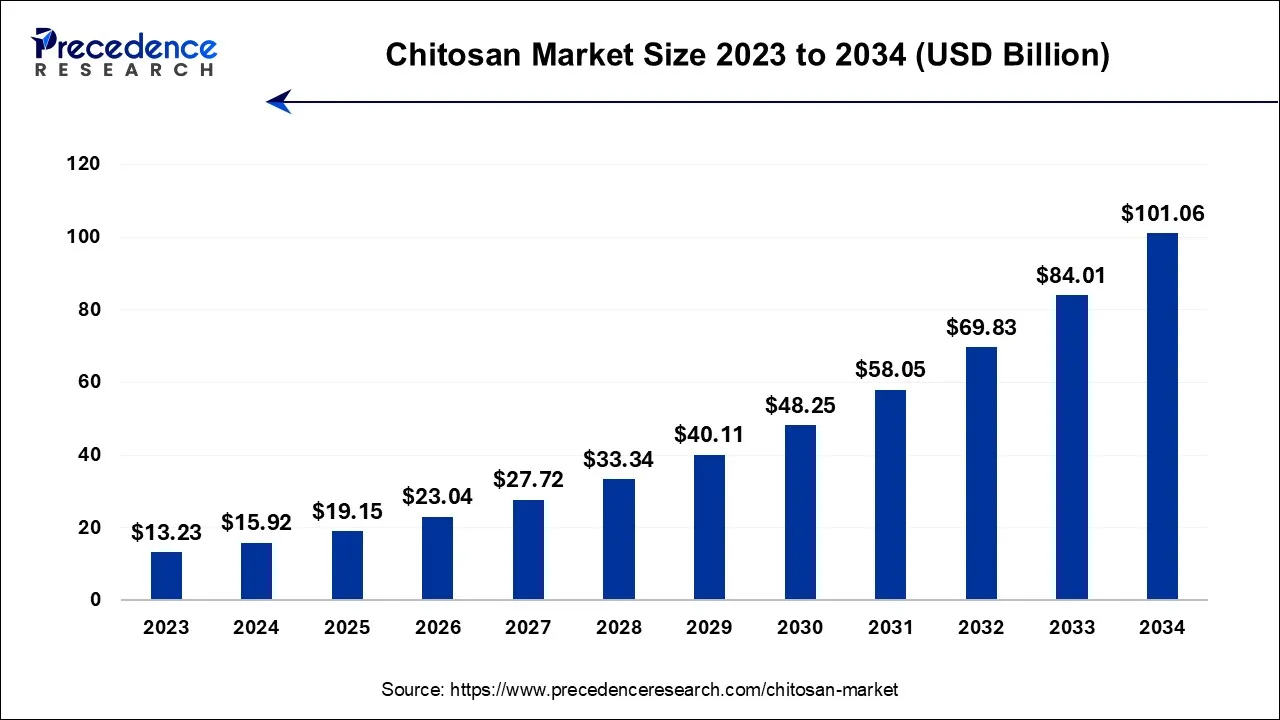

The global chitosan market size is calculated at USD 15.92 billion in 2024, grew to USD 19.15 billion in 2025, and is predicted to hit around USD 101.06 billion by 2034, poised to grow at a CAGR of 20.29% between 2024 and 2034. The North America chitosan market size accounted for USD 7.48 billion in 2024 and is anticipated to grow at the fastest CAGR of 20.42% during the forecast year.

The global chitosan market size is expected to be valued at USD 15.92 billion in 2024 and is anticipated to reach around USD 101.06 billion by 2034, expanding at a CAGR of 20.29% over the forecast period from 2024 to 2034.

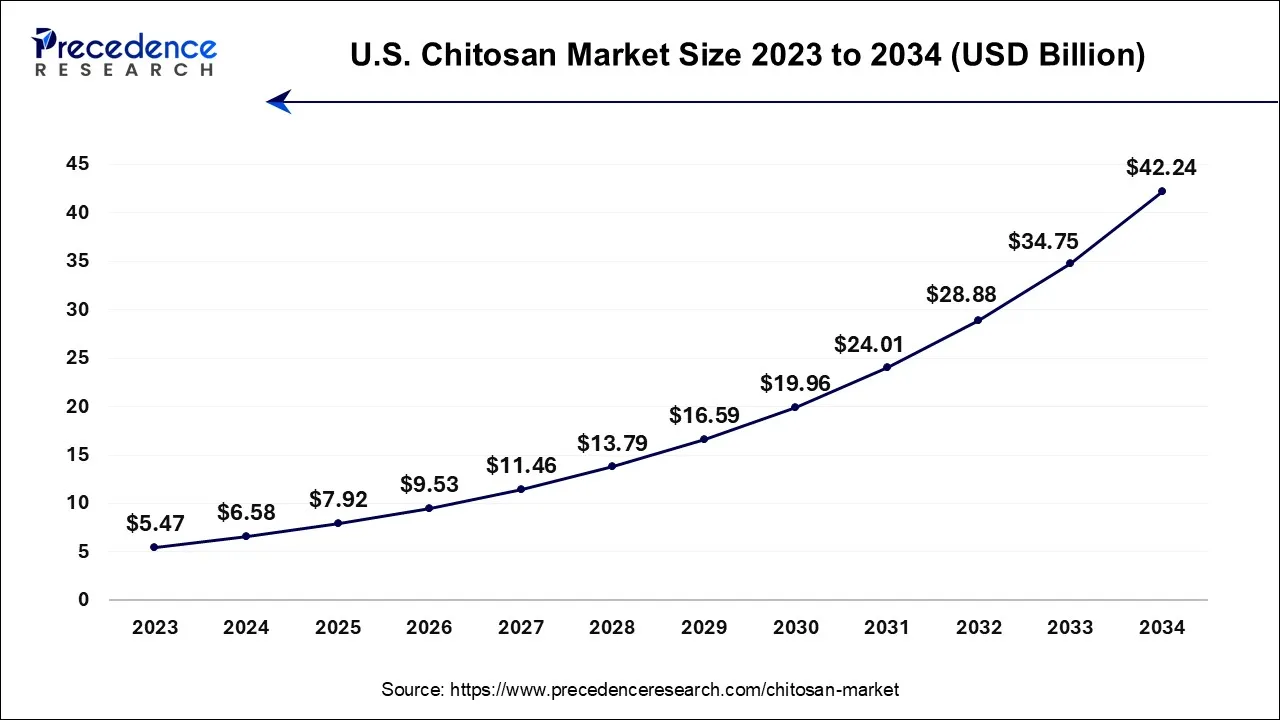

The U.S. chitosan market size accounted for USD 6.58 billion in 2024 and is projected to be worth around USD 42.24 billion by 2034, poised to grow at a CAGR of 20.43% from 2024 to 2034.

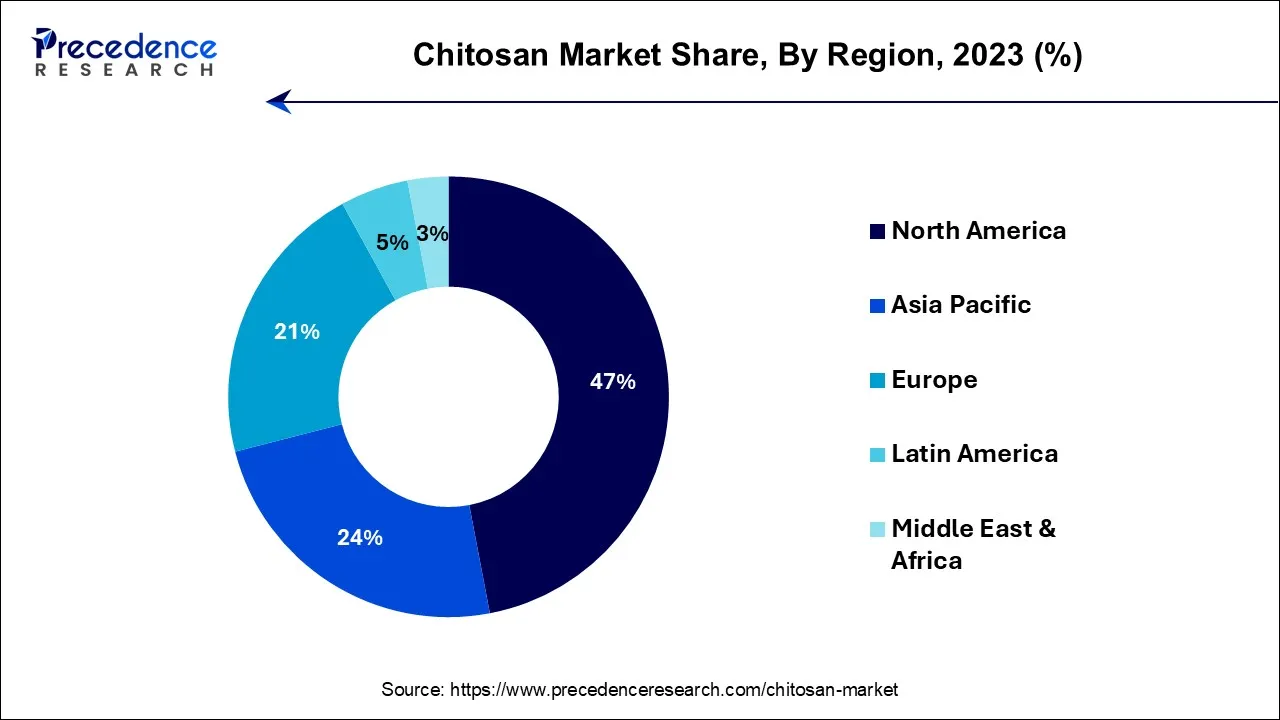

North America led the chitosan market with the largest share of 47% in 2023. The regulatory environment in North America supports the use of chitosan in various applications, from food additives to pharmaceuticals. Regulatory bodies like the FDA (Food and Drug Administration) provide clear guidelines that facilitate the approval process for new products containing chitosan, thus encouraging its adoption across industries. North America has a well-established manufacturing base for chitosan products, enabling companies to efficiently produce and distribute these materials. The presence of major players in the region, coupled with advanced manufacturing technologies, enhances the competitiveness of the chitosan market.

The Asia Pacific is estimated to expand the fastest CAGR between 2024 and 2034. The easy availability of its raw material, obtained as a waste product from the fishery industry, is one of the key factors driving chitosan demand. Fishing is one of the most important industries in the Asia Pacific. For a long time, Asia-Pacific has dominated the shrimp market.

In 2018, China produced 1,956.9 thousand metric tonnes of shrimp, with a CAGR of 1.6 percent over the forecast period. Shrimp production in China typically begins at the end of the calendar year.

The increasing demand of chitosan in the end user industries mainly in waste water treatment and food & beverages industry will proliferate the market growth. An important application is wastewater treatment with chitin or chitosan. For the removal of dyes from industrial wastewater (e.g., textile wastewaters), as well as other organic pollutants such as organochloride pesticides, organic oxidized or fatty impurities, and oil impurities. Chitosan has a number of appealing properties, including hydrophobicity, biocompatibility, biodegradability, non-toxicity, and the presence of highly reactive amino (–NH2) and hydroxyl (–OH) groups in its backbone, which is effective in the waste water treatment.

Chitosan's antioxidant and antimicrobial activity allows it to be used to extend the shelf life of foods, and its excellent emulsifying properties allow it to replace synthetic surfactants in food technologies. Chitosan can also be used as a functional ingredient against hypercholesterolemia, hypertension, and inflammations, as well as for nutrient encapsulation in functional food development. In 2021, revenue in the food & beverage industry is expected to reach USD 342,213 million. For the past two decades, the implementation of online retail in Food & Beverage has been lagging. It has, however, finally taken off, becoming the fastest-growing product category in eCommerce. Such factor will create a positive impact on the chitosan market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 20.29% |

| Market Size in 2024 | USD 15.92 Billion |

| Market Size by 2034 | USD 101.06 Billion |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Source, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the sources, the chitosan market is dominated by shrimp followed by crab. Shrimp is considered the primary source of chitosan because it contains approximately 25% to 40% chitin, whereas crab shell contains approximately 15% to 20%. The chitosan can be produced cheaply and easily from these sources.India is at the second rank when comes to the production of shrimp and largest exporter of shrimp globally after China. For instance, in 2019, the India produced 800, 000 MT shrimp which is double digit growth over the previous decade. The high production of shrimp will enhance the market growth of chitosan market in the near future.

The water treatment segment is the most prominent segment in the market which contributed the largest share in the chitosan market. According to a 2015 Bluefield Research, municipal wastewater reuse would expand by 61 percent by 2025, requiring USD 11 billion in capital. With over 247 reuse projects in various stages of preparation in the United States, which is a significant market trend. According to the UN, the world's population will exceed nine billion people by 2050. It is projected that global food production has to be boosted by 70% to ensure there is enough food for everyone. This will create a burden on the natural resources. So, in various application such agriculture, industrial application waste water utilization can solve the problems which in turn propel the growth of the chitosan market.

The improper discharge of wastewater effluents is strictly enforced, which can render factories noncompliant. Chitosan has many appealing properties, including hydrophobicity, biocompatibility, biodegradability, non-toxicity, and the presence of highly reactive amino (–NH2) and hydroxyl (–OH) groups in its backbone, making it an effective adsorbent material for the removal of wastewater pollutants.

Further, the cosmetics industry has the considerable share in the market. Chitin, chitosan, and their derivatives are widely used in cosmetics, owing to their antioxidant, cleansing, protective, humectant, and antioxidant properties. In 2019, the global cosmetics market was valued at USD 380.2 billion. Cosmetics are now an essential component of most people's modern lifestyles. Furthermore, an increase in awareness of external beauty and an individual's internal intellect has driving the use of cosmetics in the global market. Along with women, men are increasingly using cosmetics in their daily lives, which are contributing to the market growth. Hence, such changing lifestyles, have led to growth of the global cosmetics market which in turn surge a market demand of chitosan in the forecast period.

Segments Covered in the Report

By Source

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client