September 2024

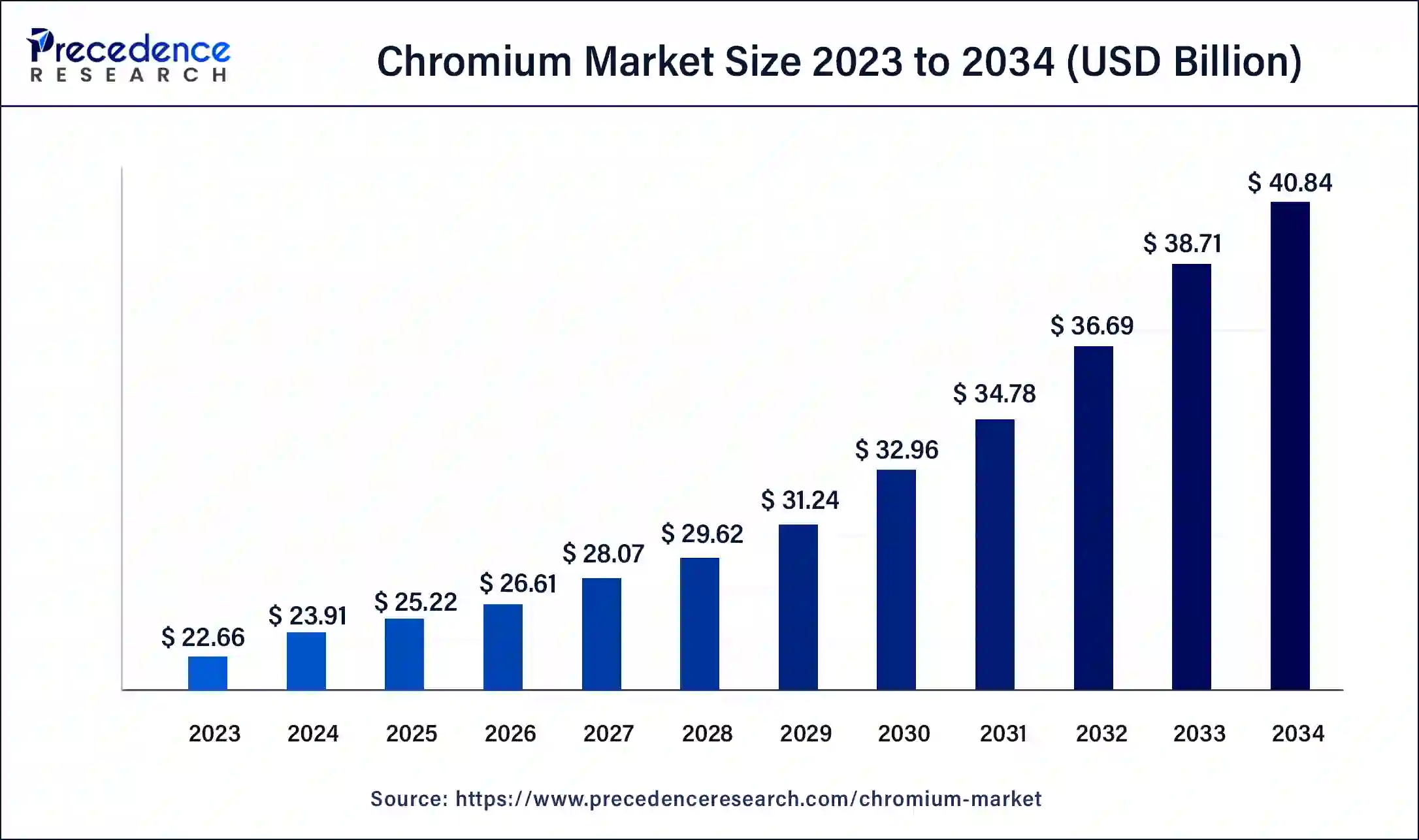

The global chromium market size was USD 22.66 billion in 2023, calculated at USD 23.91 billion in 2024 and is projected to surpass around USD 40.84 billion by 2034, expanding at a CAGR of 5.5% from 2024 to 2034.

The global chromium market size accounted for USD 23.91 billion in 2024 and is expected to be worth around USD 40.84 billion by 2034, at a CAGR of 5.5% from 2024 to 2034.

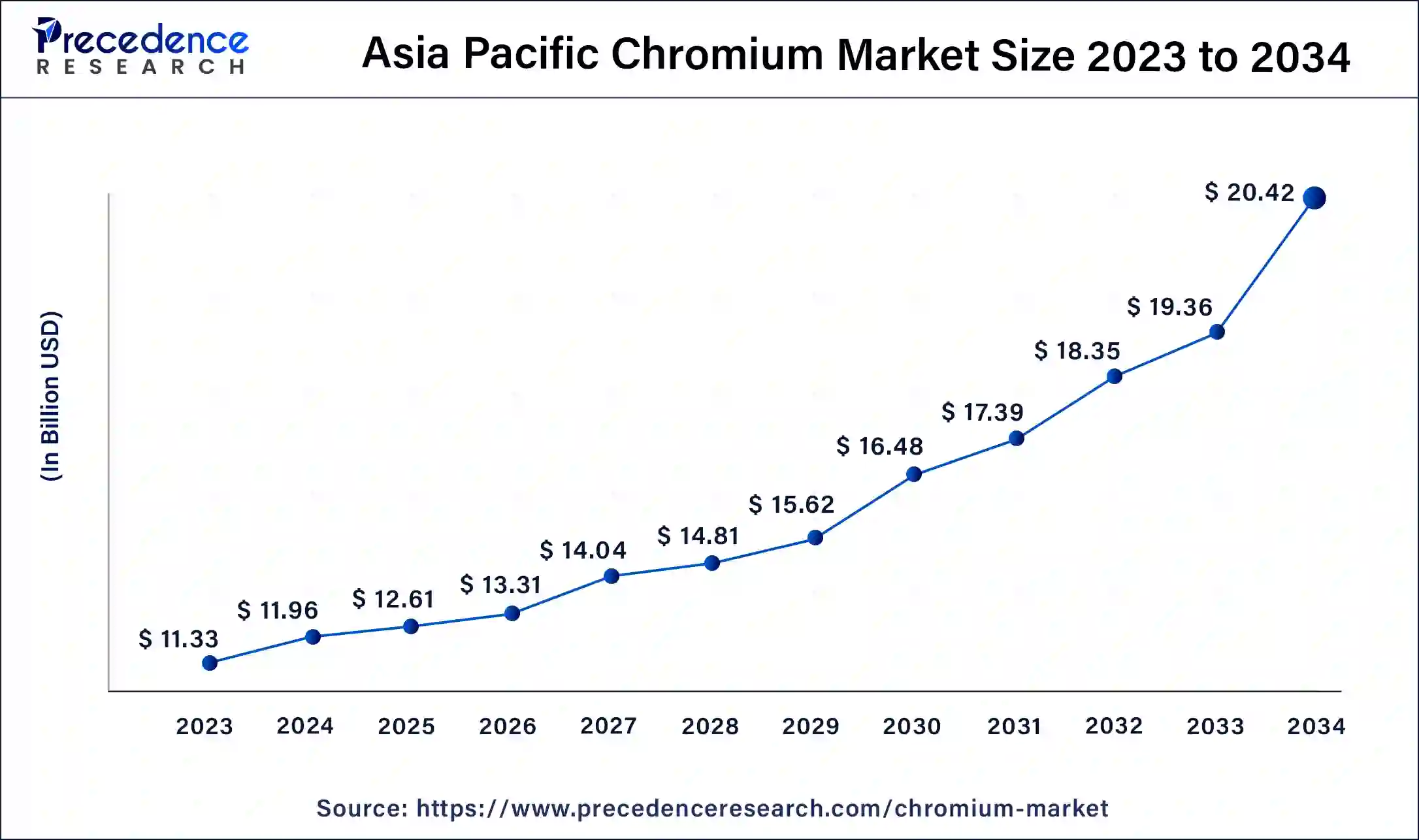

The Asia Pacific chromium market size was estimated at USD 11.33 billion in 2023 and is predicted to be worth around USD 20.42 billion by 2034, at a CAGR of 5.7% from 2024 to 2034.

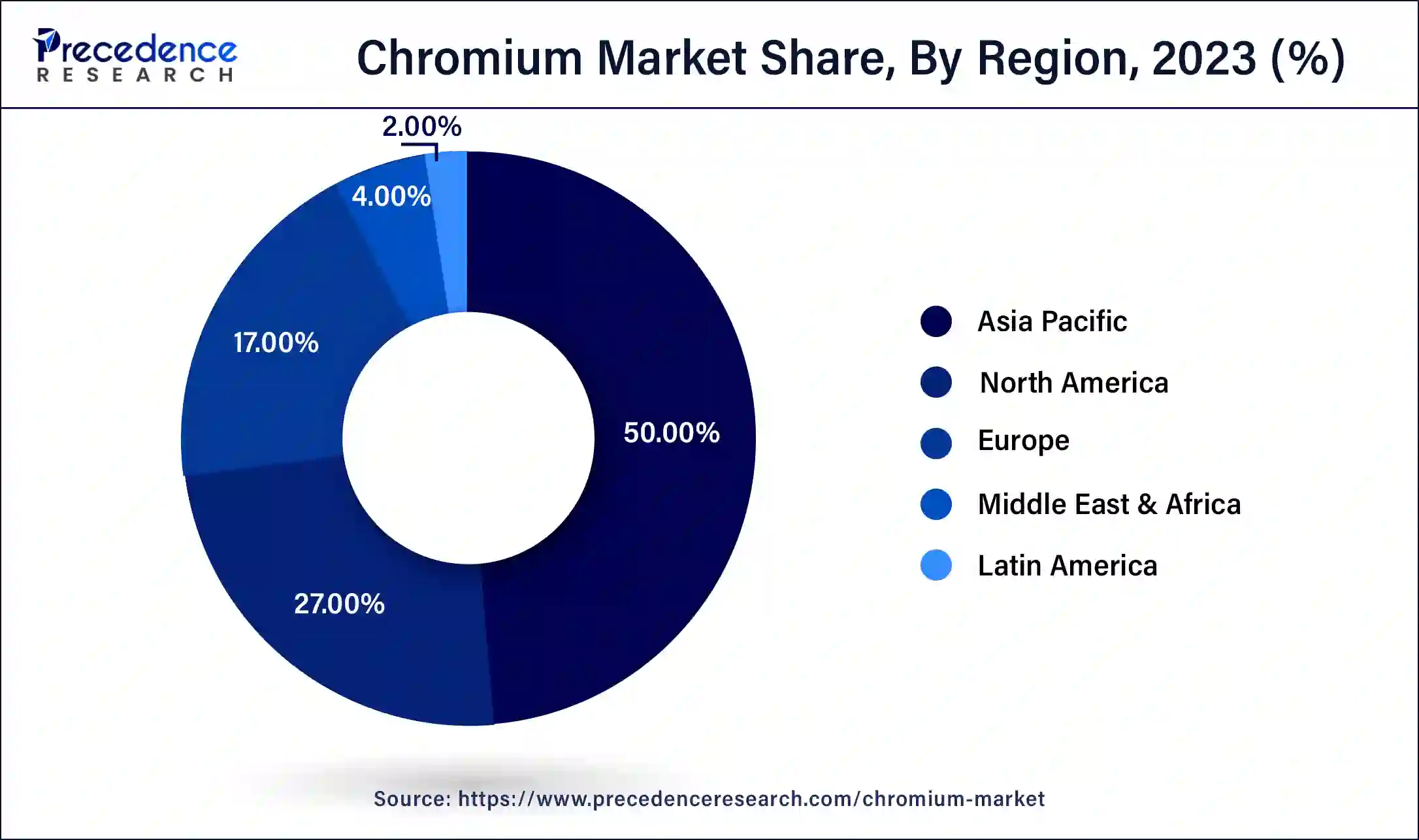

Asia-Pacific holds a share of 50% in the chromium market owing to vigorous industrial growth, infrastructure expansion, and thriving manufacturing in nations like China and India. The widespread application of chromium in producing stainless steel for construction and automotive sectors, along with the rising demand for electronics, contributes to the region's market dominance. Furthermore, Asia-Pacific's pivotal role as a global manufacturing hub, fueled by economic development and urbanization, underscores its significant influence in shaping the chromium market landscape.

North America is poised for rapid growth in the chromium market due to increasing demand from key industries. The region's robust aerospace and automotive sectors drive the need for corrosion-resistant materials, where chromium plays a pivotal role. Moreover, infrastructure development projects and a surge in renewable energy initiatives contribute to the growing demand for chromium in construction and green technologies. With a focus on technological advancements and sustainable practices, North America stands as a key player in the expanding chromium market, presenting significant growth opportunities.

Meanwhile, Europe is experiencing noteworthy growth in the chromium market due to several factors. The region's robust industrial and manufacturing activities, particularly in the aerospace and automotive sectors, drive increased demand for chromium, especially in stainless steel production. Additionally, stringent environmental regulations and a focus on sustainable practices contribute to the rising popularity of chromium in various applications. The ongoing emphasis on infrastructure development and the adoption of green technologies further amplifies the demand for chromium, positioning Europe as a key growth market in the chromium industry.

Chromium is a shiny and tough metal widely used for its good looks and durability. It adds a glossy finish to things like jewelry, kitchen items, and car parts. Not just about looks, chromium is a key ingredient in making strong stainless steel, preventing it from rusting. This makes it a big player in building sturdy structures, gadgets, and machines that last a long time. Chromium also pops up in different industrial jobs, like making colors, speeding up chemical reactions, and treating leather.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.5% |

| Market Size in 2023 | USD 22.66 Billion |

| Market Size in 2024 | USD 23.91 Billion |

| Market Size by 2034 | USD 40.84 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Material and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Infrastructure demand

The Semiconductor Industry Association (SIA) reports that the United States allocated around US$ 142.2 billion for computer production and approximately US$ 53 billion for consumer electronics, including cell phones, TVs, and similar applications.

The chromium market gets a substantial boost from the increasing demands of the electronics industry. Chromium's pivotal role in electronics lies in its use for protective coatings on devices, ensuring they remain sturdy and visually appealing. As the use of smartphones, laptops, and other gadgets continues to rise globally, there is a noticeable uptick in the demand for chromium in manufacturing processes. The corrosion resistance of chromium becomes particularly crucial, contributing to the durability and reliability of electronic devices and making it an indispensable component for industry growth.

Furthermore, as technology continues to advance, and new electronic applications emerge, the demand for chromium further intensifies. The ongoing innovation in electronic device development, coupled with the expanding consumer electronics market, underscores the vital contribution of chromium in meeting the escalating needs of the electronics industry. Consequently, the increasing incorporation of chromium in electronic manufacturing processes serves as a key driver behind the heightened market demand for this essential metal.

Mining and extraction challenges

Mining and extraction challenges present significant restraints on the market demand for chromium. The intricate processes involved in extracting chromium from ores, often found in remote locations, lead to increased extraction costs. Additionally, environmental concerns related to mining activities, including habitat disruption and water pollution, can result in heightened regulatory scrutiny and community resistance, impacting the overall supply chain. Resource depletion is another factor affecting the chromium market.

As accessible high-grade chromium deposits become scarcer, extraction becomes more challenging and costly. This scarcity can lead to supply chain disruptions, affecting industries reliant on chromium, such as stainless-steel manufacturing and aerospace. These mining and extraction challenges not only limit the availability of chromium but also contribute to market uncertainties, influencing pricing dynamics and potentially impeding the growth of the chromium market.

Recycling initiatives

In the chromium market, aerospace innovations are creating exciting opportunities. As the aerospace industry constantly seeks better performance and durability, chromium's alloys and coatings have become crucial. Chromium's special qualities, like resistance to harsh conditions and corrosion protection, make it a valuable material for crafting aircraft components. The ongoing advancements in alloys and coatings for aerospace applications not only ensure aircraft safety and longevity but also open up new possibilities for increased use of chromium in this rapidly growing sector.

As aerospace technologies progress, particularly in designing more fuel-efficient and environmentally friendly aircraft, chromium's importance grows. Opportunities lie in research and development efforts aimed at producing materials that are both lightweight and robust, with chromium's corrosion-resistant properties contributing to fuel efficiency and prolonged component life. This aligns with the aerospace industry's dedication to innovation, providing a fertile ground for the expansion of the chromium market.

The ferrochromium segment had the highest market share of 32% in 2023. Within the chromium market, ferrochromium is an alloy combining chromium and iron, widely employed in crafting stainless steel. This alloy significantly improves the strength and corrosion resistance of stainless steel, playing a pivotal role in diverse industries. Noteworthy in the ferrochromium segment is the escalating demand attributed to the expanding stainless-steel industry. As construction and infrastructure projects surge worldwide, there is a heightened requirement for stainless steel, thereby increasing the significance and demand for ferrochromium, indicating a positive trajectory in this specific market segment.

The chromium metals segment is anticipated to expand at a significant CAGR of 6.1% during the projected period. In the chromium market, the chromium metals segment encompasses alloys and compounds where chromium plays a key role. These materials, valued for their durability and resistance to corrosion, find extensive applications in industries like aerospace, automotive, and construction. Recent market trends highlight a rising need for advanced chromium alloys, particularly in aerospace innovations and the automotive sector. The shift towards lightweight and resilient materials in these industries is fueling the demand for chromium metals, reflecting a trend towards their expanded use in cutting-edge applications.

According to the application, the metallurgy segment held 92% revenue share in 2023. Within the chromium market, the metallurgy segment focuses on utilizing chromium in crafting alloys, notably stainless steel. By incorporating chromium, the corrosion resistance and durability of steel are significantly improved, making it a vital element across industries. A prevailing trend in this segment is the increasing need for top-tier alloys, particularly in construction and automotive applications. As these sectors flourish, the metallurgy segment sees ongoing growth, propelled by the essential contribution of chromium in enhancing alloy properties for a wide range of industrial uses.

The chemicals segment is anticipated to expand fastest over the projected period. In the chromium market, the chemicals segment pertains to the diverse applications of chromium compounds, including pigments, catalysts, and tanning agents. Chromium's versatile chemical properties make it valuable in numerous industrial processes. Recent trends indicate a growing demand for environmentally friendly chromium compounds, aligning with the increasing emphasis on sustainable practices. Additionally, innovations in the development of new chromium-based chemicals for various industrial applications contribute to the evolving landscape of the chemicals segment in the chromium market.

Segments Covered in the Report

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024