January 2025

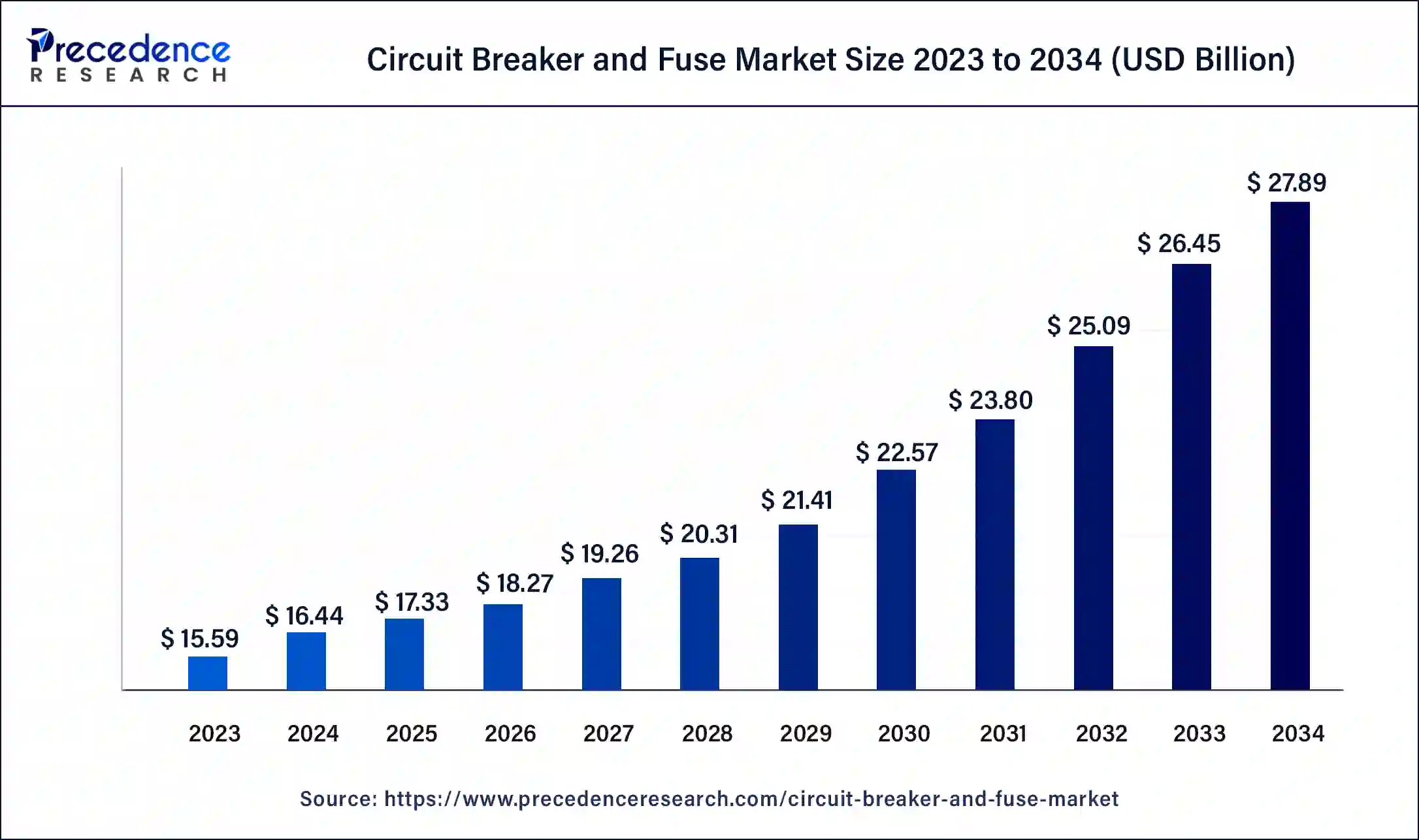

The global circuit breaker and fuse market size was USD 15.59 billion in 2023, calculated at USD 16.44 billion in 2024 and is expected to be worth around USD 27.89 billion by 2034. The market is slated to expand at 5.43% CAGR from 2024 to 2034.

The global circuit breaker and fuse market size is projected to be worth around USD 27.89 billion by 2034 from USD 16.44 billion in 2024, at a CAGR of 5.43% from 2024 to 2034. The rising focus on electrical safety standards is anticipated to boost the growth of the circuit breaker and fuse market. The rapid urbanization and industrialization are the major factors promoting the growth of the market in the upcoming years.

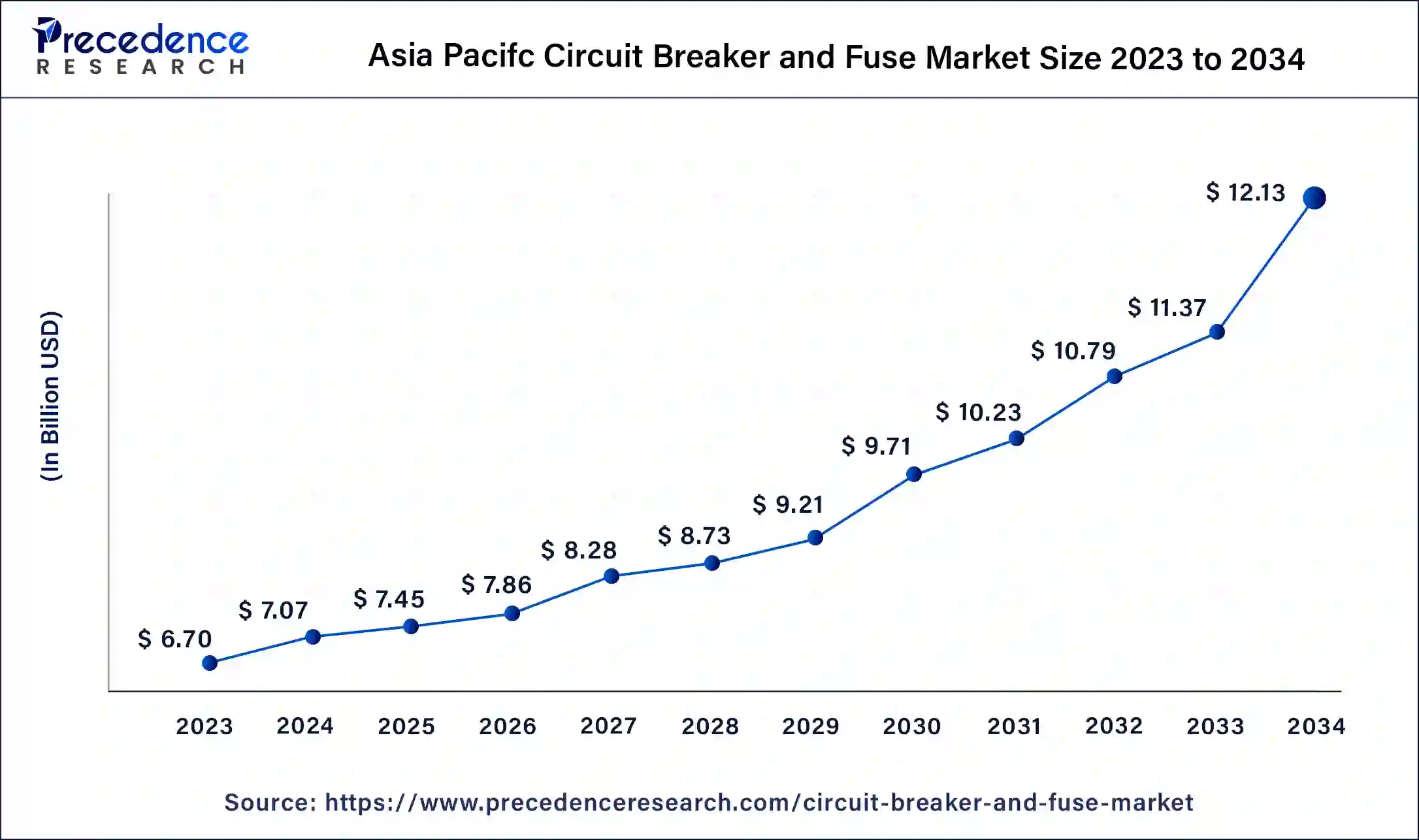

The Asia Pacific circuit breaker and fuse market size was exhibited at USD 6.70 billion in 2023 and is projected to be worth around USD 12.13 billion by 2034, poised to grow at a CAGR of 5.54% from 2024 to 2034.

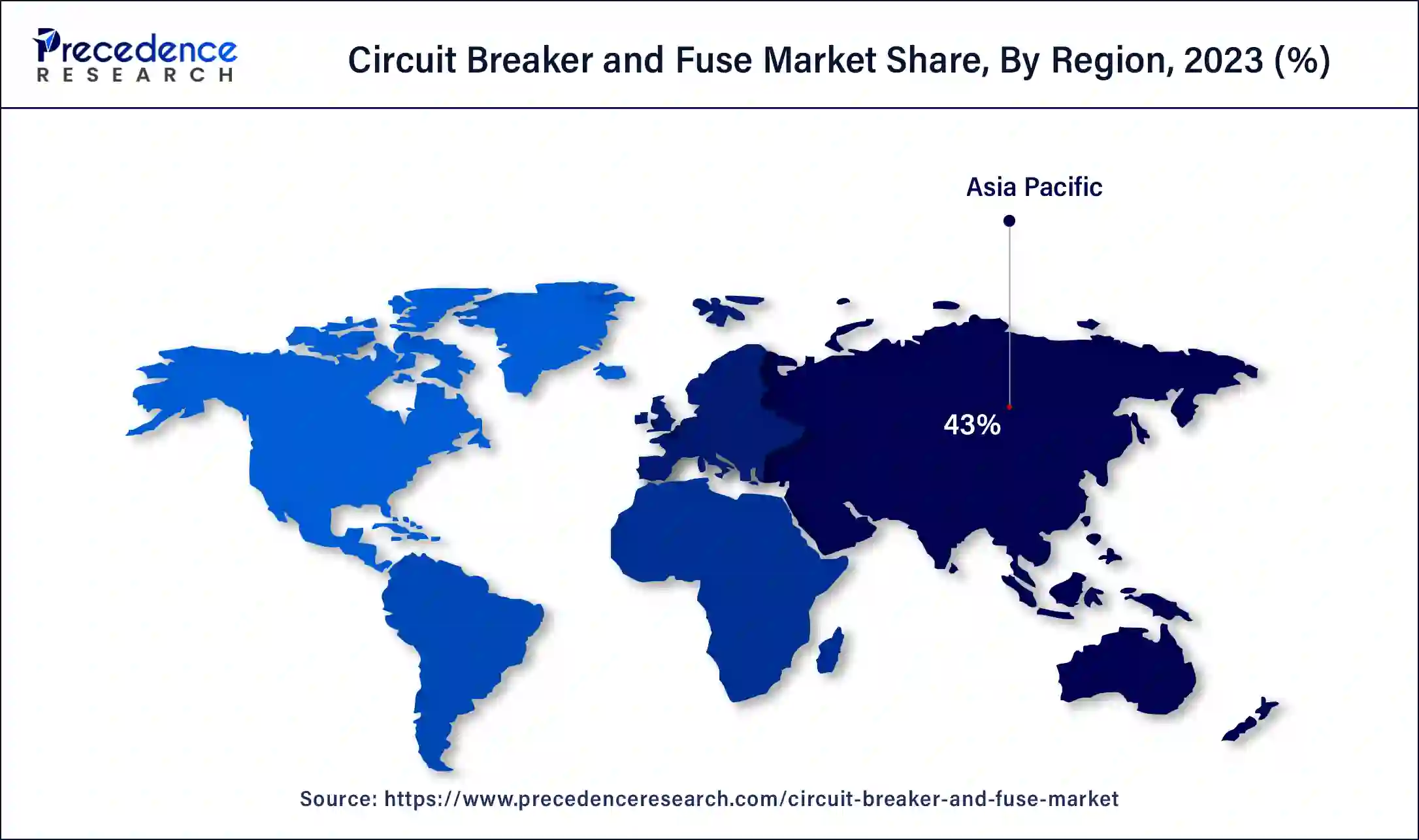

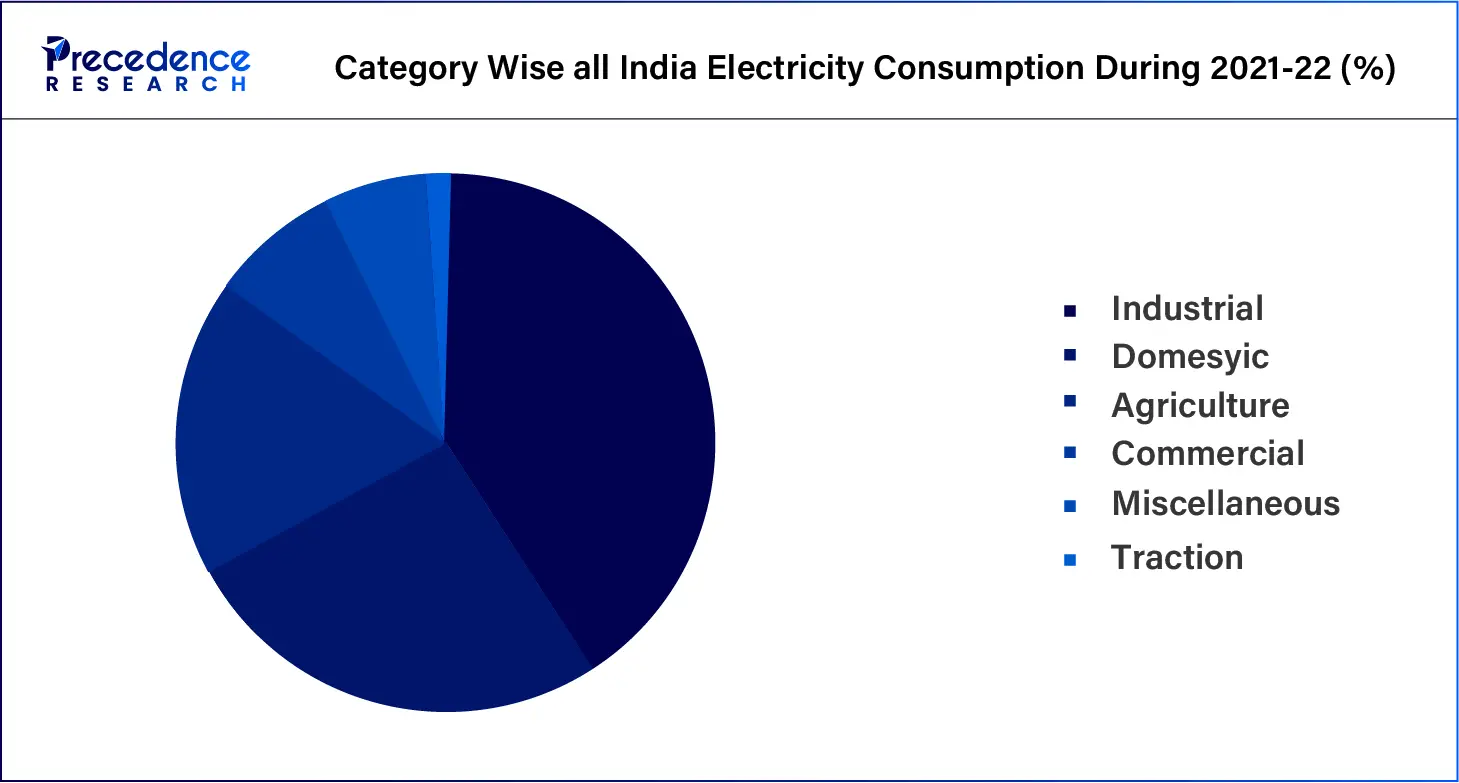

Asia Pacific held the largest share of the circuit breaker and fuse market in 2023. The growth of the region is attributed to rising urbanization & industrialization, a rise in economic growth, an increasing population, the rapid expansion of the construction industry, the presence of stringent safety regulations, the increasing electricity demand, the growing demand from the automotive sector, and the growing adoption of alternative energy generation sources including solar and wind.

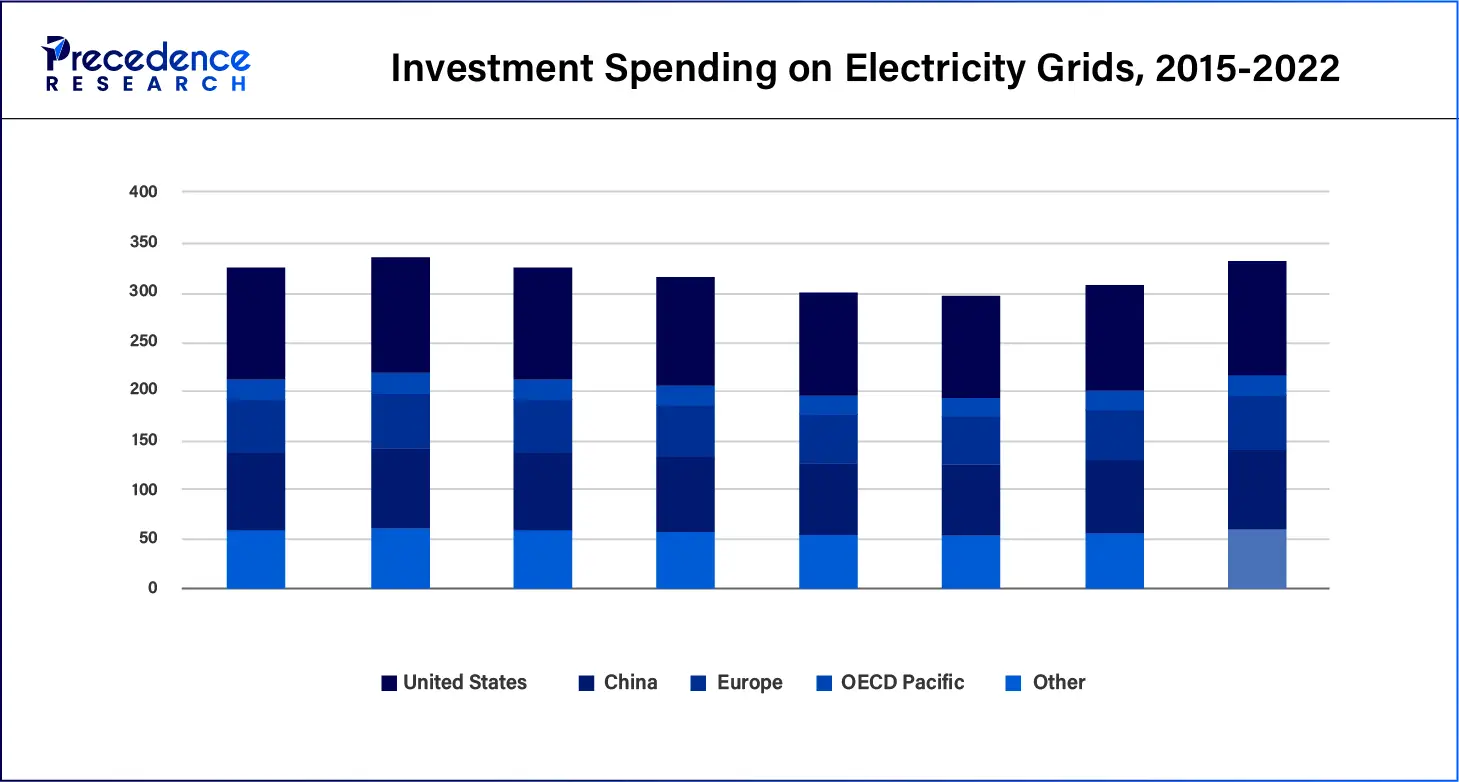

Countries such as China, Japan, India, South Korea, Indonesia, and other emerging economies are the major contributors to the market. The governments in these countries actively participate in the development of electricity networks, which further fuels the growth of the circuit breaker and fuse market in the APAC region. Moreover, the robust growth of the commercial and industrial sectors in developing nations countries is expected to spur the demand for circuit breakers and fuses, as these sectors require a seamless and reliable power supply. Furthermore, the rising adoption of advanced technologies and smart grids is anticipated to boost the demand for circuit breakers and fuses in the region.

Circuit breakers and fuses play a critical role in delivering seamless electricity and protecting electrical circuits against faults. They are widely used in residential, commercial, and some industrial settings, protecting against overcurrents, short circuits, and other electrical faults. They are available in various sizes and types in the market according to the usage of different applications and system requirements. To protect the electric circuit and appliances from damage due to abnormalities in the circuit, a fuse and circuit breaker are used in the circuit as protecting devices. Fuses and circuit breakers are designed to protect from an electrical fire that could be caused by an overload or another malfunction, providing essential protection for everyday electrical usage.

How AI is improving protective electrical devices?

The integration of AI is significantly improving the design of protective electrical devices. Electrical circuit design is both a complex and challenging task, it can be time-consuming, costly, and prone to errors while using traditional methods of circuit design. However, the potential of artificial intelligence (AI) can enhance and automate the process of electrical circuit design. There are several benefits associated with the use of AI in electrical circuit design, such as faster and streamlined design processes, more innovative and creative solutions, better integration and collaboration among different tools, and contribution to more sustainable and ethical design.

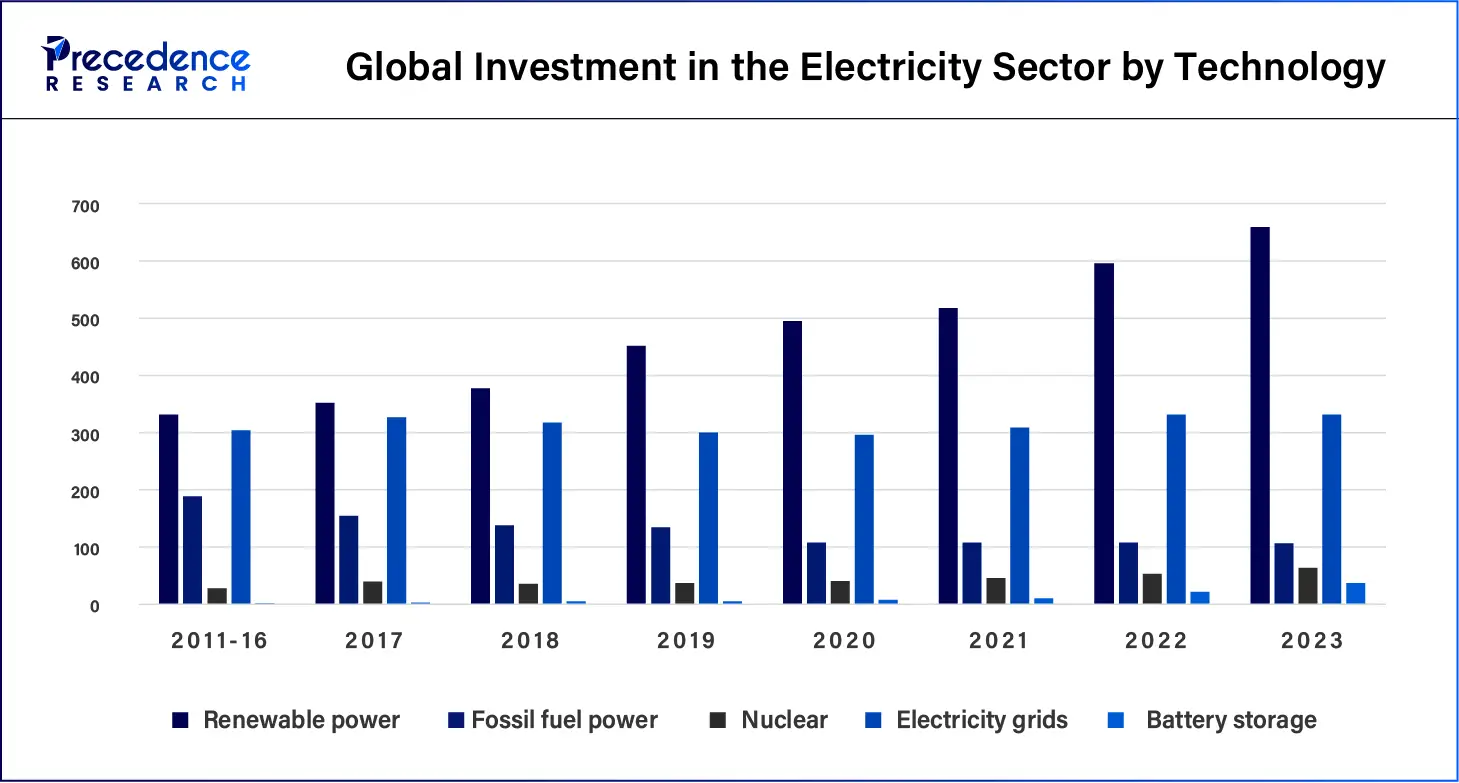

Artificial Intelligence (AI) is also transforming the energy sector, revolutionizing how power is generated, distributed, and consumed. From smart grid management to renewable energy forecasting, AI is changing the way the energy industry operates, making it more efficient and sustainable. In the renewable energy sector, Artificial intelligence is widely being to increase efficiencies and reduce costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 27.89 Billion |

| Market Size in 2023 | USD 15.59 Billion |

| Market Size in 2024 | USD 16.44 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.43% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Circuit Breaker Voltage, Circuit Breaker Technology, Fuse Voltage, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise in the number of real estate and construction projects

The significant increase in the number of real estate and construction projects particularly in the residential sector is expected to boost the growth of the global circuit breaker and fuse market. For Instance, an estimated 1,595,100 housing units were started in 2021, or a 15.6% increase from the 2020 figure of 1,379,600, according to the final new residential construction report of 2021 from the U.S. Census Bureau and the Department of Housing and Urban Development. The demand for circuit breakers and fuses has substantially increased as protective electrical devices in apartments or homes.

The use of these devices reduces and manages the electric load on home appliances and protects them from unforeseen power fluctuations that arise from situations such as overload, overvoltage, and short circuits. A fuse provides protects devices and homes against power overloads only whereas circuit breakers protect against both power overloads and short-circuiting. Additionally, rising government investment in the construction industry has led to an increasing demand for circuit breakers and fuses to ensure reliable power supply and protect against hazard incidents.

Fluctuation in raw material prices

The volatility in raw material prices is anticipated to hamper the growth of the market. Fluctuations in raw material prices can adversely impact the overall cost of the circuit breaker and fuse as well as the profitability of manufacturers as they find it difficult to pass on the increased costs to potential customers due to severe competitive pressures. In addition, strict environmental & safety regulations for the SF6 circuit breaker may restrict the expansion of the global circuit breaker and fuse market during the forecast period.

Increasing awareness of electrical safety

The rising focus and increasing awareness of electrical safety devices are projected to create lucrative growth opportunities for the prominent market players. Fuses or circuit breakers are widely used as electrical safety devices in commercial and residential areas. During an occurrence of an electrical fault, the circuit breaker will trip or the fuse will blow and the power in that area of the property will be automatically shut off to prevent overloading and fires.

Fuses and circuit breakers aim to create a safer operating environment. Both protect against electrocution and assist in preventing electrical currents from creating a power surge. Therefore, fuses or circuit breakers are highly effective at mitigating the risk of electrical overflow and protecting from damage to other devices or appliances in several scenarios, driving the growth of the global circuit breaker and fuse market in the coming years.

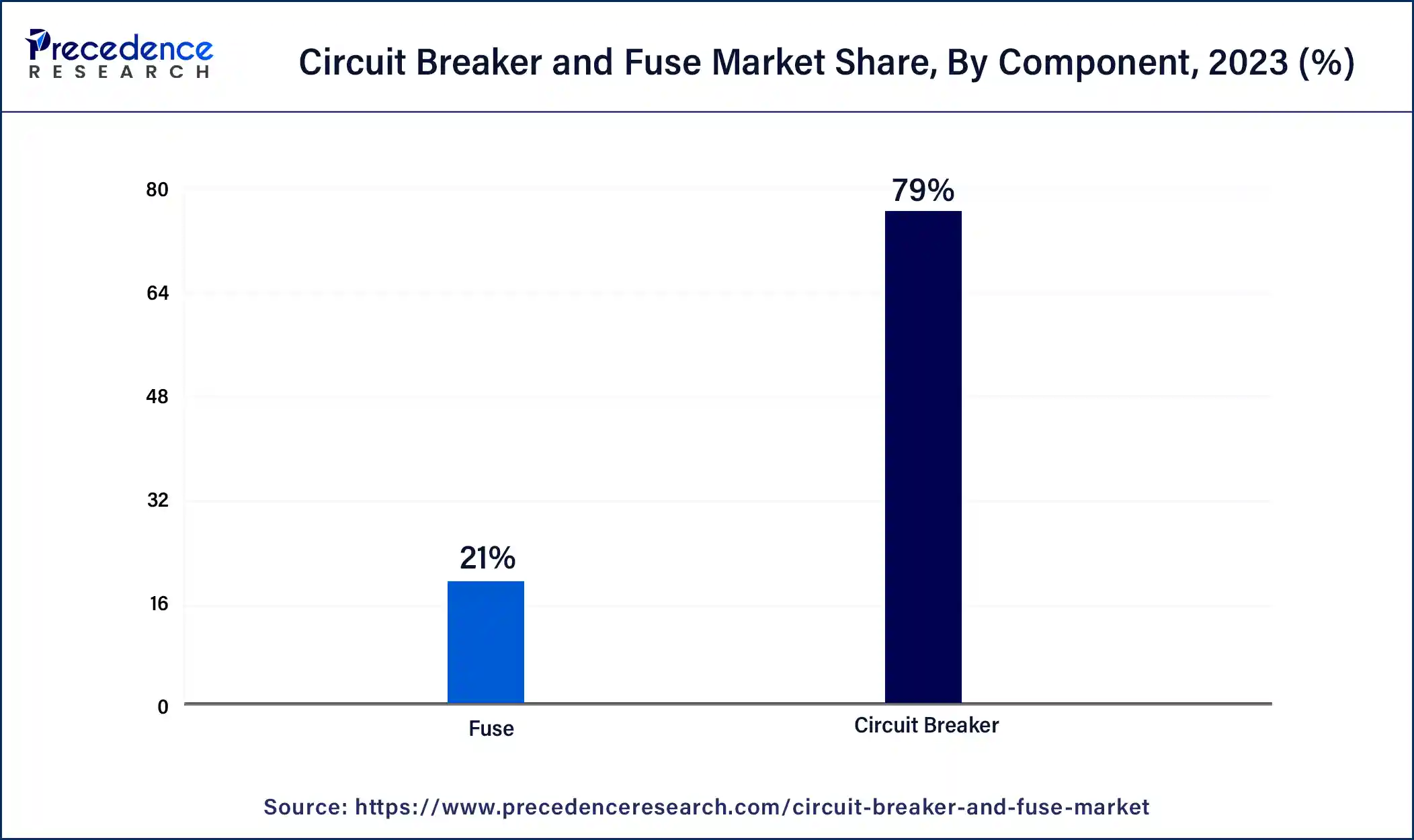

The circuit breakers segment accounted for the dominating share in 2023. A circuit breaker is designed to protect an electrical circuit from damage caused by overload, overcurrent, or short circuit. The main benefits offered by the circuit breakers are that they are reusable devices and just need to be reset manually whereas fuses are designed to be one-time-use only if a fuse blows, it needs to be replaced. Thereby, driving the growth of the segment.

On the other hand, the fuses segment is expected to witness a significant share during the forecast period. Fuses protect against overloading whereas circuit breakers protect against overloading and short circuits. The fuse wire melts and breaks the circuit in case of any fault in an electric circuit in which the fuse is connected and the flow of over-current takes place through the circuit. Thus, boosting the segment’s growth in the coming years.

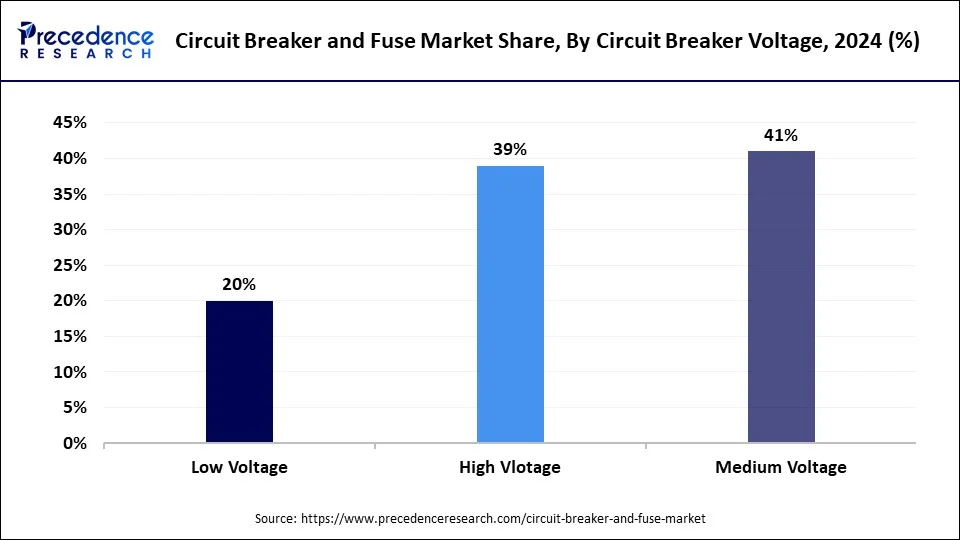

The medium voltage segment held a dominant presence in the market in 2023. A medium voltage circuit breaker generally handles the voltage between 10 and 35 kilovolts. Compared with high-voltage breakers, medium-voltage breakers have several benefits such as being more cost-effective, less hazardous to the environment, easier to use, and easier to install. Medium-range circuit breakers generally find application in distribution substations, power generation stations, urban infrastructure, airports, nuclear power, data centers, commercial and industrial buildings, and other major engineering projects. Such factors are driving the growth of the segment.

On the other hand, the low voltage segment accounted for considerable growth in the global circuit breaker and fuse market over the forecast period. The voltage rating of low-voltage circuit breakers is generally at 1000V or lower. The growth of the segment is driven by the rising urbanization rate in smart cities. They are widely used in residential, and some commercial settings. A low-voltage circuit breaker interrupts the flow of electrical current in a circuit during an occurrence of abnormal conditions. Low-voltage circuit breakers are specifically electrical devices that are designed to protect low-voltage electrical systems from short circuits, overcurrents, and other electrical faults. Therefore, are considered the most crucial component of electrical distribution systems which ensure the reliable and smooth operation of electrical equipment.

In March 2024, Schneider Electric announced the launch of the MasterPacT MTZ Active low-voltage air circuit breaker. A new low-voltage air circuit breaker designed to set new benchmarks for efficiency and sustainability.

The vacuum circuit breakers segment registered its dominance over the global circuit breaker and fuse market in 2023. Vacuum Circuit Breakers (VCBs) have gained immense popularity in the electrical industry owing to their superior operating mechanism and several benefits. VCBs are extensively used in commercial, industrial, and residential applications. VCBs offer high durability, low maintenance requirements, and long operational life compared to other types of circuit breakers. VCBs have significantly smaller and lighter designs than air circuit breakers (ACBs). Vacuum Circuit Breakers are a more environmentally friendly option for medium-voltage applications as they align with the global efforts to lower carbon emissions and combat climate change. Vacuum Circuit Breakers (VCBs) do not use sulfur hexafluoride gas like SF6 circuit breakers which is a potent greenhouse gas. Such supportive factors are driving the growth of the segment.

On the other hand, the air blast circuit breakers segment is projected to expand rapidly in the circuit breaker and fuse market in the coming years. An Air Circuit Breaker (ACB) uses air to protect an electrical circuit from damage that may be caused by excess current from a short circuit or overload. Its main purpose is to interrupt current flow after a fault is detected. ACB interrupts current by increasing arc voltage through various methods such as cooling the arc or extending the arc path. This circuit breaker generally operates in air at atmospheric pressure. Thereby, bolstering the segment’s growth.

The high voltage segment held the largest share of the circuit breaker and fuse market in 2023, the segment is expected to sustain the position throughout the forecast period. A high-voltage fuse is designed and rated for use in electrical systems with voltages above 1,000 volts AC. Most industrial and commercial end-users highly prefer high voltage fuse. High voltage fuse is highly efficient in offering protection against power fluctuations and short circuits.

On the other hand, the low voltage fuse segment is expected to grow significantly during the forecast period. The low-voltage fuse is highly preferred by residential customers. The low-voltage fuses have limited current ratings and breaking capacities which makes them suitable for several low voltage applications.

The power generation segment accounted for the largest share in the circuit breaker and fuse market in 2023. Fuses and circuit breakers play an integral role in power generation facilities by protecting transformers, generators, and other electrical equipment. These protective devices help in managing the flow of electricity within power plants and ensure the safety of equipment and personnel. Circuit breakers are extensively used in distribution boards as they help in preventing electrical fires and other hazards. The demand for these protection devices is expected to increase due to the rising need for efficient power generation as a result of an increase in the electricity demand.

On the other hand, the construction segment is expected to grow at the fastest rate during the forecast period of 2024 to 2034. Circuit breakers and fuses are widely used in commercial, residential, and industrial buildings, coupled with the development of smart. These devices protect appliances from power surges, reduce the chance of electrocution, and prevent metal cases from becoming electrified. Moreover, increasing investments in construction projects in countries such as China, India, the United States, Indonesia, Spain, Japan, and others are likely to boost the market demand. Therefore, the ongoing infrastructure development projects around the world are expected to propel the demand for circuit breakers and fuses, driving the segment’s growth in the coming years.

Asia Pacific Circuit Breaker and Fuse Market Trends

Segments Covered in the Report

By Component

By Circuit Breaker Voltage

By Circuit Breaker Technology

By Fuse Voltage

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

August 2024

August 2024