September 2024

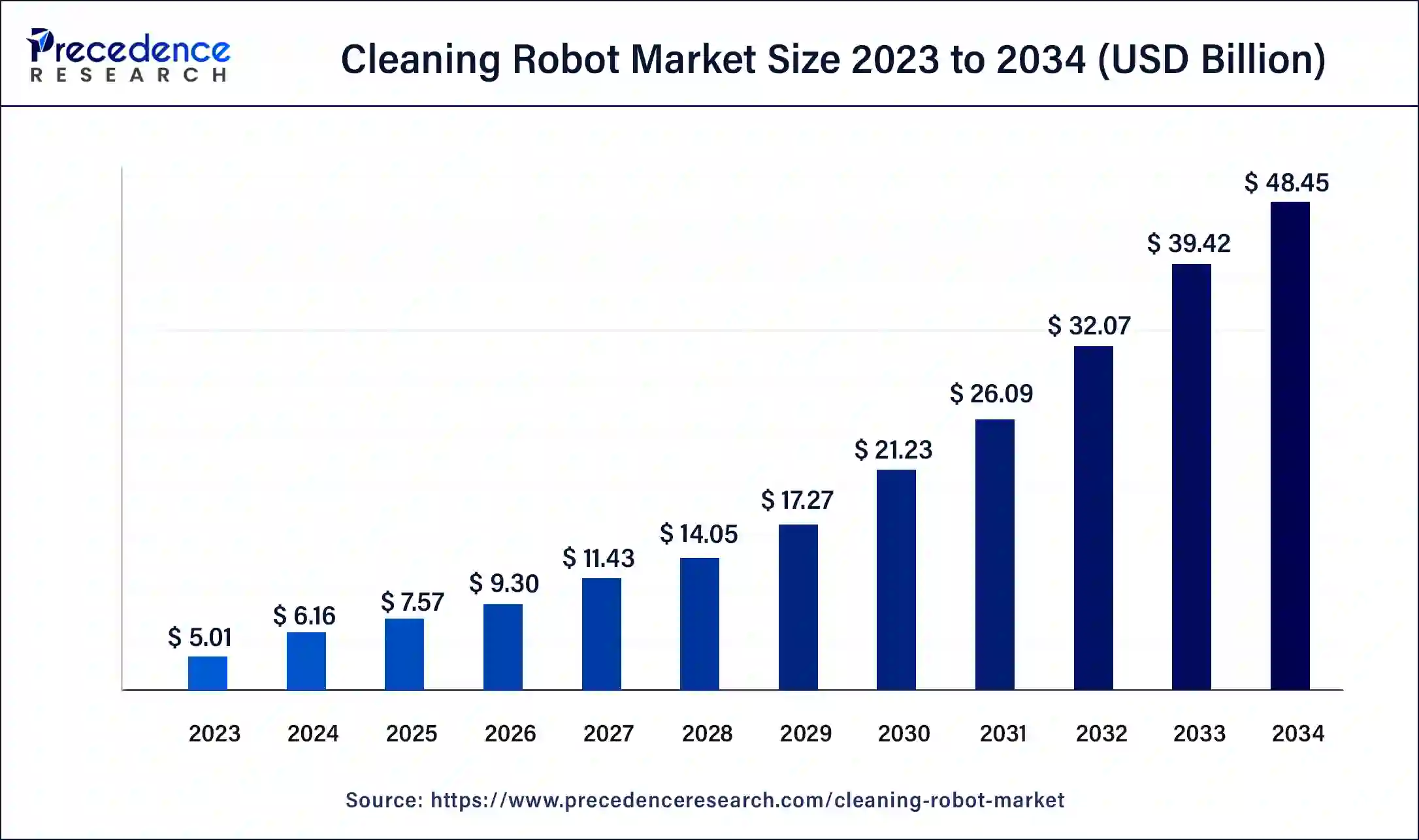

The global cleaning robot market size was USD 5.01 billion in 2023, calculated at USD 6.16 billion in 2024 and is expected to be worth around USD 48.45 billion by 2034. The market is slated to expand at 22.91% CAGR from 2024 to 2034.

The global cleaning robot market size is worth around USD 6.16 billion in 2024 and is anticipated to reach around USD 48.45 billion by 2034, growing at a CAGR of 22.91% over the forecast period 2024 to 2034. A growing working population, rising disposable incomes and increasing awareness around cleanliness and hygiene (especially after the COVID-19 pandemic) is driving growth in the cleaning robot market.

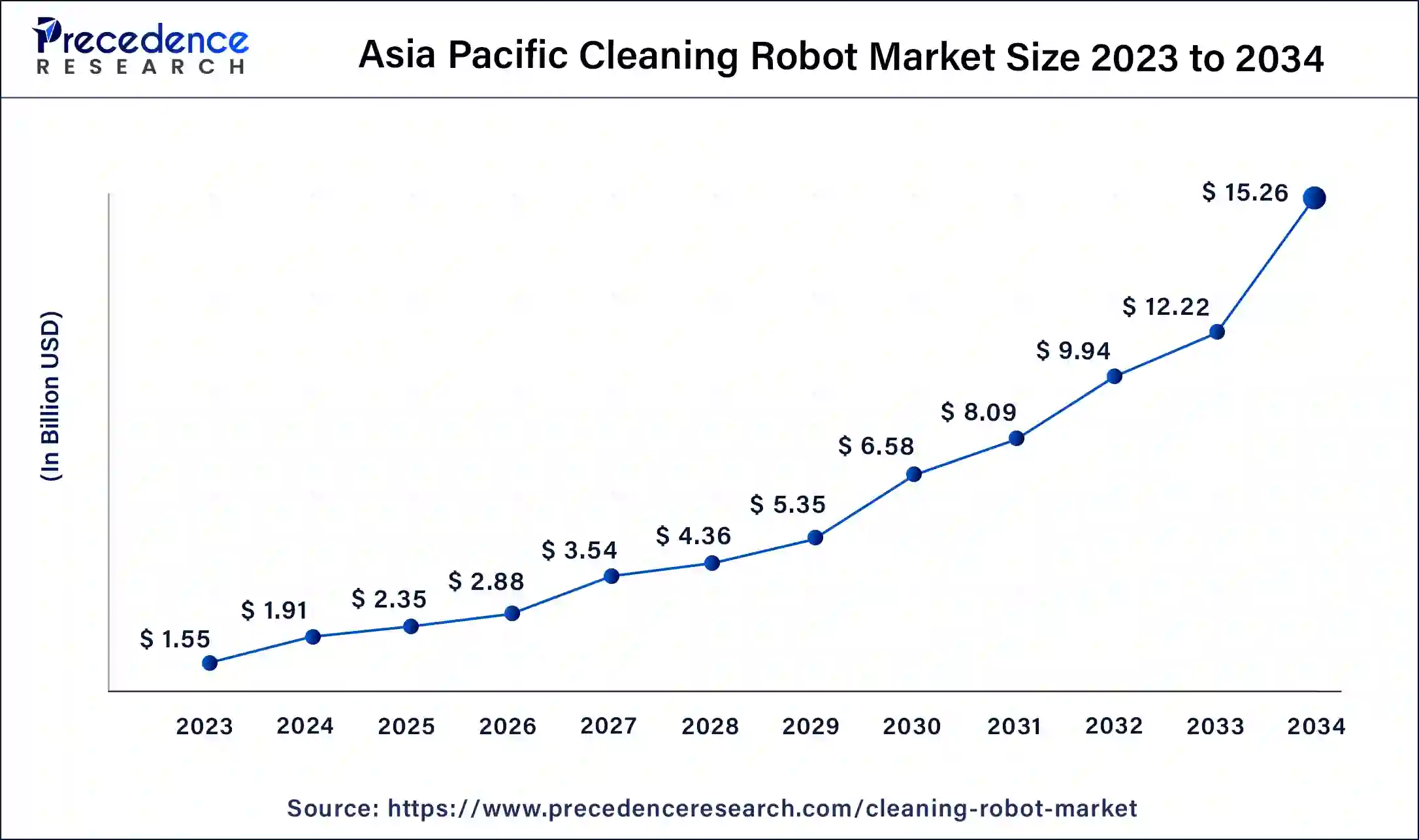

The Asia Pacific cleaning robot market size was exhibited at USD 1.55 billion in 2023 and is projected to be worth around USD 15.26 billion by 2034, poised to grow at a CAGR of 23.10% from 2024 to 2034.

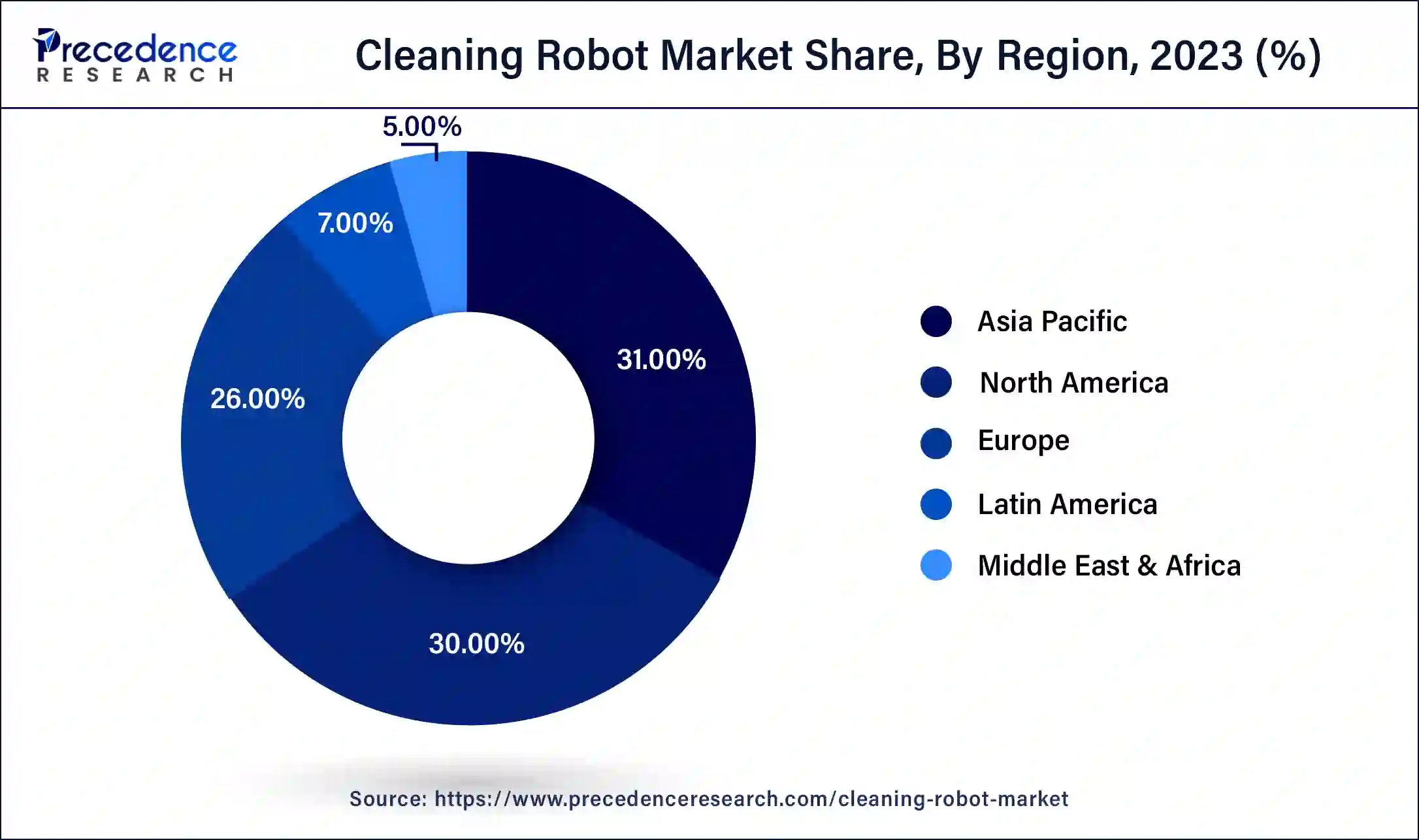

Asia Pacific contributed more than 31% of market share in 2023. Emerging economies like China are seeing widespread production and adoption of cleaning robots due to a rapid expansion of e-commerce and the availability of affordable alternatives. The robot density in the region is currently highest in South Korea and Japan. Innovations in robotics and artificial intelligence have enhanced the cleaning robots' features over the last several decades, making them adaptable to varied environments. These factors have boosted the sale of cleaning robots in the region.

North America is expected to expand at a remarkable CAGR during the forecast period. The region houses several major players, such as iRobot, in the space and is a major producer of cleaning robots. Substantial investment in research and development in sensors, AI, the Internet of Things, and machine learning in the region has led to several breakthroughs in cleaning robotics. North America’s advanced and widespread technological infrastructure and a rise in e-commerce in the region have led to the widespread adoption of cleaning robots.

Cleaning robots, sometimes called robovacs, are autonomous robots that are used to clean floors, windows, pools, and other surfaces. They use a combination of sensors and robotic drive systems to operate independently. These machines incorporate cleaning engineering with other technical disciplines, such as autonomous power supply, sensor systems, environment modeling, and path planning in dynamic environments. Increased participation in the labor force and total number of hours worked, especially by women, is also a factor contributing to growth in the market.

The cleaning robot market is set to see growing demand in the coming years due to changing cleaning and hygiene preferences and a spike in disposable incomes, especially in emerging economies such as China. Also, the prohibitive costs of cleaning robots remain a challenge to the market’s growth. While the costs of autonomous cleaning robots are declining, these machines still tend to be a lot costlier than traditional vacuum cleaners, making them less cost-effective in a residential setting.

The increased automation of cleaning processes in the industrial sector provides a huge opportunity in the cleaning robot market. According to a paper in Microsystems Technologies, the industrial cleaning sector is facing labor shortages, resulting in interest in robotic cleaning solutions. With the help of technologies such as three-dimensional laser scanning, and mapping through matrix graphics and pathing protocols such as using the boustrophedon method, there is potential for widespread adoption of cleaning robots in industrial settings.

What is the Role of AI in the Robotics Industry?

Earlier cleaning robot models did not include visual simultaneous localization and mapping or LiDAR to operate. They randomly bumped around the room, changing course whenever the robot encountered any obstacle. Newer designs use artificial intelligence (AI)-powered LiDAR solutions and VSLAM technologies to process images from a camera and help the robot understand its surroundings and location. LiDAR collects data to create a point cloud, which is then processed by machine learning algorithms. The developments of algorithms that limit reliance on laser-based point data generation and camera-based vision are leading to more cost-effective autonomous cleaning robots.

| Report Coverage | Details |

| Market Size by 2034 | USD 48.45 Billion |

| Market Size in 2023 | USD 5.01 Billion |

| Market Size in 2024 | USD 6.16 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 22.91% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Product, Charging-Type, Operation Mode, Distribution Channel, End-use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased awareness around cleanliness and rising employment rates

Since the COVID-19 pandemic, global awareness around hygiene and cleanliness has changed significantly in both established and emerging economies. A survey by Stratus Building Solutions in the United States found that 89% of people are more conscious of germs than they were before the pandemic. Furthermore, 83% of respondents said that habits such as frequent hand-washing, sanitizer use, and wiping surfaces down picked up during the pandemic are here to stay.

Along with an increased interest in hygiene, busier lifestyles are forcing households to delegate or automate chores related to cleaning. The total number of hours worked has increased across all country income groups, driven by strong employment growth throughout the recovery phase after the pandemic. As more individuals engage in employment for longer, higher-income households are increasingly adopting solutions such as cleaning robots to reduce the risk of physical strains endured due to long-time physical labor.

Decreasing the cost of components and reliance on new IoT technologies

With the falling cost of robot components and the advent of open-source hardware and software (e.g., Arduino), designing and manufacturing single-board microcontrollers for building digital devices is easier than ever before. Robots are becoming smaller and cheaper due to increasing research and development spending in the sector. New AI-powered algorithms are replacing the need to include expensive cameras and laser scanning to help the cleaning robot navigate its surroundings. IoT-based cleaning robots are increasingly using low-cost sensors to detect any obstacle and send their output to a microcontroller located in the robot’s machinery. These factors are contributing to increased demand in the cleaning robot market.

Security concerns surrounding IoT devices

With the integration of a growing number of IoT devices, threats to cyber security have expanded significantly. IoT-linked devices such as cleaning robots can be potentially used for surveillance, recording users without their knowledge or consent. IoT devices can be modified to collect and transmit sensitive information, leading to severe consequences such as identity theft, fraud, and intellectual property theft. Common IoT cyber-attacks include DDoS Attacks through the use of Botnets. Security concerns around these devices are restricting market expansion.

Applications in diverse sectors

In this cyber-physical age, cleaning robots are being improved by integrating the Internet of Things with a number of components, including sensors, to develop new algorithms to solve problems with path planning, navigation, and decision-making. Some newer models do not require cloud access or even an internet connection to operate. These contemporary machines are using increasingly sophisticated AI to successfully navigate around their environment.

The floor-cleaning robot segment dominated the cleaning robot market in 2023. Floor-cleaning robots have been around since 2002 and are seeing increased consumer demand due to busier lifestyles and rising disposable incomes globally. Floor-cleaning robots are fully autonomous robots that can clean floors in homes and commercial spaces, performing tasks such as vacuuming, mopping, scrubbing, and disinfection. There have been several technological advancements in the sector, including the integration of self-cleaning, self-charging, and scheduling capabilities in newer models. Modern floor-cleaning robots also include HEPA air filters that remove dust and pollen from the air. These innovations are driving growth in this segment of the market.

The pool-cleaning robot segment is expected to grow at the fastest rate in the cleaning robot market during the forecast period between 2024 and 2033. Pool-cleaning robots collect sediment, dirt, and debris from swimming pools with little human intervention. There have been several technological advancements in pool-cleaning robots since the first swimming pool cleaner was invented in 1912. Newer models include cordless versions, all-in-one cleaning of floors, walls, waterlines, surfaces, and even water clarification.

The in-house segment made up the largest share of the cleaning robot market in 2023. In-house domestic robots do chores around and inside homes, performing functions such as sweeping, wet mopping, and cleaning litter boxes. Most in-house robots connect to Wi-Fi home networks, the cloud, or smart environments and can be controlled by an app from the user's smartphone or connected home automation device such as Amazon Alexa and Google Nest.

The outdoor segment is projected to grow rapidly in the cleaning robot market over the forecast period between 2024 and 2033. The outdoor robot segment includes autonomous lawnmowers, pool-cleaning robots, external window-cleaning robots, and gutter-cleaning robots. These robots are increasingly being used to keep outdoor commercial spaces clean and maintained. New models now come with state-of-the-art features like advanced navigation systems, and companies are investing heavily to accelerate innovation and adoption.

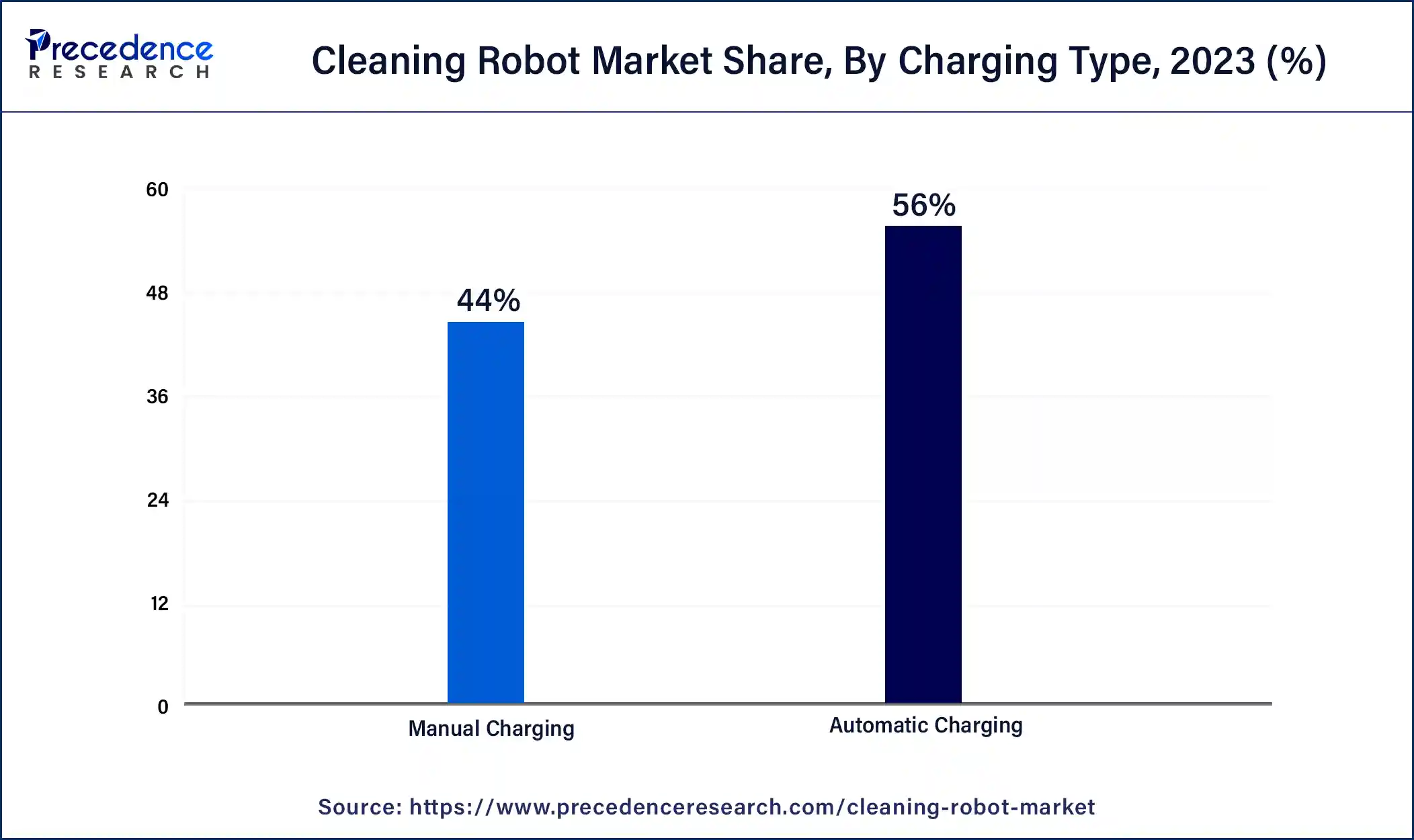

The automatic charging segment dominated the cleaning robot market in 2023. Vacuum robots with automatic charging can work continuously during a cleaning session and return to a docking station, charging themselves and preparing for the next task. This lets the robot work unsupervised, requiring just initial setup and scheduling. These advantages make it a popular choice among users.

The manual charging segment is expected to expand at a significant rate in the cleaning robot market over the forecast period, especially in emerging economies. While manual charging robots need human intervention to connect the robot to a power source, this helps cut down on the cost of purchasing these machines. This makes manual charging robots more accessible for relatively lower-income households through increased affordability.

The self-drive segment made up the largest share of the cleaning robot market in 2023. Self-driving cleaning robots are easier to use, utilizing AI algorithms and navigation technology to make their way around a space. They analyze rooms in real-time, determining where to go next depending on which areas need attention. Self-driving robots offer the advantage of doing their scheduled tasks with minimal human intervention or involvement.

The remote control segment is set to grow at the fastest rate in the cleaning robot market during the forecast period between 2024 and 2033. As their name suggests, remote control cleaning robots are controlled by a human operator, allowing adjustments to the robot’s movement according to the situation or cleaning requirements. Most robots in this segment now allow users to control the machine directly through the phone App. Remote control robots are generally cheaper than their self-driving counterparts, making them more affordable.

The online segment dominated the cleaning robot market in 2023. The global rise of e-commerce due to the flexibility and convenience offered by online shopping portals has led to significant demand in the distribution channel. Individuals who look for cleaning robots online can also access detailed product descriptions, reviews, and other useful information, helping consumers make informed decisions about their purchases.

The offline segment is set to grow at the fastest rate in the cleaning robot market during the forecast period. Some consumers still prefer to purchase appliances at brick-and-mortar stores due to special offers in physical stores. The in-store experience and ‘feel’ of the product are still important among consumers.

The residential segment made up the largest share of the cleaning robot market in 2023. Cleaning robots make it extremely convenient for homeowners with busy lifestyles, allowing them to automate labor-intensive tasks. Increasing disposable incomes and innovations in the cleaning robot industry have incentivized several residential customers to adopt the technology.

The industrial segment is set to grow at the fastest rate in the cleaning robot market during the forecast period between 2024 and 2033. Cleaning robots help industries cut down on labor associated with cleaning large spaces, including the costs of appointing and training cleaning staff. These factors are driving demand for cleaning robots in the industrial sector.

Segments Covered in the Report

By Type

By Product

By Charging Type

By Operation Mode

By Distribution Channel

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2024