March 2025

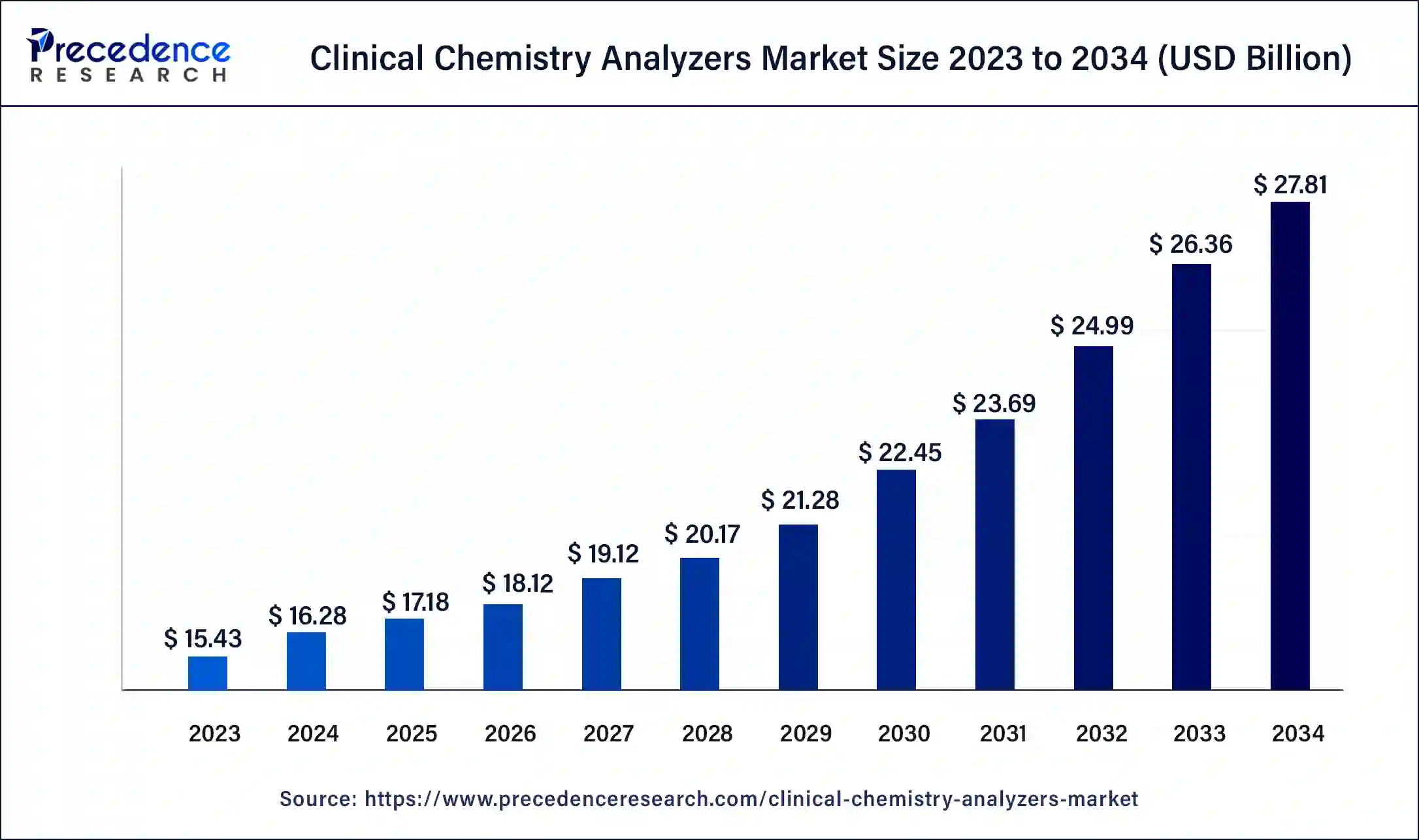

The global clinical chemistry analyzers market size was USD 15.43 billion in 2023, calculated at USD 16.28 billion in 2024 and is expected to reach around USD 27.81 billion by 2034, expanding at a CAGR of 5.5% from 2024 to 2034.

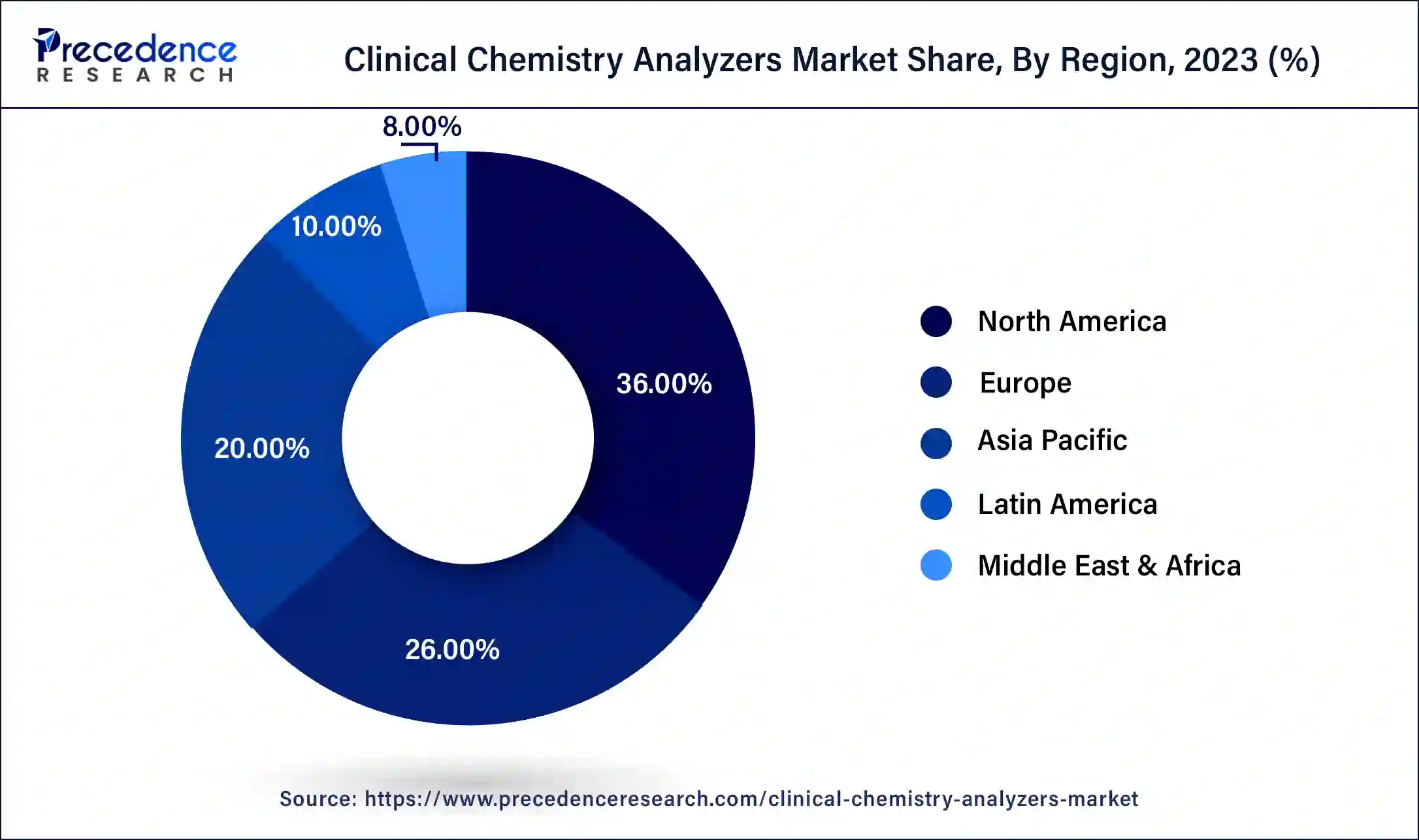

The global clinical chemistry analyzers market size accounted for USD 16.28 billion in 2024 and is expected to reach around USD 27.81 billion by 2034, expanding at a CAGR of 5.5% from 2024 to 2034. The North America clinical chemistry analyzers market size reached USD 5.55 billion in 2023.

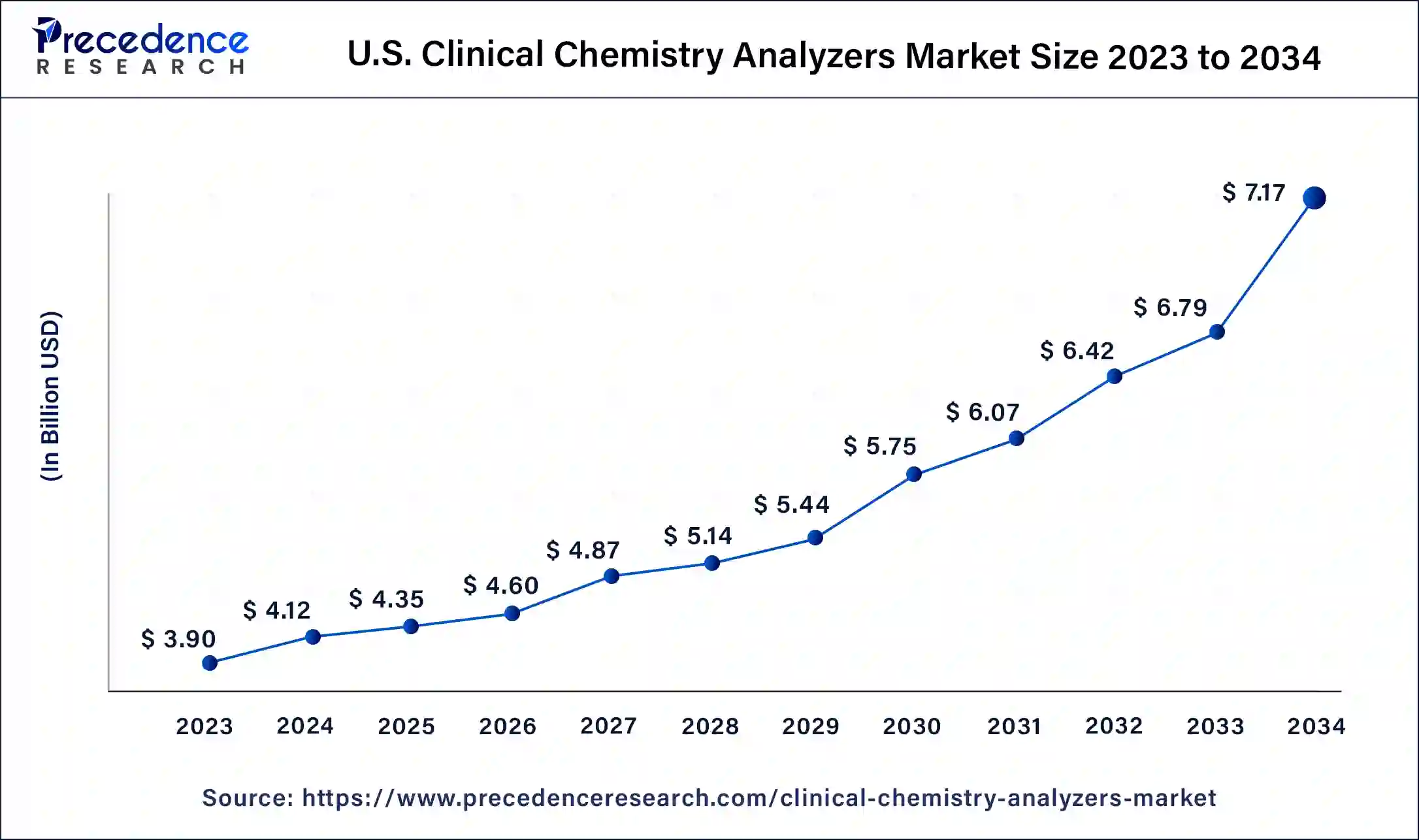

The U.S. clinical chemistry analyzers market size was estimated at USD 3.90 billion in 2023 and is predicted to be worth around USD 7.17 billion by 2034, at a CAGR of 5.7% from 2024 to 2034.

The North American region is anticipated to considerably contribute to market growth during the forecast period. The rising incidence of chronic diseases, rising healthcare costs, and product developments by the region's leading market players are the main drivers of market growth in the region. The main cause of mortality and disability in the U.S. each year is chronic diseases, according to data on chronic diseases updated by the Centers for Disease Control and Prevention in July 2022. The rise of analyzers for clinical chemistry in North America is aided by the increased prevalence of chronic disorders in the country. Other significant factors propelling the expansion of the market in the region of North America include the high burden of the target and chronic diseases in the area and the rising desire for early diagnosis.

The main market participants are introducing brand-new, innovative products to the marketplace. For instance, Thermo Fisher Scientific and Mindray collaborated to offer a couple of clinical chemistry analyzers for the screening of drugs in forensic and clinical laboratories to customers in the U.S. and Canada in February 2022. Because of a collaboration between Thermo Fisher and Mindray, toxicology labs can now purchase the FDA-cleared and Health Canada-approved BS-480 (400 tests/hour) and BA-800M (800 tests/hour) analyzers. As a result, North America is anticipated to hold the greatest market share for clinical chemistry analyzers.

Medical laboratories use chemistry analyzers to determine the concentration of certain compounds in samples of serum, plasma, urine, and/or other body fluids. These tools can analyze several metabolites, electrolytes, proteins, and/or drugs. Clinical chemistry analyzers can measure a wide range of parameters, including markers for tumors, therapeutic drugs, drugs of abuse, drugs of toxicology, therapeutic drugs used for monitoring, and specific proteins, chemicals, and lipids like cholesterol, cofactors, waste products, glucose, enzymes, and electrolytes. Due to the versatile approach of the clinical chemistry analyzers, they are used to monitor and diagnose a wide variety of disorders which includes cancer, diabetes, heart disease, liver disease, and renal disease. Increasing demand for clinical chemistry analyzers is also being fueled by the growing presence of ailments like cancer, liver disease, and diabetes, and also by the increasing age of the population.

One of the market's high impacting factors is the rising prevalence of chronic disorders like diabetes. Due to the constant rise in disease prevalence, firms have been forced to manufacture sophisticated analyzers on a wide scale to help with diagnosis. As a result, there is now intense rivalry because of the strong demand for chemical analyzers and the exceptional expansion of new market entrants. Clinical chemistry analyzers' technological advancements have allowed for more extensive testing as well as early disease identification and specialist diagnosis in the fields of cancer, gynecology, and endocrinology. Improved resolution, improved pattern recognition, computer-assisted interpretation, advanced modeling, parameter estimates, and artificial intelligence are some of the developments.

| Report Coverage | Details |

| Market Size in 2023 | USD 15.43 Billion |

| Market Size in 2024 | USD 16.28 Billion |

| Market Size by 2034 | USD 27.81 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.5% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Test, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Automated clinical chemistry analyzers are becoming more popular - Due to considerable technological breakthroughs and expanding healthcare industry demands, the use of clinical chemistry analyzers has rapidly expanded over the past few decades. Clinical chemistry provides precise diagnostic information and generally concentrates on the examination of bodily internal fluids. Modern clinical chemistry has a solid foundation due to traditional manual laboratory techniques. But as technology has developed, testing procedures have changed, many tests may be carried out in automated labs with the help of innovative equipment like chemical analyzers.

The market for clinical chemistry analyzers is expected to rise more quickly due to novel technological developments, enhanced production methods, and the introduction of innovative software during the forecast period.

Rising R&D activities - The market for clinical chemistry analyzers has consistently seen advancements, mostly brought on by the advancement of technology. Clinical chemistry analyzers' future is anticipated to be shaped by ongoing R&D initiatives and the incorporation of innovative software technologies in clinical laboratories. Additionally, it is possible that stakeholders will create new products in line with what laboratories need. Customized analyzers for small-scale laboratories are being developed by industry participants in clinical chemistry analyzers.

Additionally, producers of clinical chemistry analyzers are rapidly creating smaller clinical chemistry analyzers, which creates prospects for better testing capabilities. Hospitals, point-of-care diagnostic facilities, and research labs will all experience increased workflow efficiencies because of the upcoming generation of clinical chemistry analyzers.

Increasing prevalence of chronic & lifestyle faults and the geriatric population - The growing elderly population in developed and developing countries will drive growth in the market for clinical chemistry analyzers. Age-related disorders like diabetes, liver disease, cardiovascular, hypertension, and renal disease are predicted to become significantly more prevalent as the geriatric population increases. The detection and treatment of these problems account for the rising need for tests including the basic lipid profile, renal panel, liver panel, and metabolic panel. As chronic illnesses become more common, so will the need for the tests used to identify, diagnose, and treat them. Clinical chemistry analyzers are in high demand, which is anticipated to rise because of these factors and the move toward preventative healthcare.

The need for large capital investments is growing and aren't enough laboratory technicians with the necessary skills - The only places that are allowed to buy high-volume clinical chemistry analyzers are big hospitals and reference labs with sizable capital budgets. A particularly large or large-sized analyzer may be out of reach for most small labs, clinics, and solo practitioners without incurring capital costs. Because of the high fixed-cost requirements, the market for clinical chemistry analyzers is unable to grow. Both developed and developing countries are currently suffering from a serious shortage of laboratory personnel.

The main factors for this are a rising patient population, retiring technicians, and financially strapped institutions ending clinical lab programs. As a result, a shortage in the number of pathologists and lab technicians is experienced around the world, is predicted to hinder the market's growth.

Clinical chemistry analyzers are constantly evolving - It is anticipated that the current advancements in clinical chemistry analyzers will present a variety of lucrative prospects for market expansion during the forecast period. At the Medical Fair 2022 in May 2022, Transasia exhibited a variety of IVD products with improved client experiences. The Erba XL 640 is an autoloader-equipped random access clinical chemistry analyzer. The equipment facilitates greater productivity, lessens staff members' manual labor requirements, and facilitates quicker TAT.

Additionally, it is anticipated that the deployment of beneficial government initiatives, programs, and financing that support the growth of labs and diagnostics would provide lucrative prospects for the business during the assessment period. Due to the aforementioned factors, the market is anticipated to have several expansion possibilities over the projected period, increasing market size.

Reagents dominated the market with the maximum share in the category of product in 2023. The industry's large supply of reagents, which are provided to satisfy a range of clinical demands, is projected to be the cause of the sizeable market share. Lipids, enzymes, specific proteins, substrates, electrolytes, and other substances stand as the main ingredients of these reagents.

They are essential to achieve accurate results in analytical procedures. Reagents are also regarded as very economical, and excellent in terms of linearity, precision, and sensitivity, which assures little alterations in performance. The benefits listed above are likely to be very influential in encouraging clinicians to employ reagents for precise diagnosis.

The prevalence of lifestyle-related diseases including obesity and other metabolic abnormalities is on the rise, and in 2023, Basic Metabolic Panel (BMP) enjoyed a monopoly in the test market. The growing importance and awareness of point-of-care testing is a crucial factor in the sector share. BMP is a group of examinations that provide medical examiners with clinical information about problems caused by chemical imbalances in the body.

This test's universal acceptance and accompanying benefits have increased its market share over time. Additionally, BMP is being utilized and accepted in a growing number of applications, such as newborn screening, which makes it easier to find metabolic and genetic problems that are present at birth. It has the capacity to identify 30 hereditary metabolic diseases in a single dried filter paper blood spot, according to a study that was published in NCBI.

Hospitals led the end-use category in 2023 because of their massive sample sizes, high readmission rates, and high patient numbers. Supportive infrastructure, which enables successful diagnostic operations, also contributes to the growth of hospital segment. The increasing number of government initiatives aimed at encouraging efficient diagnostic facilities to produce quick results and increase overall efficiency is one of the main factors causing the segment's sizeable share.

Hospitals are more interested to buy completely automated systems along with built-in quality-assurance features that can analyze many individual samples in a given environment. These multiple factors are expected to positively alter segment growth.

Segments Covered in the Report

By Product

By Test

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

February 2025

January 2025