March 2025

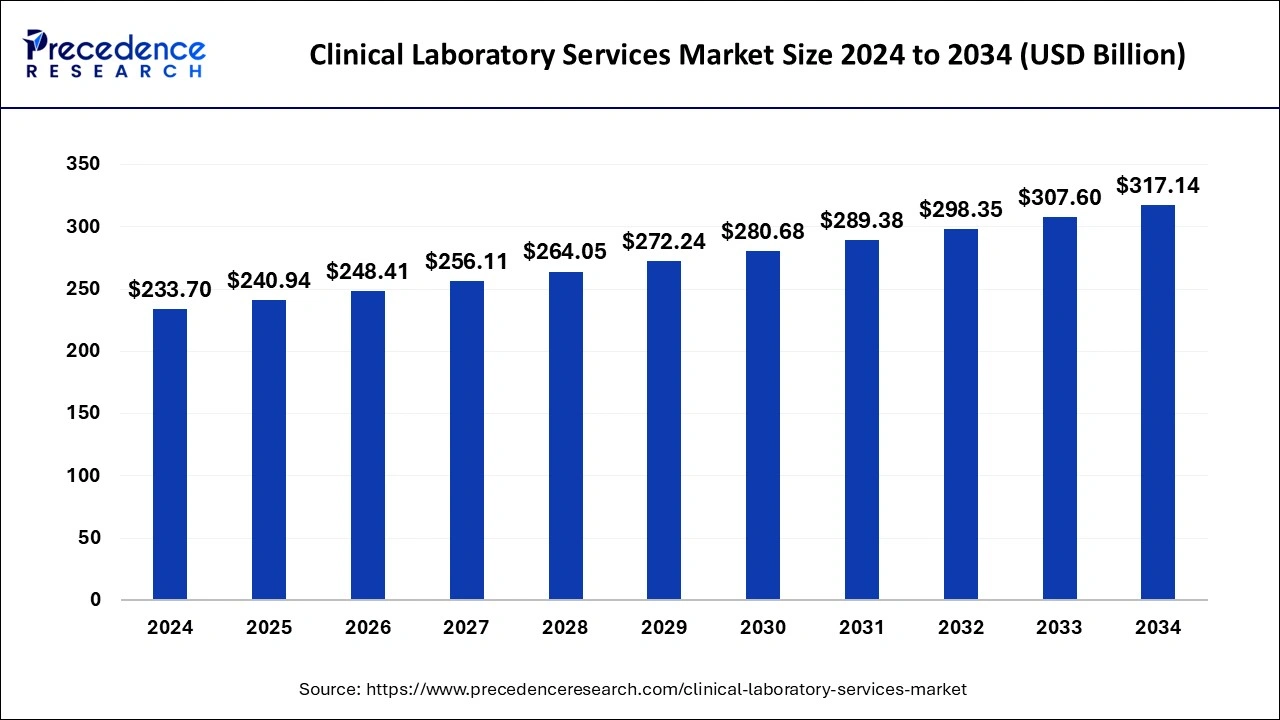

The global clinical laboratory services market size is estimated at USD 240.94 billion in 2025 and is predicted to reach around USD 317.14 billion by 2034, accelerating at a CAGR of 3.10% from 2025 to 2034. The North America clinical laboratory services market size was surpassed USD 86.47 billion in 2024 and is expanding at a CAGR of 3.23% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global clinical laboratory services market size was estimated for USD 233.70 billion in 2024 and is anticipated to reach around USD 317.14 billion by 2034, growing at a CAGR of 3.10% from 2025 to 2034.

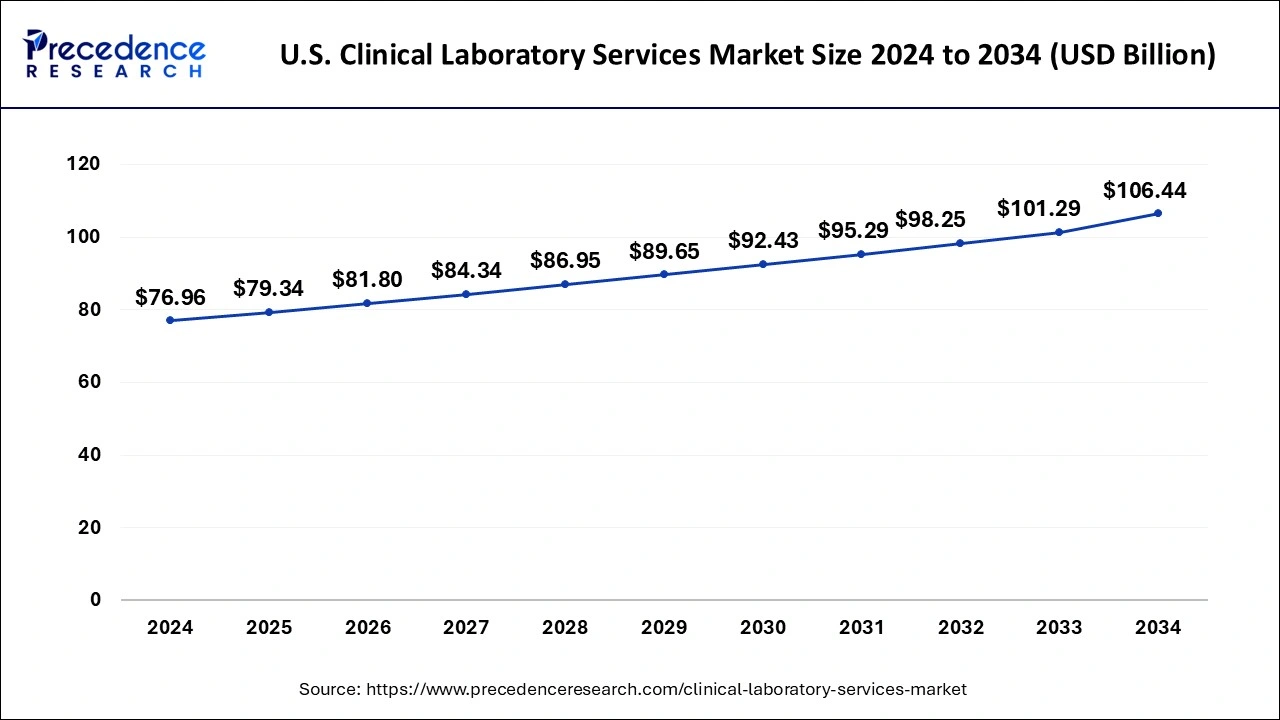

The U.S. clinical laboratory services market size was estimated at USD 76.96 billion in 2024 and is anticipated to be surpass around USD 106.44 billion by 2034, rising at a CAGR of 3.29% from 2025 to 2034.

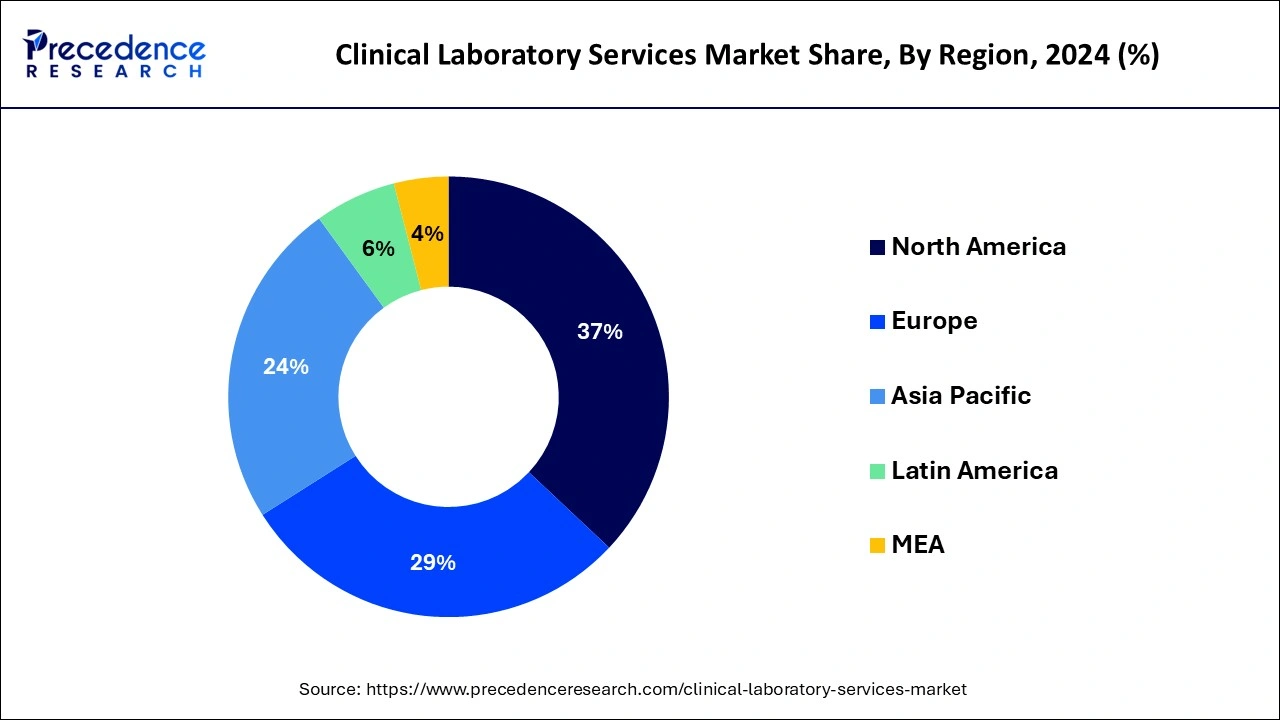

North America dominated the global clinical laboratory services market with the largest market share of 37% in 2024. The U.S. dominated the clinical laboratory services market in North America region. The clinical laboratory services market in North America region is being driven by growing prevalence of chronic disorders. In addition, favorable government conditions are also driving the growth of clinical laboratory services market in the region.

Asia-Pacific region is expected to develop at the fastest rate during the forecast period. China and India dominate the Asia-Pacific clinical laboratory services market. The ongoing research and development activities combined with government initiatives are creating new opportunities for the growth of clinical laboratory services market in the region. The factors such as rapid urbanization and rising disposable income are also driving the growth of the Asia-Pacific clinical laboratory services market.

Europe is expected to grow significantly in the clinical laboratory services market during the forecast period. The increasing incidence of various diseases in Europe is increasing the demand for clinical laboratory services. At the same time, increasing technological advancements are also contributing to the same. Furthermore, support is also being provided by the government. Thus, these factors promote the market growth.

The industries in the UK are focusing on various diagnostic approaches for enhancing the clinical laboratory services to deal with the rising incidence of diseases. This, in turn, increases the collaboration between the companies for increasing the production. Furthermore, to improve these services as well as to make them affordable the government is also providing its support.

The demand along with the use of clinical laboratory services are growing in Germany, due to the adoption of various advanced technologies. These technologies are improving the diagnostic procedures as well as reducing the manual errors. This, in turn, is attracting a large number of patients, enhancing the clinical laboratory services.

The clinical laboratory services are applicable for all type of laboratories. The growth of the global clinical laboratory services market is attributed to the growing number of clinical trials and research and development activities in the healthcare sector. One of the prominent factors driving the growth of the global clinical laboratory services market is growing prevalence of targeted disorders globally. The treatment and diagnosis of targeted disorders require utmost research, which is boosting the expansion of the global clinical laboratory services market over the forecast period.

The diseases or disorders such as cancer, diabetes, and HIV should be diagnosed and treated with latest tools and technologies. These types of diseases should be treated at an early stage. Thus, the demand and need for early disease diagnosis is increasing all around the globe. This is directly impacting the growth of the global clinical laboratory services market. In addition, the technological advancements and innovative solutions and tools are creating growth prospects for the clinical laboratory services market all around the globe.

Another factor that is boosting the growth and development of the global clinical laboratory services market is growing geriatric population. The ageing population rate is growing rapidly in developed and developing countries. The old people are vulnerable to chronic disorders and sometimes are infected with new disease. To study and get results about the specific disease, the clinical trials and research and development is very crucial. Thus, the demand for clinical laboratory services is growing at a rapid pace.

The impact of the COVID-19 pandemic on the growth of the global clinical laboratory services market was moderate in nature. The COVID-19 epidemic resulted into growing demand for clinical trials across healthcare industry. Due to coronavirus outbreak, the importance of clinical laboratory services has grown up significantly. This had positive impact on the clinical laboratory services market growth.

The government firms are getting more aware about the clinical laboratory services all around the world. For this, they are heavily investing in the healthcare sector. In addition, constant efforts are being carried out for the growth and development of the clinical laboratory services market. Furthermore, key market players are actively adopting major marketing strategies for creating awareness regarding clinical laboratory services all around the globe. The strategies that are adopted by clinical laboratory services market players are new service launch, partnership, joint venture, merger, acquisition, and business expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 317.14 Billion |

| Market Size in 2025 | USD 240.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Service Provider, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The clinical chemistry segment contributed the highest market share of 57% in 2024. The growing number of clinical tests is driving the demand for clinical chemistry tests. The growth of the segment is attributed to the growing importance of point of care tests and launch of new and advanced technologies. In addition, the adoption of clinical chemistry tests in countries such as India, the U.S., and Japan is creating growth prospects for the segment.

The genetics testing segment is projected to grow at a solid CAGR during the forecast period. The market for human and tumor genetic tests is growing due to the growing incidences of cancer. This is resulting into growing need and requirement for cancer screening at early stage. These tests provide accurate and precise results for cancer testing and diagnostics.

The hospital-based laboratories segment accounted for the highest market share of 54% in 2024. The growth of the clinical laboratory services in the hospital-based laboratories is anticipated to the growing number of patient’s visits. The growing prevalence of diseases and disorders is resulting into growing number of tests of various diseases. The tests that are carried out in hospital-based laboratories are quite cost intensive in nature.

The standalone laboratories segment is fastest growing segment of the clinical laboratory services market in 2022. After the COVID-19 pandemic, the demand for clinical laboratory services in standalone laboratories increased at a rapid pace. The tests that are being carried out in standalone laboratories help in the improvement of patient health.

The bioanalytical and lab chemistry services segment has held a major market share of 53% in 2024. The growth of the bioanalytical and lab chemistry services segment is attributed to the growing new product launches and drugs. All the new drugs and medications require clinical trials which is driving the growth of the segment.

The toxicology testing services segment is fastest growing segment of the clinical laboratory services market in 2022. The growth of the toxicology testing services segment is being driven by growing introductions and released of consumables. This helps in the enhancement of drug testing services those results into the growth of the segment.

By Test Type

By Service Provider

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

February 2025

May 2025