March 2025

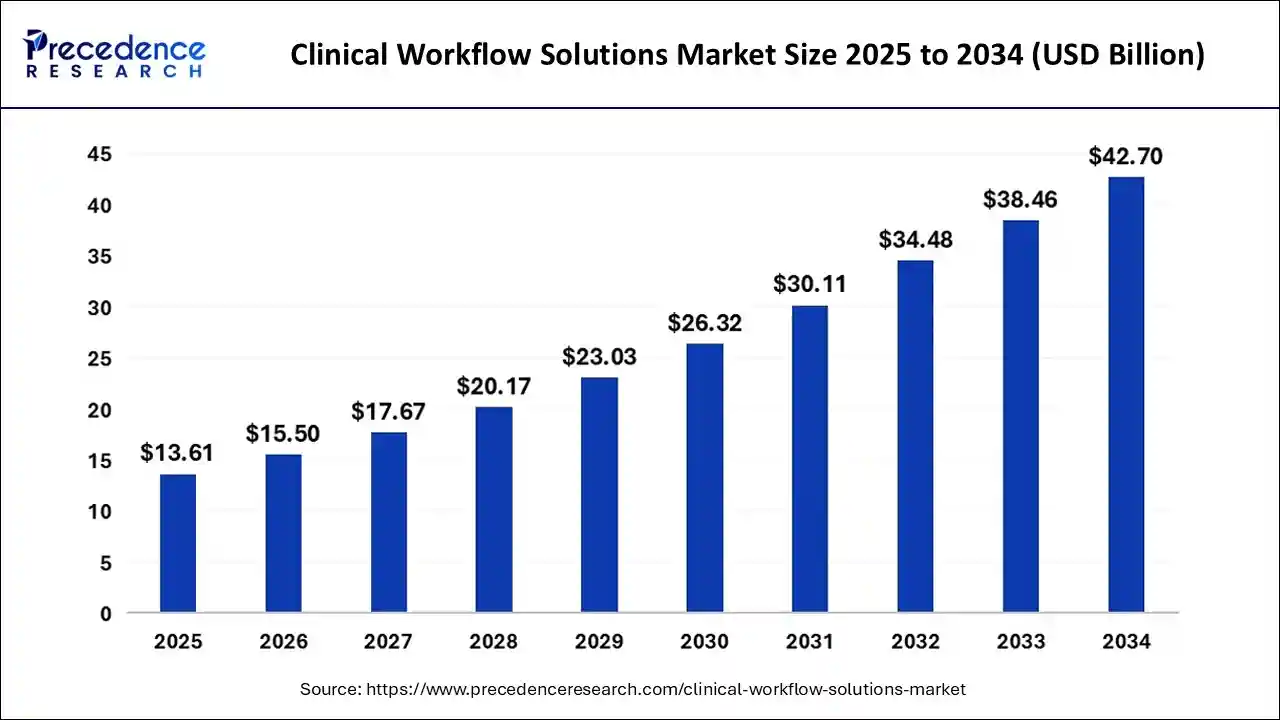

The global clinical workflow solutions market size is calculated at USD 13.61 billion in 2025 and is forecasted to reach around USD 42.7 billion by 2034, accelerating at a CAGR of 13.57% from 2025 to 2034. The North America market size surpassed USD 4.97 billion in 2024 and is expanding at a CAGR of 13.60% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global clinical workflow solutions market size accounted for USD 11.96 billion in 2024, grew to USD 13.61 billion in 2025 and is projected to surpass around USD 42.7 billion by 2034, representing a healthy CAGR of 13.57% between 2025 and 2034. The market is experiencing significant growth due to the increasing focus of healthcare organizations on streamlining operations and reducing costs.

The integration of AI algorithms in clinical workflow solutions transforms the delivery of health care. AI technologies can help streamline processes, improve patient outcomes, and reduce errors. AI and machine learning (ML) together offer predictive analytics. This allows vast amounts of data to be analyzed to identify trends and predict outcomes. AI technologies help healthcare professionals understand the situation and variables to make an informed decision about treatment options. Utilizing AI and ML models helps improve operational efficiency by automating various tasks. They analyze patient data and help categorize the patients into risk groups, helping professionals create a more targeted and personalized treatment plan.

AI and ML technologies also help forecast the admission rates of patients, further optimizing the management of hospital resources and schedules for staff. Advanced AI algorithms like natural language processing (NLP) benefit clinical workflow solutions. It assists in clinical decision support, documentation automation, patient communication, and even voice recognition. With AI technology, the efficiency and effectiveness of clinical workflow solutions can be optimized. Thus, integrating AI technologies is anticipated to boost the growth of the clinical workflow solutions market over the forecast period.

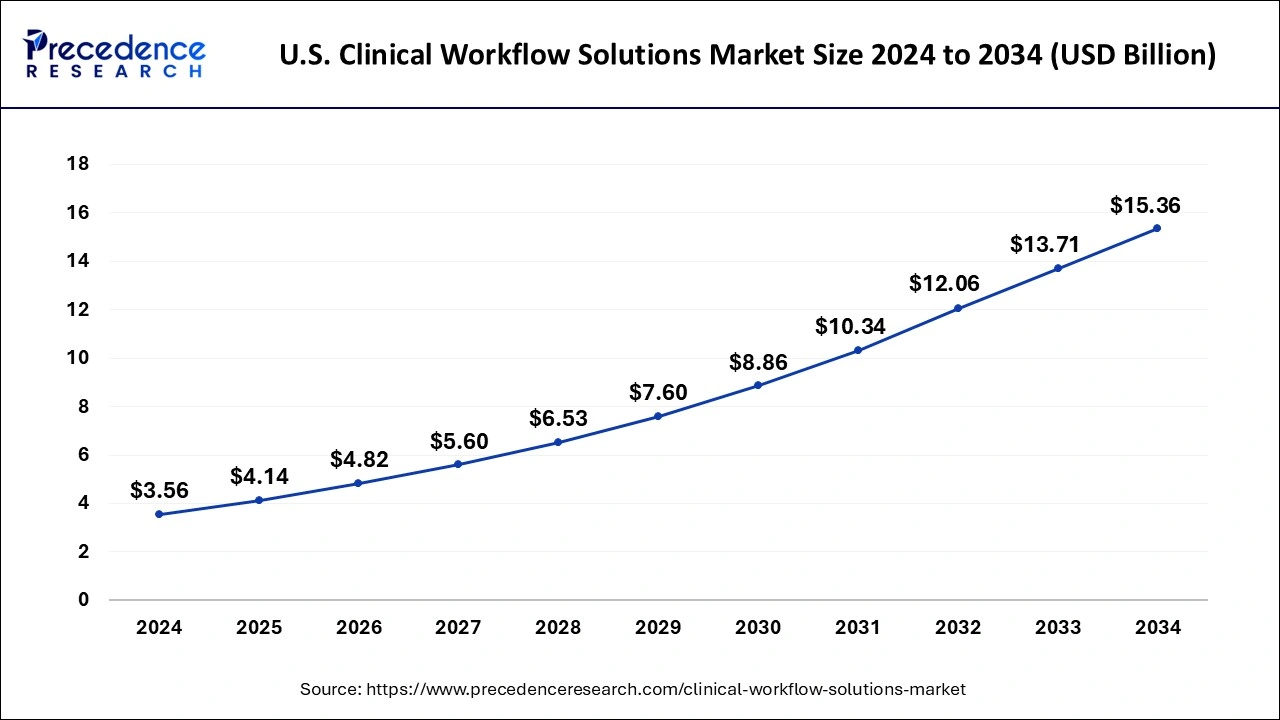

The U.S. clinical workflow solutions market size accounted for USD 3.56 billion in 2024 and is expected to reach USD 15.36 billion by 2034, growing at a CAGR of 16.16% from 2025 to 2034.

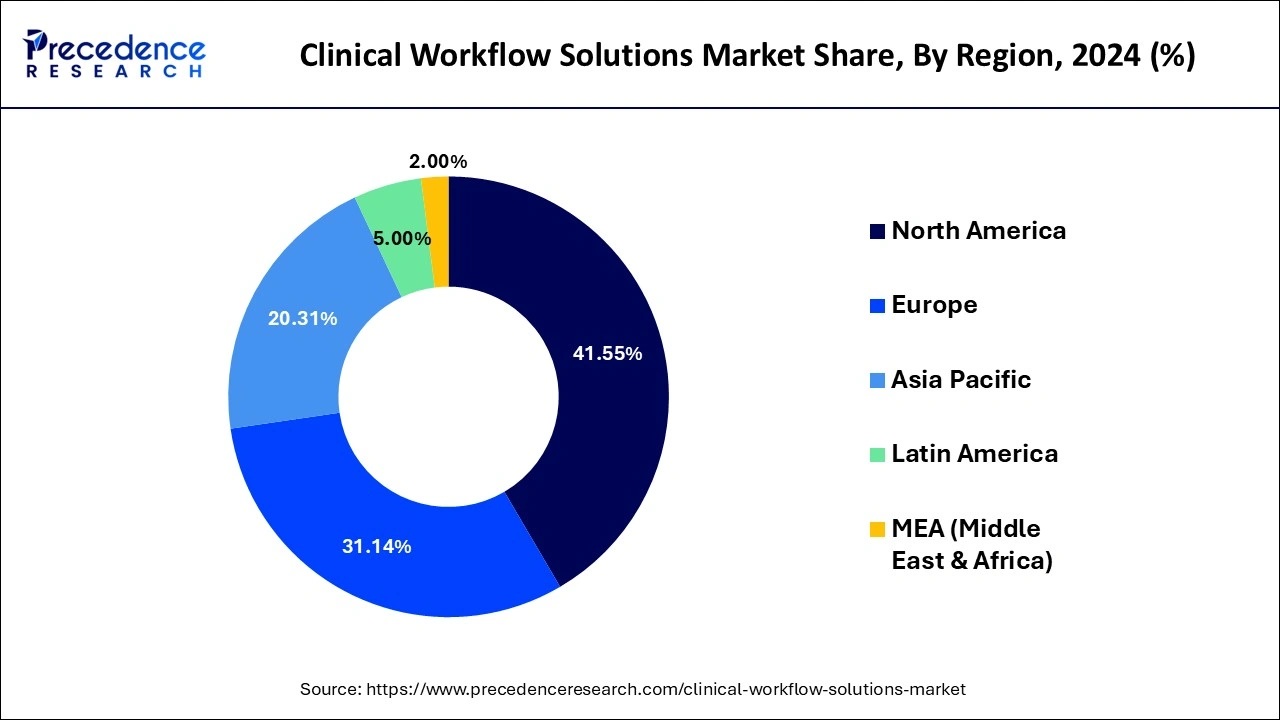

North America accounted for 41.55% market share in 2024 owing to increasing number of research & development activities on healthcare solutions along with rising number of patient admissions in the hospitals that triggers the volume of data generated expected to impel the market growth. Further, increased spending on healthcare digitization to secure the exchange of information within organizations notably supports the growth of clinical workflow solution in the region.

The rising number of incidents related to trauma injuries leads to an increased number of patients in emergency wards, boosting the demand for care collaboration solutions. Governments of various countries in North America are implementing policies to promote clinical workflow solutions. This, in turn, increases the adoption of clinical workflow solutions in healthcare facilities across the region. The region is at the forefront of healthcare technologies, leading to the rapid development of advanced clinical workflow solutions in North America.

Besides this, the Asia Pacific registered the fastest CAGR of 14% over the forecast period owing to prominent surge in the demand for healthcare IT solutions in the medical sector. Further, government support for increasing medical tourism, implementing e-Health, high demand for quality healthcare, and improving healthcare infrastructure are the important factors that supports the market growth in the region.

With the rising consumer disposable income, healthcare expenditure is rising. The rising population growth in countries like India and China significantly increases the patient pool, making it challenging for healthcare facilities to manage the patient pool efficiently. Governments of Asian countries are also investing heavily in expanding healthcare facilities in rural areas. In addition, with the increasing digitization, there is a high adoption of advanced technologies in the healthcare sector, boosting the market growth in Asia Pacific.

Clinical workflow solutions involve various tools, software, and technologies that are designed to streamline and optimize various operations of healthcare organizations. These solutions help coordinate better between medical practitioners, staff, and patients. Analytic and communication solutions are mostly utilized solutions for effective monitoring and coordination. Adopting clinical workflow solutions helps staff and patients by enhancing communication and transparency in operations. Managing and storing vast amounts of data becomes a hassle for healthcare facilities, boosting the demand for clinical workflow solutions to manage this load and reduce the burden on healthcare professionals. These solutions help with the proper management of healthcare data. The growing need for standardization of clinical workflow further boosts the market growth.

| Report Coverage | Details |

| Market Size in 2025 | USD 13.61 Billion |

| Market Size by 2034 | USD 42.7 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.57% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Surge in demand for big data analytics

Organizations are experiencing numerous challenges in dealing with fast growing data sources as their client base grows and they expand into new regions and markets. Organizations have begun to see the benefits of fully utilizing big data and are investing in big data technologies, including clinical workflow solutions, as a result of the introduction of big data technology. Thus, surge in demand for big data analytics is driving the growth of clinical workflow solutions market during the forecast period.

Lack of expertise

Organizations should use modern clinical workflow solutions in data management and business management these days to gather and integrate huge amounts of data from multiple internal and external data sources to gain significant business insights. However, a lack of knowledge and skills within the workforce prevents them from embracing clinical workflow solutions. As a result, the lack of expertise is hampering the growth of clinical workflow solutions market during the forecast period.

Opportunities

Benefits of clinical workflow solutions

Healthcare businesses seeking more attractive, smooth, and impactful ways to improve patient outcomes and safety are increasingly turning to clinical workflow solutions. This is due to the fact that these solutions allow for the continuous flow of real-time health data, resulting in better-informed care decisions and results. Clinical workflow solutions provide characteristics that can help enhance care quality, care coordination, and overall patient happiness while also lowering the risk of medication errors and adverse drug events, and their usage is projected to rise in the future years.

Lack of trained professionals

The scarcity of qualified personnel is a key impediment to the implementation of IT systems in hospitals. Healthcare organizations and vendors are finding it challenging to attract competent personnel as the number of healthcare IT initiatives grows. The demand for healthcare IT specialists is currently significantly exceeding supply, not just in developing nations but also in developed areas such as the U.S. and Europe. Thus, the lack of trained professionals is a huge challenge for the market growth.

The data integration solutions segment accounted revenue share of over 26.4% in 2024. Data integration systems are prominently preferred by the healthcare service providers due to need for integration to curb the rising costs and increasing data volumes. Hospitals and other form of caregivers are actively adopting integrated systems that enable customers to access the patient’s information during the course of their care service. This drove the market growth for data integration systems in the year 2023. Factors such as regulatory reforms & requirements, interoperability solutions, raised adoption of electronic medical records, and shifting focus towards value-based services have propelled the growth of the segment.

Care collaboration solution have gained significant traction in the past few years and expected to exhibit escalating demand during the forecast period. This is attributed to the increased emphasis on the patient-centric services. Rising number of patients across the globe also influence market players to develop more effective and efficient solutions. Care management solution provides effective workflow methodologies as well as improves patient care that save both cost and time.

Hospitals occupied the maximum clinical workflow solutions market value share of 46% in the year 2024 due to rising number of healthcare facilities along with associated data that require effective management and privacy. In addition, supportive initiatives undertaken by the governments of various regions to simplify and enhance the data handling capacity in the healthcare sectors anticipated to boost the market growth of the segment. For example, as per the statistics declared by the Healthcare Information and Management Systems Society (HIMSS) in the year 2019, more than 60% hospitals have adopted EHR technology. Furthermore, the West Health Institute (WHI) declared that rising adoption of interoperability solutions can result in prominent reduction in the healthcare spending in the United States.

Additionally, ongoing trend for connected hospitals and effective management solutions anticipated to fuel the market growth over the analysis period. The rising demand for unified critical clinical communications, integrated & collaborative care delivery, and streamlined process for call scheduling are some of the key factors that contribute significantly towards the high revenue share of the segment.

On the other hand, ambulatory care centers predicted to register the highest growth over the analysis period. This is mainly due to a spike in the out-patient admissions in health centers. Integration of IT-based solutions in ambulatory care centers notably reduces medical errors as well as enhances communication among pharmacies, physicians, nursing staff, and patient’s family.

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2025 to 2034. This report contains market breakdown and its revenue estimation by classifying it on the basis oftype, end-use, and region:

By Type

By End-User

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

February 2025

January 2025