November 2024

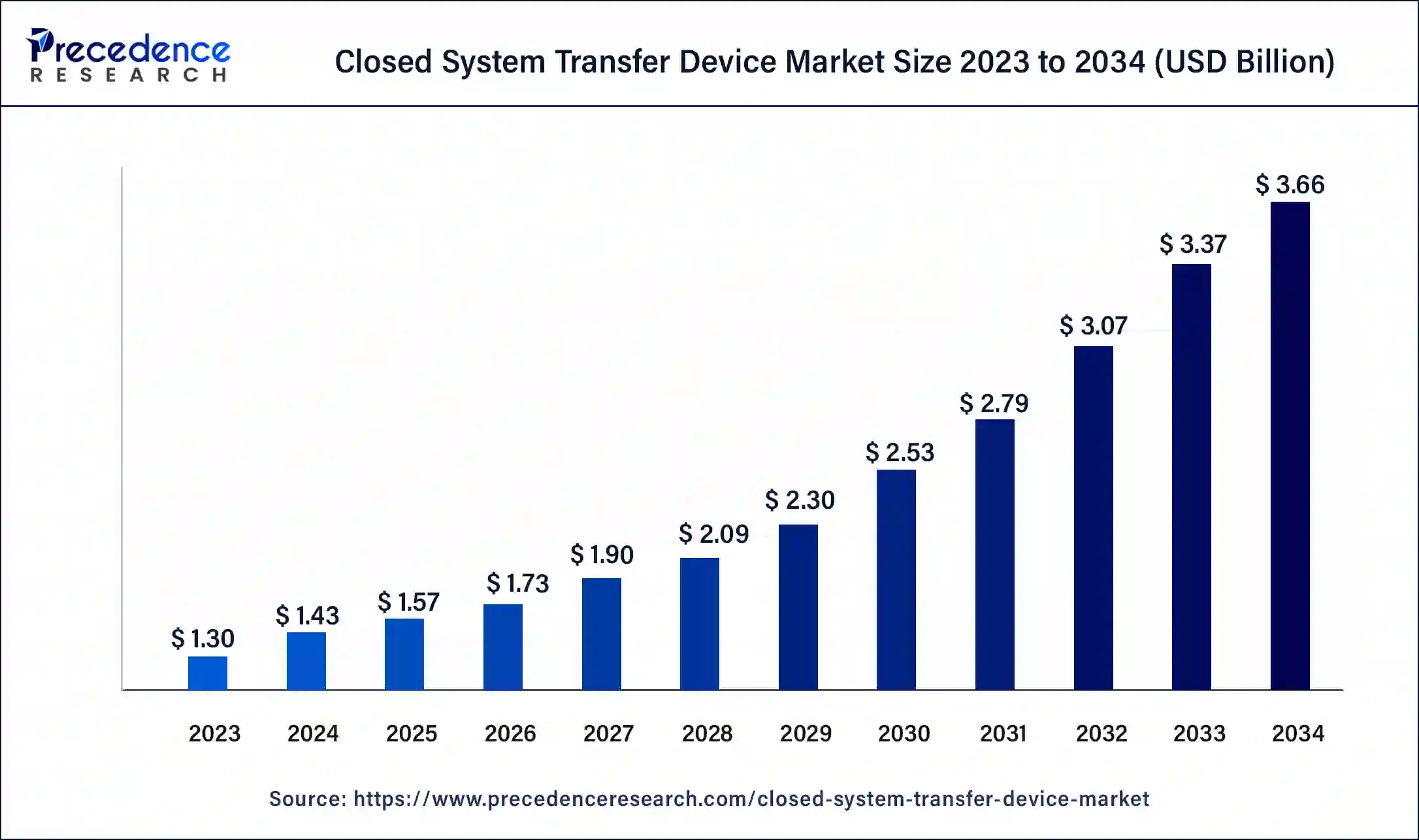

The global closed system transfer device market size was USD 1.30 billion in 2023, estimated at USD 1.43 billion in 2024 and is anticipated to reach around USD 3.66 billion by 2034, expanding at a CAGR of 9.84% from 2024 to 2034.

The global closed system transfer device market size accounted for USD 1.43 billion in 2024 and is predicted to reach around USD 3.66 billion by 2034, growing at a CAGR of 9.84% from 2024 to 2034.

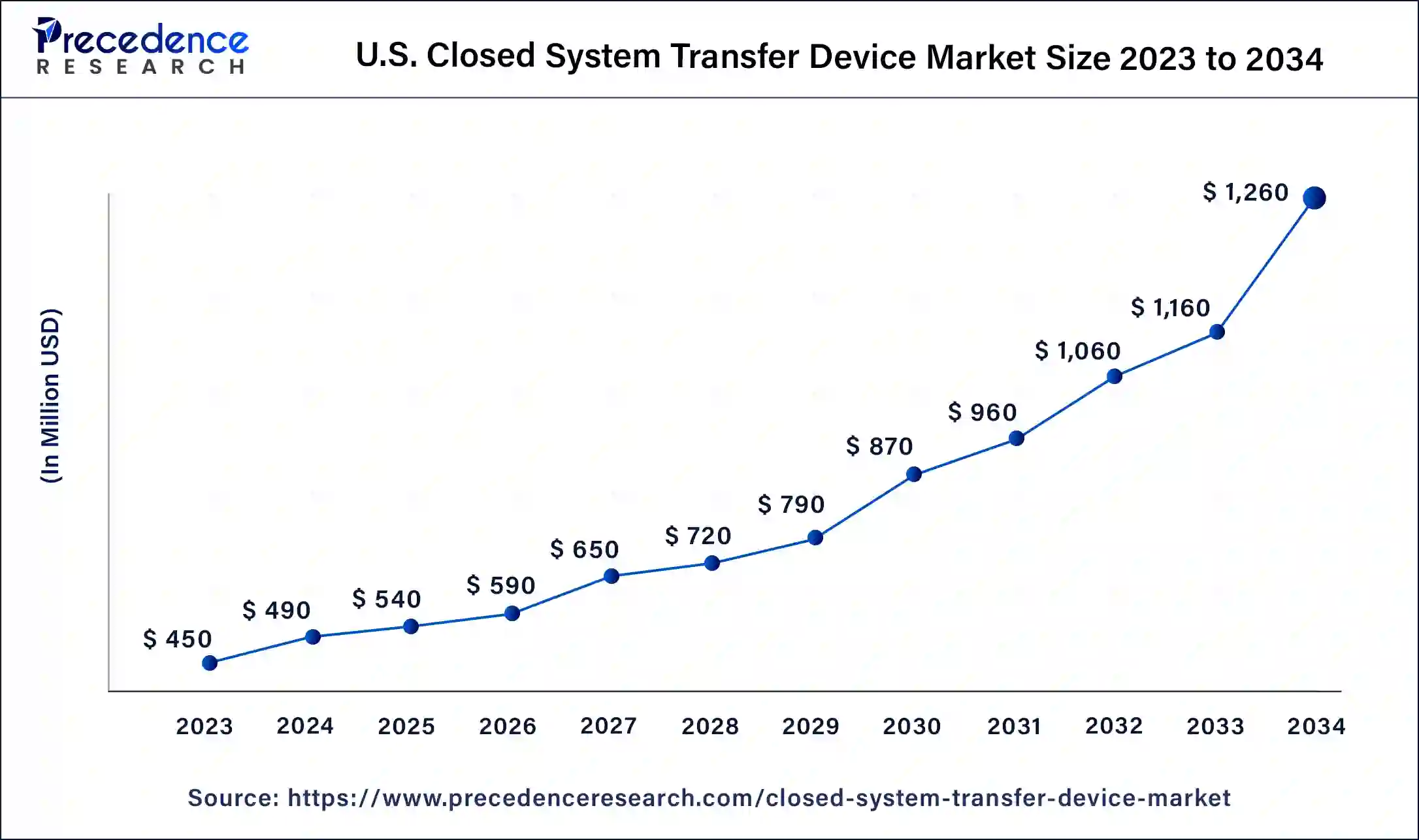

The U.S. closed system transfer device market size was valued at USD 450 million in 2023 and is expected to be worth USD 1,260 million by 20334, at a CAGR of 10% from 2024 to 2034.

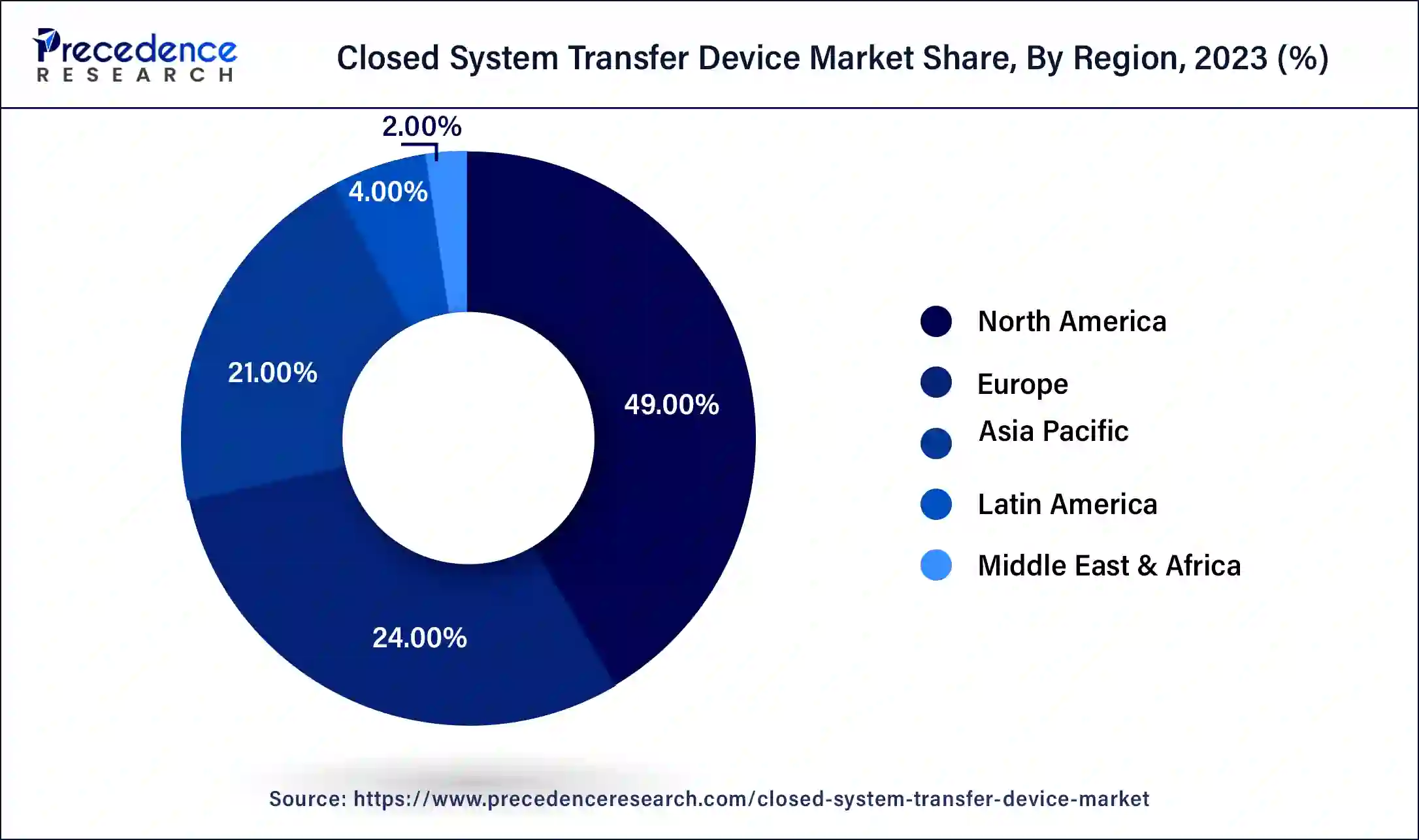

North America is Estimated to be the Largest Market for Closed System Transfer Device

The research report covers key trends and prospects of closed system transfer device products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. Geographically, the closed system transfer device market is conquered by North America owing to a high incidence of cancer and the presence of a sophisticated healthcare framework. On the other hand, Asia-Pacific is anticipated to witness a rapid growth rate, on account of increasing healthcare expenditure and growing investment by major manufacturers to launch new products.

The requirement for (CSTDs) closed system transfer devices is increasing rapidly, due to the increasing occurrence of cancer, the rising implementation of CSTDs for transporting hazardous medications, such as cytotoxic or antineoplastic drugs, the increasing need for monitoring compliance for safe management of injurious drugs, and escalating quantity of drug sanctions for cancer. These are some key factors driving the global closed system transfer device market. Moreover, closed system transfer devices support circumventing environmental contamination with damaging drugs resulting in augmented device adoption, which in turn, drives market development. The use of closed system transfer devices for other healing applications and the quick use of CSTDs in developing markets are projected to generate new growth opportunities for the worldwide closed system transfer device market.

| Report Highlights | Details |

| Market Size in 2023 | USD 1.30 Billion |

| Market Size in 2024 | USD 1.43 Billion |

| Market Size by 2034 | USD 3.66 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.84% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Component, End User, Closing Mechanism, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Membrane-to-Membrane Systems Segment Seized Foremost Market Stake in 2023

Membrane-to-Membrane Systems segment recorded the prime market share in the global closed-system transfer device Market in 2023. The membrane-to-membrane transference devices use the dual membrane system among the syringe and vial further supports to isolate the medical preparation. The factors such as reduced contamination risk, and ease of usage of the double-membrane systems confirm the safety expected to increase the usage of the membrane-to-membrane transmission devices over the estimated period.

The needleless systems are projected to grow at the highest CAGR during the forecast period mainly due to benefits such as needle-free transmission of drugs. Moreover, new product launches are expected to contribute to the high growth of needleless systems.

Push-To-Turn Systems Projected to Rulethe Closing Mechanism Segment of Closed System Transfer Device Market Revenue

Closed system transfer devices are rapidly being employed for the safe transfer of harmful medical preparations. High research and development activity in closed-system transfer devices for the transfer of oncology medications is the major reason for the high revenue share of closed-system transfer devices.

The luer-lock systems segment will expand at the highest CAGR during the forecast time frame.

Hospitals Projected to Dominate the End-User Segment of Closed System Transfer Device Market Revenue

Hospitals have the funds to procure expensive closed-system transfer devices that help in the safe transfer of hazardous medical preparations when compared to small clinics and oncology centers.

The companies focusing on research and development are expected to lead the global closed system transfer device market. Leading competitors contending in the global closed system transfer device market are as follows:

In order to better recognize the current status of closed system transfer devices, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the closed system transfer device market. This research study bids qualitative and quantitative insights into the closed system transfer device market and assessment of the market size and growth trends for potential market segments.

Major Market Segments Covered:

By Type

By Closing Mechanism

By Component

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

October 2024

January 2025