January 2025

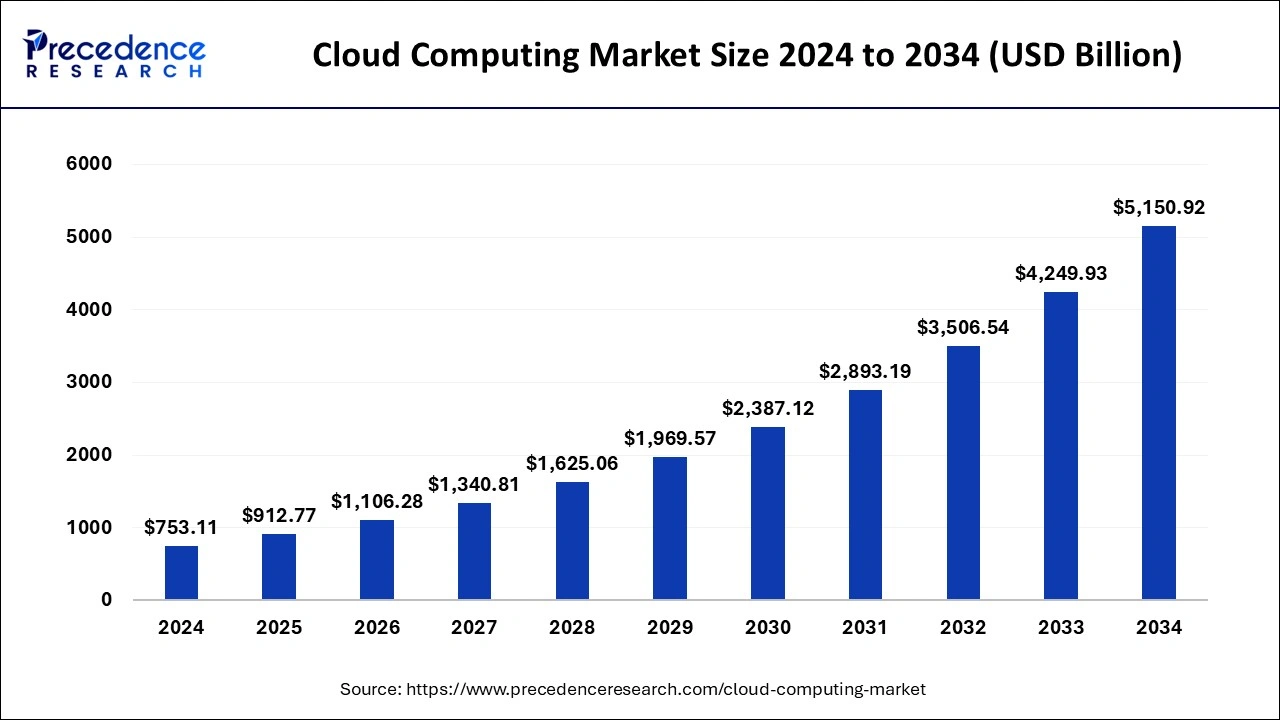

The global cloud computing market size was valued at USD 753.11 billion in 2024 and is anticipated to reach around USD 5,150.92 billion by 2034, expanding at a CAGR of 21.20% from 2025 to 2034. The cloud computing market is growing significantly due to the use of cloud computing in a lot of major industries, such as healthcare, pharmaceutical, banking, finance, information technology, logistics, manufacturing, research, education, and so on.

The digital shift will take on a new dimension over the next ten years as businesses use AI systems more and more to improve daily interactions. Automating tasks, decreasing human error, increasing productivity, applying cost-cutting strategies, and boosting efficiency are all made possible by cloud-based AI.

Cloud computing and AI algorithms work together to analyze and organize large data volumes, creating useful blueprints for upcoming migrations and changes. The incorporation of AI into cloud computing facilitates adaptability, flexible approaches, and safe systems, enabling enterprises to expand quickly and economically with strong AI solutions.

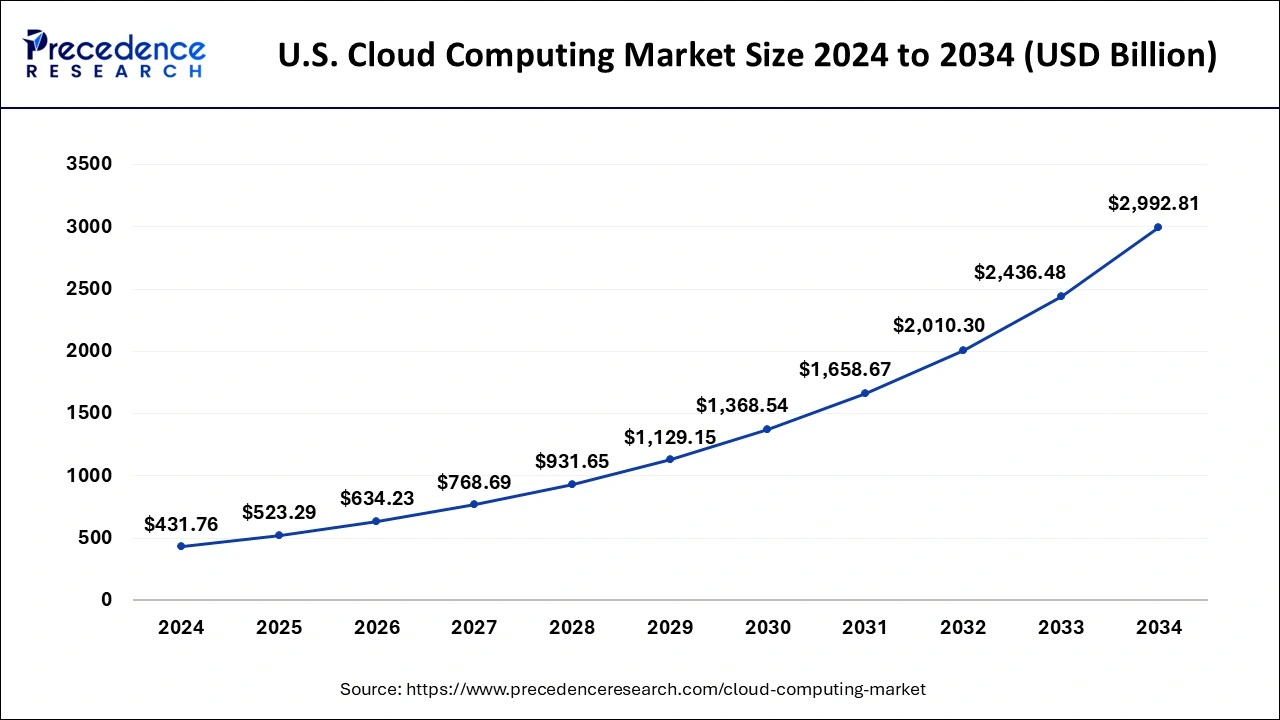

The U.S. cloud computing market size was evaluated at USD 431.76 billion in 2024 and is projected to be worth around USD 2,992.81 billion by 2034, growing at a CAGR of 21.36% from 2025 to 2034.

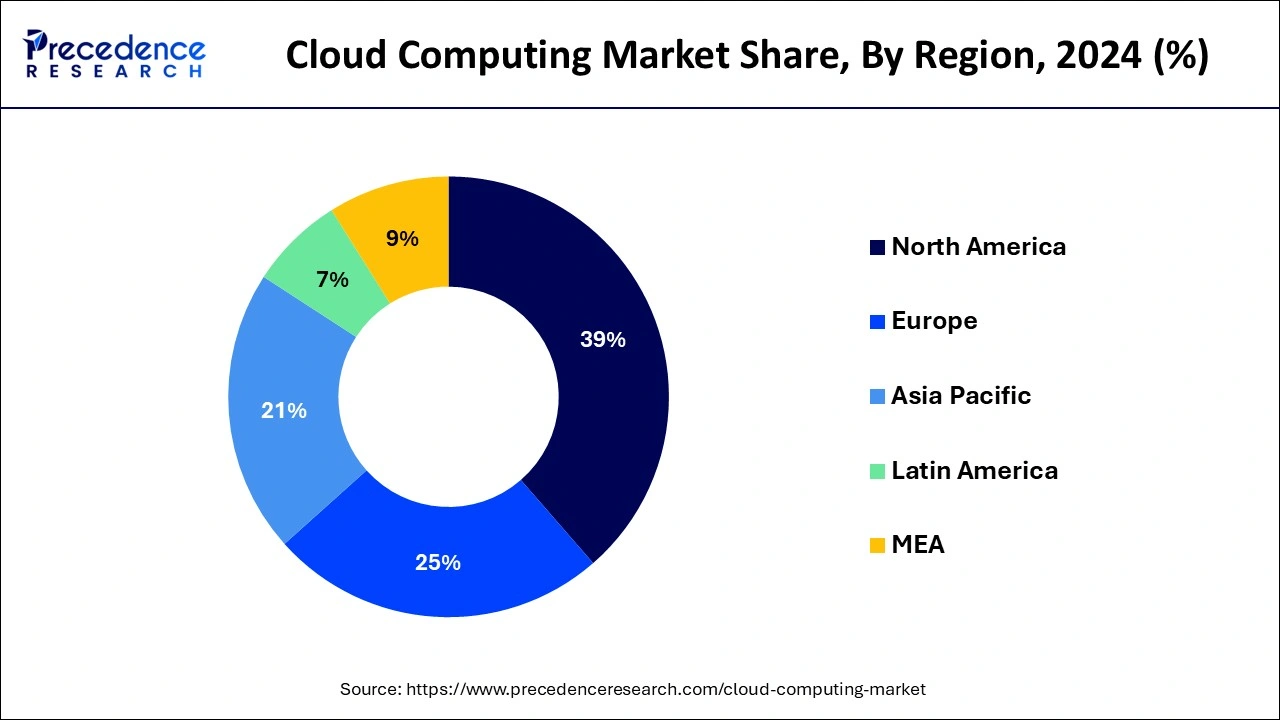

North America was the leading cloud computing market with highest revenue share in 2024. US emphasizes the adoption of advanced technologies across the industries and prefers digital transformation. US is one of the early adopters of various novel technologies like AI, IoT, AR/VR, ML, connected industries, additive manufacturing, and big data analytics. Furthermore, the rapid adoption of the 4G and 5G technologies owing to the presence of strong and well-established IT and telecommunications infrastructure. Moreover, the presence of tech giants like Amazon, Microsoft, Apple, and Google have significant contributions in the growth of the North America cloud computing market.

The International Trade Administration estimated that in 2023, the value of the U.S. computer systems and design-related services sector contributed $489.2 billion to the country's GDP. The value of data processing, online publication, and other information services to the U.S. economy increased by $469.4 billion in the same year. The CompTIA estimates that there are 585,000 software and IT services firms in the US. The market is well-established and standardized, and U.S. software companies are known for delivering dependable and efficient solutions that swiftly reach the market.

Because of its cheap business expenses, easy access to international markets, and government measures to foster innovation, Canada provides the ideal environment for international IT businesses to flourish. The bulk (more than 45,000) of the more than 48,700 businesses in Canada's information and communications technologies (ICT) industry are in the software and computer services sectors.

Asia Pacific is expected to witness the highest CAGR during the forecast period. Rapidly rising emerging economies like China and India and the emergence of regional tech giants like Alibaba are contributing to the market growth. Furthermore, various government initiatives like Make in India has attracted huge investments in the manufacturing and IT industry, which is expected to boost the demand for the cloud computing services in the forthcoming years.

Government Announcements for Promoting Cloud Computing

Meghraj – the Cloud Computing initiative of the Government of India is focused on accelerating the delivery of e-services in the country while improving the ICT spending of the Government. It aims to ensure optimum use of the architecture while improving the speed of deployment and development of eGov applications.

Through the Internet, people and companies may access and store data, apps, and other resources on distant servers due to the quickly expanding cloud computing market. The transmission of computer services, including storage, services, software, analytics, databases, networking, and intelligence, via the internet (referred to as "the cloud") in order to provide economies of scale, flexible resources, and quicker innovation is known as cloud computing. Cloud computing has become a vital strategic tool for companies across a variety of industries due to its many benefits and opportunities.

| Report Coverage | Details |

| Market Size in 2025 | USD 912.77 Billion |

| Market Size in 2034 | USD 5,150.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 21.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment, Service, End User, Organization SizeWorkload, Geography |

Acceptance for cloud computing by government agencies

In June 2023, Smart Nation Singapore and Digital Government Office launched government cloud cluster platform based on artificial intelligence. The government agencies have partnered with Google Cloud for boosting the acceptance of artificial intelligence solutions in the public sector of Singapore. The acceptance of cloud computing by government agencies serves as a significant driver for the cloud computing market.

Governments across the globe are focused on accepting cloud computing solutions for validating security, scalability and cost-effectiveness of deployed technology. This in turn encourages private sector organizations to follow suit. This acceptance also fosters innovation in the public sector while providing the local cloud-solution providers with continuous and stable revenue. All these combined effects with the government acceptance are thus observed to fuel the market’s growth.

Unstable internet connectivity in underdeveloped areas

Unstable or lack of proper internet connectivity in underdeveloped areas poses a challenge for the cloud computing market as cloud service heavily depend on a reliable and fast internet connection. Inconsistent access can lead to slow data transfers, service disruptions and reduced usability of cloud applications, limiting the benefits of scalability and remote access that cloud computing offers. This hinders the adoption of cloud services in these regions, impacting the growth and profitability of cloud providers. Thus, the unstable internet connectivity in underdeveloped areas is observed to be the restraint for the market.

Integration of specialized computing solution

The integration of specialized computing solutions as per the industry’s requirements presents a significant opportunity for the cloud computing market to grow. The integration of such solutions enables more efficient and tailored processing of specific tasks. Cloud solutions providers can offer specialized hardware and accelerates as services, allowing customers to access these resources without the need for large investments in hardware infrastructure. With the specialized solutions, the workload can be managed, and cost can be optimized. Thus, as industries start focusing on integrating specialized computing solutions, the market for cloud computing solutions is expected to grow. RCH Solutions, based in the United States is one of the most prominent providers of specialized computing solutions. The company offers specialized solutions to help research and development teams accelerate the delivery of scientific breakthroughs.

Regulatory hurdles

Regulatory hurdle for the adoption of cloud computing solutions is a major challenge for the market. Varying laws and regulations across different countries and regions can impact data privacy, security and compliance. Providers must navigate these complexities, adapting their services to meet different standards. This can slow down the expansion, increase costs of setting up the cloud computing systems and create uncertainty for both providers and users. Additionally, such regulations may restrict data sharing across borders, limiting the seamless global nature of cloud services. Thus, regulatory hurdles are observed to be a challenge that the global cloud computing market needs to address.

The private deployment segment garnered highest revenue share in 2024. The private deployment cloud computing services are available to a small users groups. The major features of private deployment segment includes self-service, elasticity, and scalability that makes it more adaptable by the enterprises. The private clouds offers higher security and privacy for the third party service providers by using internal hosting and firewalls that ensures enhanced data protection.

The hybrid deployment is anticipated to be the most opportunistic segment during the forecast period. It is an integration of the public and private cloud models. The hybrid models is gaining traction among the industries to enhance their cost optimization, business model, application modernization, business operations, and user experience. The rapid emergence of the edge computing is expected to boost the demand for the hybrid clouds across the enterprises all over the globe in the upcoming future.

Software as a Service (SaaS) was the dominant segment in 2024. It is estimated that there is a rapid rise in the number of enterprises shifting towards cloud. More than 70% of the companies are shifting majority of their application to the Software as a Service (SaaS) platform. The increased adoption of remote working has resulted in a significant rise in the demand for the SaaS platform and this trend is expected to continue over the forecast period.

With the SaaS products experiencing a strong growth across the globe, its total cost of ownership (TCO) is expected to become equal to that of the on premise models. The surging number of businesses providing cloud based services and growing demand for SaaS delivery models is anticipated to boost the growth of the SaaS segment. SaaS offers great flexibility, options, and web based subscriptions that help is accessing program remotely. All these factors are boosting the growth of this segment and SaaS is also expected to be the fastest growing segment during the forecast period.

The BFSI segment garnered highest revenue share in 2024. A significant rise in the online banking activities is a major driver of the cloud computing market in the BFSI sector. Cloud computing helps the BFSI to control expenses, increase flexibility, boost innovation, and improve client connection. Furthermore, the rising adoption of cloud services for storing and administration of the consumer related data is attributable to the growth of the BFSI segment in the market. Online money transfer, unified customer experience, digital wallets, and payment gateways are expected to play a crucial role in the BFSI industry in the forthcoming future, which will have a significant impact on the growth of the cloud computing market.

The manufacturing is expected to be the most opportunistic segment during the forecast period. This industry is anticipated to be a prime user of the cloud services due to its benefits like real-time visibility and seamless management of data. The cloud service models helps the manufacturing sector by incorporating novel technologies like big data, machine learning, artificial intelligence, internet of things, and big data analytics. The rising adoption of the cloud services in the manufacturing sector for storing information, supply chain handling, and planning enterprise resources is expected to boost the growth of this segment during the forecast period.

By Deployment

By Service

By End User

By Organization Size

By Workload

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

June 2025

January 2025

June 2025