January 2025

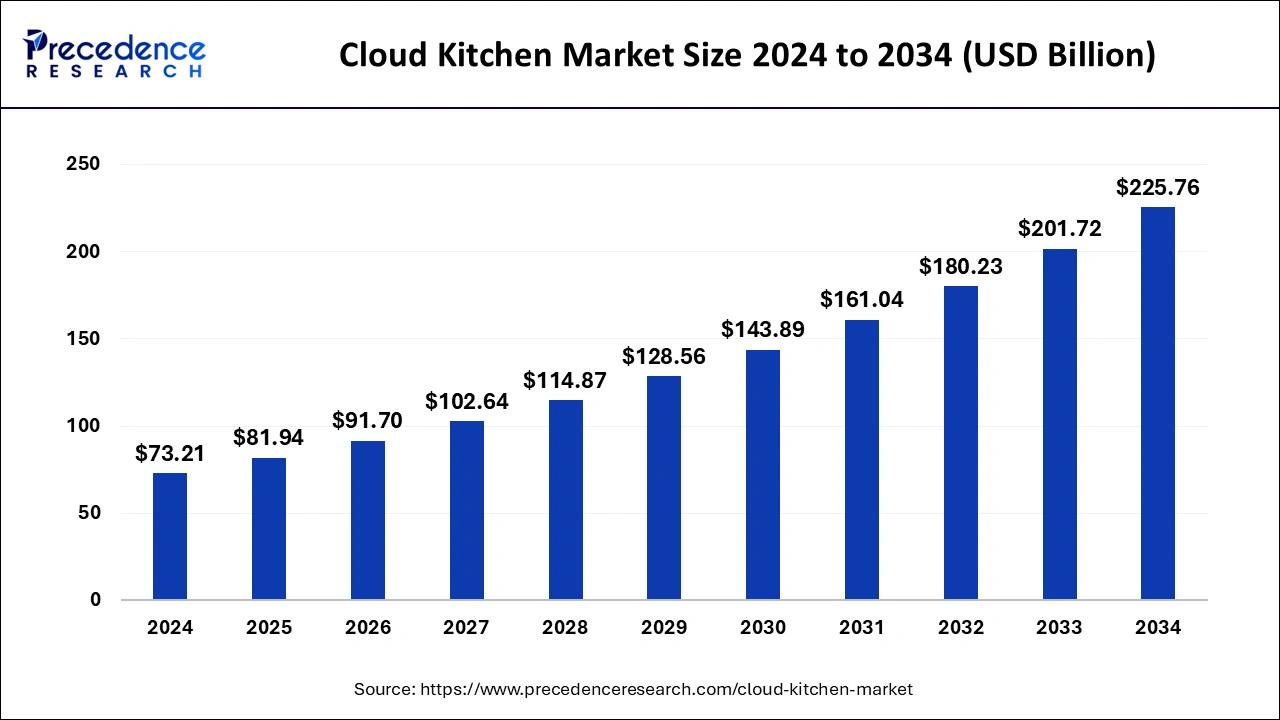

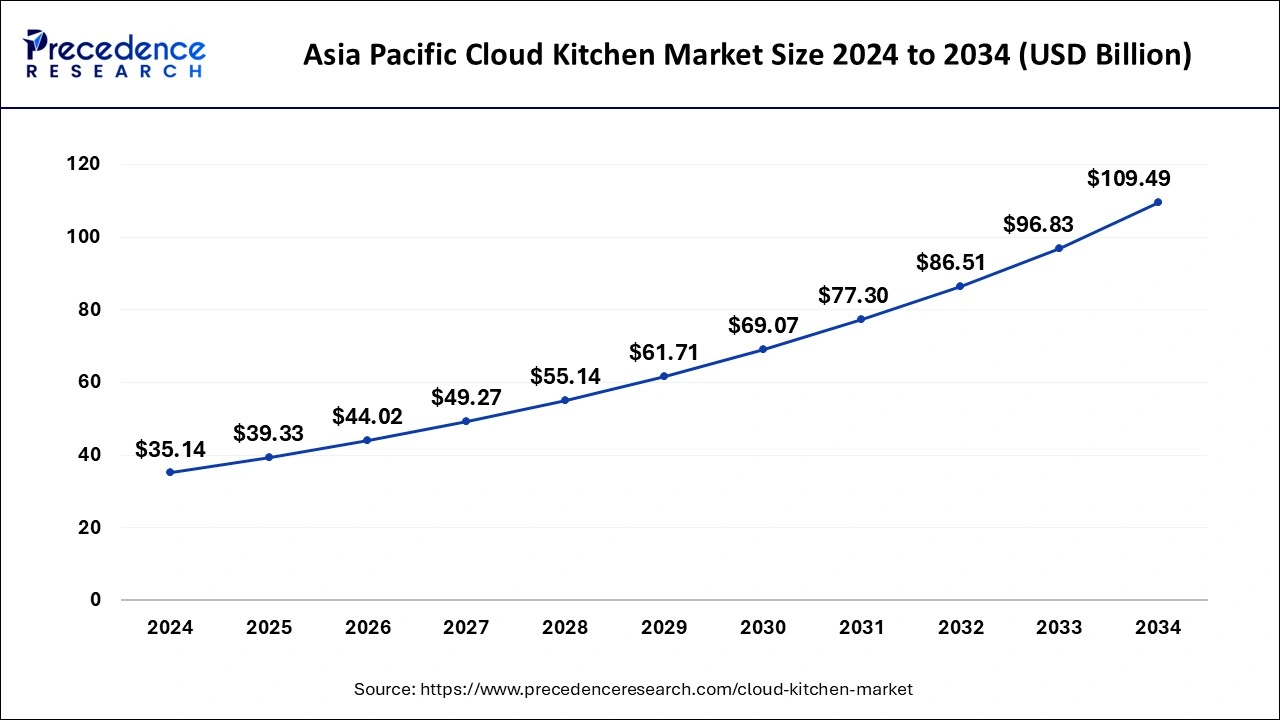

The global cloud kitchen market size is calculated at USD 81.94 billion in 2025 and is forecasted to reach around USD 225.76 billion by 2034, accelerating at a CAGR of 11.92% from 2025 to 2034. The Asia Pacific cloud kitchen market size surpassed USD 35.14 billion in 2024 and is expanding at a CAGR of 12.04% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cloud kitchen market size was estimated at USD 73.21 billion in 2024 and is anticipated to reach around USD 225.76 billion by 2034, expanding at a CAGR of 11.92% from 2025 to 2034. The global cloud kitchen market growth is attributed to the increasing preference for convenient dining options, the increasing busy lifestyles and urbanization, and the rise of food delivery apps.

Artificial Intelligence has become an essential part of our technology in recent years. Artificial Intelligence plays a very important role, from controlling the apps to every device. AI-generated robots can cook customer’s favorite food delivered to their doorstep. The installation cost of AI is cost-effective and does not need any manpower. Orders can be accepted by voice commands, with the help of Artificial Intelligence. Customers can easily receive the same treatment as restaurants through their devices and prevent long lines to place their orders at restaurants. The number of daily sales is estimated to go up with less investment in human labor fancy infrastructure, with the installment of Artificial Intelligence. AI-generated restaurants do not require hiring people to track, take orders, cook, and deliver orders. All one needs is an AI assistant to handle all functions. Due to these advanced and convenient AI trends, AI will take food apps and other businesses to a higher level and further revolutionize the growth of the cloud kitchen market.

The Asia Pacific cloud kitchen market size was evaluated at USD 35.14 billion in 2024 and is predicted to be worth around USD 109.49 billion by 2034, rising at a CAGR of 12.04% from 2025 to 2034.

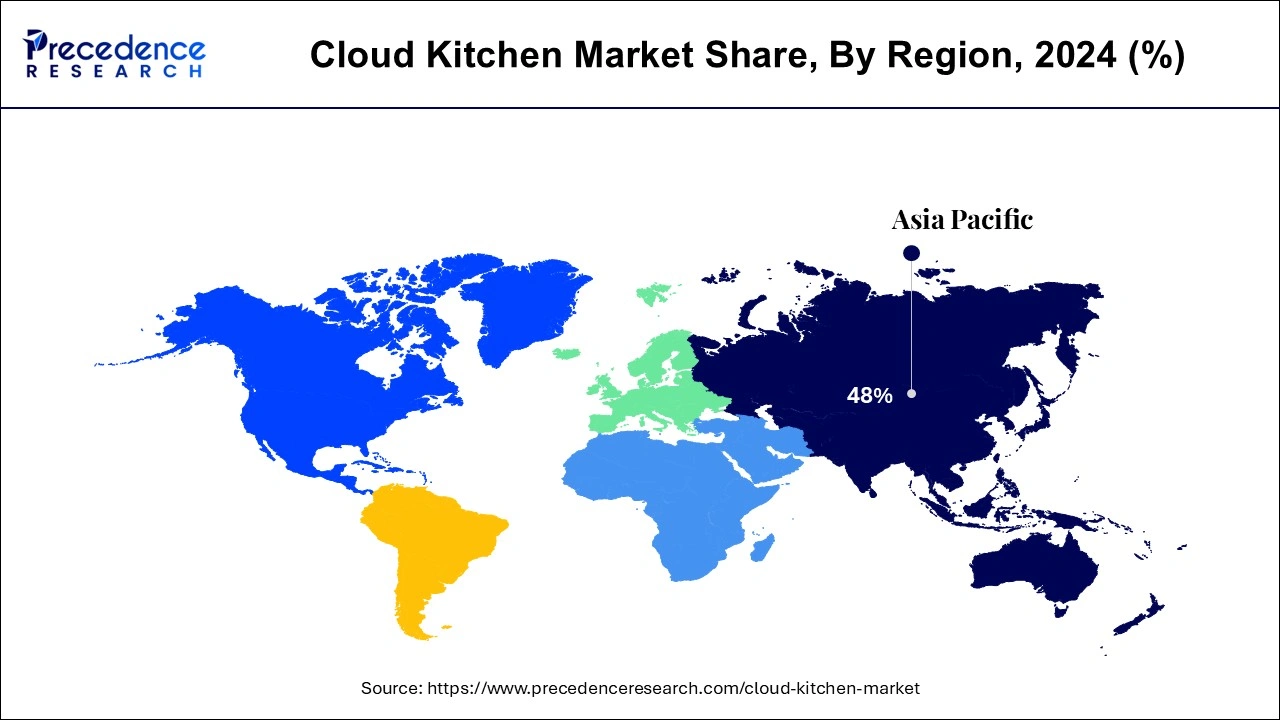

Asia Pacific was the leading cloud kitchen market that garnered a market share of more than 60% in 2024. Asia Pacific is the home to more than half of the global population which provides a huge consumer base. The rapid urbanization, rising disposable income, busy and hectic lifestyle, rising penetration of the internet, and the increasing adoption of the smartphones are some of the significant macroeconomic factors that drives the growth of the cloud kitchen market in Asia Pacific. Moreover, the presence of huge youth population and the rising demand for food along with the rising population is supplementing the market growth. The countries like China and India are showing promising growth opportunities for the market players owing to the strong economic growth in the region. The rising demand for the international cuisines and rising preferences for the food delivery over dine-in is supplementing the growth of the Asia Pacific cloud kitchen market. For this, the Asia Pacific is also estimated to be the fastest-growing market.

North America is estimated to grow at a considerable pace 10% during the forecast period. Increasing buying power, improved access to the digital technologies, higher penetration of internet, and increased adoption of the smart devices are some of the major factors that has propelled the growth of the North America cloud kitchen market. The high demand for the fast foods coupled with the busy and hectic schedules of the consumers is boosting the demand for the cloud kitchen services owing to the conveniences associated with it.

| Report Coverage | Details |

| Market Size in 2025 | USD 81.94 Billion |

| Market Size by 2034 | USD 225.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.92% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment Types, Solutions, Product, Nature, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

By product type, the burger and sandwich segment dominated the market globally. The popularity of burgers and sandwiches as classic comfort foods has gone up substantially. This segment is versatile enough to cater to different consumer tastes and preferences, able to be customized according to the regional palates. Burgers and sandwiches are also convenient for delivery, able to retain consistency and taste, making them suitable for food transportation.

The Mexican/Asian food segment is predicted to witness significant growth in the market over the forecast period. The rising global popularity of Mexican and Asian cuisine due to exposure on social media along with a larger immigrant population, as well as increased accessibility to ingredients is leading to substantial growth in this sector of the market.

The mobile segment registered its dominance over the global market. Mobile apps are widely accessible, with customers preferring to place orders on dedicated apps due to widespread smartphone usage and convenience. Mobile apps also automatically detect user phone location to suggest nearby cloud kitchens.

By deployment types, the web segment is predicted to witness significant growth in the market over the forecast period. Web access is allowing cloud kitchens to become more popular, allowing customers to easily access food from cloud kitchens through their web browsers, which integrate major food delivery platforms.

By solutions, the order management segment dominated the market globally. These apps help monitor orders from various sources, keeping tab of stock and sales figures. These systems also help track order progress, allowing the sales team to keep a record of the customers who have placed orders with the company.

By solutions, the inventory management segment is predicted to witness significant growth in the market over the forecast period. These systems allow for accurate monitoring of inventories of food and ingredients, helping identify usage patterns and assisting businesses in optimizing purchasing decisions. Many of these apps also have barcode scanning capabilities, for quick and accurate data entry.

Segments Covered in the Report

By Product

By Deployment Types

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025