January 2025

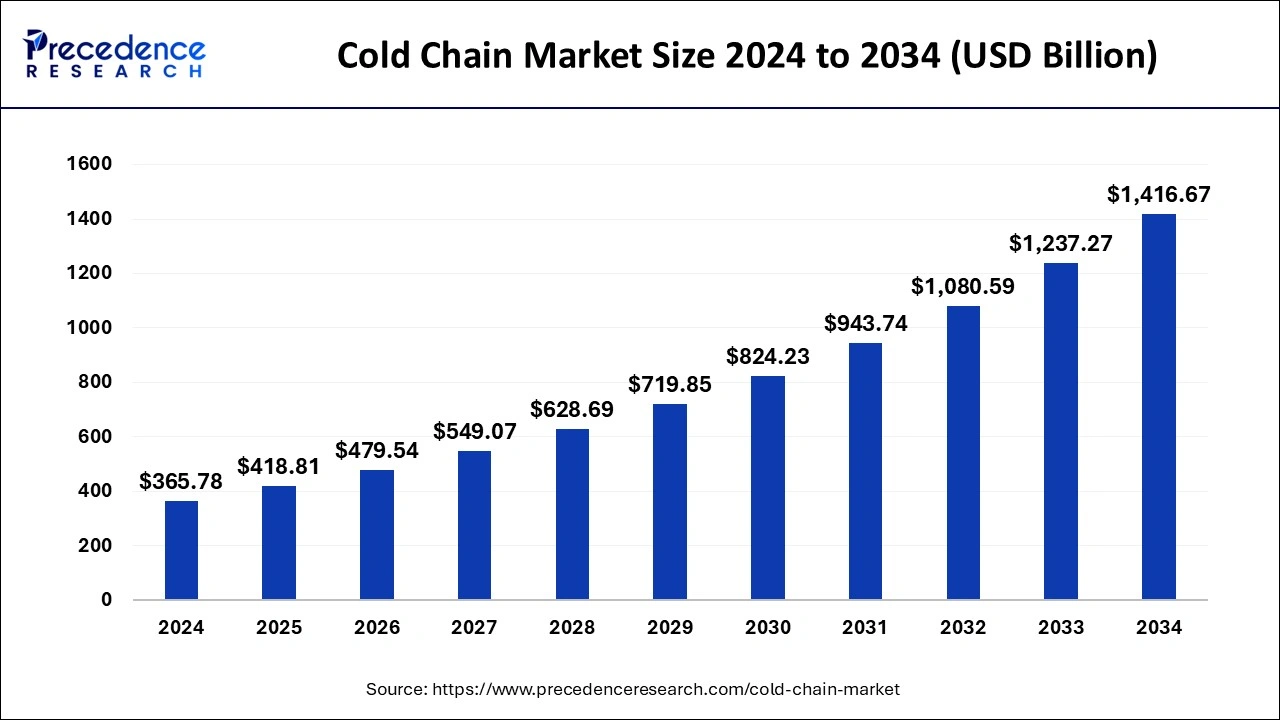

The global cold chain market size calculated at USD 418.81 billion in 2025 and is expected to reach around USD 1,416.67 billion by 2034, expanding at a CAGR of 14.50% from 2025 to 2034. The North America cold chain market size was estimated at USD 131.68 billion in 2024 and is expanding at a CAGR of 14.56% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cold chain market size accounted for USD 365.78 billion in 2024 and is expected to reach around USD 1,416.67 billion by 2034, expanding at a CAGR of 14.50% from 2025 to 2034.

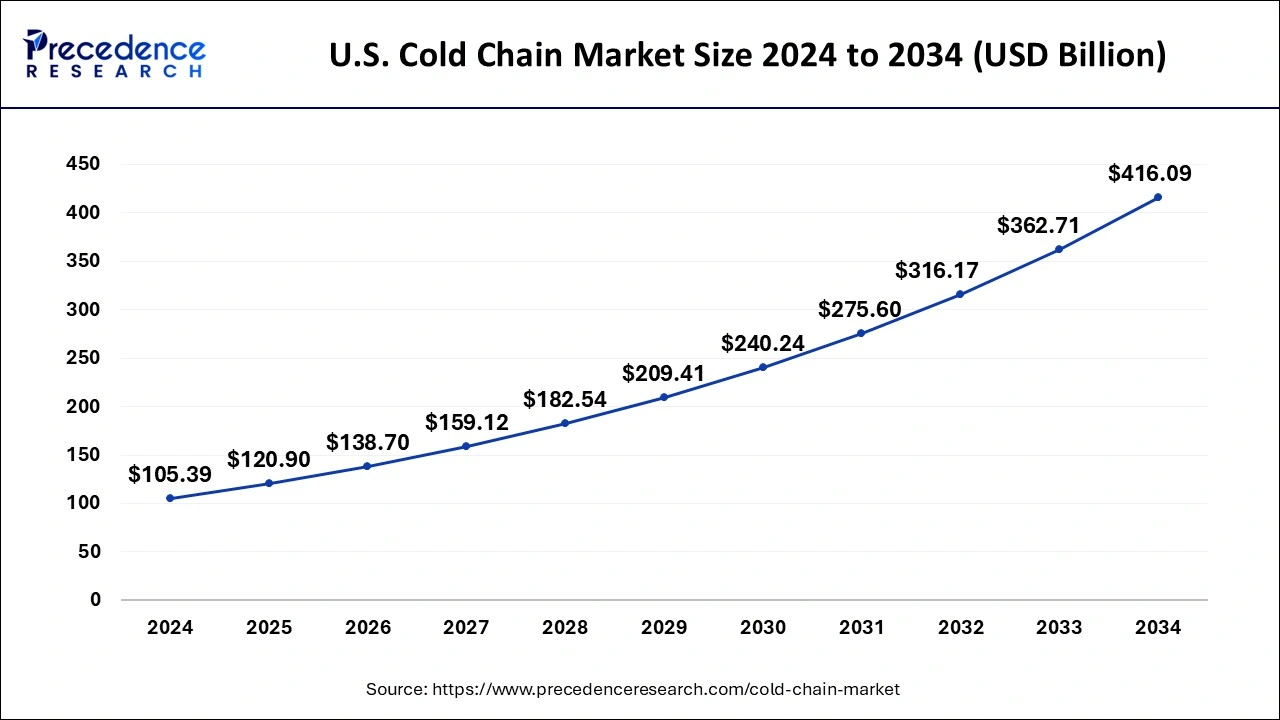

The U.S. cold chain market size was estimated at USD 105.39 billion in 2024 and is predicted to be worth around USD 416.09 billion by 2034, at a CAGR of 14.70% from 2025 to 2034.

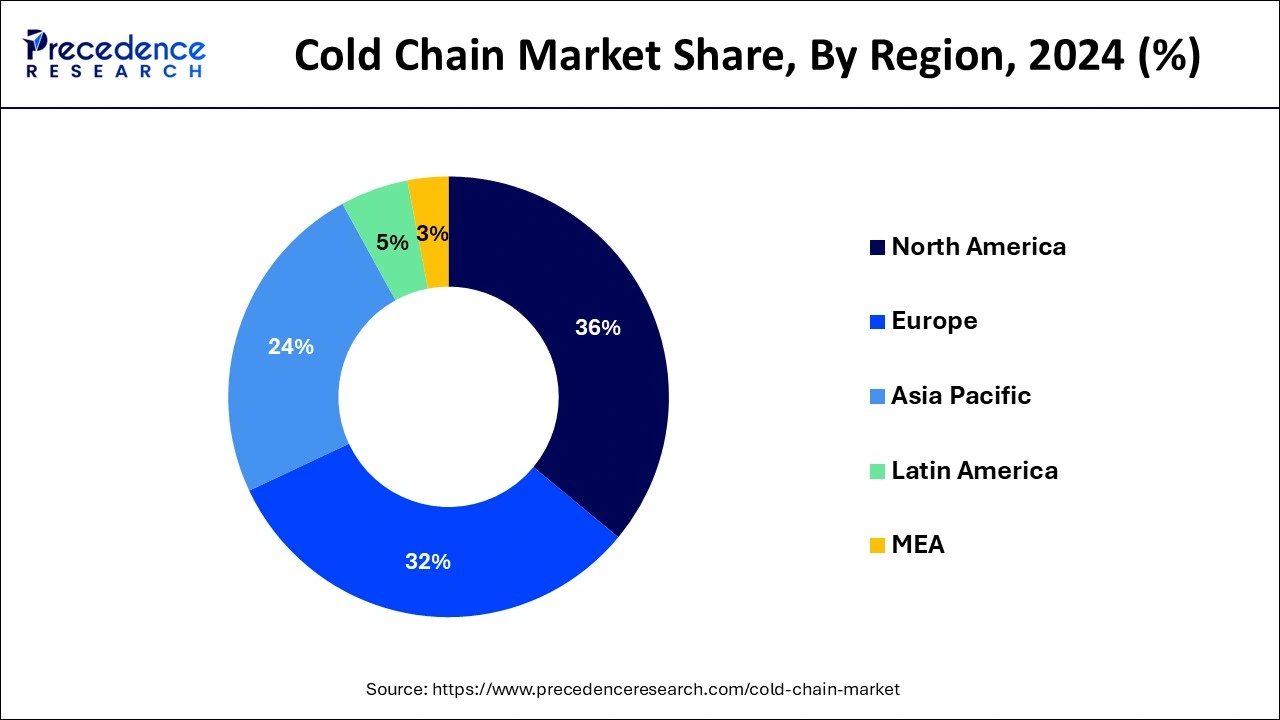

North America hold the largest revenue share contributing more than 36% in 2024 and is expected to remain in dominant position during the forecast period. The significant growth in this region is due to the presence of major market players continuously involved in developing new technologies to produce an energy efficient cold chain system. Furthermore, the increasing demand for the perishable food products in the North American market contributes significantly towards the growth of the cold chain market.

Asia Pacific region is anticipated to be the fastest growing region owing to the rise in Government investments in order to develop advanced logistics infrastructure. In this region, China is expected to hold a significant share owing to the rise in demand for technological advancements in food processing, packaging and storage of seafoods. Moreover, the development in the pharmaceutical sector in India and China will fuel the growth of the cold chain market in this region.

With the rapid technological advancements, the manufacturers of the temperature sensitive products are now extensively using the cold chain supply system and this is expected to drive the growth of the cold chain market. Furthermore, rise in demand for the temperature sensitive products such as meats, medicines and others across the globe have boosted the growth of the cold chain market.

The trade liberalization, focus on reducing food waste and expansion of retail chain in the market is anticipated to fuel the growth of the cold chain market. Furthermore, the rising disposable income of the consumers and the desire to consume ready to eat food products that needs to be preserved in a temperature-controlled environment is estimated to drive the growth of the cold chain market.

In recent times, there is a shift to protein rich foods in the developing economies and this factor is anticipated to drive the growth of the cold chain market. The surge in demand for refrigerated transportation vehicles in order to transport the perishable food product will contribute significantly in the growth of the cold chain market.

Furthermore, the growing Governments subsidies in order to boost the cold chain market are also a major attribute that will boost the growth of the cold chain market. Moreover, the significant growth of the ecommerce industry that delivers the perishable products is anticipated to fuel the growth of the cold chain market.

| Report Coverage | Details |

| Market Size in 2024 | USD 365.78 Billion |

| Market Size in 2025 | USD 418.81 Billion |

| Market Size by 2034 | USD 1416.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.50% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Sector, Temperature Type, Packaging, Application, Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

The storage segment is expected to hold the largest revenue share of more than 60% in 2024 and will remain to dominate during the forecast period owing to the surge in demand for ready to eat and frozen foods across the globe. The rapid changing lifestyles of consumers and their dietary patterns are driving the demand for the packaged food products and this attribute is estimated to drive the growth of the cold chain market.

The cold chain systems are very efficient in preserving the temperature sensitive food products. Therefore, the cold chain systems are extensively used in transportation trucks, cold storages, retails shops and others. This factor is anticipated to boost the growth of the cold chain market.

With the rapid technological development, the cold storages are efficiently monitored with the help of remote temperature sensors, RFID devices and others that helps in ensuring the safety, integrity and efficiency of the cold chain systems. This attribute fuels the growth of the cold chain market.

The public sector is expected to contribute significantly towards the market growth as these cold storages are operated by the Government in order to preserve the vegetable, medicines and other temperature sensitive products.

The private sector is also estimated to grow significantly during the forecast period owing to the increase in demand of perishable food products such as milk, meat, cheese and others. The rapid growth in the demand for packaged food products across the globe will contribute significantly towards the growth of the cold chain market. Moreover, the continuous research and developmental activities performed by the major market players to develop advanced cold chain systems will remarkably impact the growth of the cold chain market.

The manufacture of the packaged food products indulges in freezing the food products as this will help to enhance the shelf life of the food products. The freezing process lowers the biological and chemical reaction that prevents the food from getting decayed. The rising disposable income and change in food habits of the consumers leads to the demand for frozen food products and this is anticipated to drive the growth of the cold chain market.

By Type

By Sector

By Temperature Type

By Packaging

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

January 2024