September 2024

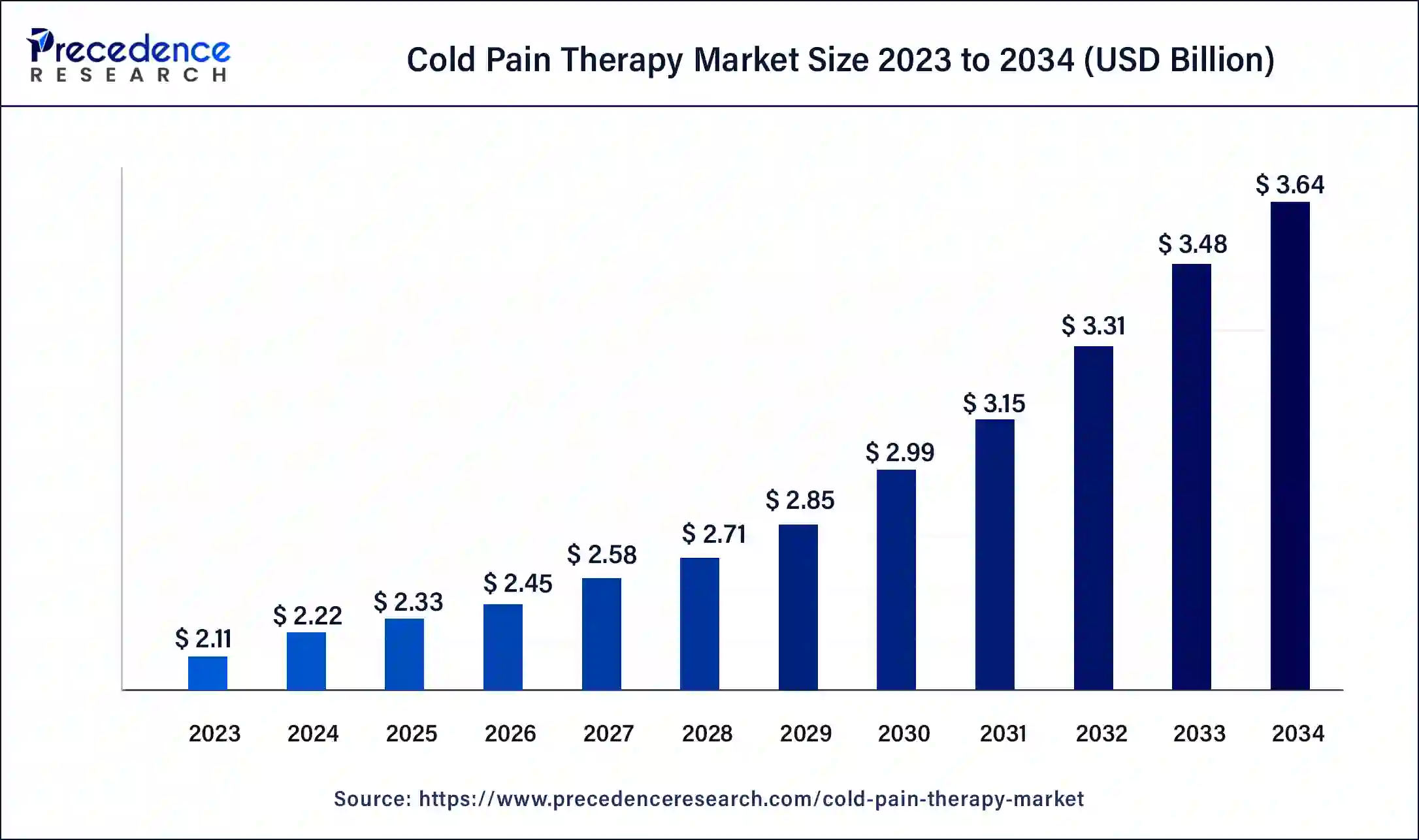

The global cold pain therapy market size was USD 2.11 billion in 2023, estimated at USD 2.22 billion in 2024 and is anticipated to reach around USD 3.64 billion by 2034, expanding at a CAGR of 5.08% from 2024 to 2034.

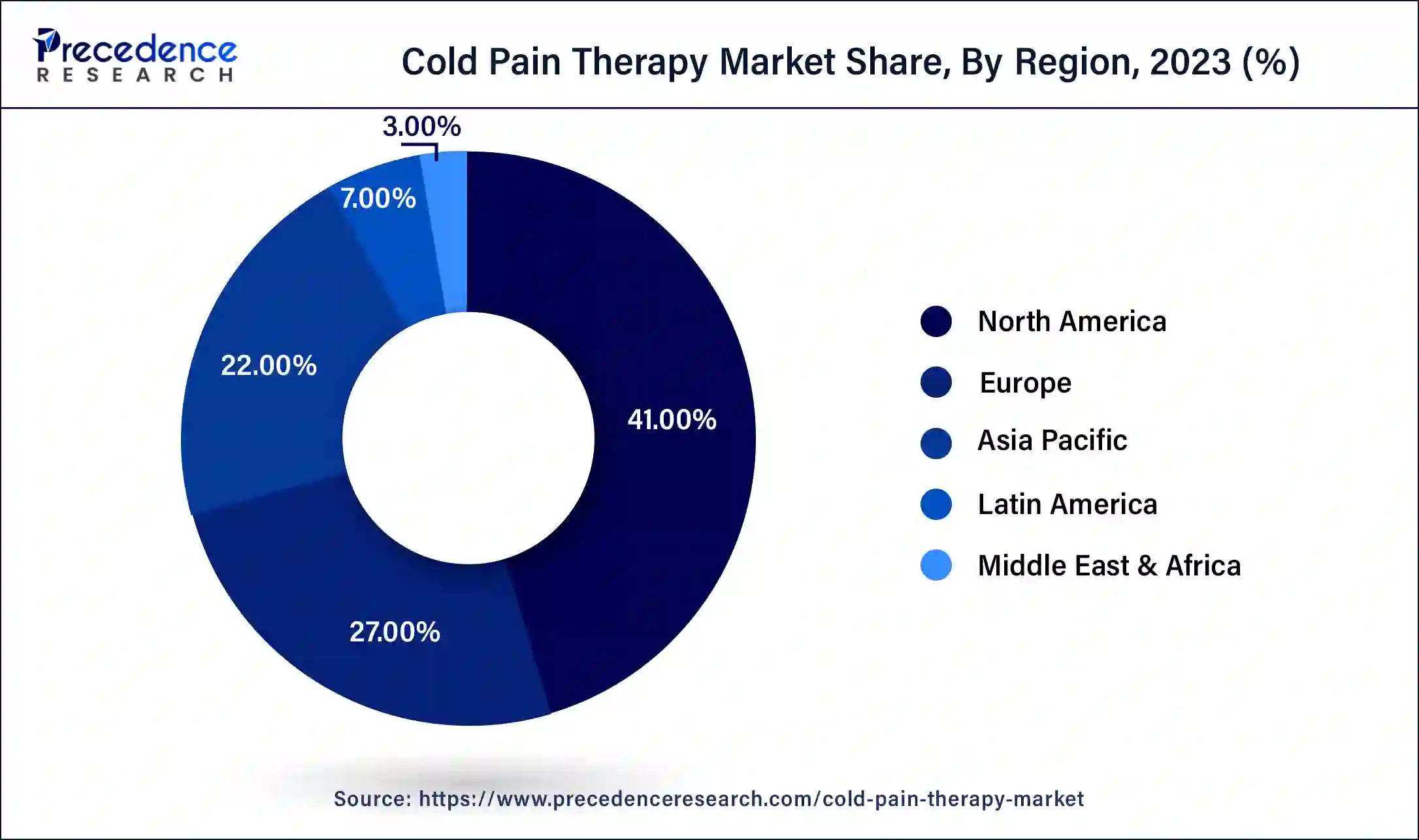

The global cold pain therapy market size accounted for USD 2.22 billion in 2024 and is predicted to reach around USD 3.64 billion by 2034, growing at a CAGR of 5.08% from 2024 to 2034. The North America cold pain therapy market size reached USD 870 million in 2023. Effective pain treatment techniques are in greater demand due to the rising incidence of ailments like arthritis, back pain, and sports injuries.

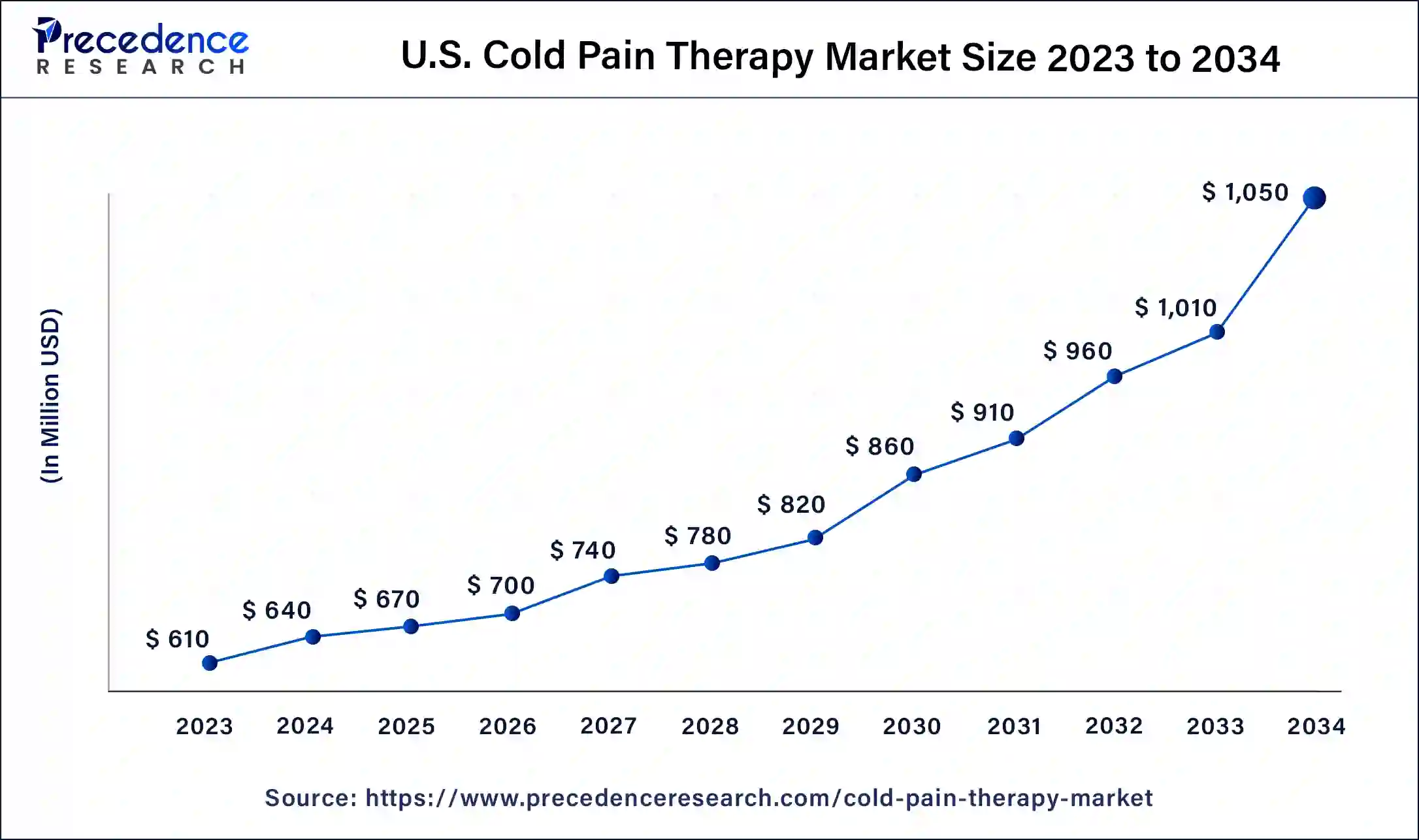

The U.S. cold pain therapy market size was estimated at USD 610 million in 2023 and is predicted to be worth around USD 1,050 million by 2034 with a CAGR of 5.16% from 2024 to 2034.

North America dominated the global cold pain therapy market in 2023. The need for cold pain therapy solutions is mostly driven by the rise in orthopedic operations and sports-related injuries. Because of how well these treatments work to lessen the pain and inflammation brought on by these kinds of injuries, they are frequently used. The need for cold pain therapy is growing as the population ages and more people develop pain-management-necessary illnesses, including arthritis and other musculoskeletal disorders. The over-the-counter (OTC) and prescription product segments make up the North American market for cold pain therapy. OTC treatments, such as creams, gels, patches, and sprays, are widely used because of their accessibility and efficacy.

Asia Pacific is expected to hold the fastest-growing cold pain therapy market during the forecast period. In Asia Pacific, the cold pain therapy market is growing significantly and is predicted to do so for the foreseeable future. The market is being pushed by an increase in musculoskeletal problems, sports injuries, and the number of elderly people who are more likely to have chronic pain.

A greater need for cold pain therapy is being caused by an aging population in nations like China and Japan, where age-related musculoskeletal problems are common. The industry is expanding due to improved healthcare infrastructure and increased spending on medical services in nations like China and India. The Asia Pacific market is expected to increase significantly due to changing demographics, rising healthcare costs, and the growing use of cutting-edge pain relief devices.

Cryotherapy, also known as cold therapy, involves the application of cooling agents such as ice packs, coolant sprays, ice massage, whirlpools, and ice baths. The cold pain therapy market deals with the sales of these products and related services focused on the treatment or management of pain. The market has been growing rapidly as a result of innovations such as smart cryotherapy devices, which provide accurate temperature control and customized treatment plans. These innovations also improve user experience and effectiveness.

One major driver driving the expansion of the cold pain therapy market is the rising incidence of diseases like osteoarthritis and arthritis, particularly in the elderly population. The increasing need for cold pain therapy solutions, which lessen pain and speed up recovery, is a result of the rise in surgical operations and sports-related injuries. This includes both motorized and non-motorized devices that are mostly employed for the treatment of chronic illnesses and the recuperation following surgery.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.11 Billion |

| Market Size in 2024 | USD 2.22 Billion |

| Market Size by 2034 | USD 3.64 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.08% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Distribution Channel, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased sports and fitness activities

Sports and leisure activities have increased due to the emphasis placed on physical fitness and good living on a global scale. An increase in the number of persons participating in these activities has led to an increase in sports-related injuries, which calls for efficient pain treatment techniques. Innovative cold therapy goods like cooling wraps, portable cold packs, and cutting-edge cryotherapy equipment have entered the market. These developments give athletes easier and more effective ways to control their pain and heal from injuries. Comprehensive sports rehabilitation programs are increasingly using cold treatment. Cold treatment is becoming increasingly popular as professional sports teams and fitness centers include it in their regular injury care routines.

Limited efficacy for chronic pain

Complex disorders like fibromyalgia, neuropathy, and arthritis can cause chronic pain. In contrast to acute pain, which is typically brought on by direct tissue injury or inflammation, chronic pain is brought on by nerve signals that are persistent and less amenable to straightforward cooling methods. The main ways that cold therapy relieves pain temporarily are by numbing nerve endings and decreasing inflammation. This implies that although cold therapy can provide momentary relief for people with chronic pain, it doesn't deal with the fundamental problems that lead to persistent pain. Cryotherapy has been shown to temporarily enhance function and reduce pain. However, there is little data to support its long-term effectiveness in treating chronic pain disorders.

Product innovation

Gel formulas used in cold therapy products are always being improved by manufacturers to increase the cooling effects and improve skin penetration for greater pain alleviation. These formulations frequently include natural substances like menthol or arnica for additional analgesic effects. With the ability to regulate the temperature dependent on the user's comfort level and pain intensity, certain cold treatment devices now have these functions. The requirement for frequent reapplication of cold treatment products has decreased due to longer-lasting chilling effects that are produced by innovations in materials and formulation techniques. Producers are investigating configurable solutions that enable consumers to customize cold therapy regimens to meet their individual requirements. This could include modular designs, movable straps, or bespoke gel packs.

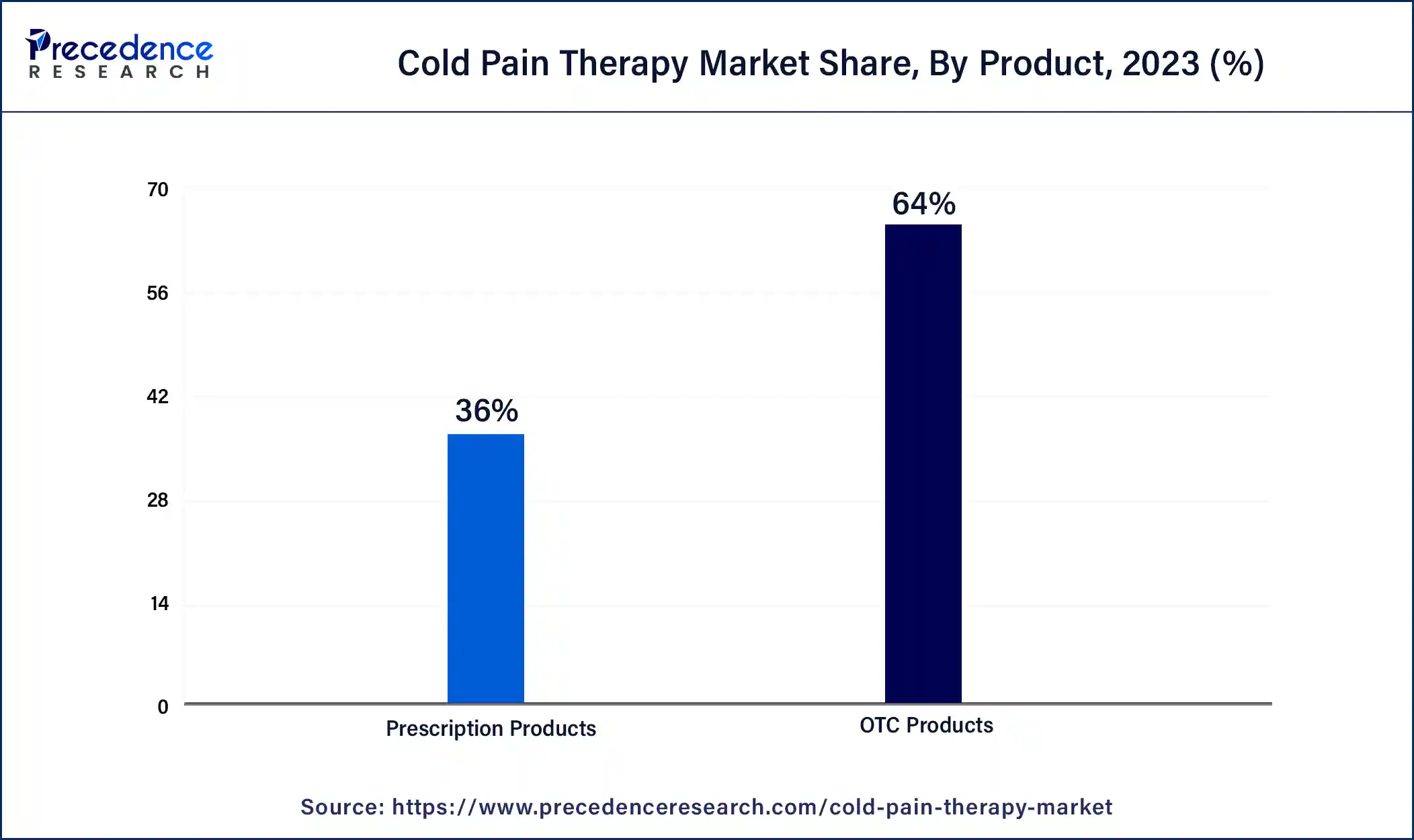

The OTC segment held the largest share of the cold pain therapy market in 2023. To reduce inflammation and numb pain, cold packs gel-filled packs or wraps can be frozen and applied to the affected area. They are frequently applied to minor wounds like bruises, sprains, and strains. Cold packs come in a variety of shapes and sizes from brands like ACE and Therapearl. Aerosol products known as "cold sprays" provide a cooling effect when applied topically.

Usually, they are used to provide immediate relief from mild joint or muscular pain, particularly in cases of sports accidents. Oral over-the-counter drugs like acetaminophen (Tylenol) or ibuprofen (Advil, Motrin) are frequently used to treat pain brought on by inflammation or injury. These drugs have the potential to decrease inflammation and pain on a systemic level.

The prescription segment is expected to grow at the fastest rate in the cold pain therapy market during the forecast period. Even though there are a lot of NSAIDs that may be bought over-the-counter, those who have significant pain or inflammation may be prescribed prescription dosage versions. These are specialist medical gadgets that target particular body parts with cold therapy. These could consist of cryotherapy chambers, cold compression wraps, and cold therapy equipment.

These are high-concentration creams, gels, or patches that contain drugs like ketoprofen, diclofenac, or lidocaine. To relieve localized pain, they are placed directly on the skin over the afflicted area. However, opioids are usually saved for severe pain that does not respond to other therapies and are strictly managed by healthcare professionals due to the potential for addiction and other negative effects.

The musculoskeletal disorders segment dominated the cold pain therapy market in 2023. Conditions known as musculoskeletal disorders (MSDs) impact the body's soft tissues, including the tendons, ligaments, joints, muscles, and bones. They may result in discomfort, stiffness, edema, and mobility restrictions, which may make it difficult for the person to carry out everyday tasks.

Cryotherapy, another name for cold pain therapy, is the application of cold to the injured area with the goal of reducing inflammation and pain. These are frequent ailments that result from tearing or stretching muscles and tendons (strains) or ligaments (sprains). Pain and swelling brought on by these injuries can be lessened with the use of cold therapy. The inflammation of the bursae, which are tiny sacs filled with fluid that cushion the muscles, tendons, and bones around joints, is known as bursitis. Bursitis-related pain and inflammation may be reduced with the use of cold therapy.

The post-trauma therapy segment is expected to expand notably in the cold pain therapy market over the projected period. Using cold therapy techniques to assist in the healing process after traumatic injuries is the main goal of post-trauma therapy, especially in the context of the market. Applying freezing temperatures to wounded areas is known as cold treatment or cryotherapy, and it is used to lessen pain, edema, and inflammation. It is frequently used to improve healing and encourage recovery in conjunction with other types of therapy, such as physical therapy. These are sleeves or wraps that can be placed directly over the wounded area to provide cold therapy and compression to lessen pain and edema. These are frequently used to administer cold therapy right away after an accident. To avoid frostbite, they can be applied directly to the skin or covered with a cloth.

The retail pharmacies segment led the global cold pain therapy market in 2023. The cold pain therapy market in retail pharmacies includes a range of items designed to reduce pain and inflammation by using cold therapy techniques. These goods, which include things like cold packs, gel packs, cold therapy wraps, and topical analgesics enhanced with cooling ingredients like menthol or camphor, are frequently sold over the counter. Bio Freeze is well-known for its menthol-based topical analgesic solutions. The company also sells gels, roll-ons, and sprays that are intended to relieve painful muscles and joints using cold therapy. Well-known company Icy Hot sells a line of topical pain relievers that blend methyl salicylate and menthol with cold treatment to provide calming relief.

The hospital pharmacies segment is expected to grow rapidly in the cold pain therapy market during the forecast period. Hospital pharmacies are a major player in the market for cold pain relief products. Using cold packs, wraps, and other devices to relieve pain, lower inflammation, and speed up recovery is known as cold pain therapy. Cold therapy items are usually available in hospital pharmacies in a range of forms, from basic ice packs to more sophisticated machines.

Hospital pharmacies make sure that patients and healthcare professionals have access to a large selection of cold therapy items. This covers conventional ice packs, cooling gels, cold therapy wraps, and more sophisticated equipment like cold therapy machines. Hospital pharmacies place a high priority on quality control and make sure that the cold therapy items they sell adhere to strict safety and effectiveness guidelines. This is essential for the best possible therapeutic results and patient safety.

Segment Covered in the Report

By Product

By Distribution Channel

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

August 2024

October 2024

October 2024