July 2024

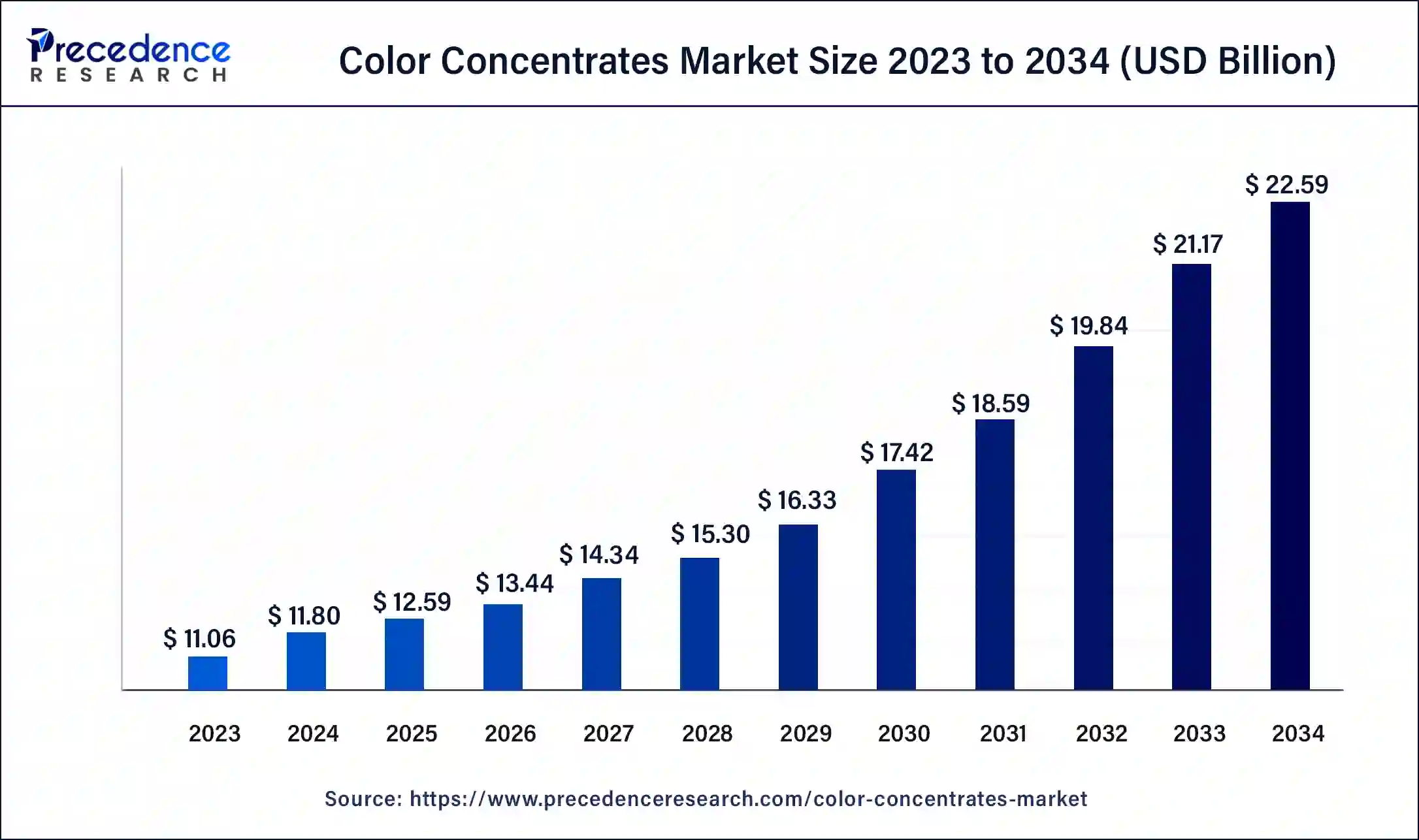

The global color concentrates market size surpassed USD 11.06 billion in 2023 and is estimated to increase from USD 11.80 billion in 2024 to approximately USD 22.59 billion by 2034. It is projected to grow at a CAGR of 6.71% from 2024 to 2034.

The global color concentrates market size is projected to be worth around USD 22.59 billion by 2034 from USD 11.80 billion in 2024, at a CAGR of 6.71% from 2024 to 2034. The benefits of color concentrates include high-impact special effects, quick color development, enhanced color dispersion, lower material costs, reduced energy consumption, etc., contributing to the growth of the market.

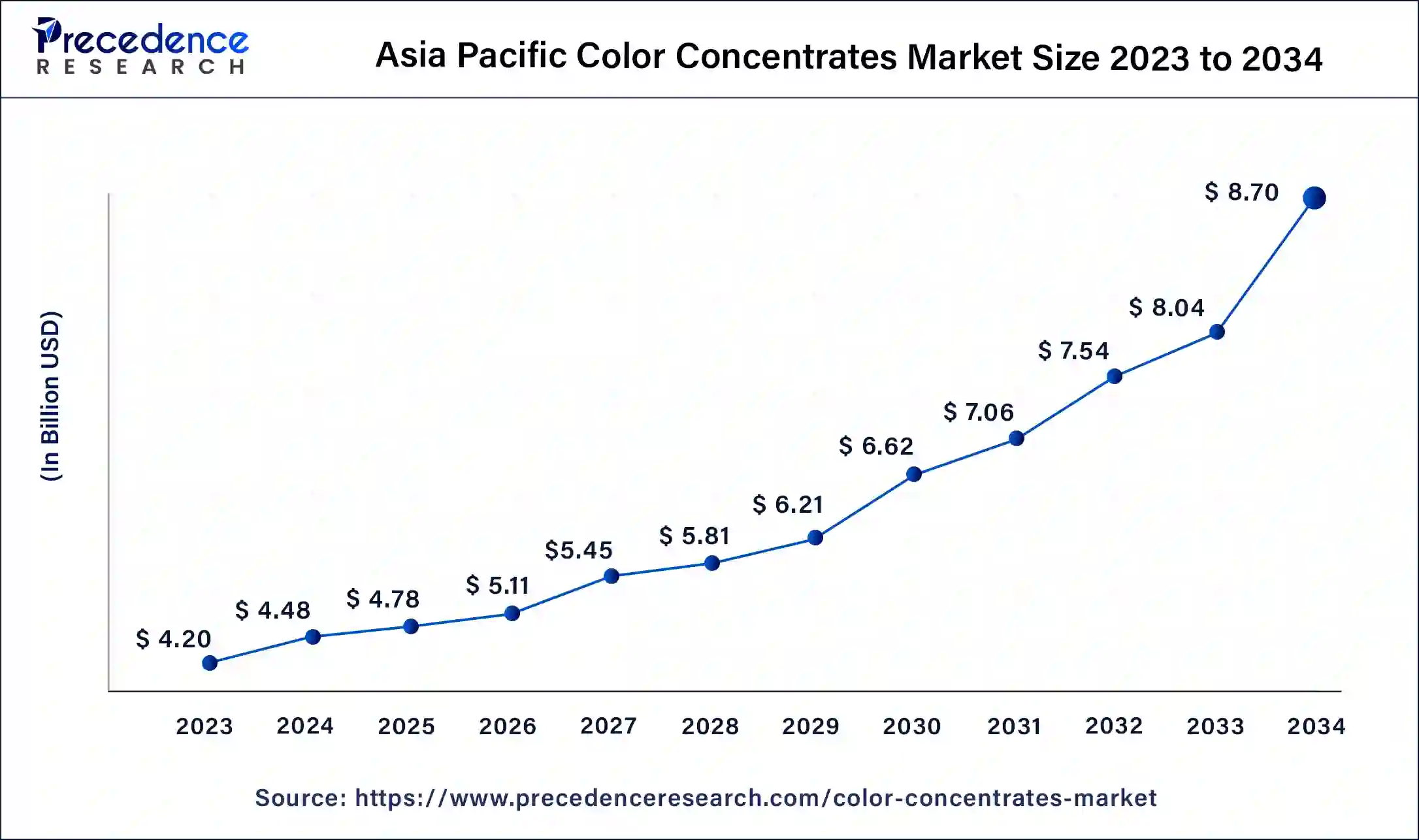

Asia Pacific Color Concentrates Market Size and Growth 2024 to 2034

The Asia Pacific color concentrates market size was exhibited at USD 4.20 billion in 2023 and is projected to be worth around USD 8.70 billion by 2034, poised to grow at a CAGR of 6.84% from 2024 to 2034.

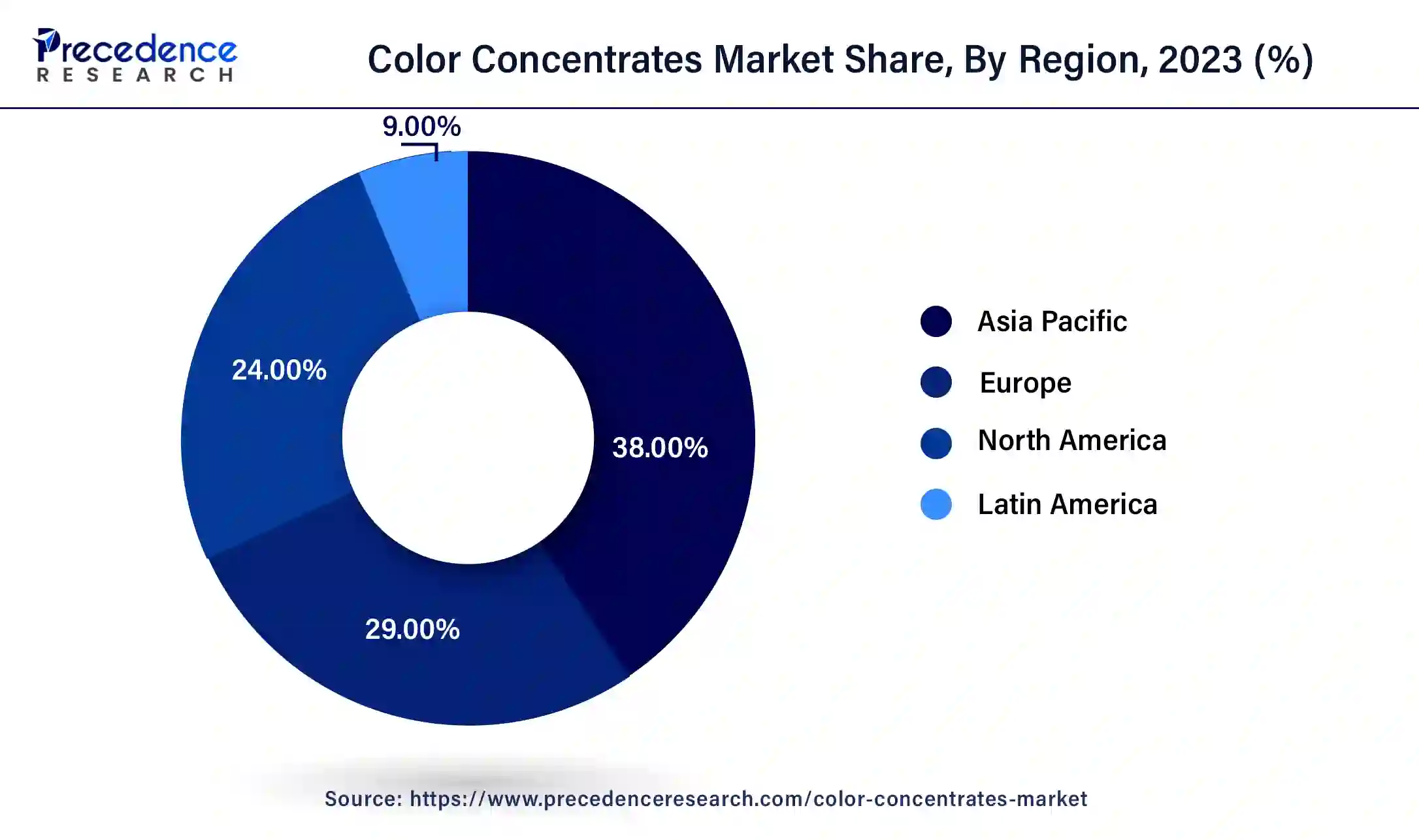

Asia Pacific held the largest share of the color concentrates market in 2023. The rapid economic growth in Asia-Pacific countries has increased consumer spending and demand for a wide range of colored products, further boosting the market for color concentrates. The large and growing population in Asia-Pacific contributes to a significant consumer market for various end products that use color concentrates. The region is investing heavily in research and development, leading to innovations in color concentrate technologies and applications, which drive market growth.

North America is observed to grow at the fastest rate in the color concentrates market during the forecast period. The benefits of color concentrates include a strong manufacturing base across diverse industries like construction, consumer goods, packaging, and automotive, which helps the growth of the market in the North American region. North America increases advanced technologies, innovative hubs, and innovative and high-quality color solutions that meet the requirements of many end users. These factors help the growth of the market in North America. The United States is the leading country in North America for the growth of the market.

Plastic companies associated with color concentrates in the U.S.

Asia Pacific is estimated to be significantly growing during the forecast period of 2024-2033. In the Asia Pacific region, many factors, which include increased demand for plastics, a shift towards sustainability, advanced technologies, and a suitable regulatory and economic environment, help the growth of the market. Research & development investments, production sites and facilities, global presence, and new market initiatives help to the growth of the color concentrates market.

The color concentrates market refers to the sector of the chemical industry that produces additives used to transfer color to many materials. Color concentrates are also called color masterbatch. These concentrates are made of high-quality dyes or pigments with carrier resins that are used in textiles, coatings, plastics, and other materials to achieve specific shades and hues. Color concentrates on ensuring that attractive products align with the brand's look in consumer goods like appliances and electronics. In addition, the medical industry uses color concentrates to differentiate different medical devices and ensure they meet safety standards, which helps the growth of the market.

How is AI Revolutionizing the Color Concentrates?

The benefits of the use of artificial intelligence (AI) in color concentrates include image colorization; artists can create more realistic and attractive pleasant results in a fraction of the time it may take them to manually colorize images. Using AI in colorization is more accurate than manual colorization as it may detect precise details in an image that can be difficult for a human to see. Use of AI-based color correction tools due to advances in constantly improving and evolving.

| Report Coverage | Details |

| Market Size by 2034 | USD 22.59 Billion |

| Market Size in 2023 | USD 11.06 Billion |

| Market Size in 2024 | USD 11.80 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.71% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End-use Industry, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of plastics in consumer goods, packaging, and automotive

The rising demand for visually appealing and customized products across industries and the increasing adoption of plastics in consumer goods, packaging, and automotive contribute to the growth of the color concentrates market because it provides consistent color throughout the plastic products and also a high control over the intensity and shade of the color.

Essential guide required to color concentrates

It is not suitable for extrusion blow molding of HDPE bottles, limited applications with the engineered polymers, and slippage of screws at high use rates, mainly in pearl and opaque, due to container changeover production interruptions caused. Specialized pumps require many segments and additive limitations. Competition from alternative coloring substitutes or methods impacts production costs due to fluctuating raw material prices, technological disruptions, geopolitical tensions, economic fluctuations, market saturation, and regulatory hurdles that can hamper the color concentrates market growth.

Technological innovations and implementation of stringent government policies

The technological innovations and implementation of government regulations and policies contribute to the growth of the market. Technological advancements allow new applications and enhance efficiency. Innovations, including automation, artificial intelligence (AI), and machine learning (ML), are mainly powerful and are helping the growth of the color concentrates market.

The solid segment dominated the color concentrates market in 2023. Solid color and additive masterbatches, also called color concentrates, have the industry-wise best practices for coloring polymers worldwide. The cost-effectiveness, ease of use, shelf life and storage, combination of performance, and cleanliness give these solid color concentrates significant advantages over raw pigments, pre-colored resin compounds, and liquid color in most plastic applications. Solid color concentrates are easier to clean than liquid color spills.

The liquid segment is expected to be the fastest-growing during the forecast period. Liquid color concentrates may help to improve products at many stages of the production process. The benefits of liquid color concentrates include giving a leg up on the competition, high-value specialty effects that add value and versatility, rapid color development, enhanced color dispersion, lower material costs, and reduced energy consumption. Liquid color concentrates are used to color plastic-based products. The liquid color concentrates are used in areas such as the toy industry, electronic industry, furniture industry, automotive industry, medical technology, and packaging industry. These factors help the growth of the liquid color concentrates segment and contribute to the growth of the color concentrates market.

The consumer goods segment dominated the color concentrates market in 2023 and is anticipated to be the fastest-growing during the forecast period. In consumer goods, color concentrates play an important role. It helps to improve the attractiveness of products like furniture, toys, and appliances. It provides more consistent color to the plastic products and also high control over the intensity and shade of the color. These are easier to incorporate and handle in manufacturing processes, reducing costs and minimizing waste.

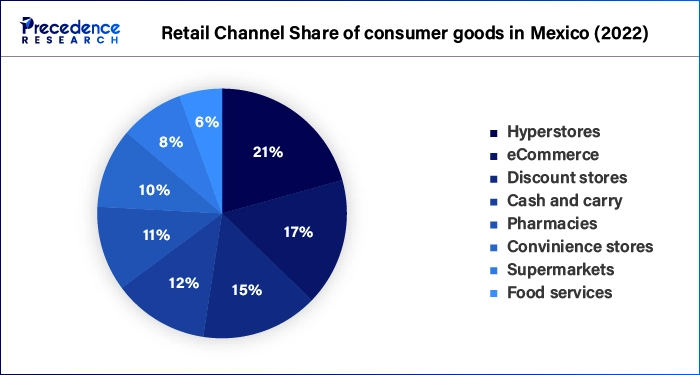

Consumer goods include huge product varieties purchased by the end users at retail channels whether eCommerce or retail stores. In Mexico, economies continue to develop and the middle class grows, and the consumption of goods and services increased by 6.5% in 2022 by Mexicans and providing opportunities for exporters of these consumer goods.

The retail channel share of consumer goods sales in Mexico in 2022 was as follows

Hyperstores (15%), eCommerce (12%), discount stores (11%), cash and carry (9%), pharmacies (8%), convenience stores (7.5%), supermarkets (6%), and food service (4%).

The packaging segment is estimated to grow significantly during the forecast period. The color concentrates play a significant role in packaging. To improve the visual appeal and vibrancy, it plays an important role in daily products. Applications of color concentrates in packaging include pharmaceutical packaging, industrial packaging, household packaging, health & beauty packaging, and food and beverage packaging. These factors help to the growth of the packaging segment and contribute to the growth of the color concentrates market.

The retail segment dominated the color concentrates market in 2023. Retail channels provide access to end consumers, mainly in sectors like automotive and consumer goods. The benefits of retail channels include marketing. Retail channels put responsibility for selling the product on the retailer; customers deal with retailers and give access to an additional customer base without investing in marketing and sales programs to capture new business and reach selling products through a retail channel, which extends the geographical reach of the business.

The online segment is anticipated to be the fastest-growing during the forecast period. The benefits of the online channel include allowing useful customer data collection, opening up new audiences, and reducing geographic constraints. However, carving out a sustainable market and competition is fierce. These factors help the growth of the online segment and contribute to the growth of the color concentrates market.

The wholesale segment is expected to grow significantly during the forecast period. Wholesale channels include production and manufacturing processes; in larger industries, buyers contribute to the growth of the market. The benefits of the wholesale channel include mitigation of risk, supply chain stability, storage capability, lower cost of business, simpler operations, and increased reach. These factors help to the growth of the wholesale segment and contribute to the growth of the color concentrates market.

Segments Covered in the Report

By Type

By End-use Industry

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024